Industry Outlook

We discussed our initial thoughts about Nabors Industries’ (NBR) Q1 2023 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook. The company’s management believes that the relative stability in crude oil prices will direct drilling activity in the crude oil-heavy Basins. Despite the short-term weakness in natural gas prices, long-cycle LNG projects will come online over the next two years.

This, however, does not mean that the energy market has rid of its challenges. Higher interest rates and the global economy’s near-recession have partially destroyed the demand growth. Many of NBR’s US onshore energy operators will likely let natural gas contracts expire, resulting in a lower rig count. The crude oil-led activity will not sufficiently compensate for the natural gas rigs’ loss, resulting in an imbalance between supply and demand. So, the market utilization can rebound.

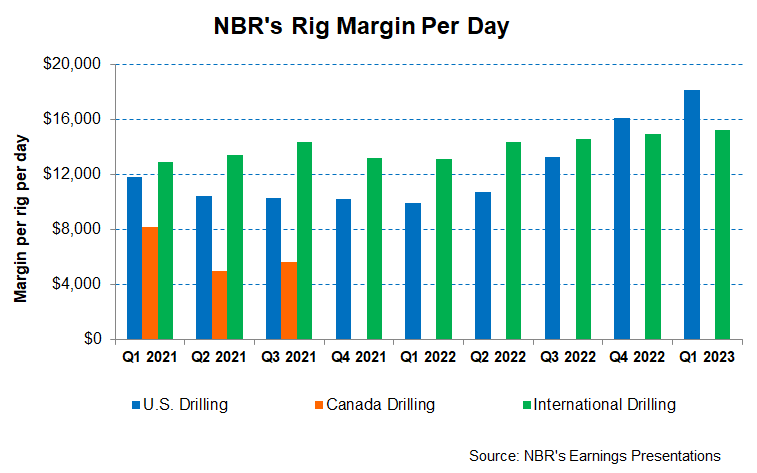

Margin To Get Traction

Mirroring the rig count and utilization progress, dayrates for its high-spec rigs will remain high, although rates in gas-heavy rigs will remain soft. So, the average daily revenue in the US onshore will remain relatively unchanged in Q2 compared to Q1. Strategically, the company prioritizes revenue and margins. In the international markets, it expects day rates and margins to expand in the Middle East and Latin America. Here, the company sees potential opportunities to add rigs as it continues to add new build rigs in Saudi Arabia. The company’s JV in Saudi Arabia will likely realize an EBITDA of ~$100 million per year from the new build program in SANAD.

Automation And Energy Transition

Inrobotization, NBR has introduced the RZR module – a robotic rig module that can be retrofitted on any rig. It improves safety by removing rig hands from the red zone. NBR’s PowerTap module connects rigs to the grid. It has now deployed 15 such units. It optimizes engine utilization and reduces remission. The company’s NanO2 diesel fuel additive offers similar advantages. It also plans to diversify into using hydrogen at the well site to reduce fuel consumption. In Q1, the company’s revenue from this portfolio increased by 68% versus the prior quarter. Still are a nascent stage, its clean energy initiatives are proliferating.

US And International Market Rig And Margin Outlook

In Q1, NBR operated 88 rigs. In Q2, its rig count may decrease by three, while the count may back up in 2H 2023. Also, the US onshore average daily margin can reduce by 6% in Q2.

In contrast, the International Drilling rig margin can expand by 5% in Q2 over Q1. The rig count in its international operations may remain unchanged in Q2. It expects the day rate in the MOS400-rig in the Gulf of Mexico to improve. In Q3, it can place another rig in Saudi Arabia and add one more in Q4. Latin America may stay in balance with a rid addition in Argentina.

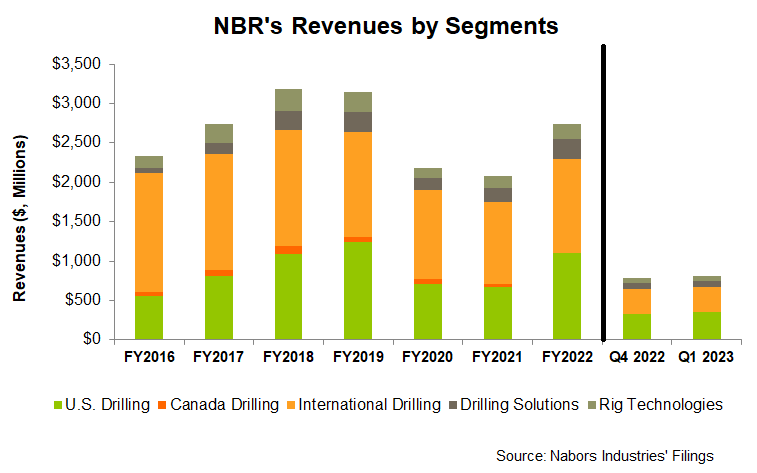

Analyzing The Q1 Drivers

As we discussed in our short article, Improved pricing for onshore drilling, broad-based improvement in U.S. Drilling, and the commencement of the second new build rig in Saudi Arabia led to performance improvement in Q1. The superior performance of the two rigs deployed in 2H 2022 in Saudi Arabia is encouraging for the broader new build program. So, it now expects to deploy three additional new buildings, while a second tranche of five rigs will commence in the coming months.

Cash Flows And Leverage

In Q2, NBR’s management expects capex to increase by 19% compared to Q1, owing primarily to higher expenditure for Sanad new builds (Saudi Arabia joint venture). In Q2, it expects to generate $50 million in free cash flow. In FY2023, it expects capex to reduce in the US onshore and Colombia and deliver a free cash flow of ~$400 million.

NBR’s liquidity was $972 million as of March 31, 2023. Its debt-to-equity (4.4x) is much higher than its competitors (HP, PTEN, and PDS). Given the high debt level, we think the company carries financial risks.

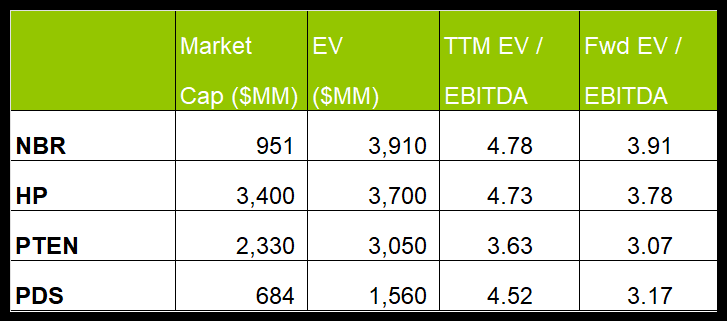

Relative Valuation

NBR is currently trading at an EV-to-adjusted EBITDA multiple of 4.8x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 3.9x. The current multiple is lower than its past five-year average EV/EBITDA multiple of 6.9x.

NBR’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is less steep than peers because its EBITDA is expected to increase less sharply than its peers in the next year. This typically results in a lower EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is higher than its peers’ (HP, PTEN, and PDS) average. So, the stock is relatively overvalued versus its peers.

Final Commentary

At the outset of Q2, the average daily revenue in the US onshore will remain relatively unchanged, following a demand-supply mismatch in a low natural gas price environment. As the margin expansion prospect dims in the US, NBR’s rig count may decrease by three in Q2,. In the international markets, day rates and margins can expand, particularly in the Middle East and Latin America. Its JV in Saudi Arabia will likely realize an EBITDA of ~$100 million per year from the new build program. In non-traditional energy sources, the company is fast expanding its NanO2 diesel fuel additive offerings and using hydrogen at the well site to reduce fuel consumption.

Although NBR spent handsomely on capex in early 2023, capex can reduce in the US onshore and Colombia, resulting in a ~$400 million free cash flow by the year-end. But, the company’s leverage is too high for comfort. The stock is relatively overvalued versus its peers. These are some concerns that investors need to be wary of.