Completion Operation Outlook

We have already discussed STEP Energy Services’ (STEP) Q3 2024 financial performance in our recent article. Here is an outline of its strategies and outlook. STEP anticipates a worse-than-usual Q4 because the weakness of energy prices can trigger a steep capex drop for energy operators. Despite the recovery in natural gas prices, high gas storage levels in Canada and the US can decelerate drilling and completion plans. The spot prices remained under pressure in Q3. The management expects utilization to improve in Q1 2025, especially in the coiled tubing and Canadian fracturing service lines.

The US fracturing line, however, will likely remain fragile for the next few quarters. The US coiled tubing business is more resilient and can finish the year slightly lower than the previous year. The company is strongly positive about the LNG business, with natural gas prices expected to increase to $4 per BTu by 2026. The EIA expects North America’s LNG export capacity to double by 2028, while Canada’s export capacity may grow from nil to 6 Bcf. STEP’s margin pressure can ease in 2H 2025 as additional LNG capacity comes online.

Frac update

STEP has upgraded its fracturing fleets with the latest Tier 4 dual-fuel engine technology. The new method can displace up to 85% of diesel with natural gas. The Tier 4 duel fuel engines reduce carbon footprint and offer clients cost-efficient and sustainable solutions. By Q3-end, 75% of the company’s Tier 2 and Tier 4 engines in the fracturing fleet turned dual fuel. Due to the challenges in the completion market, STEP fielded only one frac spread during Q3, resulting in much fewer operating days than the prior year.

Other Completion Activity Update

STEP’s coiled tubing business in the US remained resilient, with only a slight sequential decline in activity. It scaled back to 12 active coiled tubing units in Q3. When market conditions improve, some more units may be reactivated for expansion. Sand pumping in Canada, however, attained a high in Q3. One of its crews pumped over 5,400 metric tons of sand in just under 20 hours.

Q3 Analysis And Impairment Charges

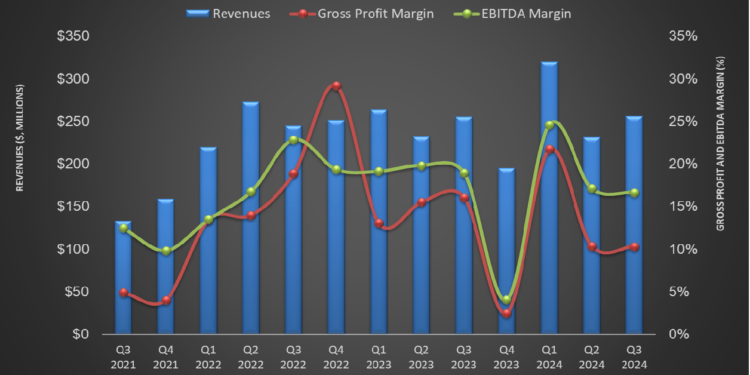

Year-over-year, STEP’s revenues increased by 34% in Canada but took a steep downturn (54% down) in the US in Q3 2024. The fall in the US was for two consecutive quarters and steeper than in Q2. However, its adjusted EBITDA margin contracted in both regions. During Q3, it recorded a net loss of CAD5.5 million compared to earnings of CAD10.5 million in Q2.

An impairment of CAD12.7 million in its US fracturing CGU worsened its financial results. The impairment related to the legacy Tier 1 and Tier 2 diesel-powered fracturing equipment. STEP’s cash flow declined (13% down) in 9M 2024 compared to a year ago, while its free cash flow decreased by 40% during this period. Its debt also decreased by ~20% in Q3 as a part of its shareholder return strategy.

Relative Valuation

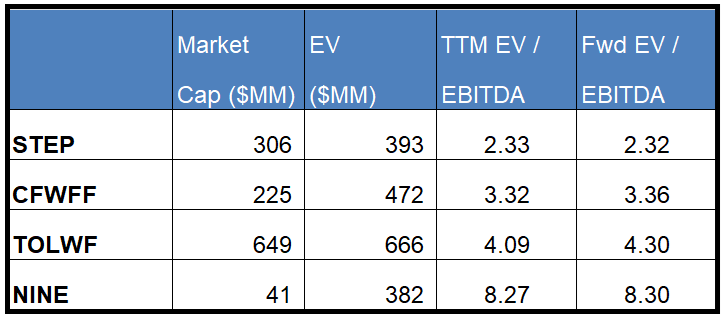

STEP is currently trading at an EV/EBITDA multiple of 2.33x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is slightly lower, at 2.32x.

STEP’s forward EV/EBITDA multiple versus the current EV/EBITDA contrasts with its peers because its EBITDA is expected to remain nearly unchanged versus a slight fall in EBITDA for its peers next year. This typically results in a small premium in the EV/EBITDA multiple compared to its peers. However, the stock’s EV/EBITDA multiple is significantly lower than its peers’ (CFWFF, TOLWF, and NINE) average. So, the stock is undervalued versus its peers.

Final Commentary

After Q4, 75% of STEP’s Tier 2 and Tier 4 engines in the fracturing fleet turned to dual fuel. The management expects utilization to improve in Q1 2025 in the coiled tubing and Canadian fracturing services. Sand pumping in Canada attained a high in Q3, while coiled tubing business in the US remained resilient.

On the other hand, STEP anticipates a worse-than-usual Q4 because of the weakness of energy prices. The spot prices remained under pressure in Q3. Its free cash flow decreased significantly in 9M 2024. It continues to deleverage its balance sheet. The stock is undervalued versus its peers.

Premium/Monthly

————————————————————————————————————-