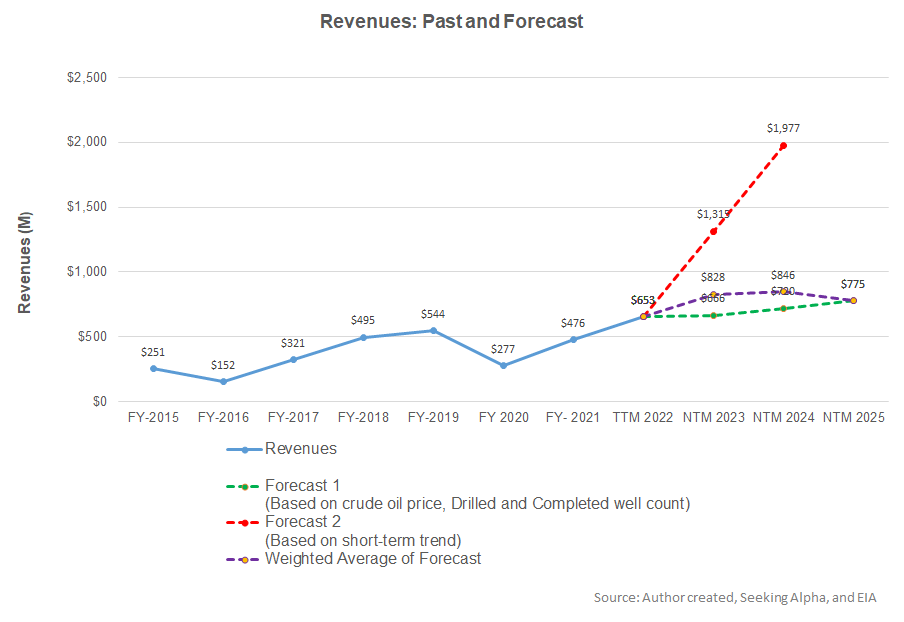

- Our linear regression model suggests steady revenue growth in NTM 2023, but the rate can decelerate severely in NTM 2024 and NTM 2025.

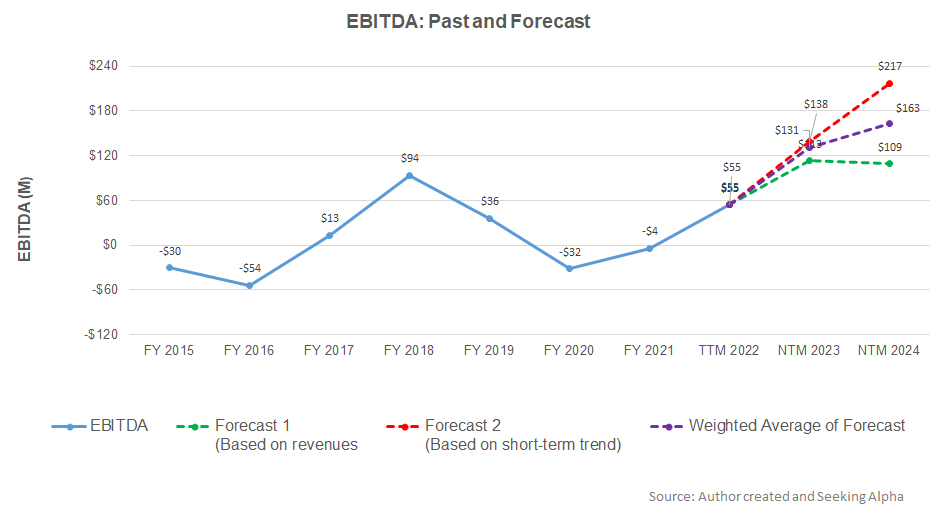

- EBITDA growth rate can decelerate in NTM 2024 after a steep hike in NTM 2023.

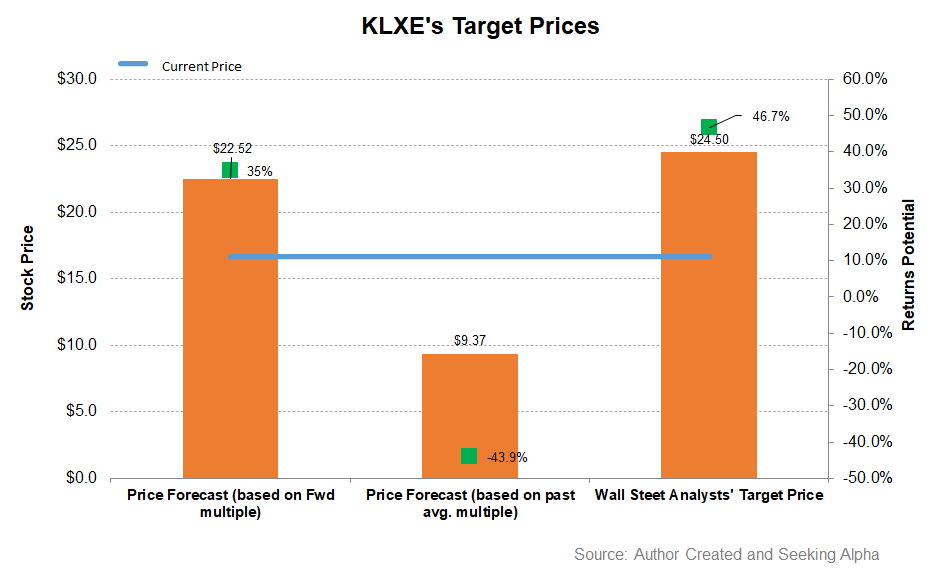

- The model suggests wide variability in the expected returns, but we expect a positive bias.

Part 1 of this article discussed KLX Energy Services’ (KLXE) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation between the key industry indicators (crude oil price and the US drilled well count and completed well count) and KLXE’s reported revenues for the past seven years and the previous four quarters, we expect its revenues to increase by 27% in the next 12 months (or NTM) in 2023. The growth rate can decelerate significantly (to 2%) in NTM 2024, while revenues can decline in NTM 2025.

Based on the same regression models and the forecast revenues, we expect the company’s EBITDA to increase 138% in NTM 2023. The EBITDA growth rate can subdue by 24% in NTM 2024.

Target Price And Analysts’ Rating

Returns potential using the past average EV/Revenue multiple (0.79x) is lower (44% downside) compared to the expected returns (35% upside) using the forward EV/Revenue multiple (0.62x). Wall Street analysts expect even higher returns (46.7%) from the stock.

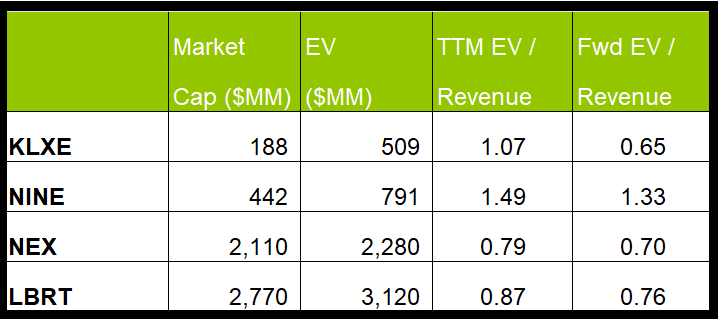

KLXE’s forward EV-to-Revenue multiple contraction versus the EV/Revenue is steeper than its peers because its revenue is expected to increase more sharply in the next year. This should typically result in a higher EV/Revenue multiple than its peers. However, the company’s EV/Revenue multiple (1.07x) is marginally lower than its peers’ (NINE, NEX, and LBRT) average of 1.1x. The stock is moderately undervalued versus its peers.

The sell-side analysts’ target price for KLXE is $24.5, which, at the current price, has a return potential of 67%. Out of two, one sell-side analyst rated KLXE a “buy” or a “strong buy,” one rated it a “hold,” and none a “sell” in the past 90 days.

What’s The Take On KLXE?

KLXE, boosted by the continued scarcity of oilfield equipment, will increase pricing in the near term. Its asset utilization will also improve further. It will exercise cost controls and strict capital discipline by selectively allocating assets and resources. On top of improving the operating profit margins, it will seek strategic M&A opportunities as the payback period shortens. So, the stock significantly outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

By the end of Q3, its cash flows seem to be turning around. However, negative shareholders’ equity remains a threat to its financial security. Recently, it extended the ABL facility debt maturity, removing the fixed charge related to the facility and improving the margin. The rise in capex in 2H 2022 will challenge its objective of generating positive FCF in 2022. We do not see much upside at this level.