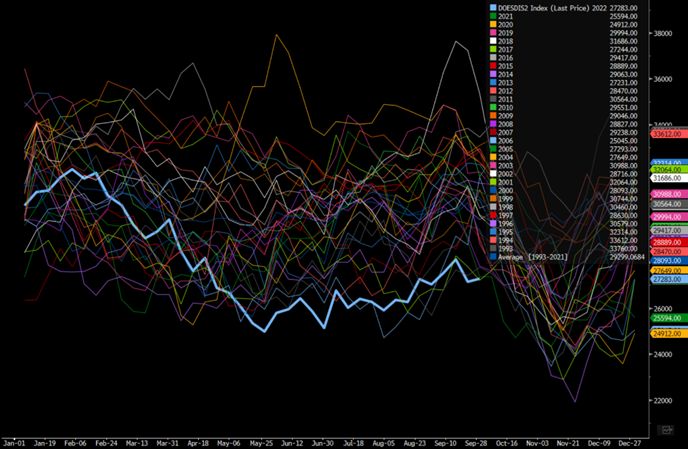

We have been beating the drum on how short the world is on distillate, and the position for diesel/heating oil has never been this bullish for pricing before. When we go back through history, the economics for diesel are at record prices, but it’s also important to look at the elevated levels it has sustained over the last 12 months. The demand side will soften on the trucking side, but heating oil demand season is rapidly approaching and will drive demand back up on a seasonal basis.

Here is the “zoomed-in” view on where crack spreads sit right now. There is a lot of staying power in crack spreads given the Canadian oil discounts, and more importantly, the low level of global diesel in storage.

“Canadian heavy Cold Lake crude discount continues to widen, expanding to record $25/bbl at Cushing from $21.75/bbl on Tue. and $23/bbl at Gulf Coast from $20.50 Tue., according to Link Data Services.

- Heavy Western Canadian Select in Alberta’s discount widens $1.50 to $32.50, widest since massive pipeline bottlenecks developed in late 2018: data compiled by Bloomberg

- Relatively wide discount at Gulf vs. Hardisty happens as 3.5% sulfur fuel oil FOB at Gulf falls to $55.63/bbl, more than $31 discount to WTI based on today’s futures prices, widest in more than a decade, data compiled by Bloomberg show

- High-sulfur fuel oil floating inventories off Singapore rose to year-and-half high wk ended Oct. 10 with high-sulfur fuel oil stockpiles rising 9% w/w as Russian fuel oil flows to Asia rise as U.S. and Europe reject Russian supply, Vortexa said in report Mon.

- Asia resid fuel exports also jumped in Sept. to highest in ~2 yrs

- NOTE: Russia has been selling crude, fuel at discounted rates amid sanctions due to Ukraine war

- High-sulfur fuel oil floating inventories off Singapore rose to year-and-half high wk ended Oct. 10 with high-sulfur fuel oil stockpiles rising 9% w/w as Russian fuel oil flows to Asia rise as U.S. and Europe reject Russian supply, Vortexa said in report Mon.

- NOTE: High-sulfur fuel oil is similar to Canadian heavy crude and can trade in tandem at times”

High-sulfur fuel oil has been piling up as Russia has been pushing more volume into the market at steep discounts. The shift in economics will push Emerging Markets (especially in Central Asia) to run more high-sulfur fuel oil for power generation instead of low-sulfur diesel or LNG. Pakistan recently couldn’t secure a shipment of LNG, and the shortages will persist based on availability but also the price rise, which only gets worse in the winter months.

Russia pushing more product into Asia and floating storage has displaced other cargoes pushing more into the U.S and Europe, which the U.S. can use as a feedstock for refining. It will help keep discounts broad for fuel oil in the Gulf but also Canadian flows into PADD2. PADD 2 distillate storage is at the lowest on record, while PADD 1 continues to print new all-time lows. This will help support the economics for refiners that can target a higher cut of distillate.

As a refiner targets more diesel, they will inherently create more gasoline as well because on average for every one barrel of diesel created it throws off two barrels of gasoline. This has created a growing gasoline glut as consumers due less while diesel is imperative for heating, mining, shipping, or for just making everyday life possible.

We also have some news that TC Energy will temporarily increase flow rates on the current Keystone pipeline in November.

“TC Energy plans to initiate a temporary increase in flow rate on segments of the Keystone Pipeline System from November, according to an emailed statement.

- Higher flows will last through December, testing the system’s operational performance and reliability

- Upon completion of test, TC Energy will lower flow rate to current system throughput of 622k b/d

- Co. declined to say how much flows will be raised

- NOTE: The main Keystone crude pipe ships oil from Hardisty, Alberta, to Steele City, Neb., and from there to either Patoka, Ill., or Cushing, Okla.

- The system’s Gulf Coast segment is also known as Marketlink pipeline and runs from Cushing to Port Arthur, Tex., with extension to Houston; capacity 800k b/d”

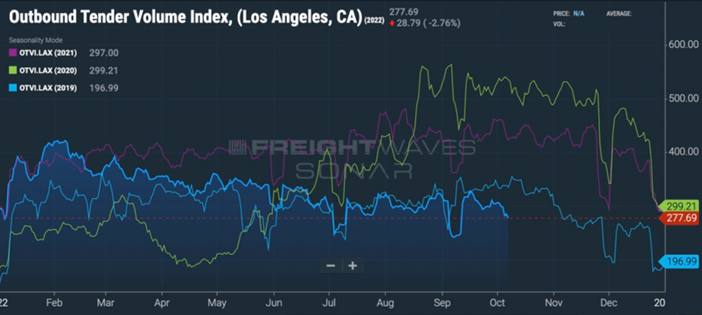

The additional flows will support heavy crude availability for refiners in PADD 2 as well as push Cushing higher as it remains at lows. On the shipping/trucking side, demand is now below 2019 levels- which was the point we turned very bearish on the U.S. markets. For those that have been following Primary Vision, and my insights since that point will remember our bearish stance heading into the end of ’19 and into 2020. The below data point is a huge bellwether for the health of the U.S. economy and the underlying consumer: “Trucking freight volumes out of the most important port city are now trending below 2019 levels.”

This shift in trucking will slow demand on the diesel front, but as trucking demand wanes- heating demand picks up!

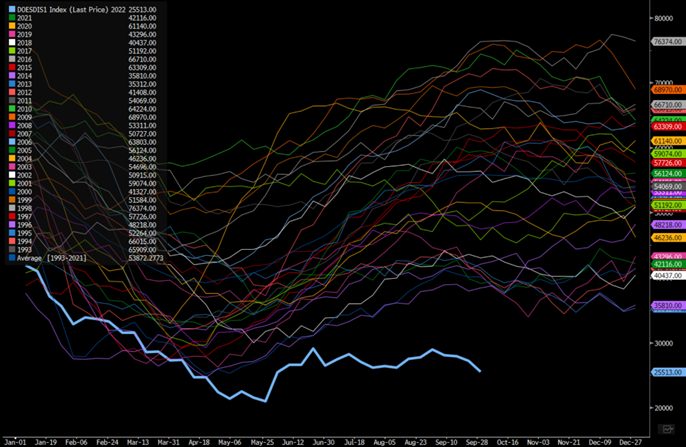

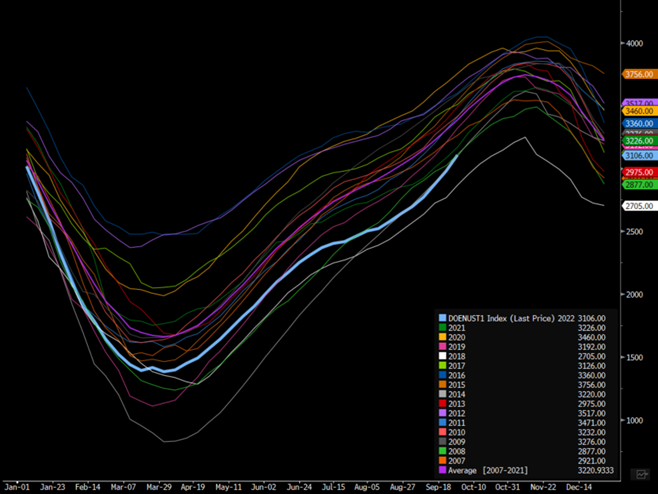

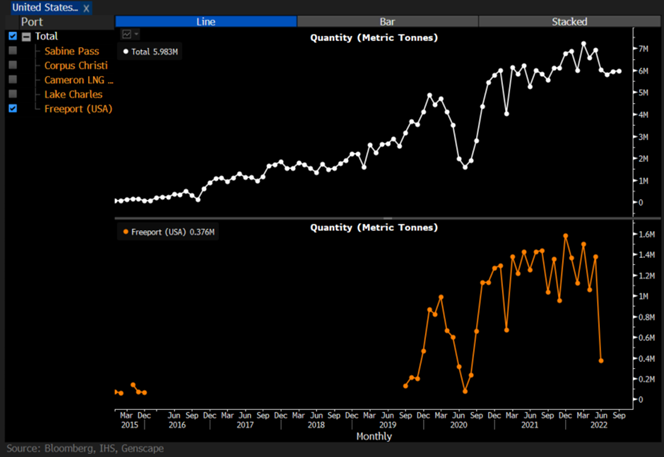

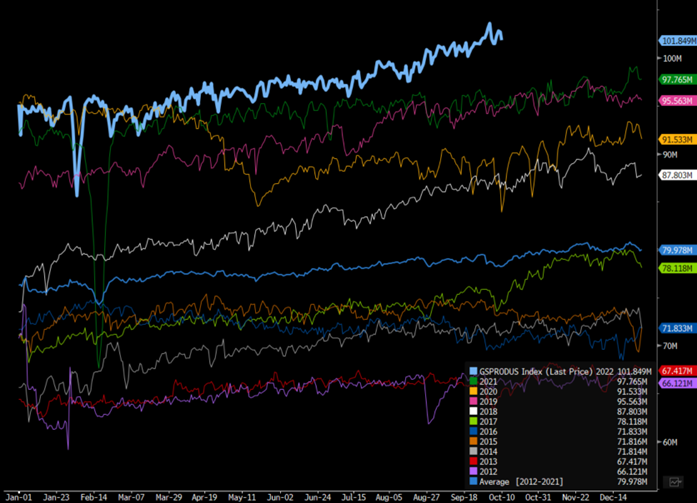

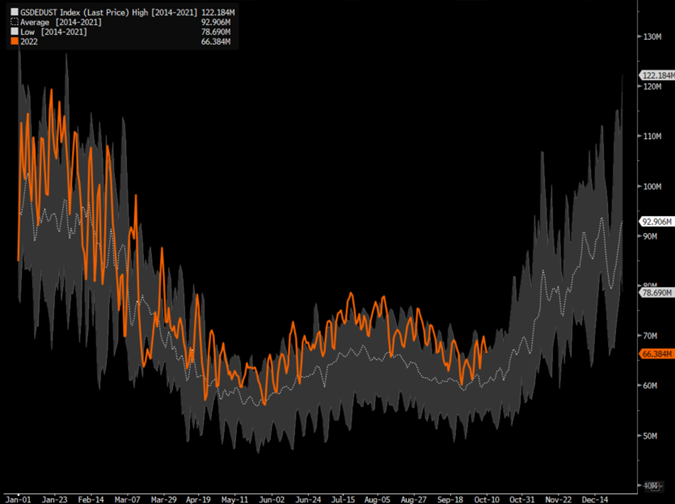

The natural gas backdrop remains supportive as storage sits at the low end over the last 15 years, and demand holds in across the U.S. Storage is at the same levels it was in 2014 with 2018 at a lower point over the same time. We have a bit of a different setup this time around with LNG exports well above previous years. There is also more export capacity coming back online between Freeport and new construction- Golden Pass and Port Arthur. Freeport LNG is expected to be back to partial operation by the middle of November enabling them to meet contractual obligations. This has helped tip the U.S. into one of the most bullish setups for natural gas (and the underlying E&Ps) in a very long time.

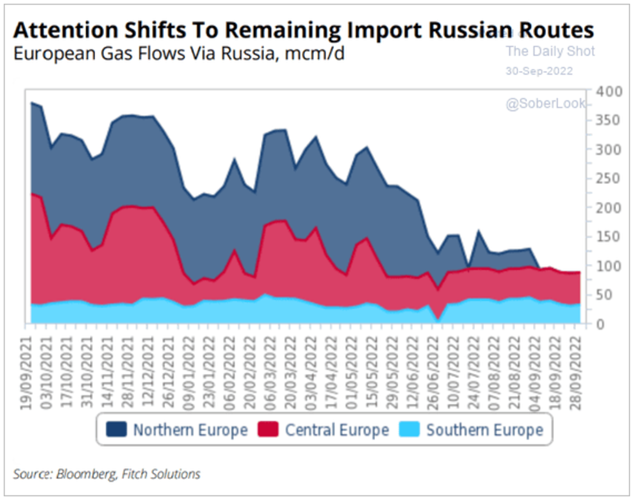

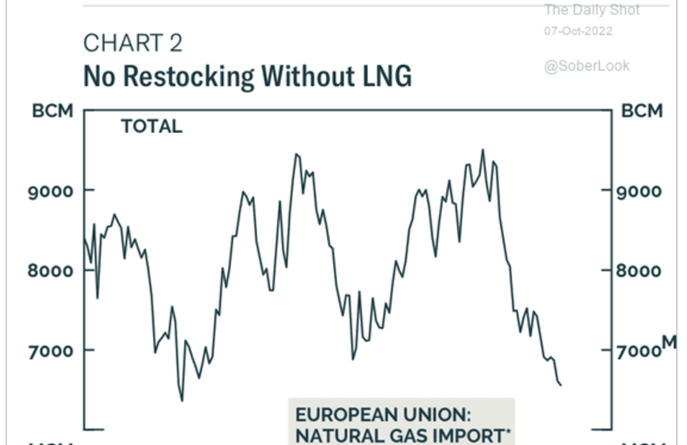

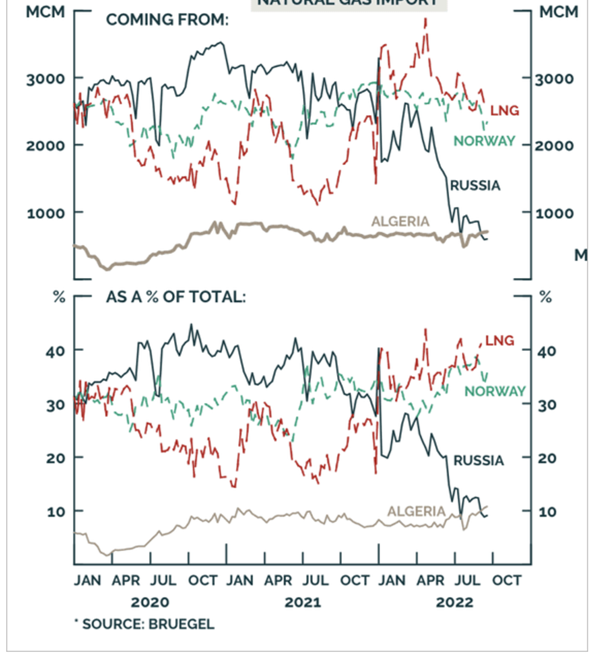

Nord Stream 1 and 2 were hit by sabotage that have rendered line 1 completely inoperable with line 2 still operable at a reduced rate. It’s definitely “interesting” that line 1 had a complete breech while line 2 only had an “outer breech” leaving the inner components of the pipeline operable. It’s also “interesting” that the explosions occurred just outside of Exclusive Economic Zones (EEZs) avoiding the potential of triggering Article 5 of the NATO treaty. Natural gas wasn’t flowing through the pipelines at the time, but they were still filled to maintain pressure and hadn’t been drained yet. So, when we look at the below chart, you get an idea how just how low imports have been into Europe. We have seen Europe focus on cutting demand in order to put storage into a “comfortable” position, but even a negotiation now will leave Nord Stream mothballed.

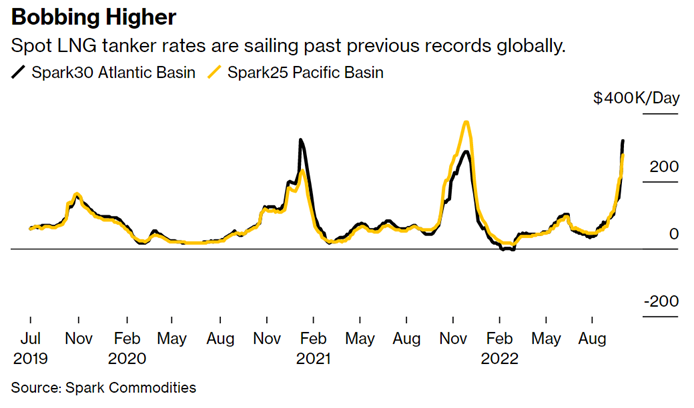

The situation is going to keep Europe beholden to the floating market, and it has already created one of the largest increases in LNG tanker rates in history. We expect rates to keep shifting higher, but it will also price people out of the market. Pakistan was already unable to secure a cargo of LNG driven by price, which will become a more common theme as we head into peak demand season.

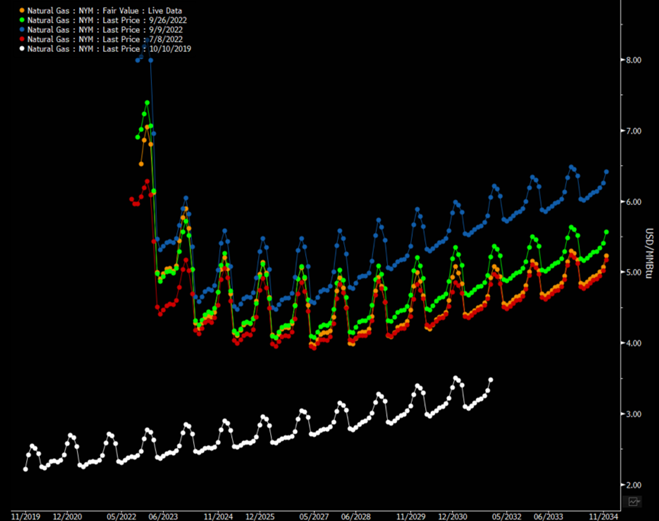

The curve below helps to highlight how the economics have pivoted over the last 3 years. The market is pricing in an average of $4-$6 over the next decade given the global backdrop for natural gas. Russia pivots have helped the situation, but global demand was already shifting to consume more natural gas. Even with a reconciliation with Russia (highly unlikely), the gas curve would adjust- but rerate at a higher level given the fundamentals in the market. With the destruction of Nord Stream, even some sort of ceasefire, treaty, or other “pause” in fighting would leave a major pipeline inoperable. Russia invading Ukraine has pushed more natural gas by pipe to China and reduced their need for LNG cargoes. While Europe has reduced their piped natural gas but increased their imports from LNG. The curve helps to highlight how different things are from three years ago, and even as the curve gyrates week over week- it is still holding large parts of the gains.

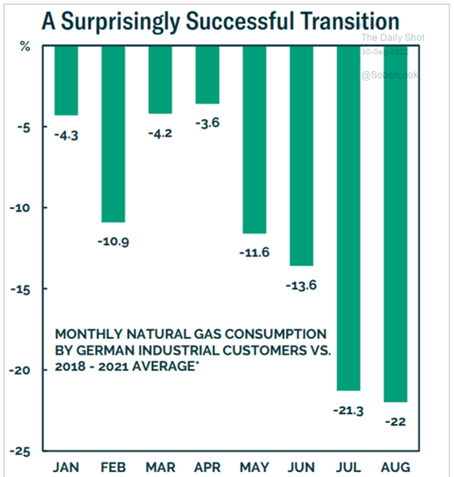

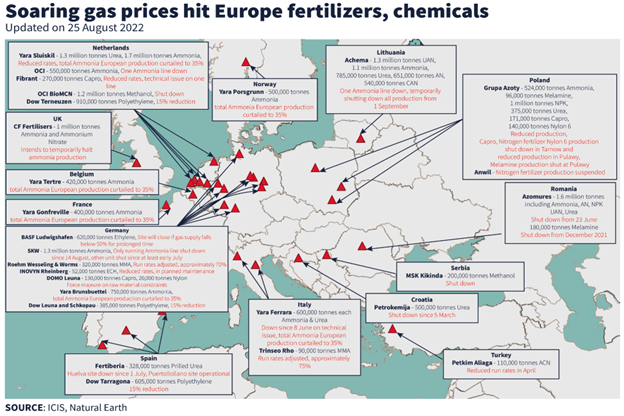

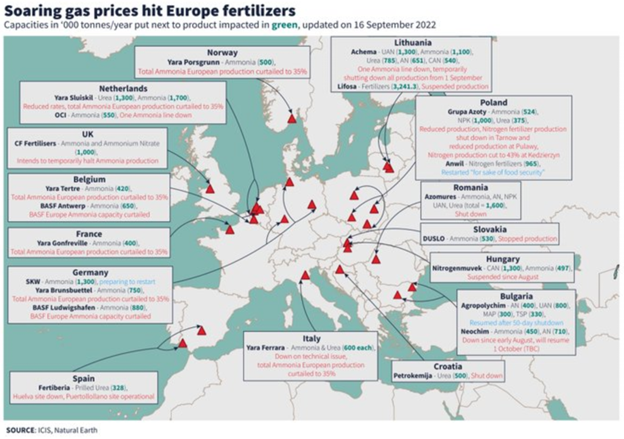

There has been a lot of talk about European natural gas storage, and it is being used as a reason to demonstrate how “overblown” the market fear is regarding winter. There is some truth behind the comments, but it is MUCH more complicated. There has been a huge hit to demand with shuttered petrochemical and fertilizer facilities as well as other industrial assets. Refiners have been rolling out economic run cuts and smaller companies are naturally reducing consumption of electricity/natural gas due to prices. The shift in demand has put more product into storage, but the cuts aren’t sustainable to have a normally functioning economy.

The below shows the “successful” transition for Germany in order to reduce their consumption of natural gas but at what cost? They have seen a huge drop in industrial capacity including fertilizer, petrochemicals, refining, and other manufacturing industries. So, while they have “achieved” their goal to increase storage, it came at the cost of crushing their economy.

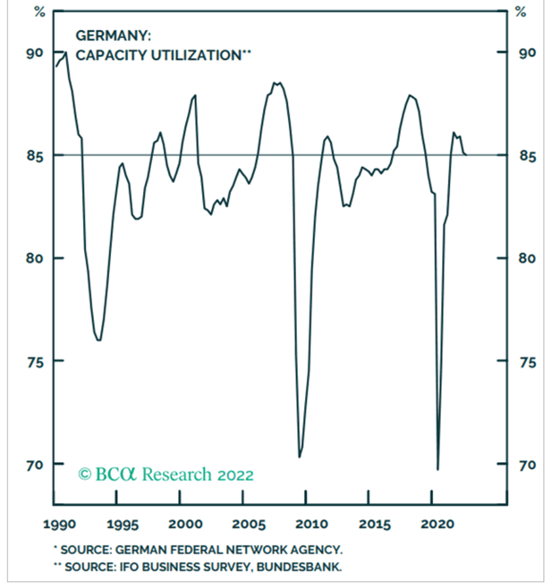

German capacity utilization is also pushing lower, so what happens the government tries to “restart” the economy. Even if the industries can afford natural gas, will there be any available?

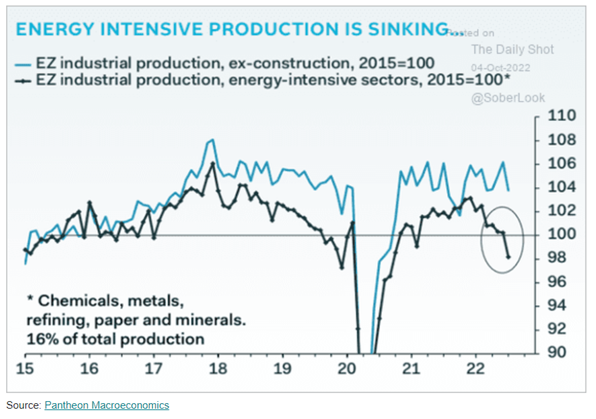

Germany isn’t the only nation that has looked at rationing natural gas. The below chart shows how many energy intensive industries have cut runs throughout the European Zone. The U.K., France, and other European nations have highlighted ways they will curb demand through rationing and rolling brownouts. The shortages within Europe are going to keep them beholden to the floating market, which has been the main outlet for the region to fill the void.

The below charts put into perspective just how important LNG is to the region.

Even with Freeport sidelined, we are still exporting about 6M tons, and when Freeport comes back in November- the U.S. will be back to about 7M tons. This is going to keep a steady flow of product moving offshore and helping support U.S. prices. Macron has complained about “price gauging” in the U.S., but Henry Hub is the most liquid trading hub in the world for natural gas. This makes it REALLY hard to see a meaningful ability to create a target means of price manipulation. Instead, we are seeing a rise in global demand for natural gas and a concern about availability leading to countries/companies trying to secure as much volume as possible.

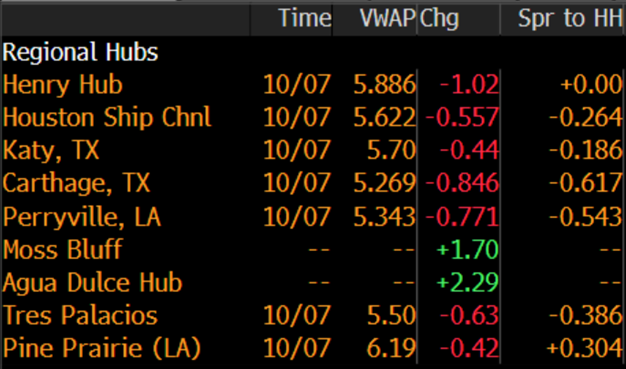

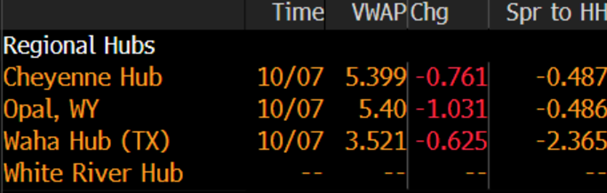

U.S. natural gas production has been pushing higher, but because of shortages in pipeline capacity/availability some product is “stranded.” This creates broad price differentials with some of the biggest occurring between Waha and Henry Hub.

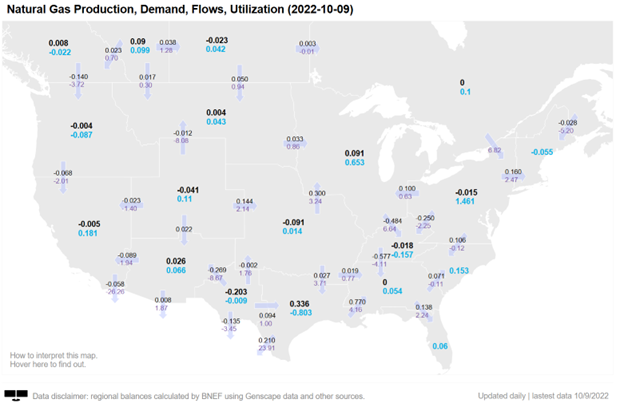

While production has moved higher, we have also seen a rise in U.S. domestic demand for natural gas. The below demand figures also carry a slowdown in LNG gas flows as Cove Point conducts maintenance ahead of the winter push.

It’s important to appreciate that not all volume is the same with Henry Hub vs Waha the perfect example. Even as natural gas supply pushes higher, a lot of that is originating from the Permian by way of associated gas. This is going to trap natural gas at Waha where it has no easy route to domestic or international markets. It’s a key reason why the CEO of Kinder Morgan stated that the U.S. is going to need another 20bcf/d of natural gas pipeline capacity built over the next decade. This is needed to help debottleneck the market and get natural gas to the market, but in the meantime we are going to have some product stuck in the market.

Here is a map that helps you visualize where the biggest bottlenecks exist:

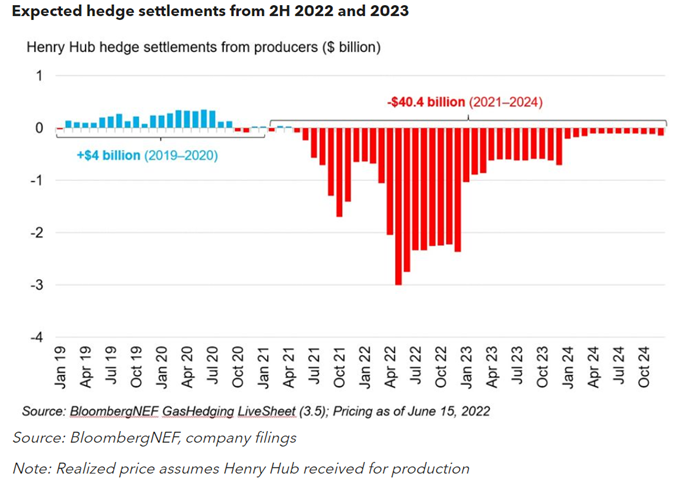

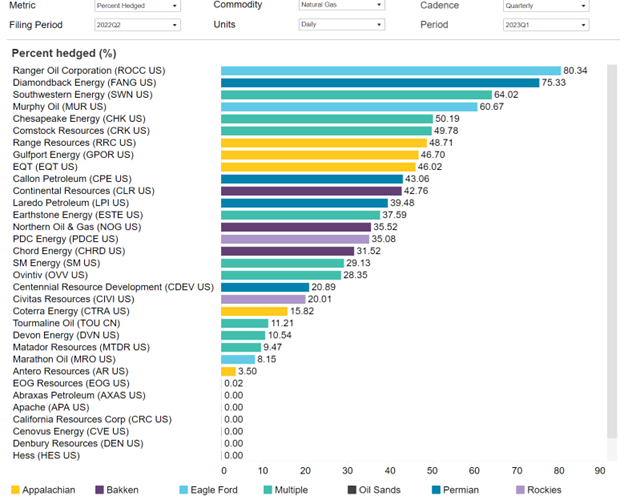

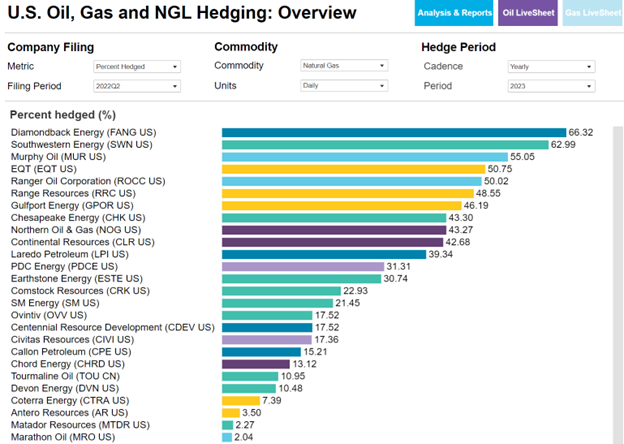

As we look forward, natural gas producers aren’t as hedged as they have been in previous years. They have been able to lock-in some healthy pricing when we look at 2023 and beyond.

We are looking at companies that are in a good position to capture upside to spot prices as well as locked in healthy gains by way of hedges.

The news of the Nord Stream “leak” followed closely to the G7 agreement to issue price caps on Russian crude. “The G-7 plan, which is part of broader efforts to punish Russia for its military invasion of Ukraine, would allow buyers of Russian oil under a capped price to continue getting crucial services like financing and insurance for tankers.” This would keep insurance available as well as tankers but attempt to reduce the revenue Russia can possibly earned. This faces several problems

- All 27 EU nations must sign off on it to be adopted

- Russia’s major buyers (India/China) haven’t signed up for the deal

“But it remains unclear how effective a price-cap regime would be, particularly since some of Russia’s biggest buyers haven’t agreed to join. India is reluctant to formally join a price-cap scheme, since its industry worries it could lose out to other buyers on the chance to buy discounted Russian crude, according to people familiar with the views of Indian firms.”

There are a lot of ways around these initiatives, so even if it’s adopted- I don’t see this having any impact. Russia has also said that they won’t sell crude to countries that participate in it, but the work arounds regarding insurance and STS will keep things flowing.

Europe’s natural gas demand over coming winter is seen 7% down from the past five-year average as a result of high prices, which is still “notably below” the target set by the European Commission, according to Kateryna Filippenko, an analyst at Wood Mackenzie.

- “There’s potential for even more demand destruction,” Filippenko said in a Bloomberg TV interview

- Further disruptions in Russian gas supplies to Europe are likely, with Moscow set to keep putting pressure on the bloc

- A potential slowdown in China due to Covid woes and comfortable storage levels in Japan may limit their appetite for gas, which is “good news for Europe”

It’s also important to consider that we are also coming into shoulder season when demand naturally diminishes mixed with the broad shutdown of the industrial sector. Electricity prices hit insane levels, but even as it falls- it will level off at prices that are still insanely expensive.

So is above seasonally normal storage good- absolutely- but you need to look at the total picture. The next question is- what does mother nature bring for the winter? If there is a polar vortex- which will pull a significant amount of natural gas out of storage- Europe can’t just buy more by pipe. Instead, they will have to rely on the LNG markets, which will be very expensive as well as much tighter given the time of year.

I agree with the view that some of the prices became absurd, but to ignore the prevailing problems heading into winter just because they have natural gas in storage is crazy. The below chart just puts into perspective the sheer number of cuts that have occurred throughout Europe. Can the continent’s economy really survive with this much capacity offline? If all these facilities were to run “normal”- the natural gas in storage would drop quickly with little ability to refill it quickly.

In short, the problems are far from over.

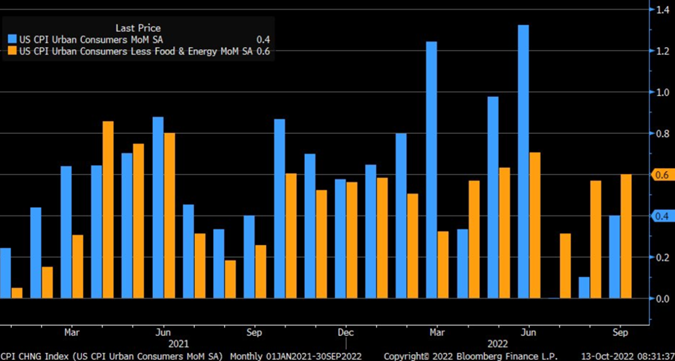

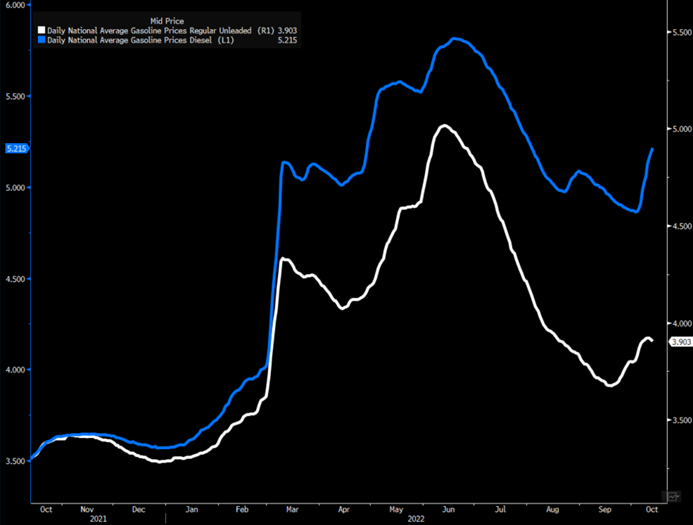

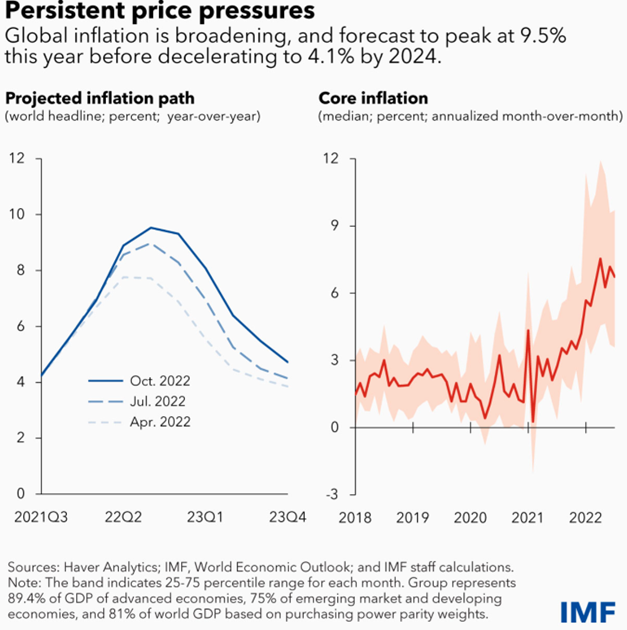

The U.S. posted another acceleration in inflation with leading indicators showing things only picked up again in October. September had a pick-up in consumer inflation topping estimates and showing a pick-up month over month. The increase came just as gasoline/diesel dipped during last month, but now it has increased aggressively in October. As we highlighted above, we see way more pain ahead when it comes to heating oil (diesel) heading into the winter months. Gasoline will bounce around (nationally) when it comes to the unplanned downtime in PADD 2 and the planned maintenance in PADD 5. “In m/m terms, CPI +0.4% vs. +0.2% est. & +0.1% prior … core +0.6% vs. +0.4% est. & +0.6% prior.”

Based on recent regulation (over the last 7 years or so), heating oil and road diesel (ultra-low diesel) will remain above $5 that will put more pressure on the supply chain costs as well as consumer prices for heating.

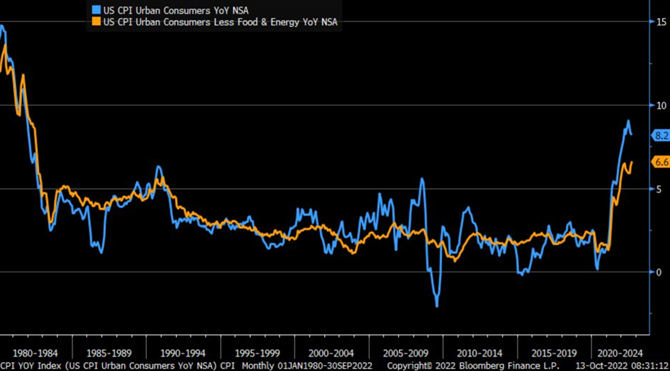

When we look at the year over year, inflation picked up outpacing estimates with core inflation reaccelerating. “September CPI inflation hotter at +8.2% y/y vs. +8.1% est. & +8.3% est. … core a bit worrisome at +6.6% vs. +6.5% est. & +6.3% prior.”

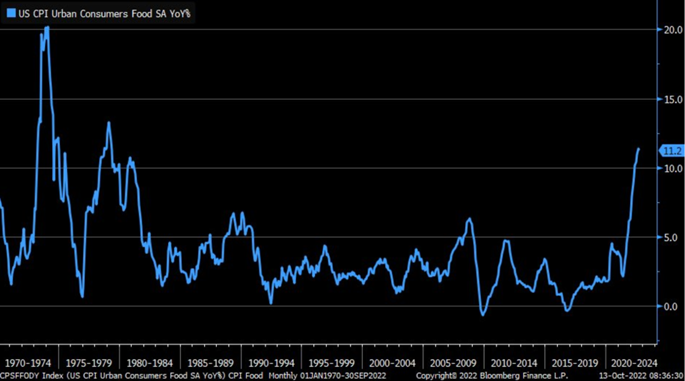

If you were to convert the current inflationary data to the “old” method, we are approaching something closer to 17%- which I think is closer to what people are thinking/feeling. If we just look at food as an example, the push higher has been aggressive in key areas that impact consumers the most- food and rent. The food component of Sept CPI improved ever so slightly from 11.4% to 11.2%, but it’s still near the fastest rate going back to the 1980’s.

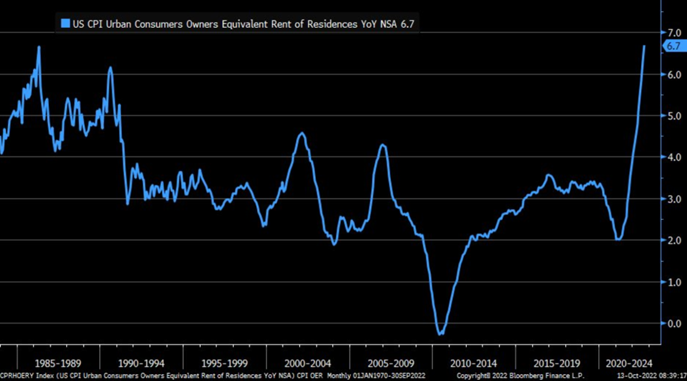

As we called out last year, owner’s equivalent rent was going to catch-up aggressively with way more to come. “Owners’ equivalent rent portion of September CPI inflation continued to surge, up by 6.7% y/y and now climbing at fastest pace on record.”

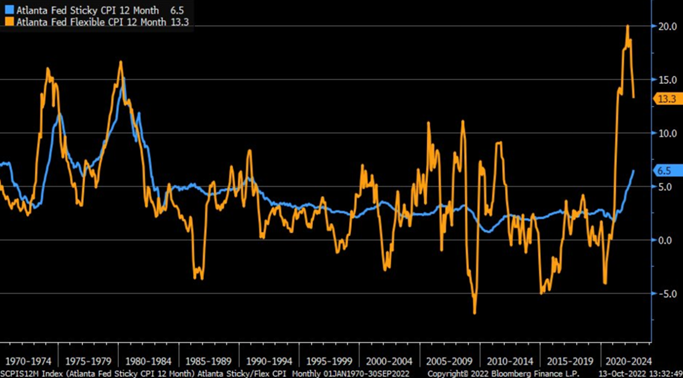

The other big difference we have been highlight in the variation between flexible and sticky inflation. The “sticky” side of the equation has continued to aggressively move higher with not only a lot of staying power but also more upside ahead.

Even as “flexible” has fallen, it remains at the highs not seen since the 70’s and given the increase in diesel/gasoline so far in October- we are going to see a pivot higher. The move higher in sticky inflation hasn’t broken stride, and it will keep driving higher given the internal metrics measured as well as flexible inflation still very elevated and pivoting back up.

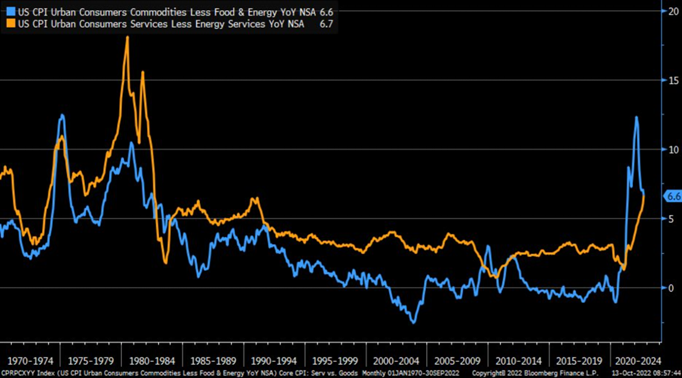

A key driver of the move higher has been services, which typically doesn’t fluctuate the same way. This is exactly what we have been highlighting regarding the move. Our view has been that core goods component was going to get cheaper as inventory grew and demand waned, while services was going to trend higher causing the items to converge. You can see below- they have finally married. “Convergence: core goods component of CPI (blue) is up 6.6% y/y while core services (orange) are up 6.7%; worrisome development as services is stickier.”

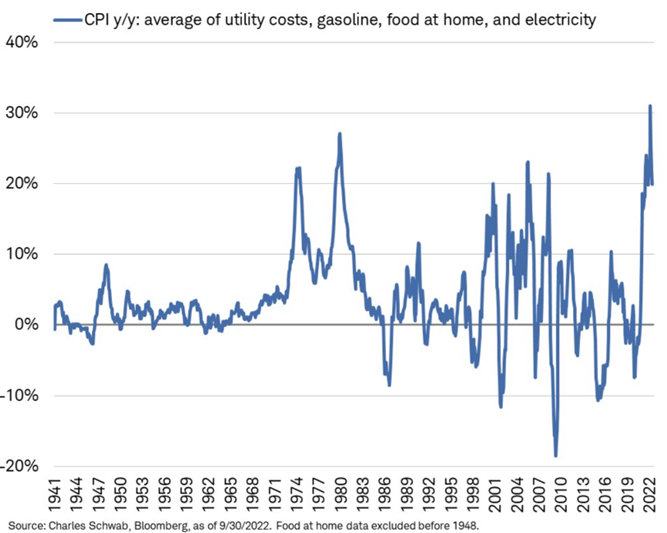

The pace of staple items cooled off a touch, but September is firmly the “shoulder season” and given diesel prices and the distillate backdrop- this will go higher. “Staple items for consumers (utility costs, gasoline, food at home & electricity) getting expensive but at less aggressive pace (19.9% y/y in September vs. +22% in prior month) … still rapid compared to history.”

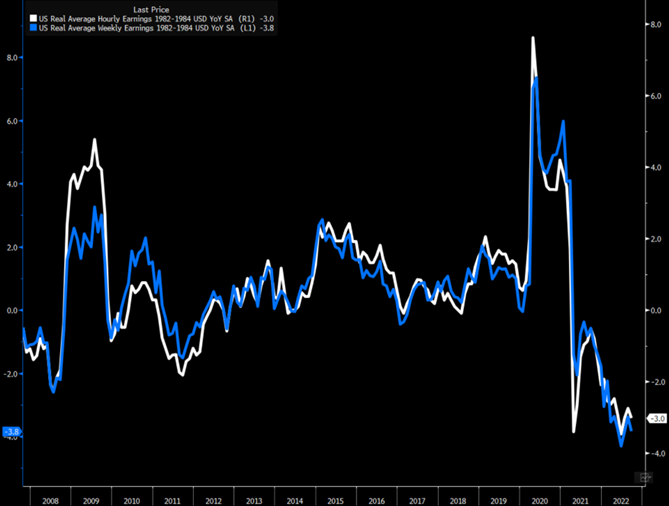

The acceleration in price is resulting in a drop across the earnings capacity for consumers. Wage growth has started to roll-over, which is happening while costs are still rising. “Wage growth as tracked by Atlanta Fed now rolling over. Latest update shows +6.3% growth in September, which is first sign of easing since October 2021.”

When we factor in inflation and wages, you can see that “real wages” have accelerated to the downside following the newest data sets. This is another key reason we are expecting a big drop in consumer spending and underlying activity.

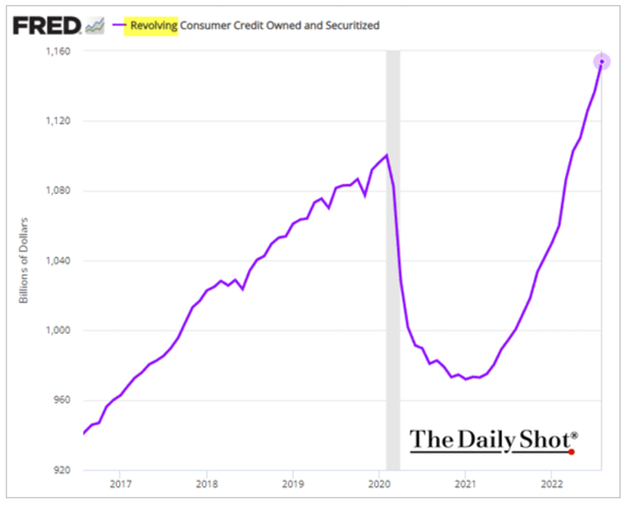

Revolving consumer credit has exploded to the upside and with the “adjustment” to savings volumes- the U.S. consumer is going to weaken considerably.

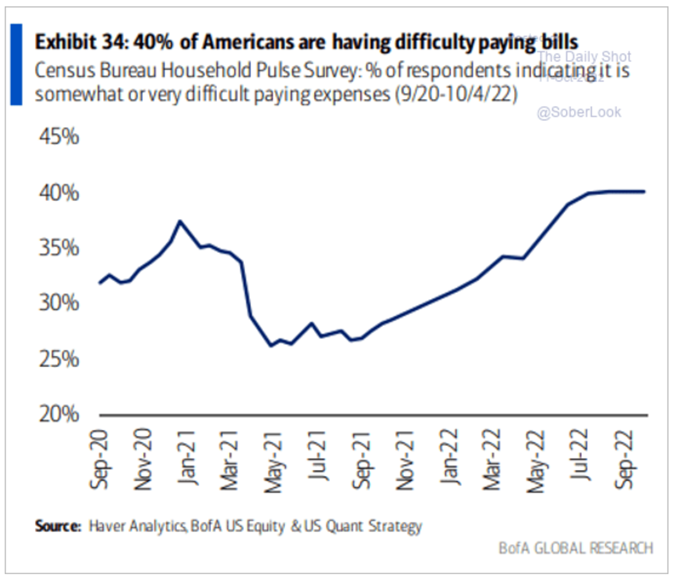

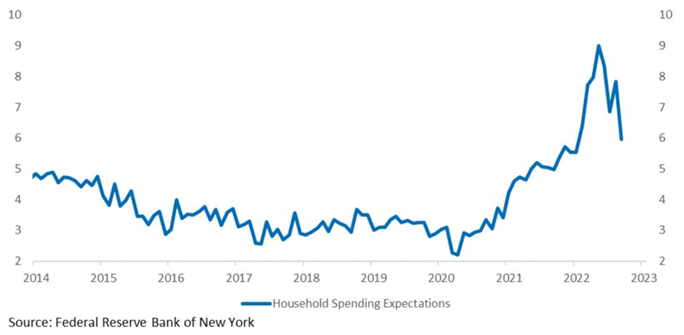

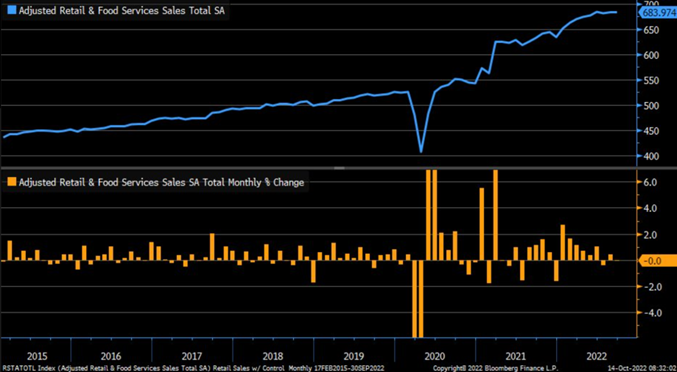

As costs rise for consumers and real wages (and nominal) fall, we expect to see more pressure given the rise in credit, and the difficulty people are having to pay their bills- the hit to spending will pick up speed. The NY Fed is showing the exact issue we are speculating that household spending expectations are tanking. Therefore, we see retail sales and underlying spending getting hit hard in October and throughout the rest of the year.

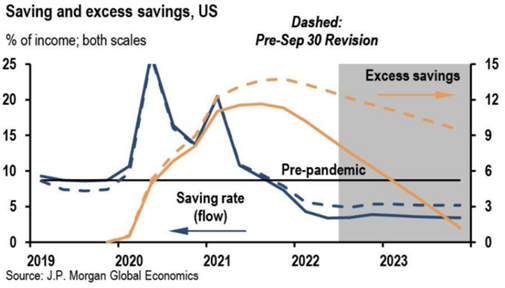

As the 10-year rate pushes higher and the Fed maintains rate hikes, consumers have relied on credit and savings. We have called out the issues on savings being overstated, and now we have some data points proving our views were accurate.

The shift lower in total savings points to how quickly the situation changes across the board. The data has now plateaued, and we think October is going to show the first sustained move lower. You can see the trend has been lower on the “adjusted retail sales,” and October will see a marked shift down.

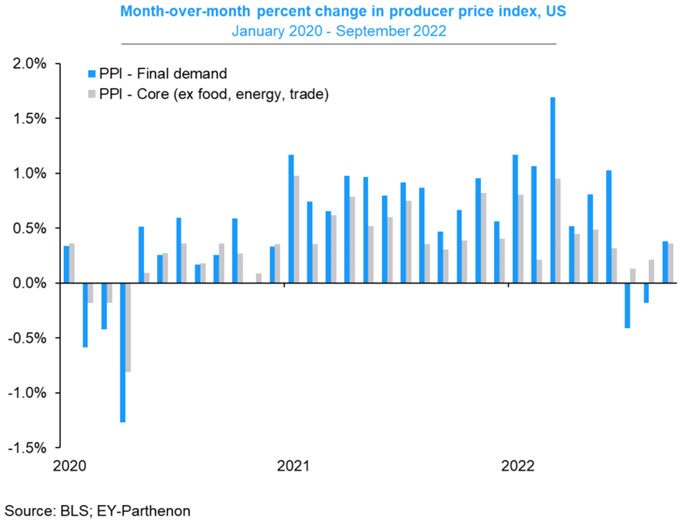

Even as demand slows, input prices keep rising along the PPI (Producer Price Index.) “September PPI inflation +8.5% y/y vs. +8.4% est. & +8.7% prior … excluding food & energy +7.2% vs. +7.3% est. & +7.2% prior (rev down from +7.3%).”

It’s important to look at core PPI that saw the pace of increases slow but never went negative. Now we see a big step-up in final demand, which is pulling core back into a more aggressive shift higher. This will keep pushing underlying costs to companies up, which they will continue to attempt to pass through.

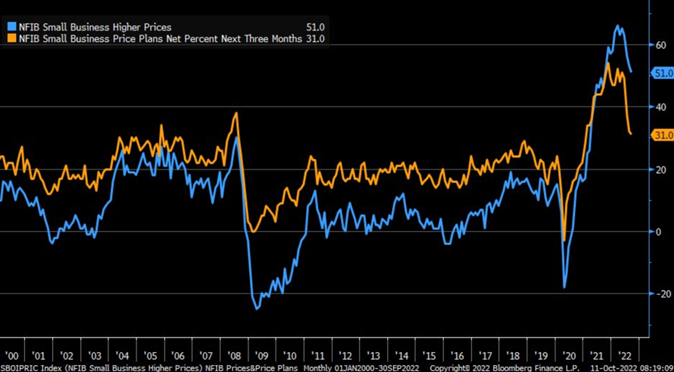

Small business data is showing some slowdown in prices appreciation, but you can see they are still in an upward trend. This will keep prices pinned to the highs, and based on the tightness that remains in the jobs data (discussed in last week’s insights) mixed with inflation- the Fed is going to keep driving higher.

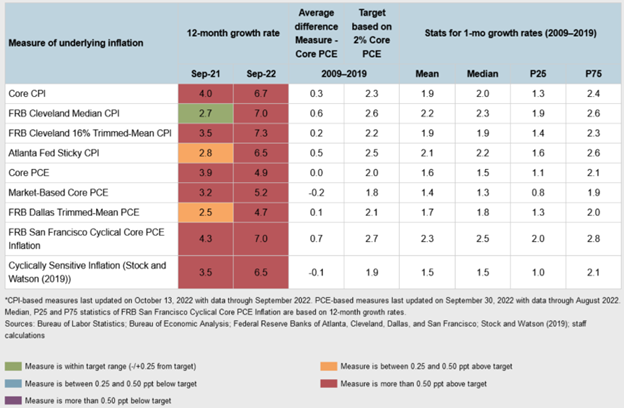

Factoring in some key metrics: FRB Median CPI and Trimmed-Mean are still above Core CPI, which point to another round of increases in core. All of the leading indicators are pointing to more pressure upwards especially as “flexible” costs spike (again) and sticky inflation maintains its upward momentum.

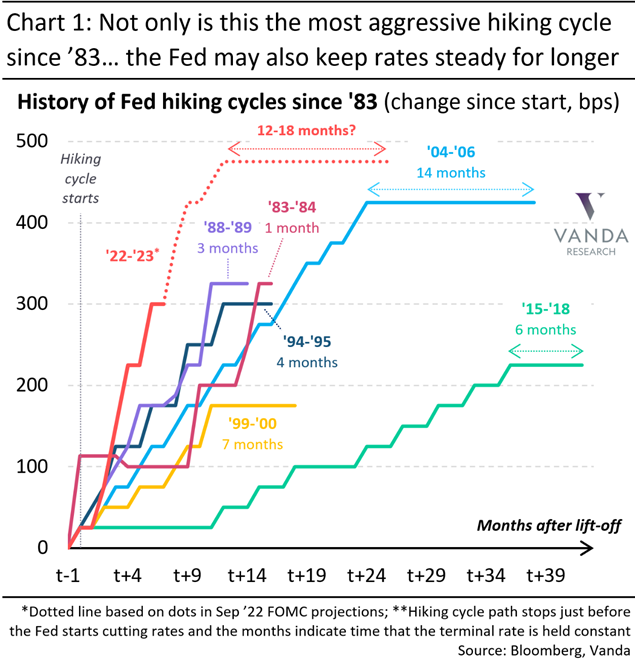

All of this leads to the Fed moving higher with rates and keeping rates elevated throughout ALL of 2023. We expect to see the below chart play out and remain at those fixed rates for all of next year.

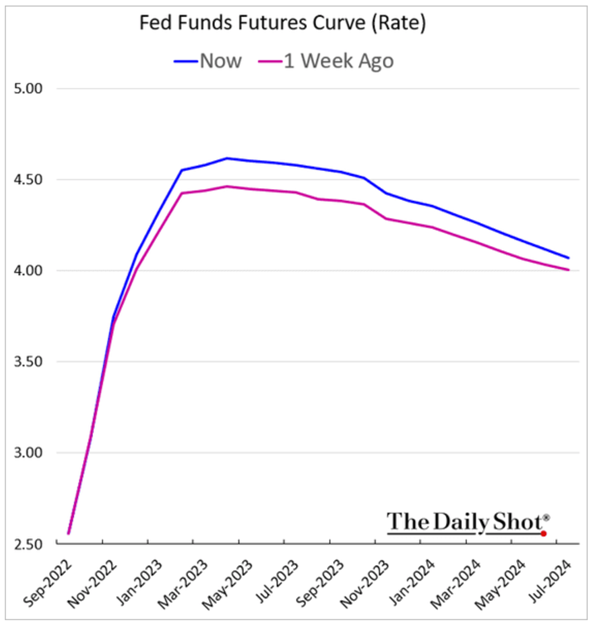

The market is starting to finally price in the increase in rates, but they still have a move lower later next year. The problem is- the Fed cannot pivot based on the underlying market.

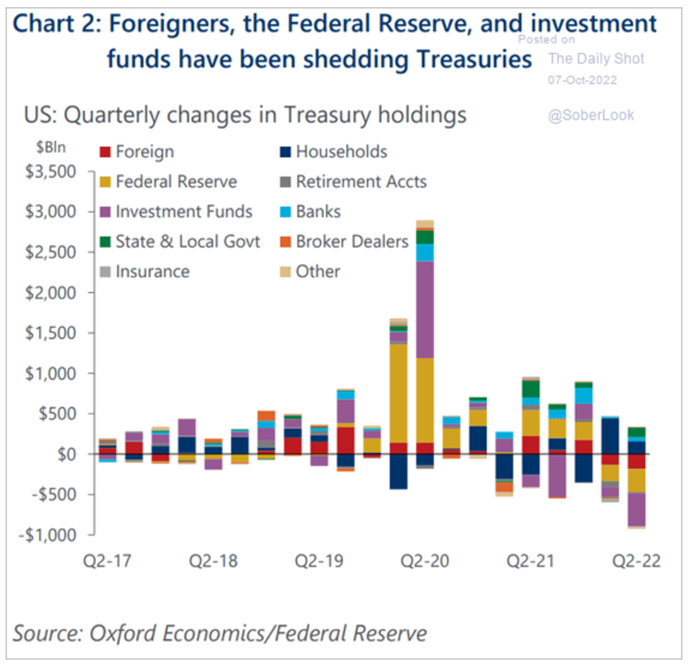

The Fed hasn’t even aggressively moved the balance sheet lower, but as the three largest buyers of treasuries disappear and become net sellers (China, Japan, Fed)- the pressure will mount on rates keeping things elevated. The below chart puts into perspective the shift in underlying treasury flows and the issues facing the market.

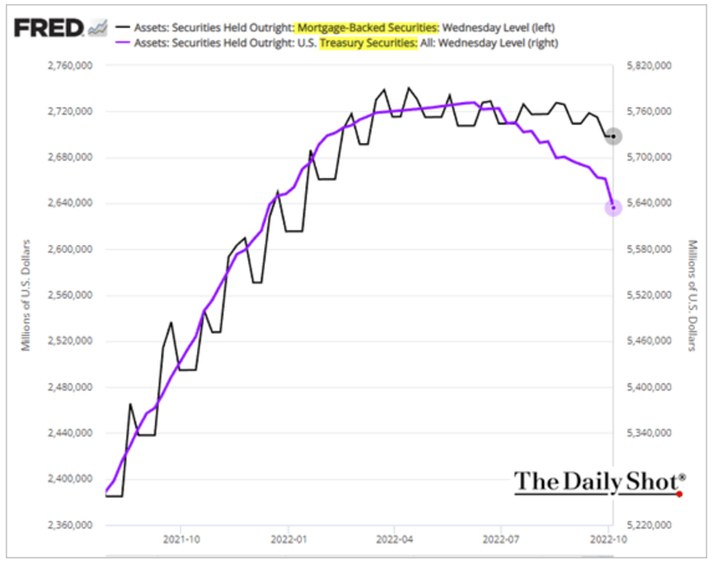

This comes at a point where the Fed is JUST starting to accelerate some of their sales.

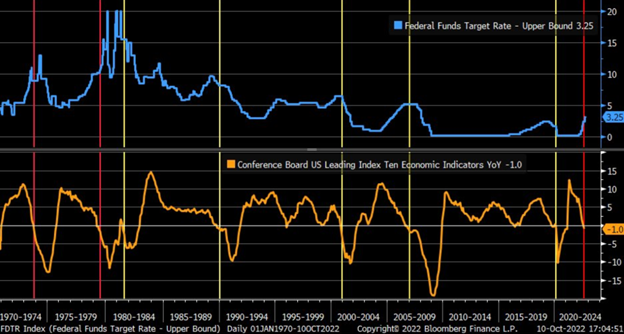

Even as the Leading Economic Index (LEI) has fallen by at least 1% y/y- rates are still going to move higher. Normally, this pushes rates lower as you can see from the chart below, but because of central banks delaying ANY type of meaningful action over the last 18 months- they are pinned to raising rates.

The market keeps trending closer to the ‘70’s at shortfalls persists and inflation drives higher forcing action. “Going back in history, rare to see Fed hiking rates as Leading Economic Index (LEI) has fallen by at least 1% y/y (like today) … most instances of falling LEIs were accompanied by rate pauses or cuts (yellow lines), but 1970s were similar to today (red lines)”.

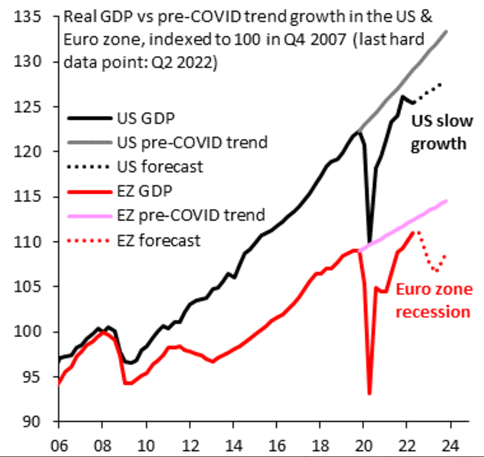

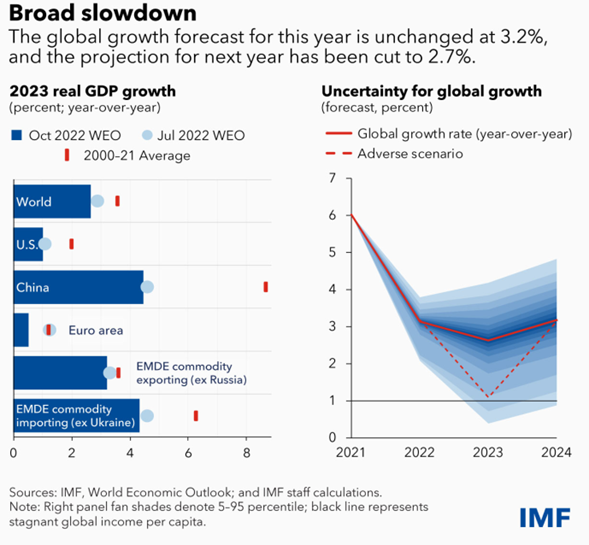

This is keeping the real GDP growth trending WAY below normal, but the pressure is even worse at the Eurozone level. Here is a good quote from IIF, which we agree with “One number matters above all others in this week’s IMF World Economic Outlook. If the IMF doesn’t project negative Euro zone growth in 2023, it suggests there’s substantial downside to their global growth forecast. For reference, we forecast a -2.4% Euro zone recession in 2023.”

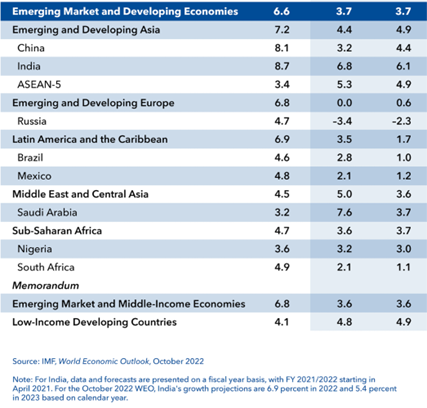

We strongly disagree with the IMF estimates for China and Europe where we see way more pain ahead. This will also cause even more pressure at the Emerging Market level, which OPEC isn’t helping as they continue to “balance” the market by cutting supplies.

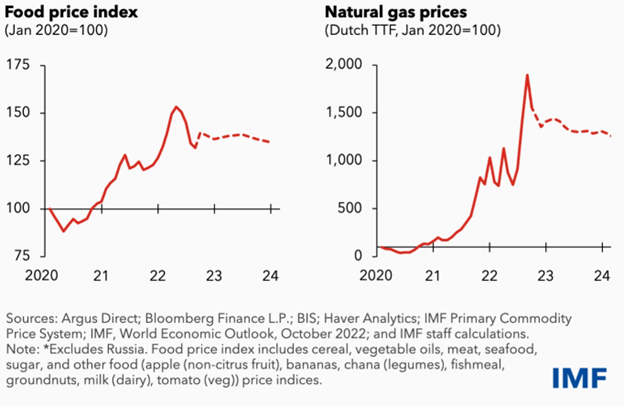

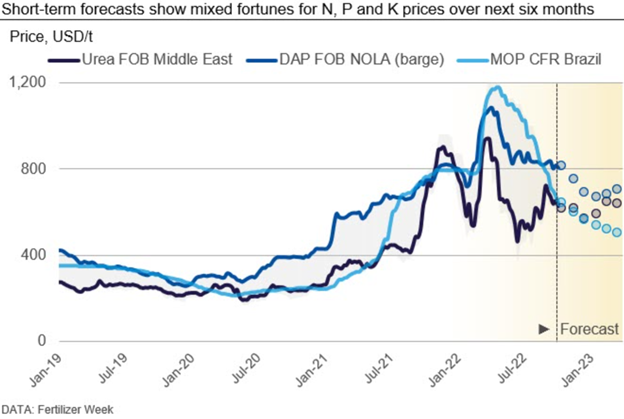

When we simply look at inflation, food, and global trade, the pressure is mounting on all markets but will hit the hardest in the Emerging market world. Food and energy prices are expected to remain well above normal, and given the current backdrop on the fertilizer front- unlikely to get any better in 2023.

This will keep the projected path of inflation well above the IMF expectations that have only drifted higher throughout 2022, which is exactly what we have been calling for since 2020.

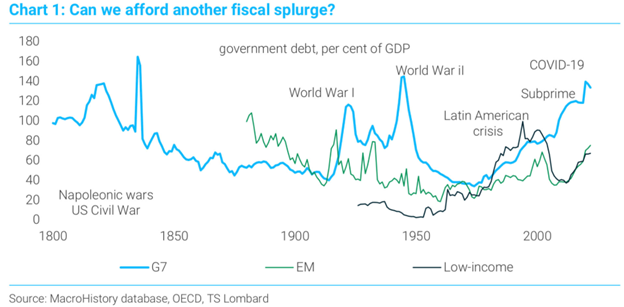

Not only did central banks dump money into the markets, but governments also issued as much debt as they could to provide fiscal support. This has pushed the global debt market to the highest levels since World War 2. It’s near impossible for central banks to step in to provide monetary support outside of some sporadic intervention. They will be forced back out of the market- similar to what we have seen with the Bank of England.

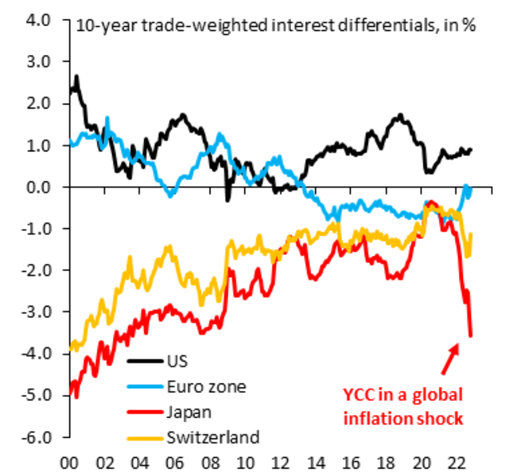

The BoJ is trying to stay in the market longer with their Yield Curve Control, but the market is testing their resolve by leaning into the Yen and making it MUCH weaker vs the dollar. I think Robin Brooks at IIF hits the nail on the head with the following statement: “FX intervention in Japan is futile. Yen weakness is driven by a massive move in rate differentials against the Yen (red), with YCC anchoring Japanese yields as the global inflation shock pushes rates up everywhere else. Only an end to YCC will turn the Yen & that is NOT coming.” The market will keep pushing their resolve as inflation and more importantly PPI explode to the upside and move WAY above estimates.

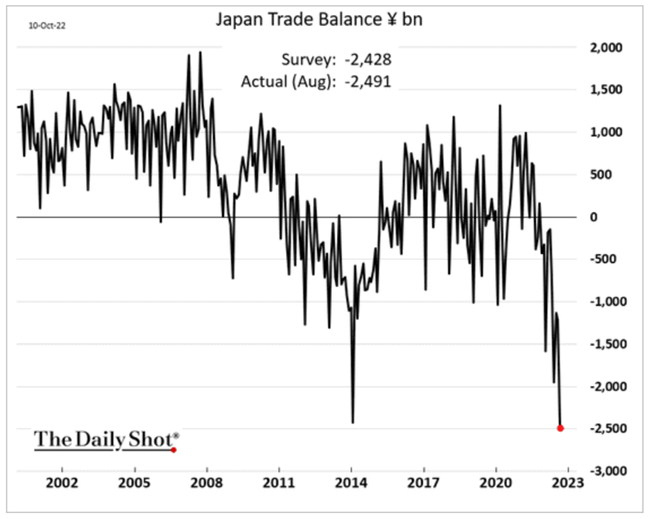

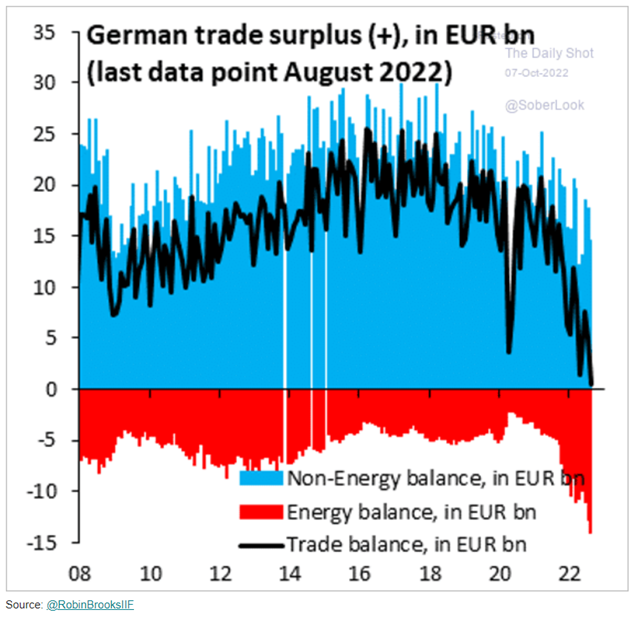

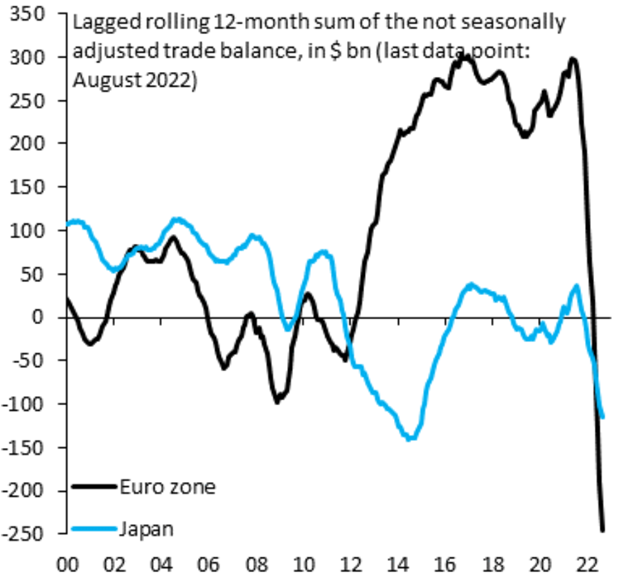

The big step up in import prices is crushing the trade balance, which is happening around the world for key exporting nations.

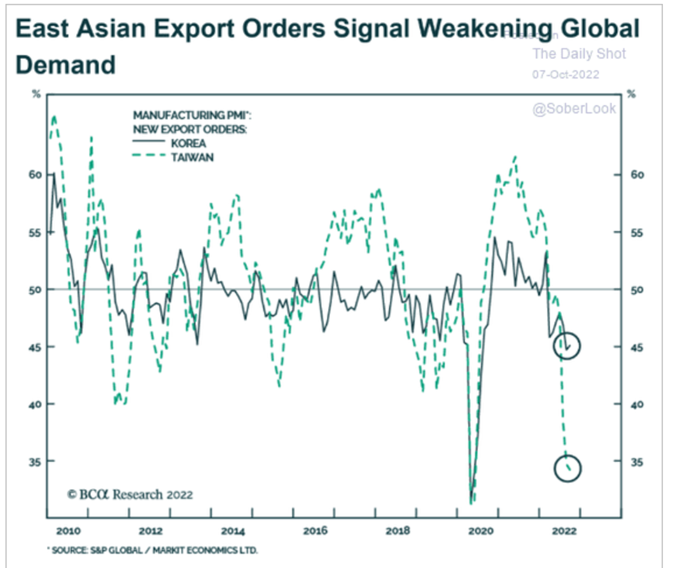

The shift in export orders is signaling a much broader slowdown that is reverberating throughout the system.

German trade surplus is showing something similar absolutely destroying the prospects of European growth.

The issues across the economic backdrop are continuing to deteriorate with more to come unfortunately.

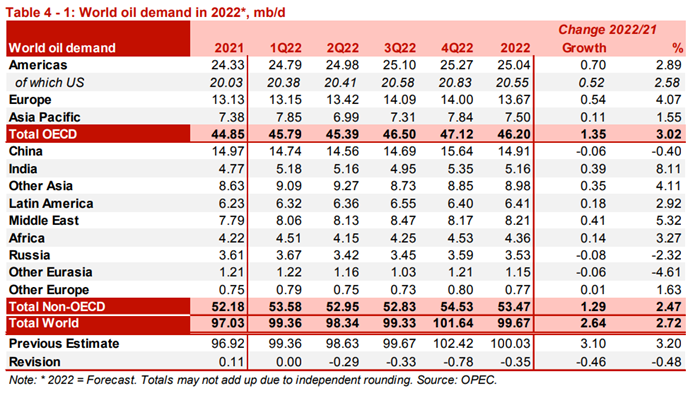

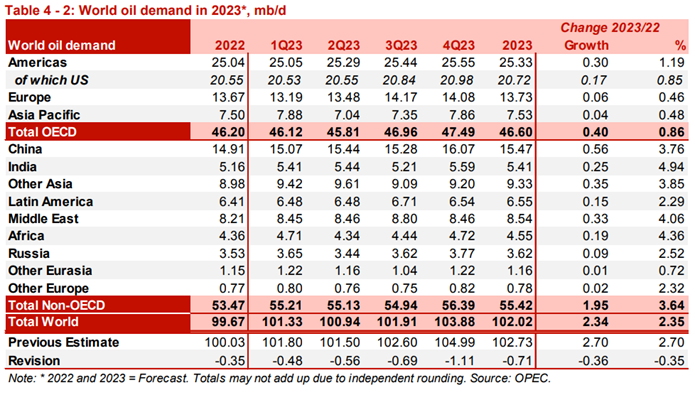

OPEC posted their October research for oil demand and supply. We discussed how their demand scenarios were too high, but now following the supply cut- they had to show a moderating demand situation. It’s the only way they can justify the support given the political pressure they are facing from the U.S. and Europe. If they can show a broader decline, it gives a backstop to issue a supply cut even though a large part of it is in name only.

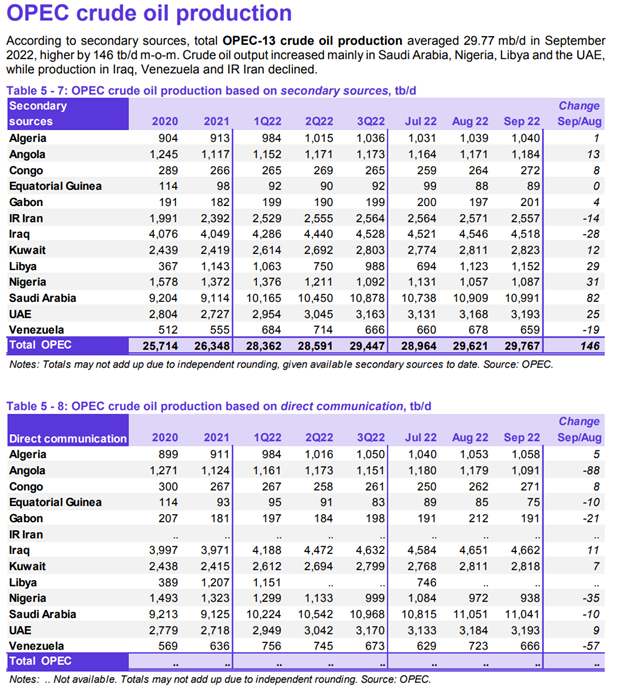

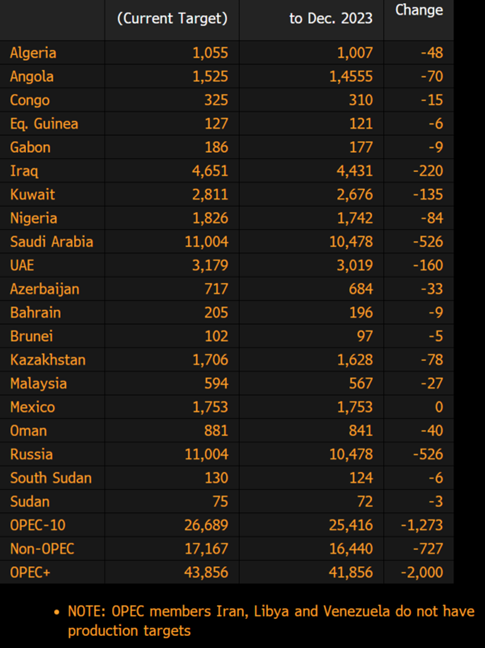

As we discussed last week, the cut of 2M barrels is much closer to 750k-800k barrels a day in reduction. West Africa is still producing way below their allotment so the cut will really be centered around the Middle East.

So when we look at the current crude production and the new quotas, you can see that while the cut is theoretically 2M- it won’t have that kind of impact on supply. The secondary sources show a better picture for where actual production sits, and how the cuts will be much smaller overall.

“Actual OPEC+ output is lagging well behind target, with combined production in September falling about 3.5 million barrels a day short of the planned level, according to Bloomberg estimates. That will dilute the impact on actual production levels of the announced cut in targets.The OPEC+ group also decide to end its monthly meetings, reverting to the previous schedule of gathering every six months to coincide with the OPEC meetings.”

When you look at the “actual” cut of about 750k to 800k and the “new” reduction in demand of 780k for Q4’22- you can see how OPEC is trying to cover themselves politically. Now- we have always believed that the demand numbers were overstated, but by reducing supply- we are going to see a steady crude pricing profile in this range of $90-$95. A crude price in this range doesn’t help inflation, and increases the pressure on Emerging Markets that are already facing a growing problem.

The issues on the Emerging Market level are multifaceted when you consider fiscal, monetary, and trade based. Inflation is reaccelerating on multiple levels- especially when you consider the import cost of energy and food. Global fertilizer forecasts have pivoted higher again, which will provide support for underlying increases in crop prices. “CRU Fertilizer Week’s latest short-term forecasts show mixed fortunes for fertilizers over the next few months. The overall trend remains downward for phosphates and #potash but high gas prices are limiting downside for urea and other nitrogen product prices.”

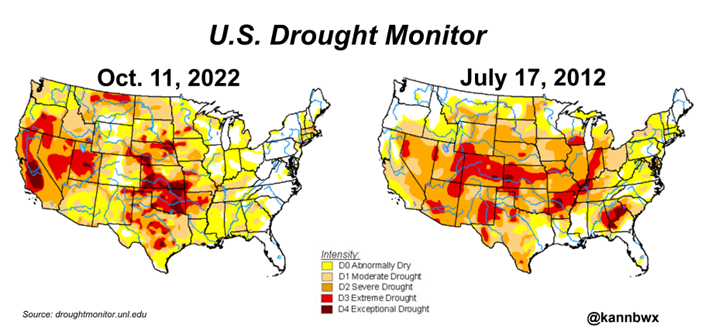

This is coming at a time that the drought situation in the U.S. is getting worse and driving more concerns for global availability of grains. “Drought Monitor RECORD: 81.8% of the USA is now abnormally dry, the most in data back to 2000, replacing the prior high of 80.8% from July 2012. However, area covered by moderate or worse drought was higher in 2012. Fall/winter/spring replenishment *critical* for 2023 harvest.”

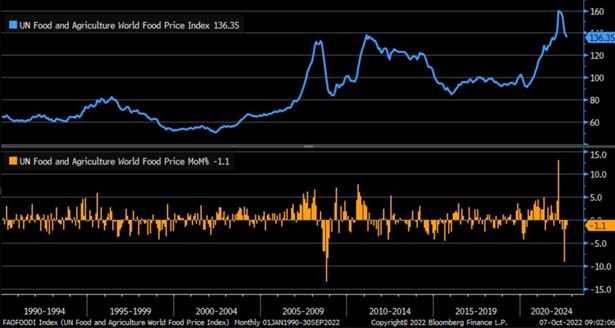

Even as the UN food and Agriculture world food price falls, it’s still at a record level looking back over the last few decades. This will hit Emerging Markets the hardest because many of them are beholden to the import markets for food, which has seen the US Dollar appreciate to a multi-decade record high.

This is just another reason we believe that the real GDP metrics are overstated for 2023 per the below data:

We continue to believe that the IMF data is overstated, and we will see another set of declines.

As exports slow from key nations, it means they require less raw materials or intermediate goods- with a lot of them originating from the Emerging Markets.

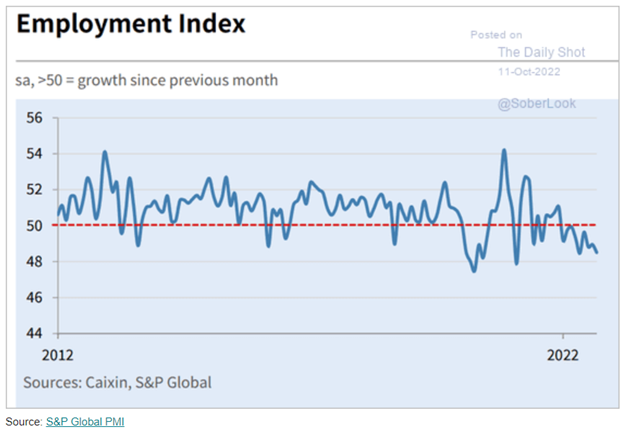

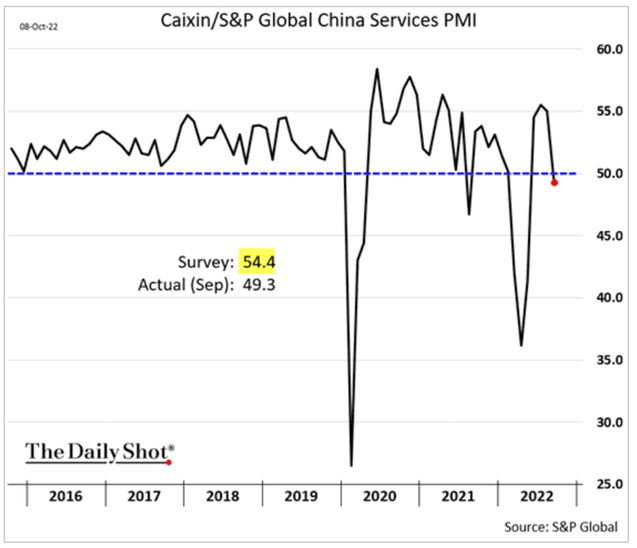

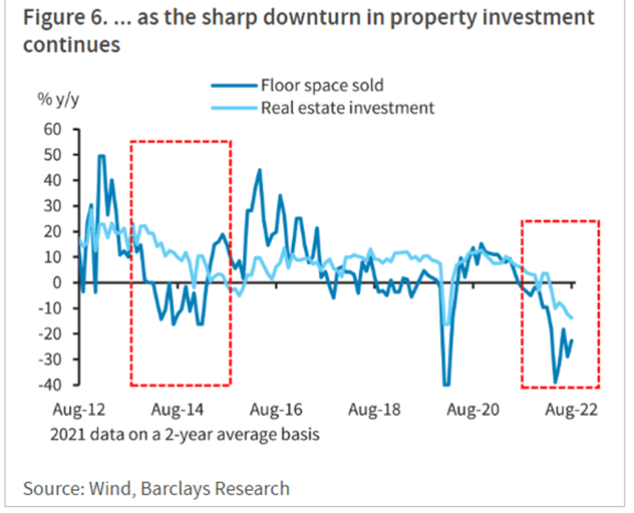

China data has only gotten worse, and I will go through more of it next week following the Chinese Communist Congress because a lot of valuable information will be coming out. My biggest focus will be on the consumer and the weakening consumer- especially as employment remains weak and purchasing pivots hard to the downside.

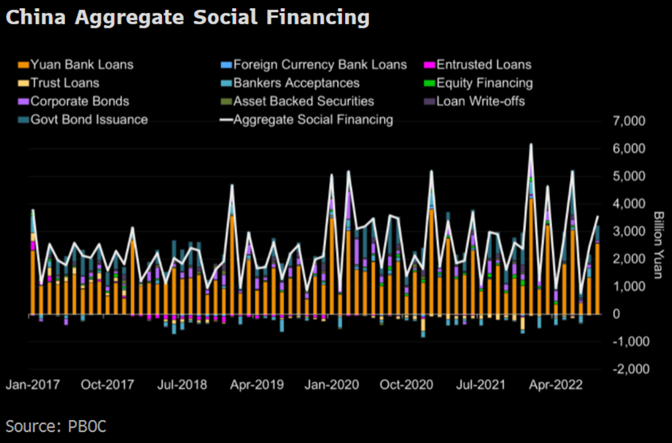

- “Monthly new aggregate social financing came in at 3,530 billion yuan in September, a significant increase on the 2,432 billion yuan in August. This was above both the consensus estimate in a Bloomberg survey (2,750 billion yuan) and our forecast (2,400 billion yuan).

- Monthly new yuan loans jumped to 2,470 billion yuan from 1,254 billion yuan in the month prior, exceeding the consensus forecast (1,800 billion yuan) and our estimate (1,900 billion yuan).

- The credit acceleration was mainly seen in corporate loans, which climbed to 1,918 billion yuan in September — a 1,043 billion yuan increase from August. As a comparison, lending to households rose to 646 billion yuan, just 188 billion yuan higher than August.”

The softness in the consumer keeps borrowing on the sidelines and puts more pressure on the Chinese housing sector.

Some key things I think will be important in the Congress- (Summarized from Trivium)

Will a successor be appointed?

- While Xi is all but guaranteed a third five-year term, we will be carefully watching the Congress proceedings for any hint about a possible successor to the big man or the emergence of a new generation of top leaders.

- If Xi plans to step down in 2027, tradition dictates that he would appoint a successor to head the Secretariat of the Party Central Committee at this year’s Congress. Indeed, this is how Xi and his predecessor, Hu Jintao, were made heir apparent to the Party Secretaryship.

At the Congress, we’ll be watching for the following:

- Whether Xi revives the Chairmanship: The position of Chairman of the CCP was established in 1945 by Mao and represented his unquestioned leadership of the Party. The position was abolished in 1982 in favor of the more limited “General Secretary,” as the Party instituted a collective leadership system. If Xi revives the position and is appointed as Chairman at the Congress, it would formally place him above the other Politburo Standing Committee members and signal his expanded authority.

- Whether Xi is referred to as the “People’s leader” or “Helmsman”: In December 2019, a Politburo readout referred to Xi as the “People’s Leader,” a title previously held only by Mao and his successor, Hua Guofeng.

Why it matters

- Should Xi’s thinking get shortened at the Party Congress, it would put him on a par with Mao Zedong in the Party pantheon.

- It would also imply he is still supremely in charge of the Party and that, at present, other senior leaders or leader groups lack the political clout to prevent him from asserting his power within the Party.

Conversely, if the abbreviation doesn’t happen, it would mean Xi still faces resistance within the Party, or at least still must seek meaningful consensus with other Party elites or key Party groups.

- Additionally, the specific Xi theories that end up in the Party constitution will give us a sense of where Xi plans to focus his energies in his third term (and possibly beyond).

Specifically, we are looking for:

- Whether “Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era” gets shortened to “Xi Jinping Thought” in the Party constitution

Will there be any changes to Taiwan policy?

In recent months, long-held assumptions about the cross-strait status quo have been brought into question.

- The US has reaffirmed and even deepened its relationship with Taiwan.

- Beijing’s hopes of peaceful reunification seem to be withering in the face of a young Taiwanese populace increasingly favoring self-determination.

- We’ll be watching closely to see if the Congress heralds a shift in the mainland’s Taiwan policy.

- The most significant development at the Congress would be for the mainland to put forward a concrete timeline for reunification.

- Such a timeline would represent a huge geopolitical gamble, implying the strong possibility of military action against Taiwan – since peaceful reunification seems increasingly unlikely.

- Alternately, the Congress may simply reaffirm Beijing’s commitment to the cross-strait status quo or, rather less likely, extend an olive branch to Taipei.

And MOST IMPORTANTLY!!!!

How will Common Prosperity be conceptualized?

- Common Prosperity – the Party’s drive to achieve greater economic equality – has been a topic of heated discussion since the Central Commission for Financial and Economic Affairs, chaired by Xi, held a meeting on the subject in August 2021.

- We know Common Prosperity is a top priority – still, it isn’t entirely clear how the Party intends to implement the initiative in practice.

- Some have argued it should be a statist project to forcibly redistribute wealth.

- Others have insisted it should focus on liberalizing reforms to foster greater equality of opportunity.

- The August Politburo meeting indicated that the 20th Party Congress report would focus on Common Prosperity.

- So we expect to gain a better sense at the Congress of how the initiative will be translated into concrete policy in the years ahead.

- Why it matters

- Common Prosperity is one of China’s most important policy shifts in decades, with the potential to completely restructure the economy.

- The trajectory that shift takes will profoundly impact how China’s economy and business environment take shape in the years to come.