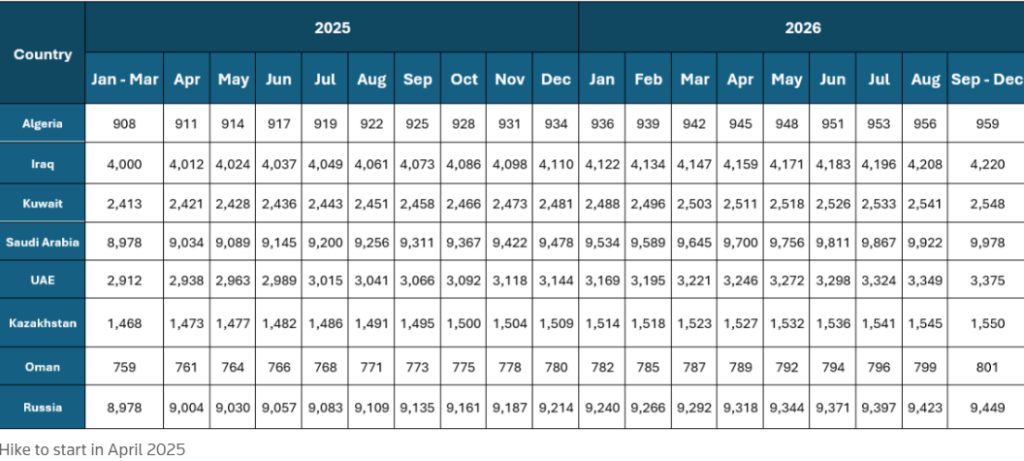

OPEC+ has once again adjusted its strategy to navigate the turbulent waters of global oil demand. Initially, the group planned to ease production cuts starting October 1, then pushed this back to January 1. Now, the goalpost has shifted further to April 2025, with the unwinding set to stretch over 18 months. The group’s cautious approach reflects a reality: the global oil market remains fragile, and demand growth has been slower than anticipated. This isn’t just a recalibration of production schedules—it’s a stark acknowledgment of the challenges posed by softening demand, geopolitical uncertainties, and unpredictable market dynamics. The planned unwinding focuses on three key production tranches agreed

upon by OPEC+ members. The voluntary cuts of 2.2 million barrels per day (bpd) by eight member nations are now set to phase out gradually starting in April 2025 and continuing through September 2026. The broader collective cut of 2 million bpd will be extended through 2026, while no definitive plans have been announced for the nine-member voluntary cuts, a clear sign of the group’s hesitance to risk oversupplying the market.

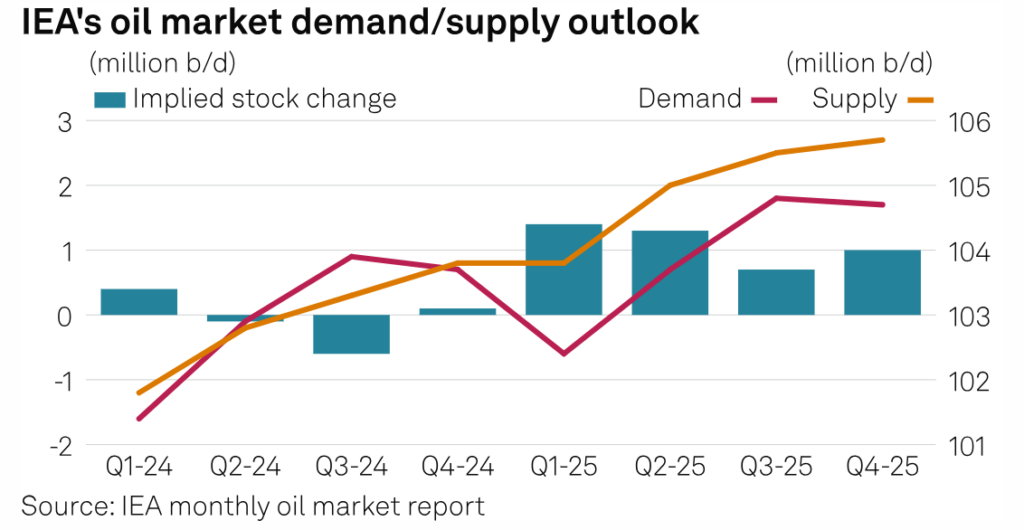

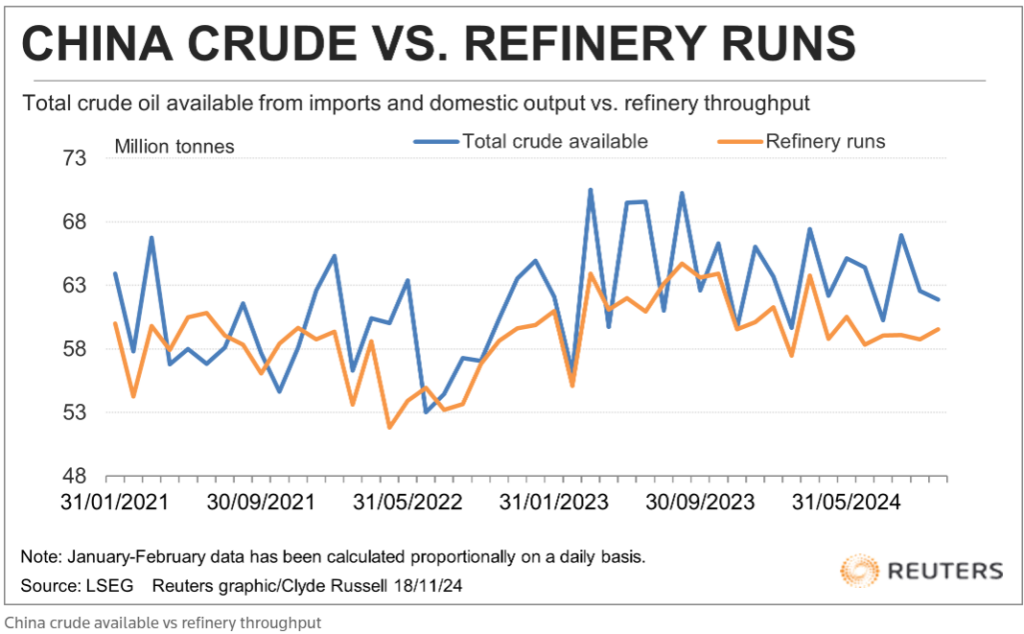

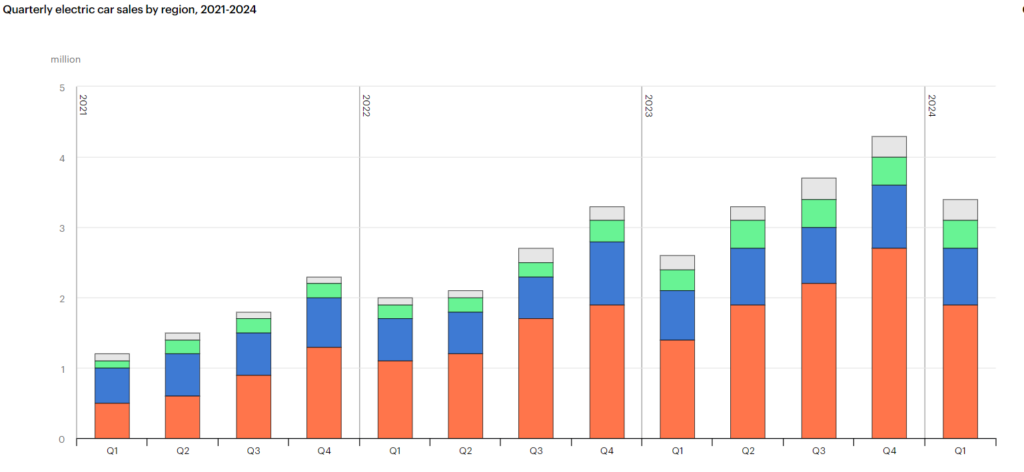

Demand forecasts for 2024 have been repeatedly revised downward, with OPEC’s November report now projecting a growth of 1.82 million bpd, down from an initial estimate of 2.25 million bpd. The International Energy Agency (IEA) and U.S. Energy Information Administration (EIA) offer even more conservative outlooks. Much of this reduction stems from slower-than-expected growth in China, where demand growth projections have fallen from 580,000 bpd to 450,000 bpd. China’s economic softness, coupled with its pivot toward electric vehicles (EVs) and LNG-powered trucks, has dampened its appetite for crude imports. Across Asia, the trend toward electrification and alternative energy sources is accelerating, further pressuring OPEC+’s traditional markets.

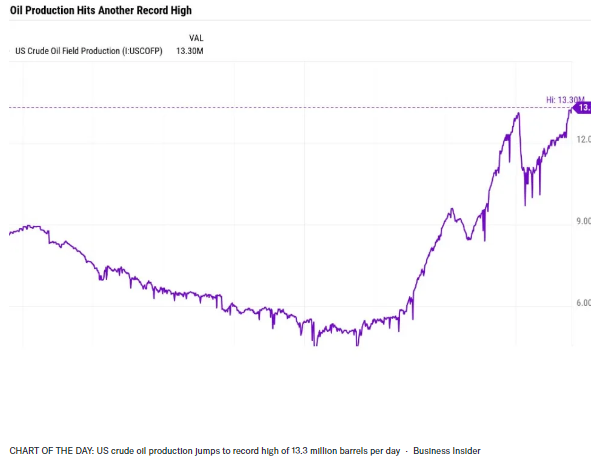

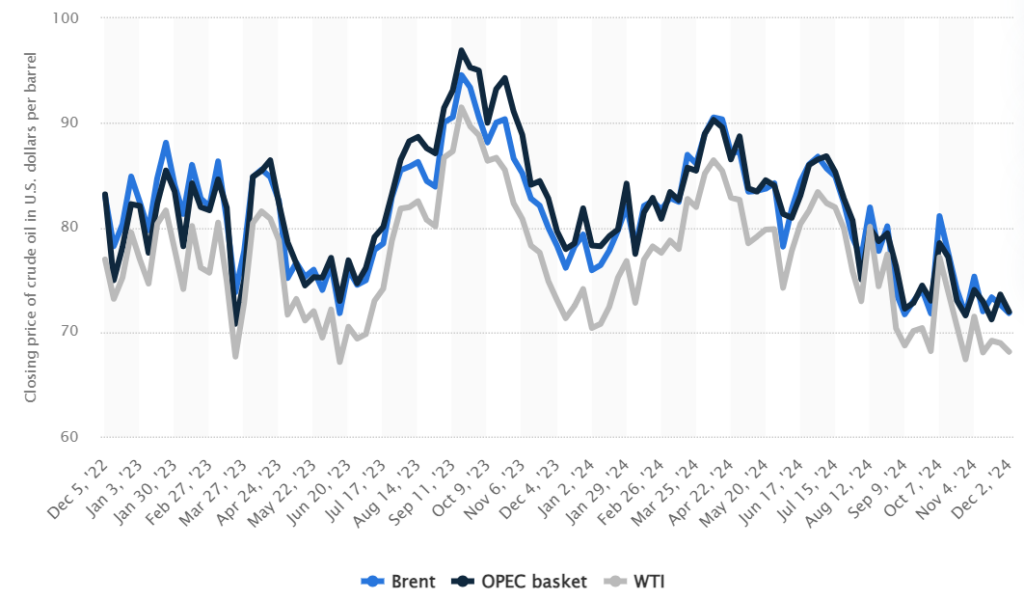

While OPEC+ has been remarkably effective at using production cuts to stabilize prices since its formation in 2016, the current scenario presents unique challenges. Prices have struggled to hold above $75 per barrel in 2024, reflecting the delicate balancing act OPEC+ must perform. By extending deep output cuts totaling 5.86 million bpd, the group is essentially ceding market share to competitors like the U.S., whose production hit an all-time high in August before a slight decline in September. This dynamic underscores the tension between sustaining prices and maintaining relevance in an increasingly crowded market.

The return of Donald Trump to the White House in January 2025 is another challenge. Trump’s energy policies are expected to prioritize lower fuel prices for U.S. consumers, potentially leading to deregulation and increased domestic production. While this could bolster U.S. natural gas output, crude oil production faces capacity constraints and economic disincentives for producers if prices drop too low. Trump’s rhetoric about imposing tariffs on Canadian and Mexican oil imports could further disrupt global flows, potentially raising domestic prices and reducing profits for U.S. refiners. The geopolitical implications of Trump’s presidency are equally complex. A renewed hardline stance against Iran could tighten global supplies and elevate prices, while potential peace negotiations in Ukraine or the Middle East might ease supply constraints, exerting downward pressure. These scenarios highlight the unpredictability Trump introduces to the already volatile oil market.

OPEC+ also faces pressure from its rivals, particularly U.S. shale producers, who have shown resilience in maintaining output despite economic headwinds. As OPEC+ extends its production cuts to prop up prices, it inadvertently creates opportunities for competitors to fill any supply gaps. This dynamic is especially evident in Asia, where seaborne crude imports have fallen by 370,000 bpd year-over-year, contradicting OPEC’s earlier forecasts of robust demand growth in the region. Compounding the dilemma is the shift in consumer preferences and policy-driven energy transitions. The rise of EVs, particularly in China and other Asian markets, is reshaping long-term oil demand. According to the IEA’s 2024 Global EV Outlook, EVs are expected to account for nearly one in five vehicles sold globally by 2030, a trend that will continue to erode gasoline consumption. The U.S., too, has seen a decline in gasoline demand, which peaked in 2016 and has since fallen by more than 6% despite population growth.

For OPEC+, maintaining the current cuts is essential to prevent a price collapse, but it comes at a cost. By supporting prices, the group effectively subsidizes its competitors, allowing them to capture market share in regions where demand growth persists. Analysts interpret the delayed unwinding of cuts as a sign of OPEC+’s long-term commitment to price stability, even at the expense of short-term market share. However, not all market participants are convinced. Swissquote Bank noted a lack of enthusiasm among oil bulls, as the production delay is unlikely to prevent a global surplus.

For OPEC+ 2025 is going to be difficult to navigate. The group must contend with the rapid pace of energy transitions, geopolitical shifts, and the unpredictability of U.S. policies under Trump’s administration. With Brent crude projected to average $73 per barrel in 2025, according to Primary Vision’s analysis, the market appears to be pricing in a modest surplus. This environment underscores the importance of OPEC+’s cautious approach, as any misstep could exacerbate market imbalances and undermine its efforts to stabilize prices. The oil market’s immediate future remains clouded by uncertainty. OPEC+ must strike a delicate balance between supporting prices and adapting to a rapidly evolving energy landscape. As the group extends its cuts and braces for potential disruptions, the next few months will be critical in determining whether its strategies can sustain long-term relevance in a world increasingly shaped by alternative energy and shifting geopolitical currents.