In Q1 2025, ProPetro’s revenues and adjusted EBITDA segments increased compared to the quarter earlier. Free cash flow, however, decreased. It has lowered the FY2025 planned capex and plans to focus on the natural gas-fueled power generation business.

PUMP’s Frac Spread Count To Decline in Q2: During Q1, PUMP had 14-15 hydraulic fracturing spreads operating. Its frac spreads include two Tier IV DGB dual-fuel and four FORCE electric-powered hydraulic fracturing spreads. It expects the active frac spread count to decline to 13-14 in Q2.

Early in 2024, PUMP received a total of 140 megawatts of natural gas-fueled power generation equipment orders. It will carry out the business under a subsidiary called PROPWR. Later, it received an additional 80 MW of orders. It has also secured letters of intent for ~75 MW of long-term PROPWR service capacity in the Permian Basin. Read more about this in our recent article here.

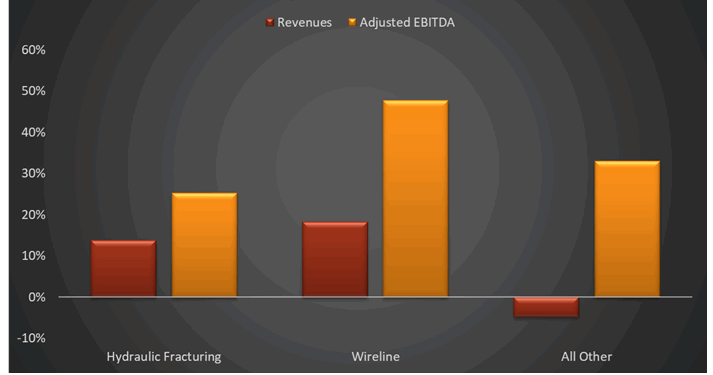

Key Metrics Improved In Q1: Quarter-over-quarter, PUMP’s revenues from the Hydraulic Fracturing segment increased by 14% in Q1 2025, while its adjusted EBITDA increased by 25%. Its revenues and adjusted EBITDA from the Wireline segment increased by 18% and 48%, respectively. Despite lower activity in the industry, PUMP’s asset utilization was robust while it kept pricing steady in Q1. It recorded a $10 million loss related to Tier II hydraulic fracturing equipment sales. Despite that, it recorded ~$10 million in net income compared to a net loss in Q4.

PUMP’s Cash Flows and Capex Guidance: PUMP’s cash flow from operations decreased (by 27%) in Q1 2025 compared to FY2024. Its free cash flow also decreased during this period. The company’s debt-to-equity ratio improved marginally, falling to 0.05x as of March 31, 2025. It lowered its FY2025 capex guidance by 9% as it lowered the completion capex target following cost optimization initiatives.

Thanks for reading the PUMP Take Three, designed to give you three critical takeaways from PUMP’s earnings report. Soon, we will present a second update on PUMP earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-