FTI’s topline and EBITDA margin can improve in FY2025 due to deepwater project growth in international markets. Its financial performance should improve due to a robust demand for its iEPCI and Subsea 2.0 platform. Despite a Q1 slowdown, the company’s FCF should improve significantly in FY2025.

2024 Order Backlog

We have already discussed TechnipFMC’s (FTI) Q4 2024 financial performance in our recent article. This article will dive deeper into the industry and its current outlook. In FY2024, FTI had a total inbound order of $11.6 billion, 5% higher than a year earlier. This was due to a growth in iEPCI (integrated Engineering, Procurement, Construction and Installation), Subsea 2.0, and Subsea Services order. iEPCI orders grew nearly 25% year-over-year. We detailed some of the key projects in our short article.

Subsea 2.0 and Non-traditional Sources

FTI’s product architecture, Subsea 2.0, allows it to configure an order model and create incremental manufacturing capacity by eliminating engineering hours and streamlining the supply chain. So, it prevents committing excess capex. So Subsea 2.0 saw a high order growth rate in 2024. The company secured $20.2 billion of Subsea orders in the past two years, while it expects to exceed $10 billion in 2024.

In 2024, FTI received an iEPCI project from Petrobras that will utilize Subsea processing to capture CO2 directly from the well stream for injection back into the reservoir. It has also announced an all-electric system for carbon transportation and storage in the United Kingdom. It will also create iEPCI for offshore floating wind in a new partnership with Prysmian.

International Growth

In the Middle East, FTI expects to benefit from ramp-up activity in the UAE and Saudi Arabia. It anticipates that offshore and the Middle East will attract investment from operators due to improved economic returns. In the coming months, it expects to expand into new regions with a growing clientele.

Outlook And Forecast

In FY2025, FTI’s management expects Subsea segment revenues to increase by 10% compared to FY2024, with an adjusted EBITDA margin of 19.5%. In Surface Technologies, it expects revenues to remain relatively unchanged (1% up) with an adjusted EBITDA margin of 15.5%. Overall, its revenue can increase by “high single digits”, leading to an improvement in the adjusted EBITDA margin in FY2025.

In Q1 2025, however, FTI expects some headwinds. Its Subsea revenues can decline by “low to mid-single digits” sequentially due to the adverse effect of seasonality. In Surface Technologies, revenue can decline by ~10%.

Key Q4 Metrics

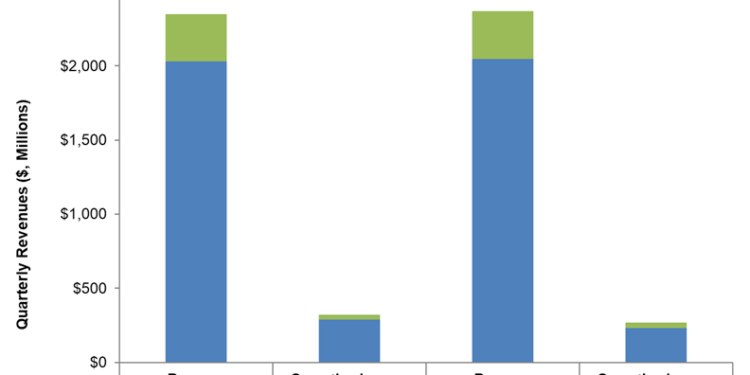

Quarter-over-quarter, revenues in the company’s Subsea operating segment rose slightly in Q4. The top line in the Surface Technologies segment decreased moderately, by 0.3%. Operating income in the Subsea segment declined by 20% in Q4.

FTI’s cash flow from operations increased by 39% in FY2024 from a year ago. As a result, its FCF increased by 45% in FY2024. It expects to convert over 50% of adjusted EBITDA into free cash flow in FY2025, which translates to a range of $850 million to $1 billion. It also expects to spend $340 million in capex in FY2025, or 21% higher than FY2024.

Relative Valuation

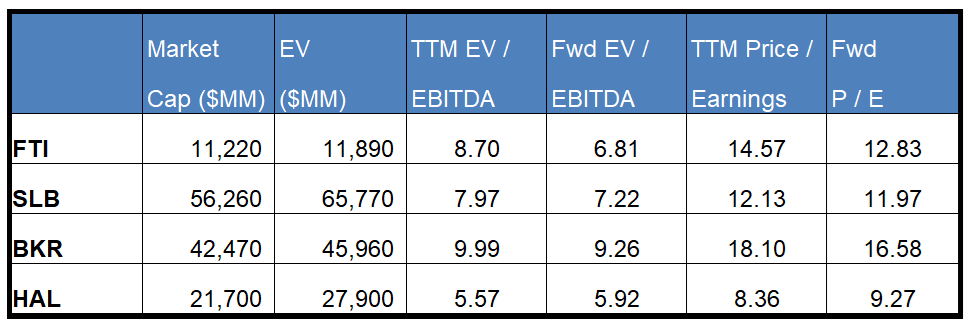

FTI is currently trading at an EV-to-adjusted EBITDA multiple of 8.7x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 6.8x. The current multiple is above its five-year average EV/EBITDA multiple of 8.5x.

FTI’s forward EV-to-EBITDA multiple contraction versus the adjusted current EV/EBITDA is steeper than peers’ because the company’s EBITDA is expected to increase more sharply in the next four quarters. This typically results in a higher EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is slightly higher than its peers’ (SLB, BKR, and HAL) average. So, the stock is reasonably valued, with a positive bias, compared to its peers.

Final Commentary

In 2024, FTI’s subsea order book made a strong recovery due primarily to growth in iEPCI contracts in the Middle East. Also, its Subsea 2.0 saw high order growth as it diversified into CO2 capturing and all-electric systems for carbon transportation and storage. The company revised its FY2025 forecast due to robust growth in the order backlog.

However, the company’s Q1’05 revenue and EBITDA outlook are relatively shaky due to the seasonality impact. Despite a higher capex planned for FY2025, it sees step growth in FCF for the year. The stock is reasonably valued, with a positive bias, compared to its peers.

Premium/Monthly

————————————————————————————————————-