NINE’s revenues and EBITDA margin improved in Q1 despite a lower rig count in the industry. The Cementing and coiled tubing businesses were the main drivers in Q1. However, its cash flows weakened in Q1. Its management expects a fall in Q2.

This content is locked

Login To Unlock The Content!

A Downfall Expected In Q2: NINE Energy’s (NINE) management is concerned about the impact of the recent tariff hikes. It anticipates activity declines and pricing pressure, primarily in the Permian Basin, as the crude oil price declines. On the positive side, it expects to benefit from the market growth in the natural gas levered basin. Overall, it anticipates “Q2 revenue and earnings will be down compared to Q1.” Read more about NINE’s recent past in our article here.

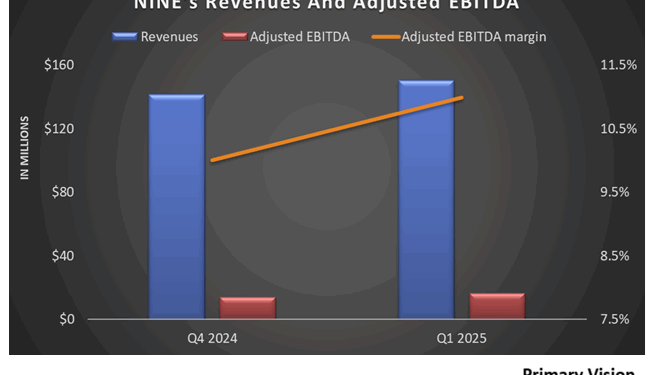

Revenue and EBITDA Margin Improved in Q1: Quarter-over-quarter, NINE’s revenues increased by 6.4% in Q1, while its adjusted EBITDA margin expanded by 99 basis points. The company’s market share improved while it reduced costs. Cementing and coiled tubing businesses primarily drove the growth. Plus, it achieved more efficient operations and less white space during Q1.

Negative Cash Flows And Liquidity: NINE’s cash flow from operations turned negative in Q1 2025 compared to a quarter ago. As a result, free cash flow turned negative in Q1. Due to negative shareholders’ equity, its debt-to-equity ratio remained negative as of March 31, 2025. However, the company has closed its $125 million revolving credit facility, which will improve its liquidity.

Thanks for reading the NINE Take Three, designed to give you three critical takeaways from NINE’s earnings report. Soon, we will present a second update on NINE earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.