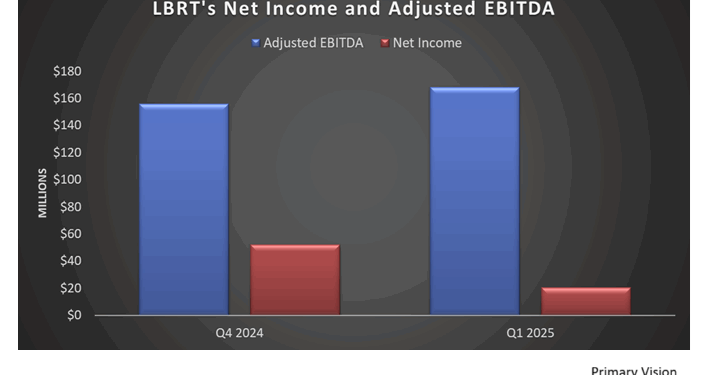

Liberty’s topline and EBITDA outperformed the energy industry slowdown in Q1. However, its net income fell. Despite a potential slowdown in energy market activity, it anticipates revenue and profitability growth in Q2. The natural gas market growth can sustain the momentum in 2025.

Outlook for Q2 And Beyond: LBRT anticipates revenue and profitability growth in Q2 due to higher utilization. Higher efficiency will help it neutralize the negative impact of the higher tariff. LBRT’s management expects growing power demand from data centers, manufacturing, mining, and industrial electrification in 2025. It also plans to face the industry slowdown with its robust balance sheet.

LBRT expects a “potential slowdown” in energy market activity in 2025. In an environment where the supply side remains uncertain following the OPEC+ production strategy and constraints on Iranian, Russian, and Venezuelan oil exports, natural gas can prove to be more reliable. The company may target the large, well-capitalized producers in the shale basins who can withstand the volatility of crude oil prices. It also expects the current “decline in service activity would likely be less pronounced than in the past.”

Key Developments in Q1: Liberty’s acquisition of IMG, a distributed power systems company, will complement its Liberty Power Innovations with power plant EPC (engineering, procurement, and construction) management and utility market expertise. You can also read more about LBRT’s fracking activities here.

Topline Grew But Bottomline Shrank In Q1: LBRT’s revenues increased by 3.6% quarter-over-quarter in Q1, while its adjusted EBITDA went up by 8%. However, its net income dipped sharply, by 61%, in Q1’25 compared to Q4’24 due to higher cost of services.

The company’s debt-to-equity ratio deteriorated marginally to 0.11x as of March 31, 2025. During Q1, it repurchased 1.0% of its outstanding shares at $15.5 per share (higher than the market price of $11.4). It also maintained its quarterly dividend at $0.08 per share.

Thanks for reading the LBRT Take Three, designed to give you three critical takeaways from LBRT’s earnings report. Soon, we will present a second update on LBRT’s earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-