In this article I will try to provide some short summaries of a few important reports recently. One such report is 2023 ICIS’ Global LNG Supply and Demand Outlook. The other one is International Energy Agency’s Electricity Market Report 2023 and some interesting insights from El Erian of the Queen’s College at University of Cambridge.

Let’s start with the LNG report.

In 2022, the global LNG and natural gas markets experienced a year unlike any other due to the war in Ukraine and the subsequent decrease of Russian pipeline exports to Europe, leading to high spot prices worldwide. The need for the EU to reduce dependence on Russia’s Gazprom and increase LNG imports led to significant changes in trade flows of liquefied natural gas, with Europe becoming the premium spot market. The ICIS Global LNG Supply & Demand Outlook predicted a tight year ahead, with a deficit of around 4.5 million tonnes, which grew even larger with the advent of the war. In 2023, Europe is expected to remain a significant source of LNG demand, especially as new import terminals become operational and the effort to end dependence on Russia continues.

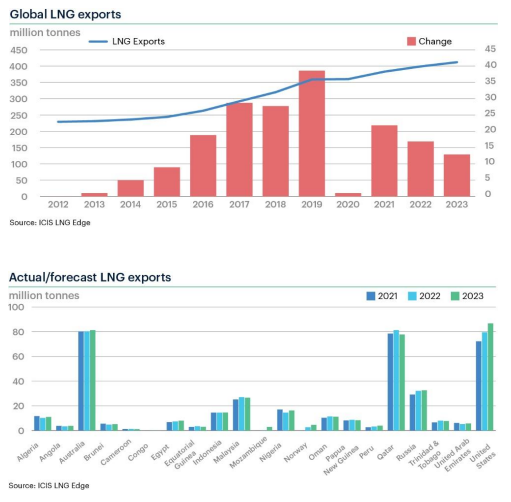

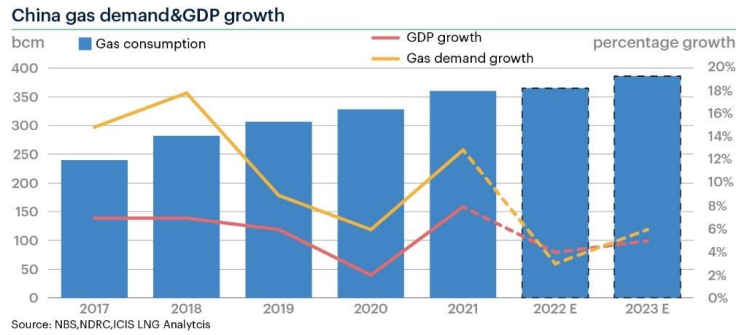

In 2023, the ICIS predicts 410 million tonnes of LNG to be exported globally, with Qatar, the United States, and Australia remaining in close competition for the top producer. Europe’s demand for LNG is not expected to slow down, as the last of the new wave of LNG supply has run its course and few new projects are expected in 2023-24. LNG demand is expected to reach 395 million tonnes in 2023, with a dip of -1% compared to 2022. The EU and UK market is expected to decrease slightly by -2%, to 113 million tonnes, while the China market is expected to revive as the economy improves.

ICIS predicts that the US will become the top global LNG export in 2023 with exports of 86.7 million tonnes. The role of price-response is crucial in maintaining balance in the market, and newly introduced pricing rules in Europe could potentially effect supply and demand. Japan and South Korea’s LNG demand is expected to decrease as they shift towards coal and nuclear electricity, while Taiwan’s demand is expected to remain in place. The rest of the world is expected to continue to experience demand destruction, with no rebound expected to pre-2022 levels.

Few interesting charts:

It is important to learn about the dynamics of LNG as it pertains to European Energy Crisis and also the whole Global South. I explored this dimension connecting weather and energy and developing countries in my latest article here:

Now on to the IEA’s Electricity Report 2023:

The global energy crisis triggered by Russia’s invasion of Ukraine had an impact on the world’s electricity demand in 2022. Despite the crisis, electricity demand still rose by nearly 2%, driven by the continued electrification of the transport and heating sectors. The rise in demand was also due to record numbers of electric vehicles and heat pumps sold in 2022. However, the world’s economies, still recovering from the effects of the Covid-19 pandemic, were battered by record-high energy prices and high electricity prices, leading to a slowdown in electricity demand growth in most regions. The European Union recorded a sharp 3.5% decline in electricity demand due to high energy prices and a mild winter, while the US recorded a 2.6% increase, driven by economic activity and higher residential use. In India, electricity demand rose by 8.4% due to its post-pandemic economic recovery and high summer temperatures.

Low-emissions sources are expected to cover almost all the growth in global electricity demand by 2025. Renewables and nuclear energy will dominate the growth of global electricity supply, meeting more than 90% of the additional demand. China and the EU are the largest contributors to the growth of renewables, and there will be a need for investment in grids and flexibility for successful integration. Meanwhile, global electricity generation from natural gas and coal is expected to remain flat. China’s share of global electricity consumption is forecast to rise to one-third by 2025, and over 70% of the growth in global electricity demand will come from China, India, and Southeast Asia. The global electricity demand is expected to grow at a faster pace of 3% per year from 2023 to 2025, resulting in a total increase in demand of 2,500 terawatt-hours by 2025.

After reaching an all-time high in 2022, power generation emissions are expected to plateau through 2025. Global CO2 emissions from electricity generation increased by 1.3% in 2022, a significant slowdown from the 6% rise in 2021, and will depend on developments in the global economy, weather events, fuel prices, and government policies. The full extent of the economic impacts of Covid-19 in China, where more than half of the world’s coal-fired generation occurs, remains unclear and is a key factor in the growth of electricity demand.

Finally, El Erian’s stance on inflation is the highlight of the week.

Refelcting on the current state of inflation and the Federal Reserve’s response to it he argues that the Fed’s initial response wasn’t timely and the debate between transitory and sticky kept a timely policy decision at bay. However, with the recent hikes and a slight fall in inflation it is very likely that the policy makers can become lazy again. Moving forward he outlines three potential scenarios for the rest of the year and early 2024: orderly disinflation, sticky inflation, and “U inflation”. He puts a 25 percent, 50 percent and 25 percent probability of each respectively. He warns that the probabilities must be viewed with caution and that there is a sense of uncertainty in the outlook for economic activity, prices, and monetary policy. The worst thing to do is to fall back into complacency and to start relying on ‘simplistic economic narratives’.

El Erian mentions former US Secretary of the Treasury Lawrence H. Summers’ view on the current economy, which is that it is “difficult to read.” He mentions other factors contributing to the uncertainty such as the clean-energy transition, the rewiring of global supply chains, and heightened geopolitical tensions. I agree with this conclusion that Powell is now warning against complacency and that the base case is that inflation will take some time to go away and will require more rate increases. Those predicting that a U.S. recession will be “short and shallow” need to revisit this rosy outlook.

In this regard I highly recommend that you watch Mark Rossano’s recent ECON commentary here.

See you all next week! Don’t forget to watch today’s Monday Macro View where I discuss more about US inflation and recession.