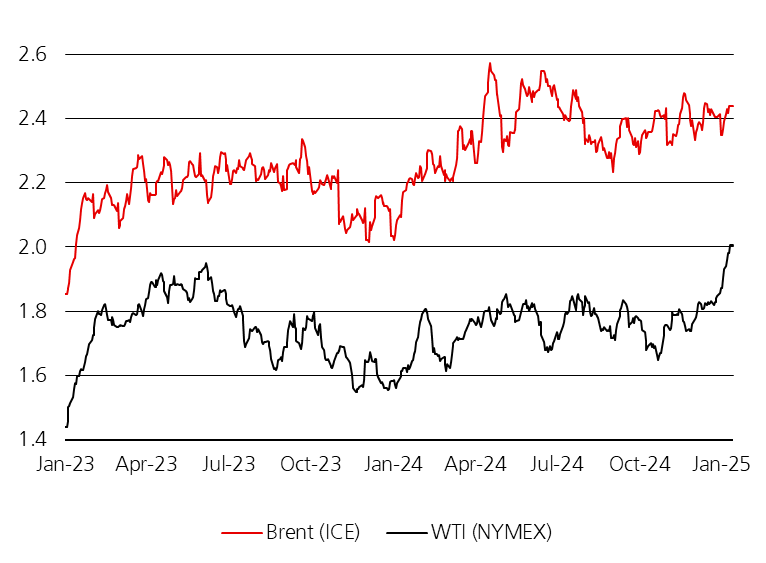

The oil markets have seen a strong spike to start the year with the recent surge driven by renewed sanctions on Russian crude. There has been a big concern around production growth expectations in “non-OPEC” regions. There’s more concern now around the estimates in Latin America and the U.S. as we came into 2025. We expect to see some pressure to production, but the bigger issue remains demand as we head into 2025. China has seen some significant structural demand declines that is very real, and it will likely only get worse throughout the rest of the 2020’s. Brent prices at the current levels is a huge hit to people’s balance sheets- especially emerging markets. The US Dollar and crude moving higher is a double whammy for many Emerging Markets, and at these prices, many developed markets. In the near term, we will see Brent prices a bit higher in the $73-$78 range, but I think you will see more pressure develop throughout Q2/Q3 on the global economic level. This will pull down pricing- especially as refined product prices get pushed higher hitting the consumer again.

When we look at flows, differentials have strengthened across the board following the sanctions on Russia. The Middle East crude benchmarks have now hit a 15-month high:

- Cash Dubai swaps rose a $1.35 to $3.08, which is the biggest gain since Sept 2020.

- Oman premiums rose to $2.90

- Murban rose to $3.10

Shipping rates for VLCCs also saw a big jump of about 10% on the ME to China route. Angola’s February loading program is almost down driven by the Asian buying. Angolan differentials for Feb have risen by $.50-$1 for most grades versus this month (Jan).

European diesel refining margins have also spiked driven by the sanction’s announcement, which will be supportive of WAF and ME crude grades competing to get into the European markets.

These sanctions will create additional uncertainty as we head into the end of the month. There was already some additional buying in January, and this created another surge as countries look to purchase different volumes.

The energy markets are seeing a strong surge at the beginning of the year driven by several factors:

- Biden rolled out new sanctions against Russia focusing on about 160 oil tankers. As we’ve said from the beginning, the only way to really “embargo” crude shipments is through the shipping/ insurance side of the business.

A. India has said they will honor the sanctions and not allow those tankers into their harbors.

B. “As well as the tankers, two large producers and exporters were sanctioned, traders organizing hundreds of shipments have been listed, pivotal insurance companies have been named, and two US oil service providers have been told to exit. A Chinese oil terminal operator was also included.”[1]

- Surgutneftegas and Gazprom Neft were sanctioned, and they shipped about 970k barrels a day in 2024.

- The below chart shows how the ships sanctioned have surged over the last few months- with another big spike in the new year.

- There were also some sanctions against traders: “OFAC has also targeted the “opaque traders willing to ship and sell” Russia’s oil, who “often are registered in high-risk jurisdictions, have murky corporate structures and personnel with links to Russia, and conceal their business activities.”

- These moves will limit who buys crude in India and China from the sanctioned vessels, and it will limit total availability.

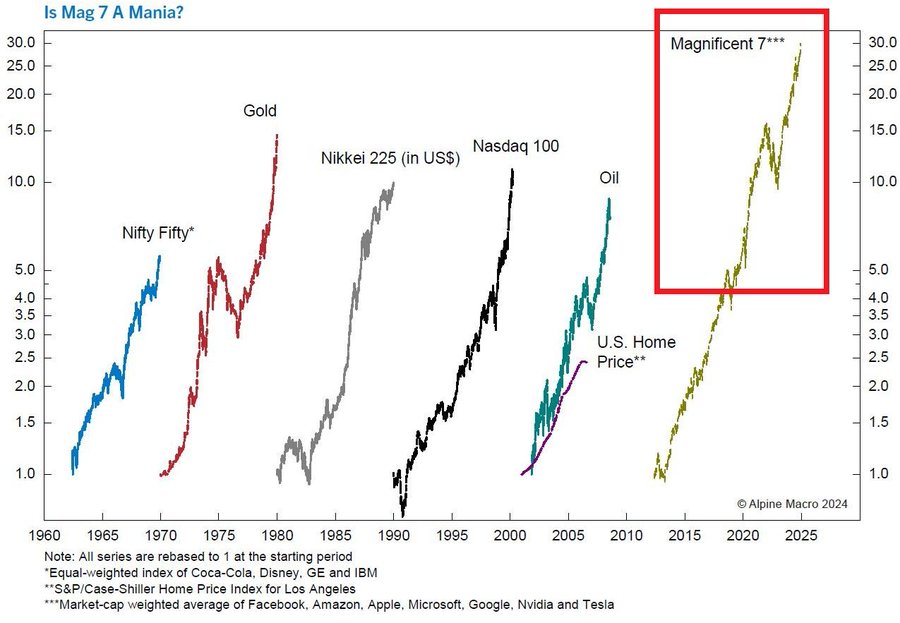

- Money flows- energy has been an avoided sector with tech attracting a large portion of investment. Tech stocks saw a huge amount of investment over the last several years, and this puts the “Magnificent 7” into extreme bubble territory.

- The new year saw profit taking and some movement into energy after the trade of 2024 was short energy and long tech. As the trade becomes more profitable, you need to balance it by taking some of it off and reallocating.

- This shift has helped support some of the volumes into the futures and energy equities

- Open Interest (chart below) has pushed higher, which shows a slew of new longs coming into the market. This helped push the market higher, and give legs to a market that was already moving higher.

- Chinese stimulus talk has taken center stage once again in 2025. The hope of support from the government and PBoC has been enough to drive up futures in the past.

- “China’s central government urged local authorities to offer handouts to people struggling with the cost of living, Xinhua News Agency reported, citing a notice from the Ministry of Civil Affairs.

- Municipalities with the means are encouraged to provide financial aid ahead of the New Year and the Lunar New Year festival in late January, state-owned Xinhua reported on Saturday. For maximum impact, local government agencies should set up systems to temporarily subsidize prices and link social assistance with price levels, according to the report.”[2]

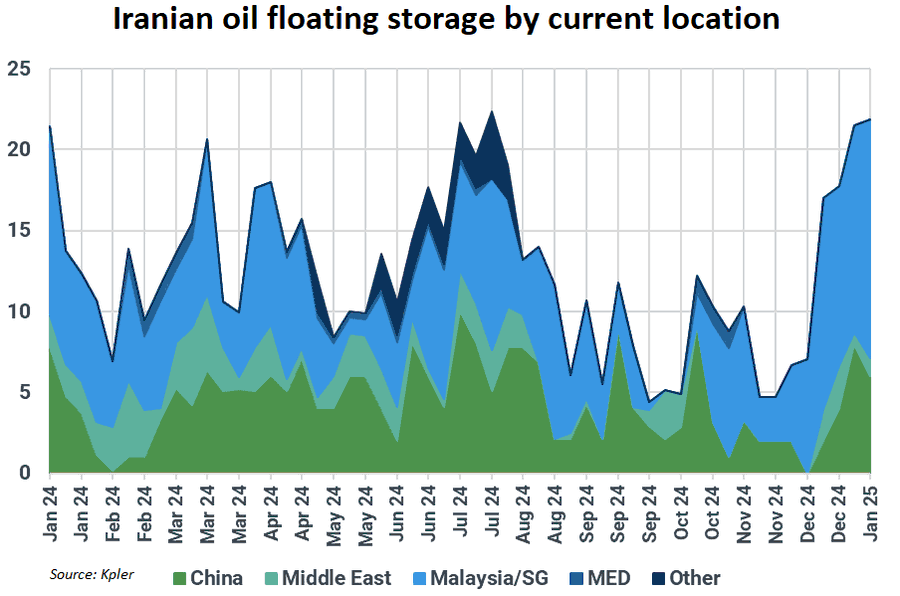

- Flows from Iran have diminished as floating storage increases. “EOPL’s Iranian crude floating storage began to increase as dark fleet availability for EOPL-China voyages started to be limited.”

- This pushes normal buyers (China) to find alternatives to the normal Iranian volumes.

- Spreads in the physical market have improved with premiums carrying over from some late buying in December

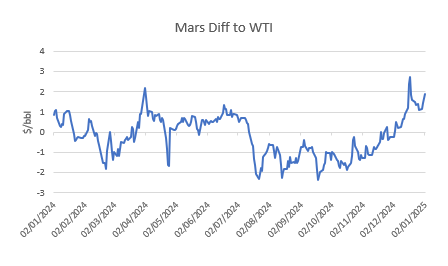

- The biggest driver has been the heavy/med sour vs light sweet. One of our core views has been the shift with limited heavy and growing volumes of light/sweet.

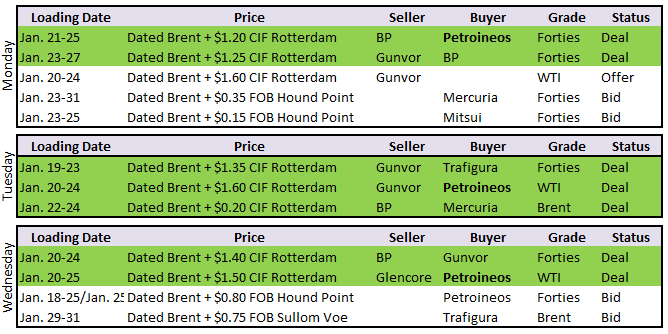

- The below diffs helps drive home some of these shifts that have remained in the market since the end of Dec.

- They have cooled off slightly after being up almost $1, but on the physical side differentials gained a little. 2 things to note here: Total was out today and Petroineos is back (China), Brent vs Dubai is in play, we should see PI amassing cargoes and sending a V East

- Physical East to West..! Cash Dubai’s premium to swaps fell 4 cents to $1.56/bbl.

- North Sea: Chinese are active in the North Sea. Forties, Brent and WTI Midland all rise.

- Gunvor bought a Jan 20-24 Forties cargo from BP at Dated Brent plus $1.40 CIF Rotterdam, equivalent to $0.42 on an FOB basis.

- Petroineos bid Jan 18-25 and Jan 25-Feb 1 Forties cargo at Dated Brent plus $0.80 FOB, boosting the average to $0.61.

- Petroineos bought a Jan 20-25 WTI Midland cargo from Glencore at Dated Brent plus $1.50 CIF Rotterdam, equivalent to $0.59 on an FOB basis.

- Petroineos bid a WTI Midland cargo at Dated Brent plus $1.80 CIF Rotterdam, equivalent to $0.89 on an FOB basis, boosting the average to $0.72.

- Trafigura bid a Jan 29-31 Brent cargo at Dated Brent plus $0.75 FOB.

- WAF: Sonangol sold the Cabinda into a buying tender run by Indonesia’s Pertamina. The cargo was last offered at Dated Brent plus $1.

- On Nigerian crude, about 10-15 cargoes for January loading are still unsold, as the market begins to trade February cargoes.

- WAF continues to struggle selling

- Saudi allocations for Chinese customers in Feb are lower than Jan, prompting China to seek barrels in the West. WAF started to pick up yesterday, tankers, spreads…everything. Sentiment is shifting amid this Chinese front loading before Lunar new year.

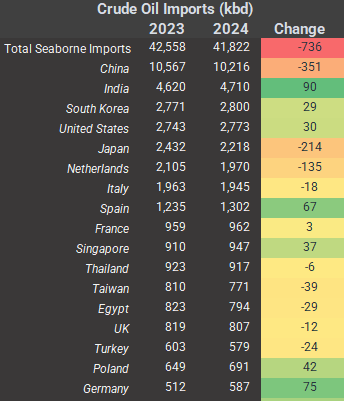

There is usually a sizeable increase in buying in December- especially following a slow year for imports. China will likely see some increased buying in Jan following a very slow year, and we saw KSA increase prices inline with expectations. Saudi Aramco raises its OSP for Feb loadings to Asian customers by $0,60 and $1.20 to European.

OPEC+ finished strong in December by keeping volumes off the market, but it was mostly driven by Russia. This is less about them being good OPEC citizens, and more because there was a drop in demand for their crude in Dec. It will be important to see how this adjusts in Jan, and if a large part of this volume is kept off the market.

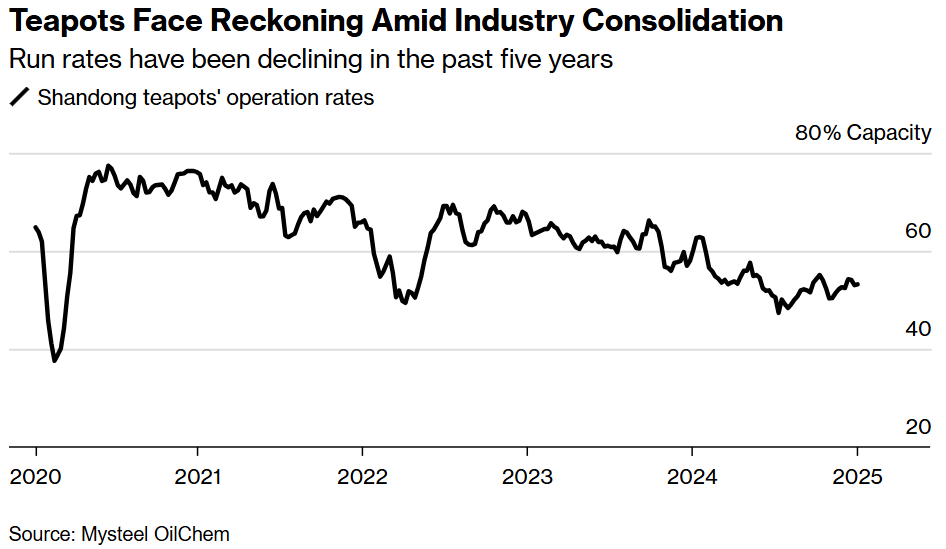

China is unlikely to be the same buyer- especially of Urals and Iranian crude- with Teapot refiners being so sluggish. I think we’ve seen activity levels “flatline” for now, but there will be renewed pressure lower as additional facilities are shuttered. Shandong (Teapot) refiners are some of the biggest buyers of Iran crude, and with sanctions and sluggish activity- buying will be under pressure.

“Teapots are already running at 55% or less of capacity, according to Mysteel OilChem, and are likely to shrink runs even further, or shutter plants for maintenance for longer, in order to cope with the squeeze on margins.”[3]

The Chinese government has been pushing more of these teapots to close, but it’s been difficult given local demand and the need for jobs over the years. With demand shifting internally, there is a renewed push to shutter more of the facilities. The below chart puts into perspective how much capacity is still left in Teapots.

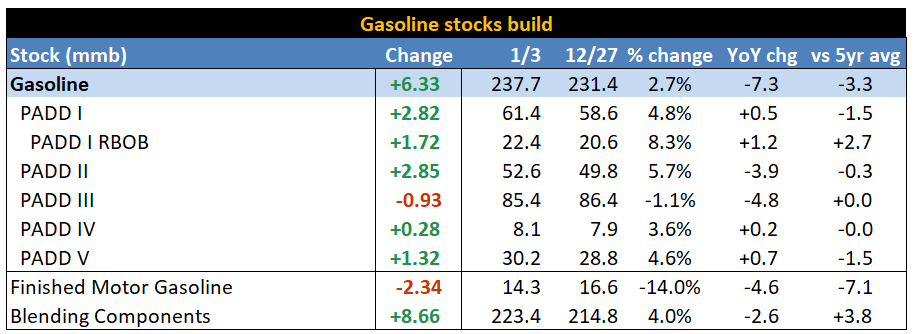

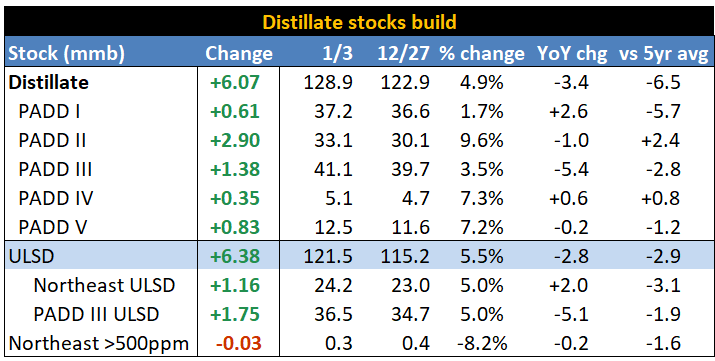

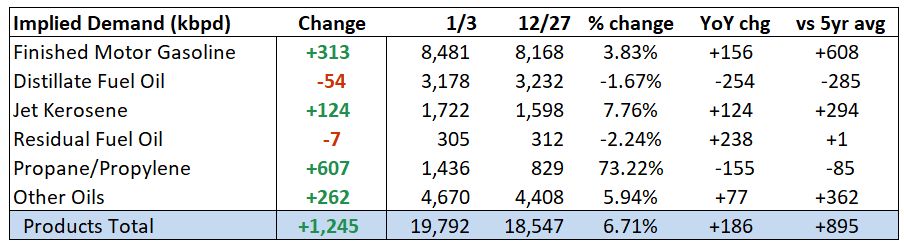

The biggest overhang for the market is the products market, which has continued to worsen over the last few weeks. There have been some sizeable builds over the last week with more likely to come given the broad slowdown in economic activity. The U.S. is no different with big builds across the board in all products.

The U.S. is also facing two winter storms that will dramatically impact gasoline demand in the near term following two separate occasions where close to 100M people were under some sort of winter storm watch. The market tried to front run some of the buying post holidays and in front of the storms, so I expect to see a sizeable drop in broad gasoline demand.

The shift in sanctions will adjust distillate flows from the U.S. There was an initial expectation that exports will start to slow, but as the arbitrage blows back open- we will see an elevated amount of volume moving into Europe. Between cold weather in the U.S. and Europe increasing heating demand, we will more support in the distillate side of the equation.

U.S. crude production is sitting around 13.4-13.5M barrels a day, and we don’t see much movement in 2025 above 13.7M barrels a day. As we’ve discussed in the past, there is a limitation in the light, sweet crude that U.S. refiners can process. This means more barrels need to be exported into the broader market, with a large portion heading into Europe. There is also a limit to the physical infrastructure utilized to move the crude and put it on the water. These broad limitations to buyers and physical pipes leads to a broader slowdown in the pace of new production. It’s unlikely we see an exit rate in the U.S. of 14M barrels a day of crude production, but we expect to see something closer to 13.7-13.8M barrels a day.

Another pressure point is the differential issue with natural gas- especially when you look at the difference between Waha and the Northeast. There won’t be another big debottlenecking event until next year, and it will leave a lot of natural gas trapped in the Permian. The cost differentials will benefit natural gas producers in the Northeast and Midwest because they can get around the bigger bottlenecks and sell into Henry Hub or local markets/exchanges.

While we are going to have a strong set up to kick off the year, these countries will find ways to work around the new restrictions. These sanctions will be MUCH harder to work around, and it will be impossible to move the same volumes as before- but we will see some “normalcy” return to the market. The bigger problem is on the demand front- The average U.S. consumer expects real income growth over the next 1-2 years to be at a record low. How do you think a person will spend if they expect incomes to weaken?

The net percentage of Americans expecting a higher inflation-adjusted income is even lower than during the 2008 Financial Crisis. To put this into perspective, Americans expected a higher income growth in 1980 when the inflation rate was ~14%, or 5 times higher than it is now. Furthermore, real income growth expectations over the next 5 years also fell to all-time lows. All while long-term inflation expectations have hit their highest since 2008. Consumers have lost confidence in the Fed.

Our next insights will cover the demand backdrop and dig into the economic setup as we head into a difficult 2025.

- https://www.bloomberg.com/news/articles/2025-01-10/why-biden-s-farewell-sanctions-on-russian-oil-are-a-big-deal

- https://www.bloomberg.com/news/articles/2024-12-28/china-urges-local-governments-to-give-cash-handouts-for-new-year

- https://www.bloomberg.com/news/articles/2025-01-05/china-oil-teapots-face-reckoning-as-beijing-tackles-overcapacity