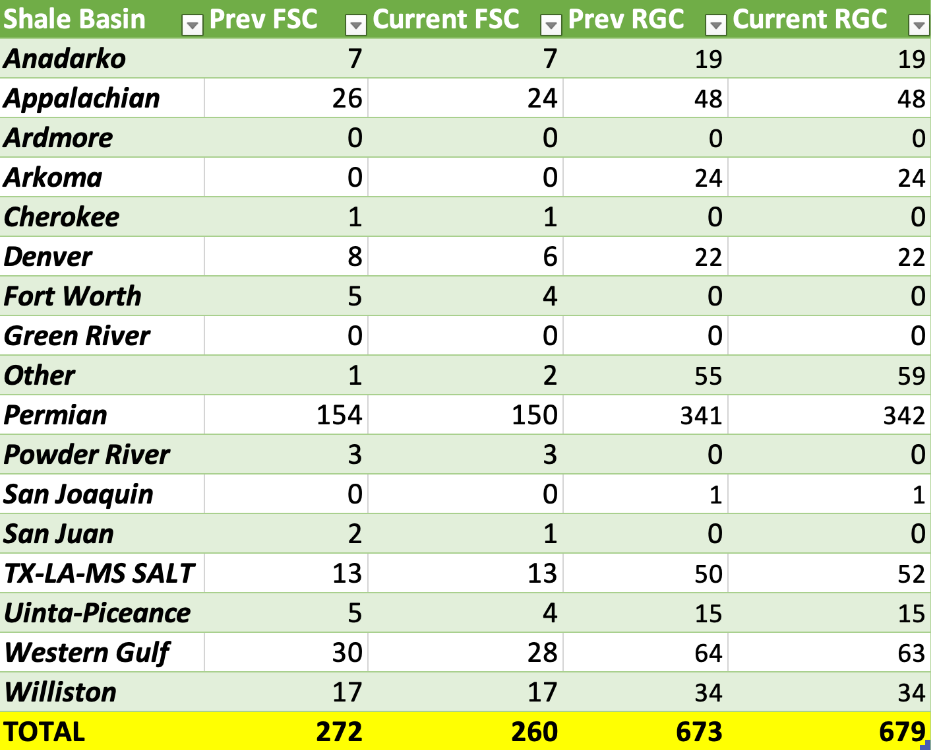

The U.S. saw a drop in completion crews as worked slowed for the 4th of July holiday and a broad heatwave impacted activity. We normally get a bit of a slowdown for the 4th, and the snap back typically takes 7-10 days before all of the crews are back in the field. We should see about 270-274 active again next week with a steady move through July to about 285 spreads. The Permian will move back to about 160 spreads as we see some pick-up in Western Gulf. The smaller basins also see a bit more activity as we head into the Aug/Sept period helping push us higher. Last year we thought production would exit at about 12.7M barrels a day, but with activity sitting at these current levels and only a muted increase- we adjusted it to about 12.5M-12.6M barrels a day. In order to hit the top end, we will need to see spreads get back to about 290 in Sept/Oct. The next 2-3 months will be important to see what part of the range we are able to hit.

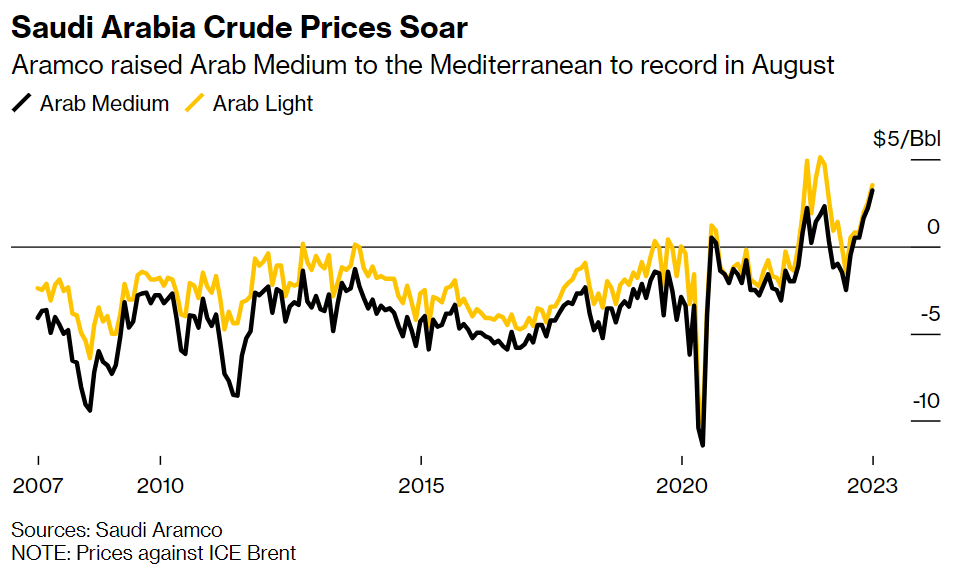

Saudi Arabia carried forward the additional 1M barrel cut from July into August, which was something we discussed in previous insights/YT shows. Our base case was that KSA would maintain cuts of 500k in August because they weren’t seeing the progress they wanted in the floating market. Where we got it wrong was the OSPs (official selling prices) because we expected KSA to reduce prices in August to help clear some of the glut. Instead, they raised prices again pushing companies to reduce their term volumes once again. It has also exacerbated the already tight market between light-sweet and medium/heavy sour. “However, Saudi Arabia hiked the premiums it charges for its own barrels — which are similar to the Norwegian grade, triggering the price surge, the traders said. The kingdom is also limiting global supply to try to support prices. There are also millions of barrels of its crude parked on tankers in Egypt’s Red Sea, waiting to deliver barrels into the Mediterranean. The kingdom’s curbs have had an outsized impact on the supply of so-called medium- and heavy-sour barrels, driving up their price.”

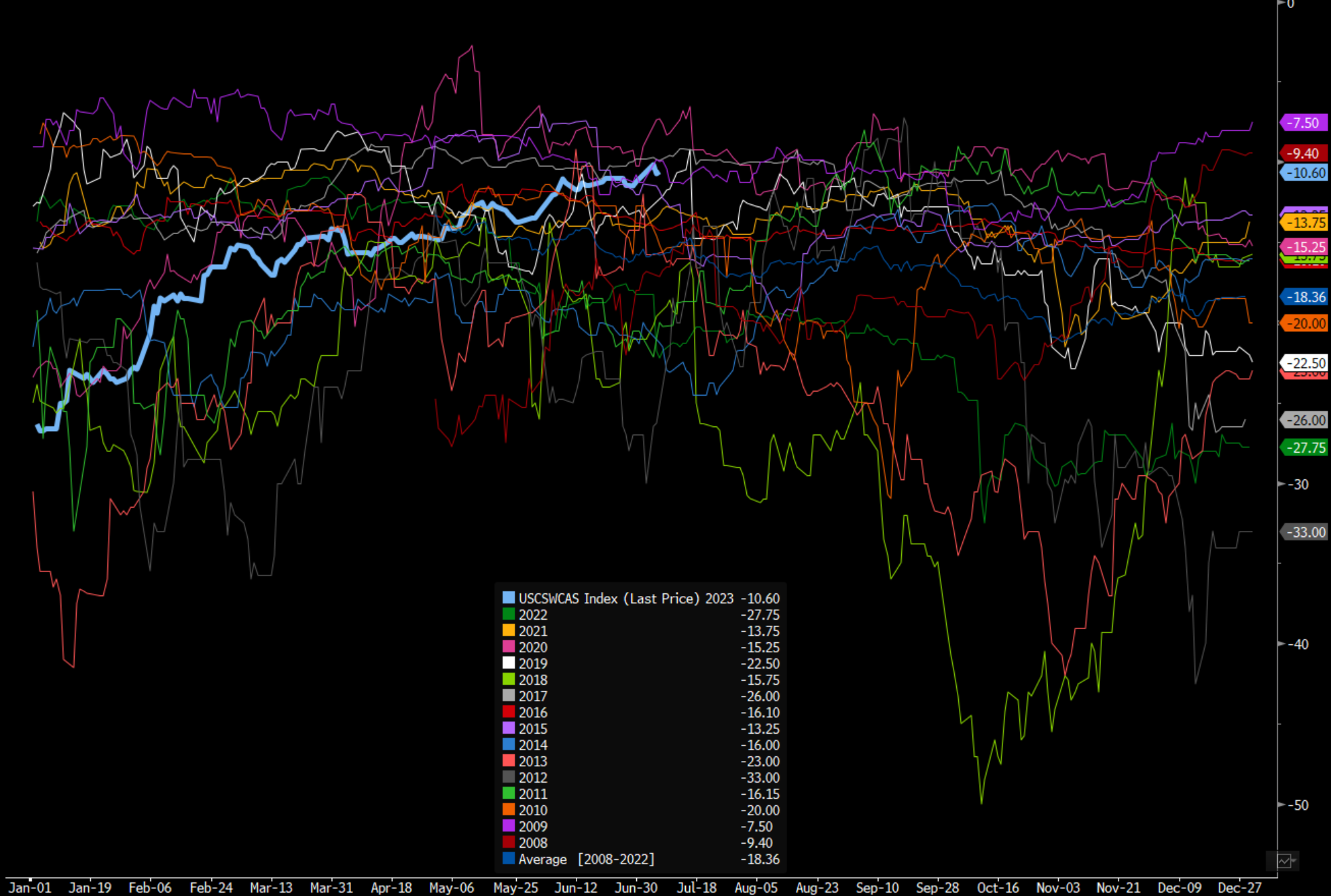

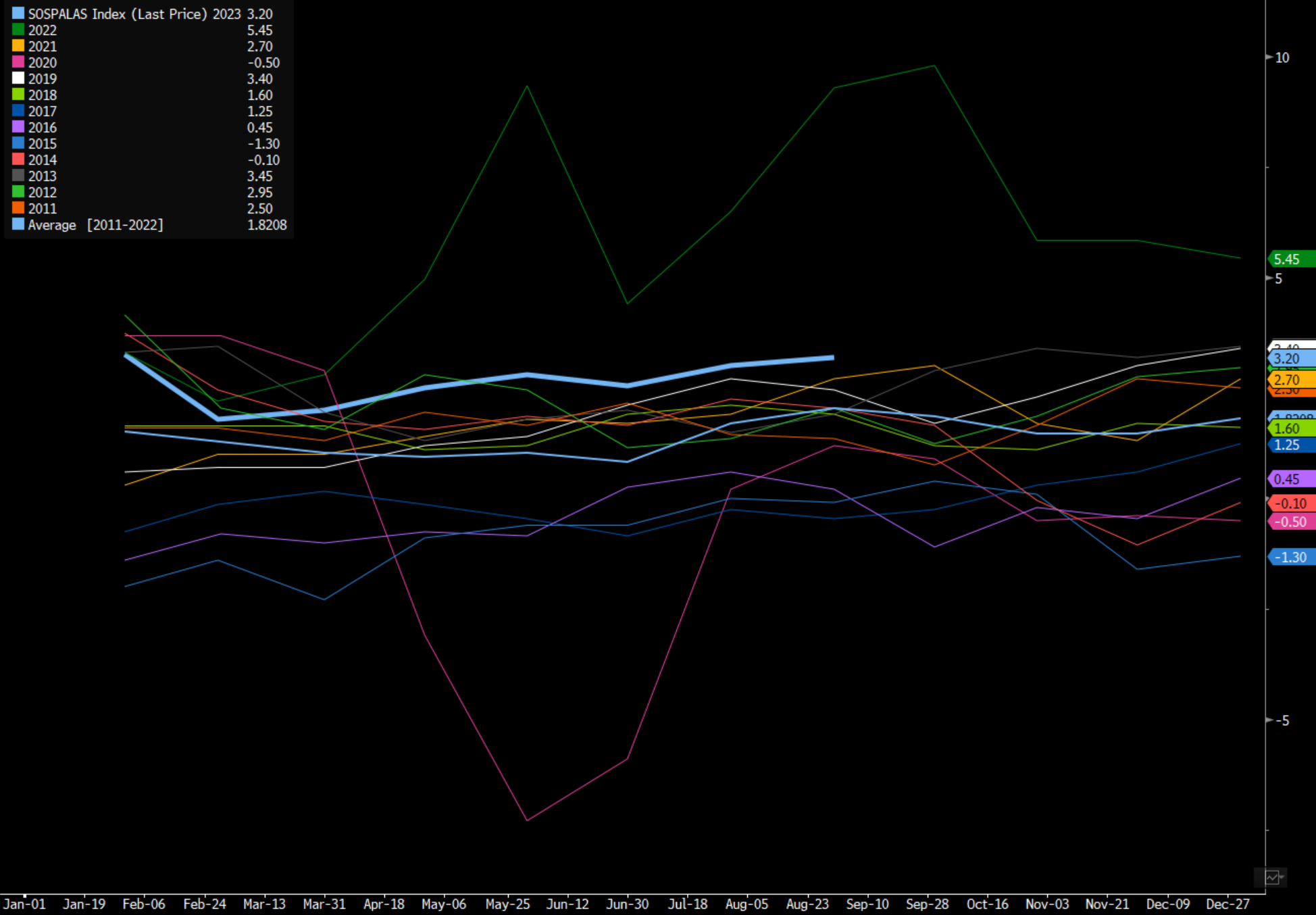

This has driven prices higher for replacement barrels- one of them being Johan Sverdrup: “The grade traded Friday at about $3.50 a barrel more than Dated Brent, a benchmark for physical oil transactions globally. That’s a record and compares with a $6 discount as recently as December, according to traders involved in the market.” The North Sea isn’t the only one that is seeing a big bump as the price of heavy rises around the world. The U.S. is bidding up WCS (Western Canadian Select) to replace the missing barrels, which is also complicated by some disruptions created by wildfires. “Alberta’s total oil production drops 2.8% to 3.43m b/d in May, lowest since May 2021, AER data show.

- Decline happens amid 14% drop in conventional light crude oil output, 10% decline in total conventional crude oil production.

- NOTE: Alberta wildfires in the main gas and light oil producing regions of Alberta prompted output shut ins

Here is another example of replacement values: Mars started the day 20c higher than WTI MEH at $73.53/bbl before falling to a discount of 15c, according to Bloomberg data

- Prices jumped early on news of an explosion at a gas platform off the coast of Mexico; gas is injected into wells producing heavy sour oil that is typically exported to the US

- Mars closed at a premium to WTI MEH on Thursday for the first time since April 2022

Johan loadings will reach records in August at about 774k barrels a day. The demand has been driven higher given its quality, but it was also a natural replacement for Russian crude once the seaborne imports were banned. It will be interesting to see what happens to Mayan as well as Latin American flows coming from Brazil/ Venezuela. Iran has already increased their exports into Asia, while companies reduce their term contracts with Saudi. KSA has started to offload some of their Red Sea floating storage into onshore tanks in Egypt. It’s unlikely any of this crude moves into the European/Mediterranean markets given the increase in OSPs. The below gives a breakdown of the OSP increases that were pushed through by Saudi Arabia. The U.S. is at a laughable level while the other prices have priced them out of many parts of the market.

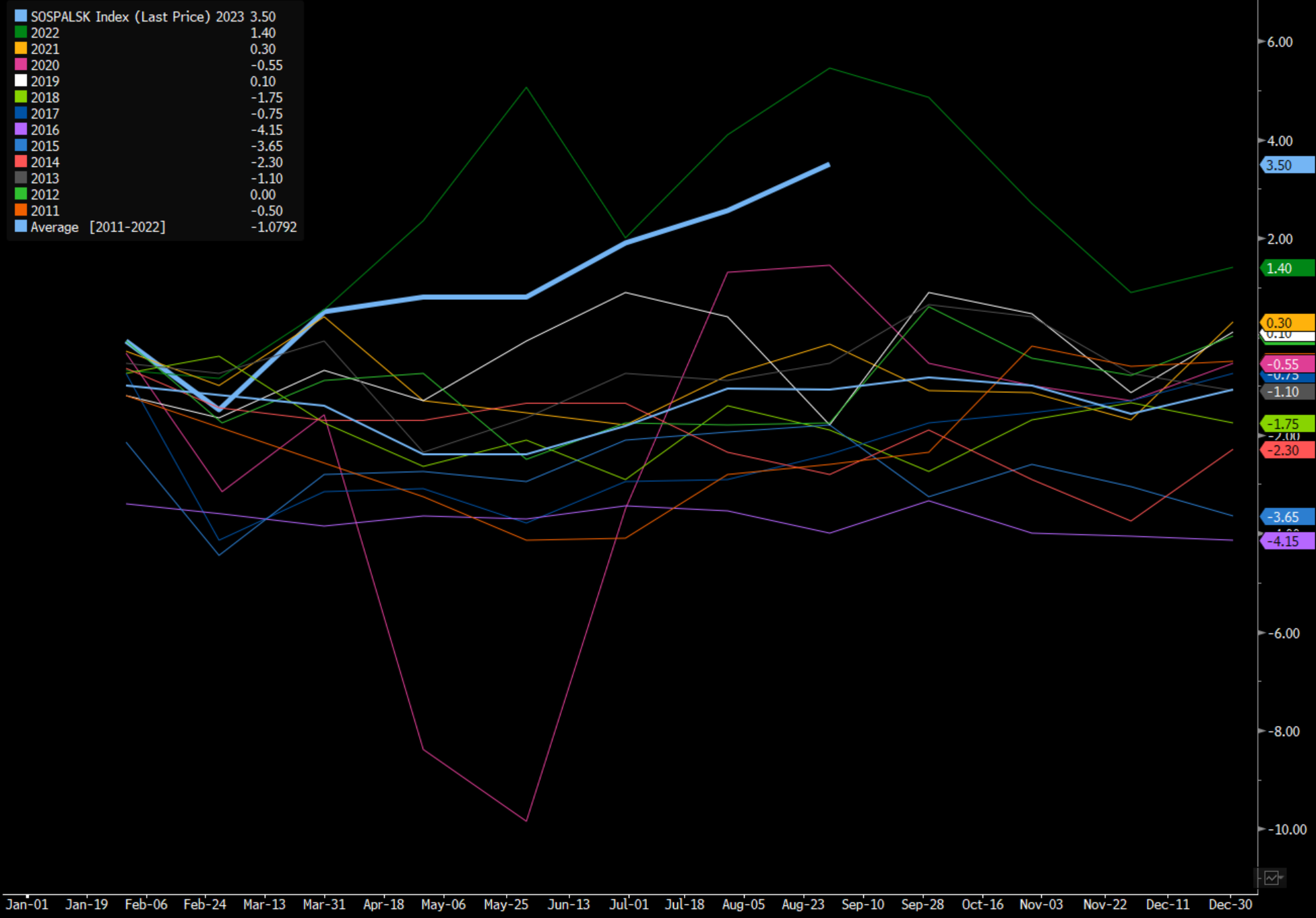

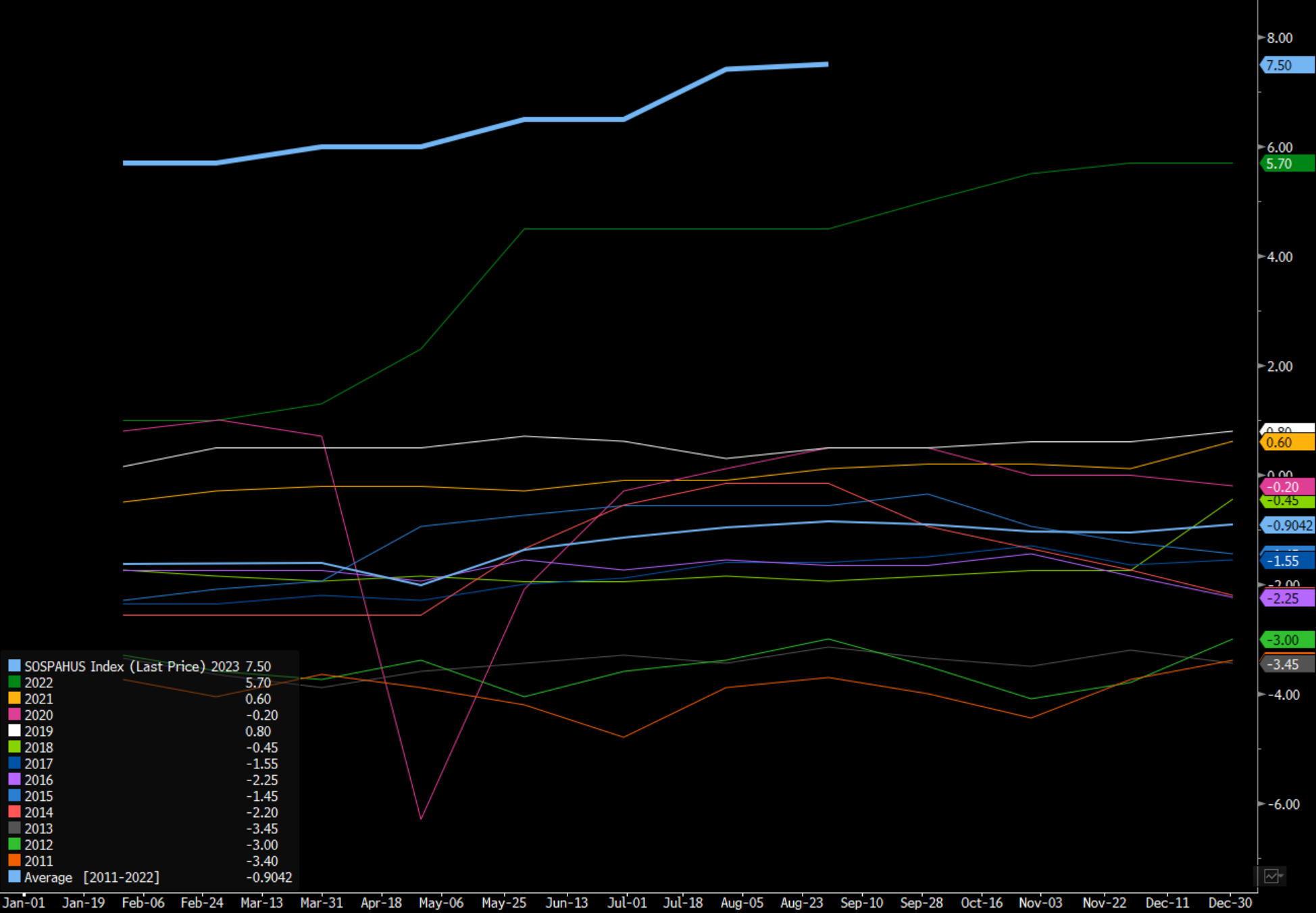

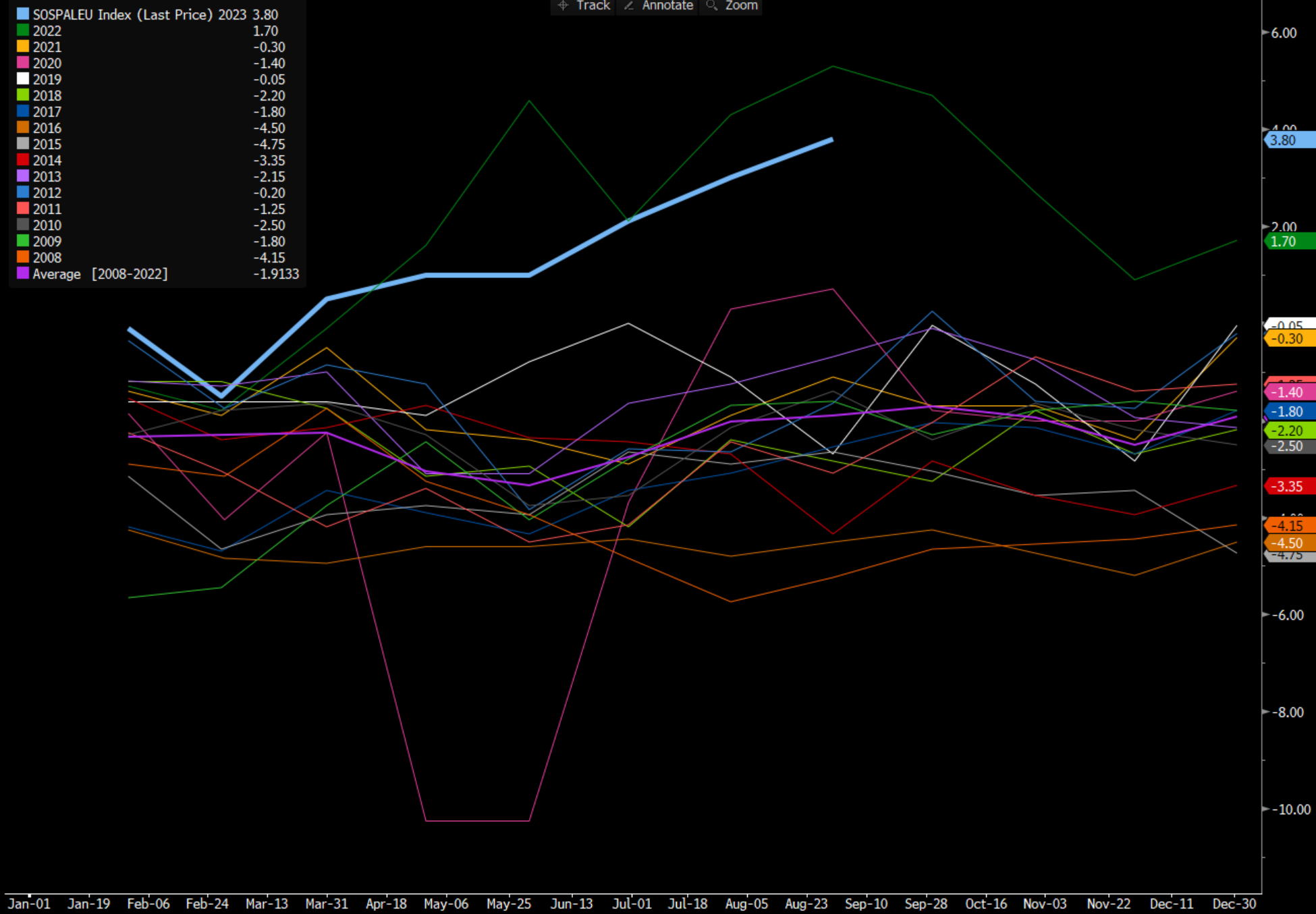

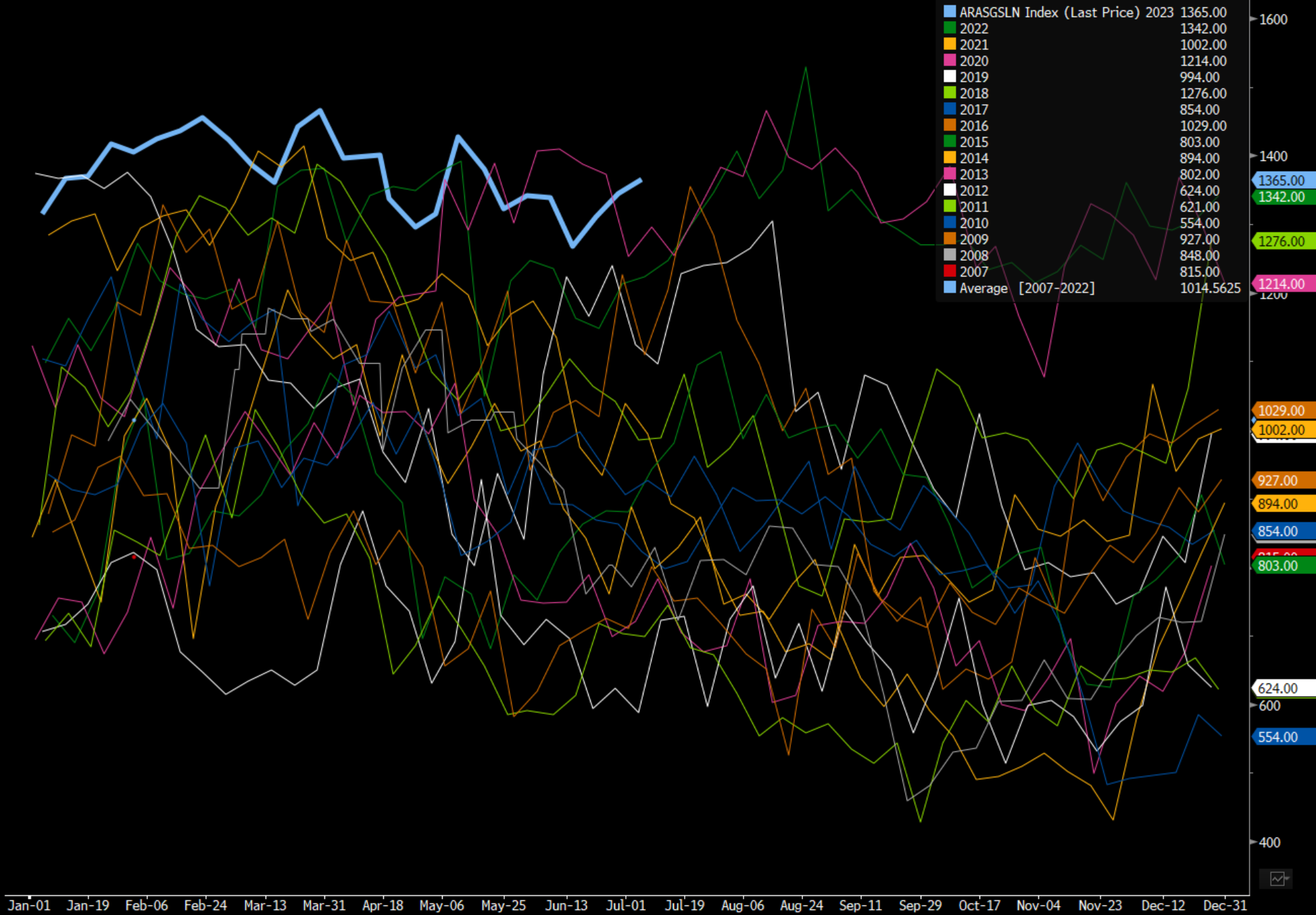

Just to put some of these prices increases into historical perspective- here is a sample of some of the premiums verses history.

Middle East Arab Light Crude Saudi to Asia OSP Spread vs Average Oman/Dubai FOB

Middle East Arab Light Crude Saudi Arabia FOB Sidi Kerir OSP

Middle East Arab Heavy Crude Saudi Arabia to US vs ASCI Spread

Middle East Arab Light Crude Saudi Arabia to NWE OSP

The last chart would be what the lion share of Europe would pay for KSA crude. “Some key buyers of Saudi Arabia’s crude in Asia and Europe are seeking reduced volumes for next month after the kingdom hiked official prices and extended output cuts. At least four term-supply customers want to take less August-shipped oil, according to traders with knowledge of the matter. If buyers are then allocated smaller volumes, they may turn to the spot market for replacement supply, potentially strengthening the physical market, they said.” This should result in more reductions of floating storage with WAF “West Africa” being the key one to watch for meaningful drops.

A key spot to watch is China as runs have been disappointing vs historics. We expected Teapots to be operating closer to 68% by this time of year, but they have been much lower vs normal. Typically, state-owned assets are running closer to 85%-87% by this time of year- which is another disappointment for crude runs. China’s state-run oil refiners raised run rates by 0.05 ppt w/w to 77.9% as of July 6, according to industry consultant OilChem.

- Independents +1.47 ppt w/w to 62.37%, OliChem said in note

- Run rates for Shandong teapots -0.28 ppt to 60.8%

- Teapots in Dongming cut runs due to CDU work, while Wudi Xinyue shut units for maintenance

- Commercial diesel stockpiles +1.6% w/w to 16.41m tons as of July 6, while Gasoline supplies -1.8% w/w to 12.9m tons

These reduced Chinese runs are happening at a time when imports and floating storage remains elevated in the region. This means a large part of this crude is being moved into tanks as China keeps filling their storage. The economic data within China keeps missing all estimates, while internal activity keeps shifting lower.

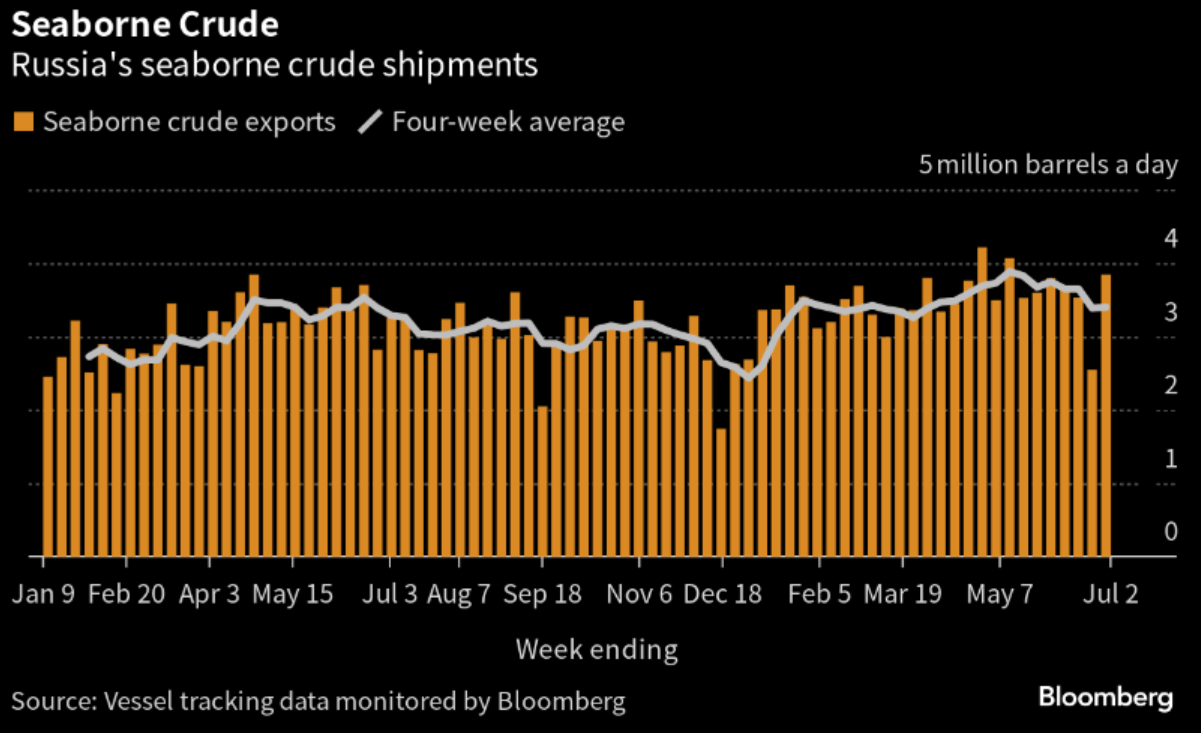

China and India keep increasing their purchases of Russian crude, which “shockingly” fell short of their pledges. Russia pledged 500k but instead only hit 350k barrels a day. “Russia’s daily crude output averaged 1.310 million tons last month, the people said, asking not to be identified because figures aren’t public. That equates to 9.599 million barrels a day, based on a 7.33-barrels-per-ton conversion rate. It was about 60,000 barrels a day lower than in May. Even with the monthly drop, Russia’s production was only 350,000 barrels a day lower than in February, the baseline to measure pledged voluntary cuts. The nation promised to reduce its crude output by 500,000 barrels a day starting March and maintain the curbs through 2024. “

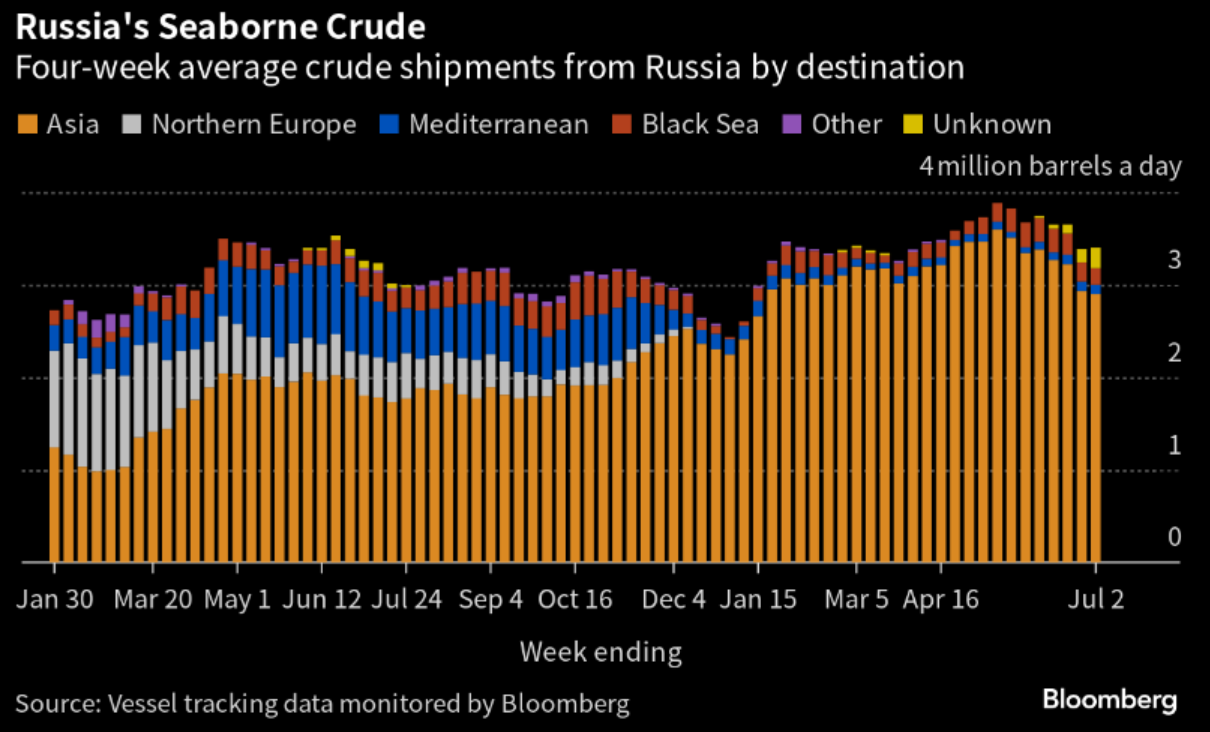

Russia also promised to reduce their exports, which is also amusing given the current levels being pushed into the market. They may reduce their crude exports, but they will likely just replace the crude with refined products. It’s important to look at total flows moving from Russia into the global market. This past week was the third most crude exported in the last year, and we expect to see similar volumes being moved into the market.

This is based on the continued demand from Asia that is absorbing most (if not all) of the Russian crude being moved into the market.

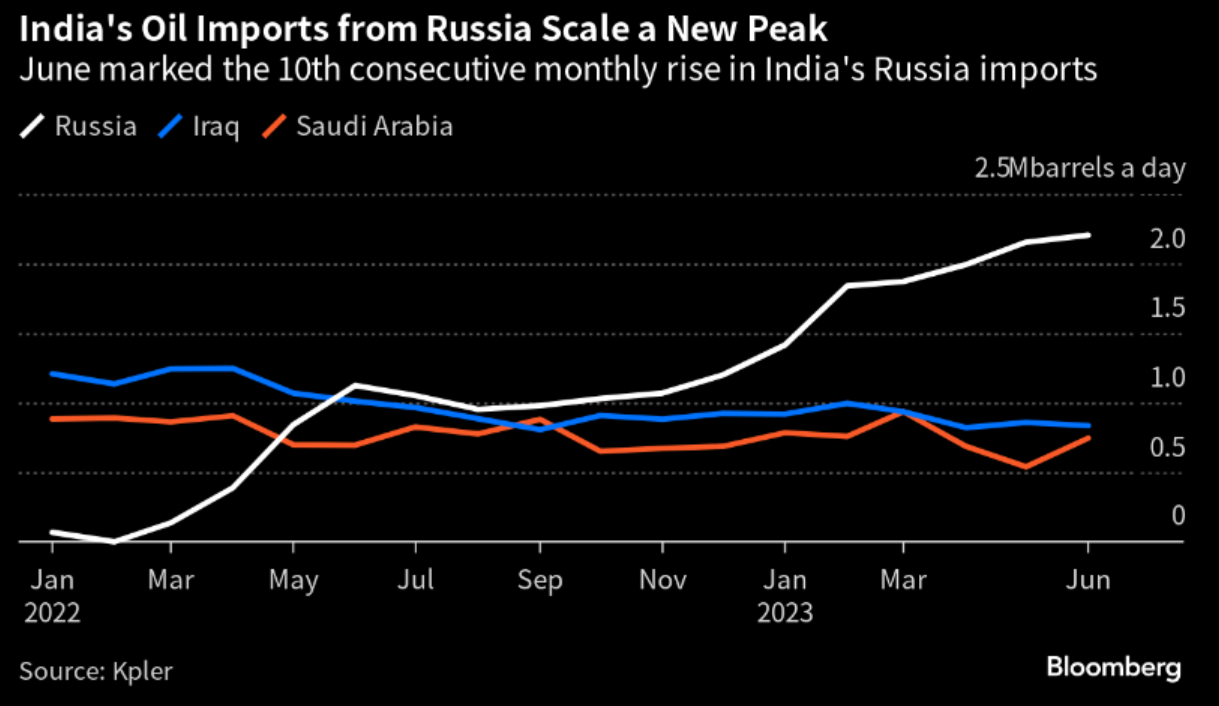

India saw another record of imports from Russia as they also capitalize on the cheaper volumes and helping their refiner margins.

Kazakhstan has corrected their power outage bringing back most of their production, which will benefit Europe. “Oil production in Kazakhstan, the largest energy producer in Central Asia, is recovering after being disrupted by power outages earlier this week. Crude output rose by almost 12% to 223,700 tons on Wednesday from the day before, a unit of the Energy Ministry said in a statement on its website. That’s the equivalent of about 1.64 million barrels per day. Kazakhstan suffered massive outages after one block at a power station in the nation’s west experienced an emergency stoppage on Monday. As a result, oil production slumped about 21% on Tuesday from pre-outage levels. The Caspian Pipeline Consortium, the main conduit for Kazakh barrels, is accepting crude for shipment from all the nation’s key oil fields without restrictions, the CPC operator said in a separate statement on Thursday. For a brief spell on Wednesday, it only took flows from Tengiz, the nation’s largest upstream project.”

CPC PRICES:

- CPC now trades at discounts of about $1.70-$2/bbl to Dated Brent, CIF Augusta: traders

- This is about 40c-70c higher than a week ago

- Petraco sold one CPC cargo to Shell at Dated -$2.75/bbl on the Platts window on June 30; price was lower than market level partly due to its prompt delivery date

- Loading program for August is set to be shorter than normal, also pushing up prices, they said

- Despite narrowing discounts, CPC prices are still much lower than other sweet grades in the Mediterranean

- Azeri Light is now traded at a premium of more than $4 to Dated, CIF Augusta, traders said

- The strengthening prices in CPC, however, temporarily closed arbitrage window from Med to Asia

- Asian refiners have yet to buy any CPC cargoes for August loading, traders said

Given the availability of WAF and LatAm, I don’t see Asia as big buyers as shipping rates also make it prohibitive.

The UAE also made a point to highlight how they won’t be joining the voluntary cut. The way Murban futures price the KSA moves will help them move some additional volumes. “The United Arab Emirates is “doing enough” to contribute to the OPEC+ production cuts and won’t be making further voluntary supply reductions at the present time, Energy Minister Suhail Al Mazrouei tells reporters in Vienna.

- Voluntary cuts by other group members are sufficient to balance the oil market

- OPEC+ may need to invite newcomers to join the group, as the group’s job becomes easier with more members”

This isn’t a huge surprise as the UAE already participated in the additional cuts for the year while getting their quota increased. There have been rumors circulating that Kuwait also wants to increase their quota- it was “officially” denied by the oil minister but there is truth behind it. The UAE, Kuwait, KSA, and Iraq have spent billions expanding their production- so I believe there is truth in the Kuwait rumor. It will be interesting to see where Iraq sets their differentials because they are in a prime position to benefit from the shortages in the medium/heavy market.

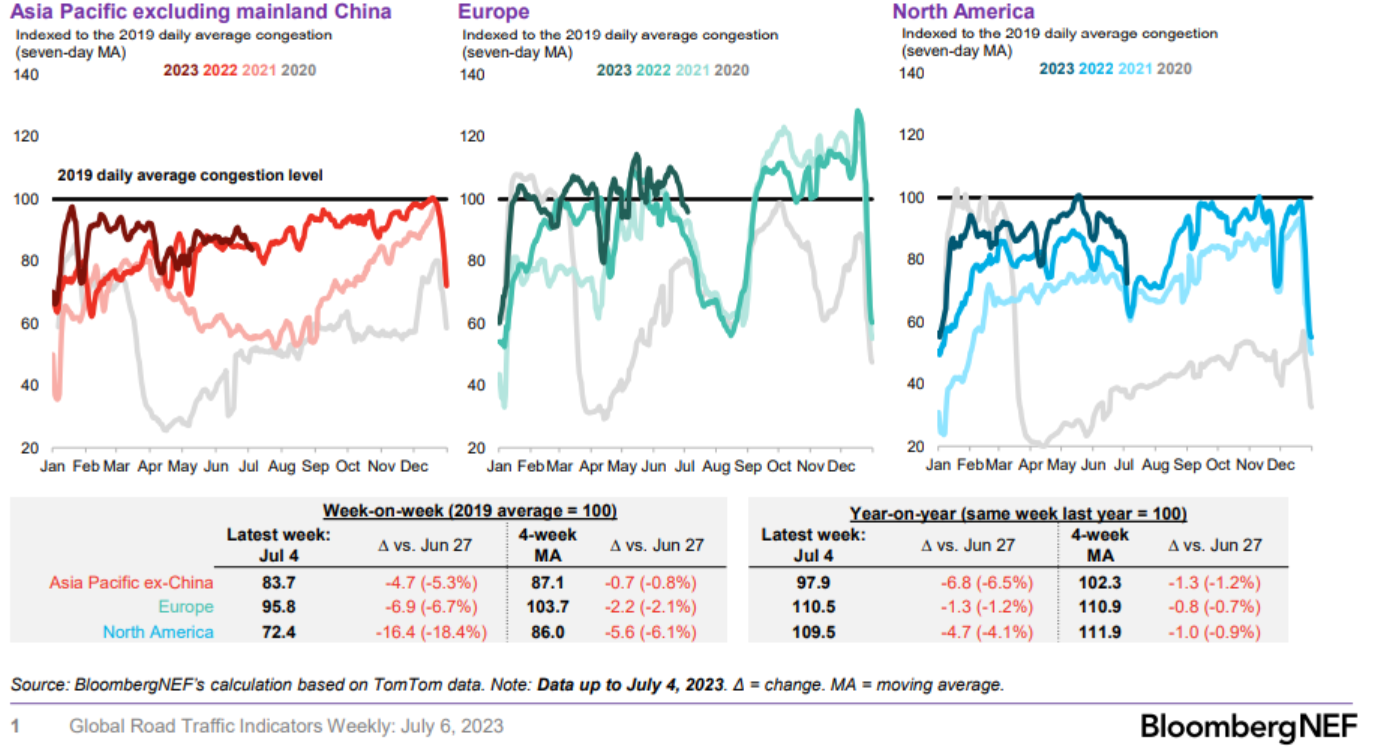

The key area that is being watched closely remains gasoline as the U.S. enters “core” driving season. It wasn’t surprised to see a bit of a decline for the 4th of July holiday, but the question will be how big is the bounce back. Asia Pacific saw another decline following the Dragon Boat festival and EID holiday. Europe typically sees a sizeable drop in July/Aug as many nations go on extended holidays.

The EIA reported an increase in gasoline demand, which is very normal for the holiday week. The data showed something a bit higher vs what we (and others) expected. Our data was something closer to 9.4M barrels a day, which was confirmed by GasBuddy and TomTom. So far, the data from GasBuddy shows a steep drop for the week: “After last week’s US gasoline demand surged 4.3%, this week isn’t looking nearly as bright. Week to date through Thursday, demand is down 8.3% from last week.” A drop is typical- especially when the holiday falls in the middle of the week. People will take the whole week off resulting in a big drop-in driving activity until we get to the weekend after. There will likely be a sharp increase Sun/Mon, but we still expect driving activity for the core season to average 9.4M-9.5M. This spread is about 200k-300k below the normal range we see at the same period.

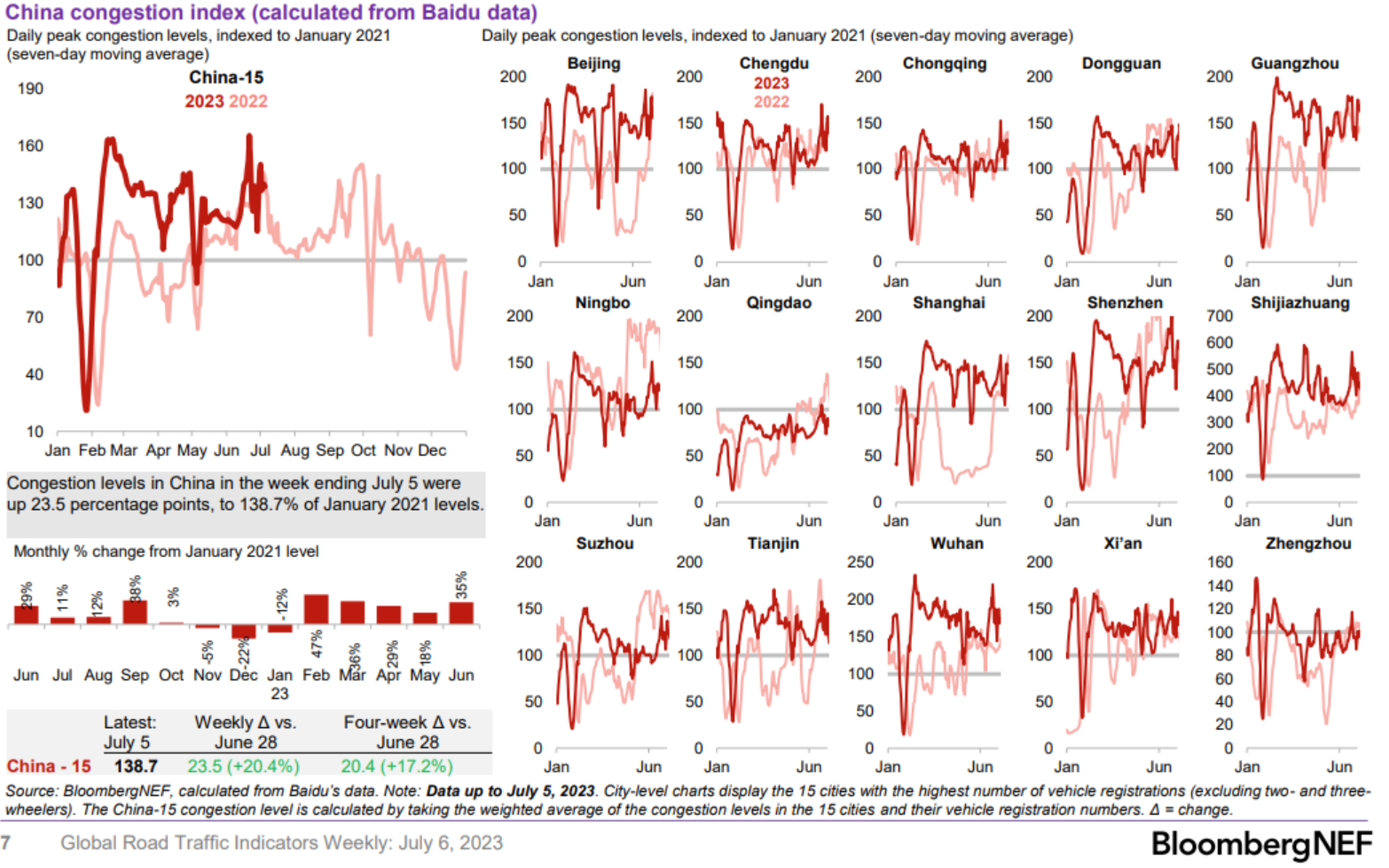

China has seen a fairly stable amount of driving in-line with 2022 levels. We don’t see much of an increase vs 2022 especially as pricing is set to change for local consumers.

“Fuel export margins could come under renewed pressure if domestic prices continue rising after the imposition of new consumption taxes, according to a note from Energy Aspects dated July 4.

- China’s Ministry of Finance and State Taxation Administration issued a notice on June 30 to include 17 additional products used for fuel blending within the scope of the country’s consumption taxes

- That’s increasing the costs of gasoline and diesel blending, driving domestic prices higher

- Domestic product prices jumped when the tax rumor first emerged last May, and rose further by ~100-200 yuan/ton after the notice was released

- Blending costs will increase by ~$270/ton on paper, but exchange rates and conversions of liters to metric tons means the actual figure will vary

- Export margins have rebounded since June with diesel margins reaching breakeven levels due to rising Singapore cracks

- New policy will levy consumption taxes on alkylate at the rate of gasoline, and tax white oils and some aromatics at rates similar to solvent oil and naphtha

- The rate for all will be 1.52 yuan/liter”

Domestic prices could be moved higher, but if you listen to the commentary from the CCP- they want to make things more affordable for people. The CCP has been pushing “common prosperity”, but if you increase the cost of refined products- it will hurt the lower middle class and poor more than the wealthy. It seems that refiners are holding off on ramping up production or exports until there is more clarity on the new pricing metrics. Once this is settled, we expect to see a sizeable increase in exports of distillates and diesel into the market given the current spreads.

KSA’s actions will help keep prices tight and the trading floor firmly at $73 Brent. As prices increase, it keeps refiners under pressure as margins get squeezed, and they attempt to push through higher prices by way of refined products. Inflation remains a fundamental problem around the world and higher crude prices aren’t going to make it any easier.

The U.S’s current gasoline prices will incentivize more imports- especially into PADD1 (East Coast). These prices are a problem for consumers already struggling with rising costs.

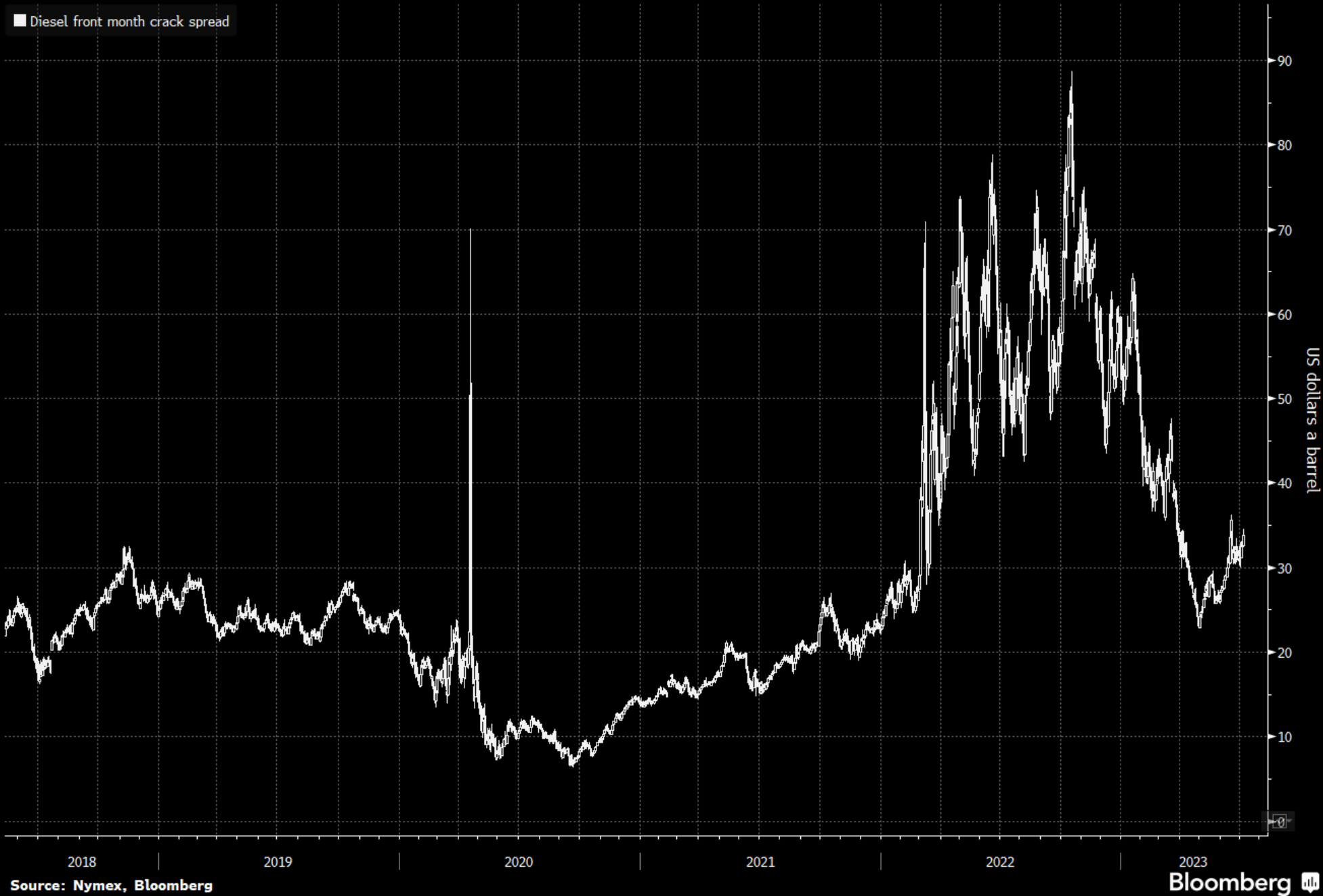

Diesel crack spreads will be important to watch especially as flows from the U.S. PADD 3 (GoM) pick back up into Europe. Things had slowed down as flows from the Middle East and Asia were flowing into Europe. The arb closed moving from East to West with some small periods when the arb opened. As it shuts back down, it will pull more disty from the U.S. into Europe and help our refiners on the coast.

The U.S. will keep importing above average amounts of European gasoline as their storage hit a new seasonal record.

ARA Gasoline Inventory

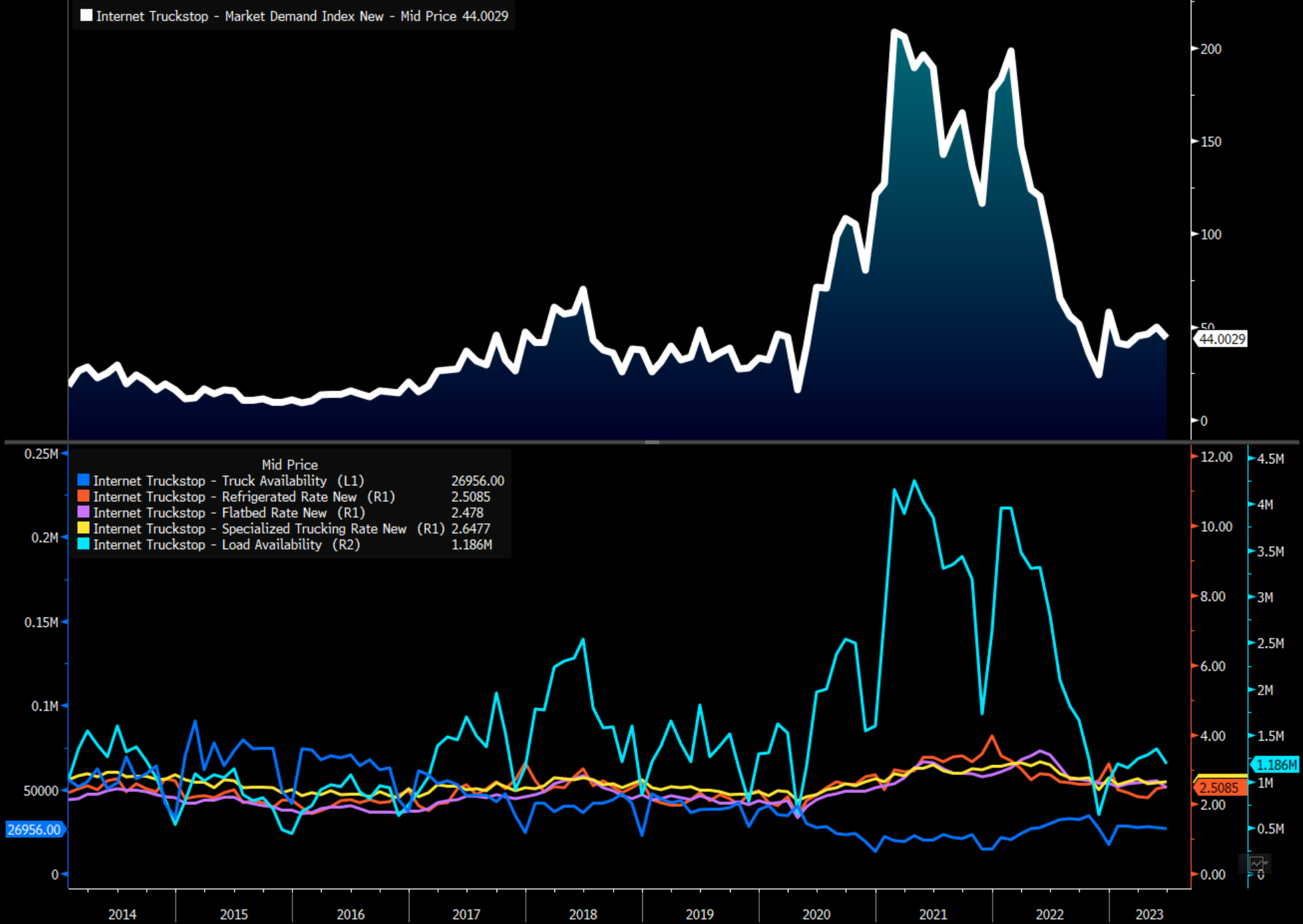

The diesel market isn’t going to save us as trucking remains a headwind and package movements slow considerable.

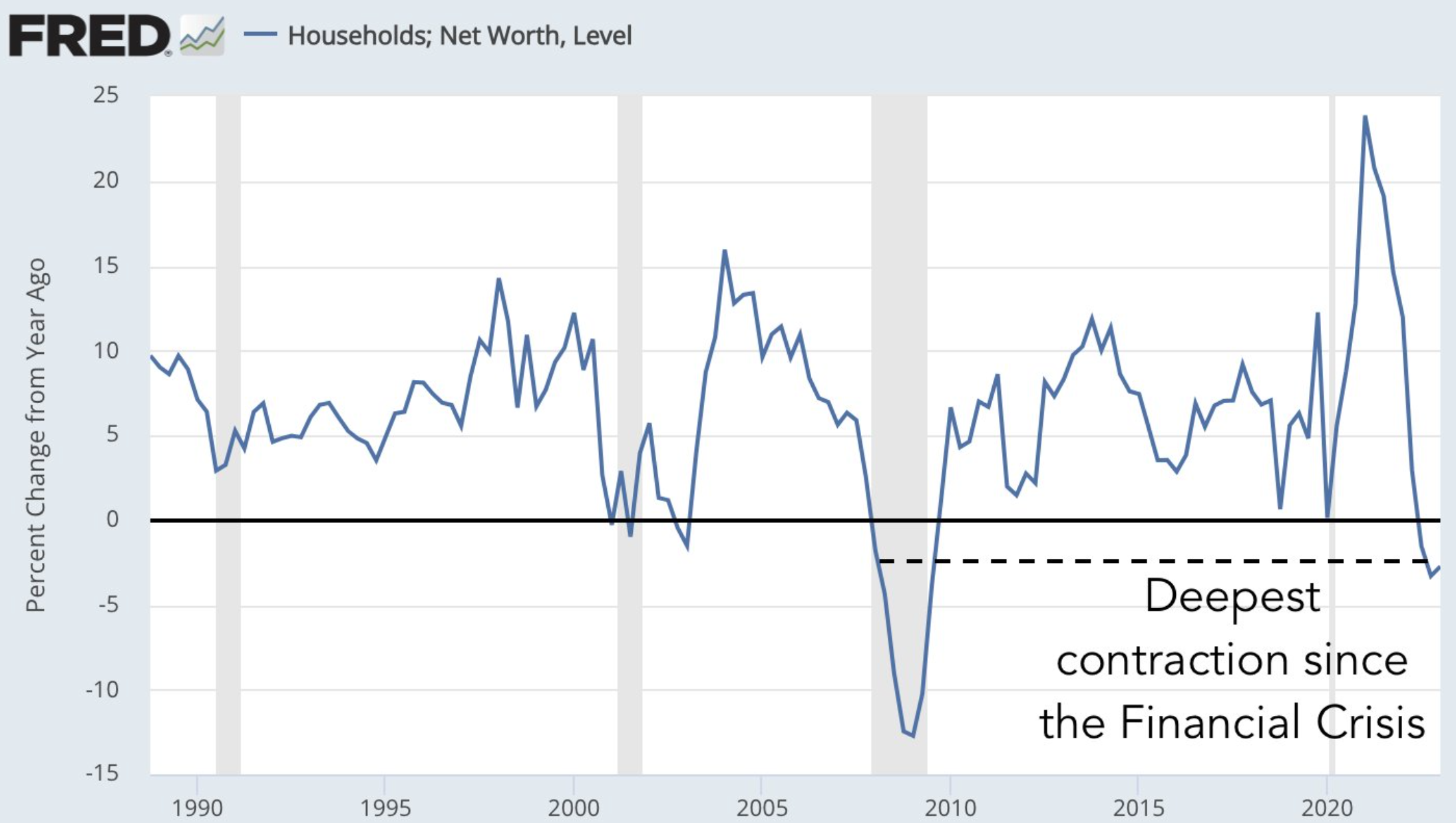

When we look at the economic backdrop, things have only worsened across the board. Household net worth has dropped as real wages hit their 26th month of contraction.

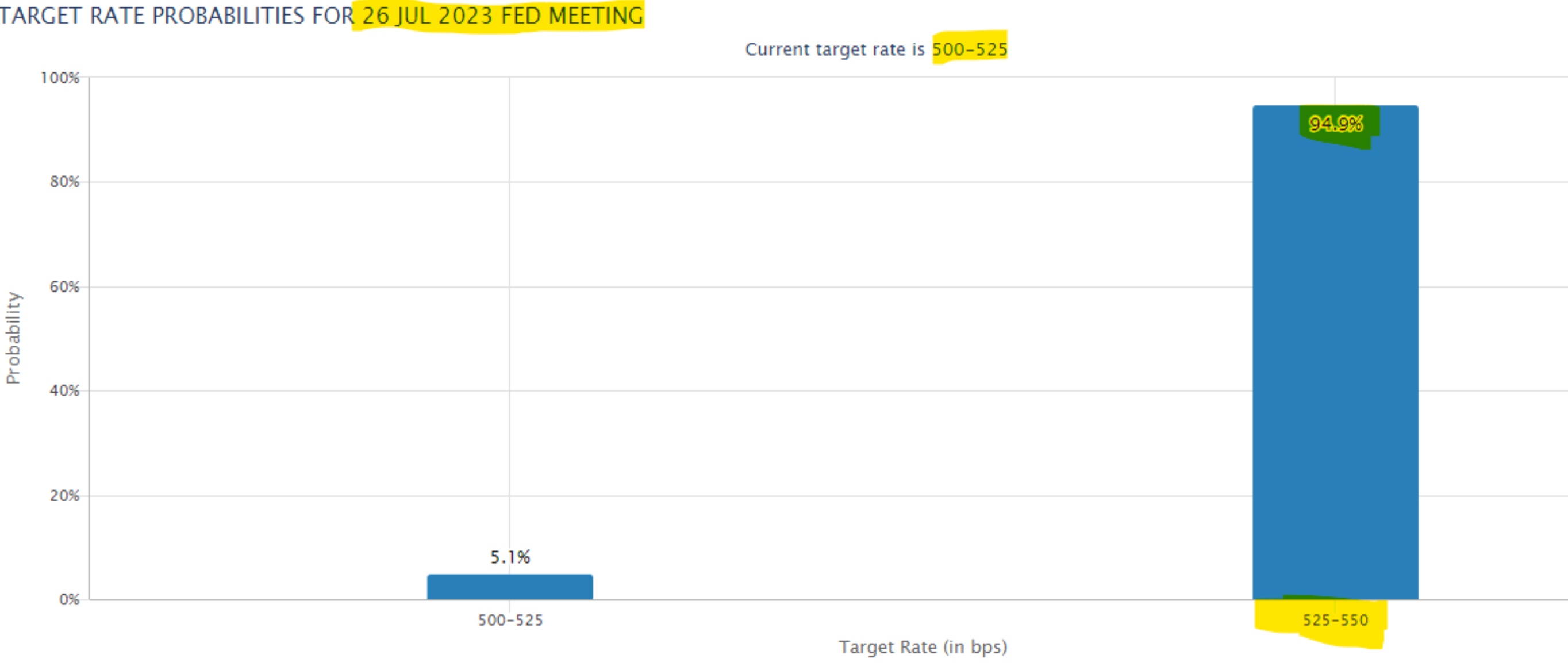

Even as net worth falls and real wages stay negative, the jobs data came in stronger than expected as inflation still remains on pace for additional growth. This will keep the Fed on pace to raise rates again at the end of the month, which has been our base case. We believe there are two more 25bps hikes coming in the remainder of the year.

Based on the above data, we aren’t alone in that view as well for the July.

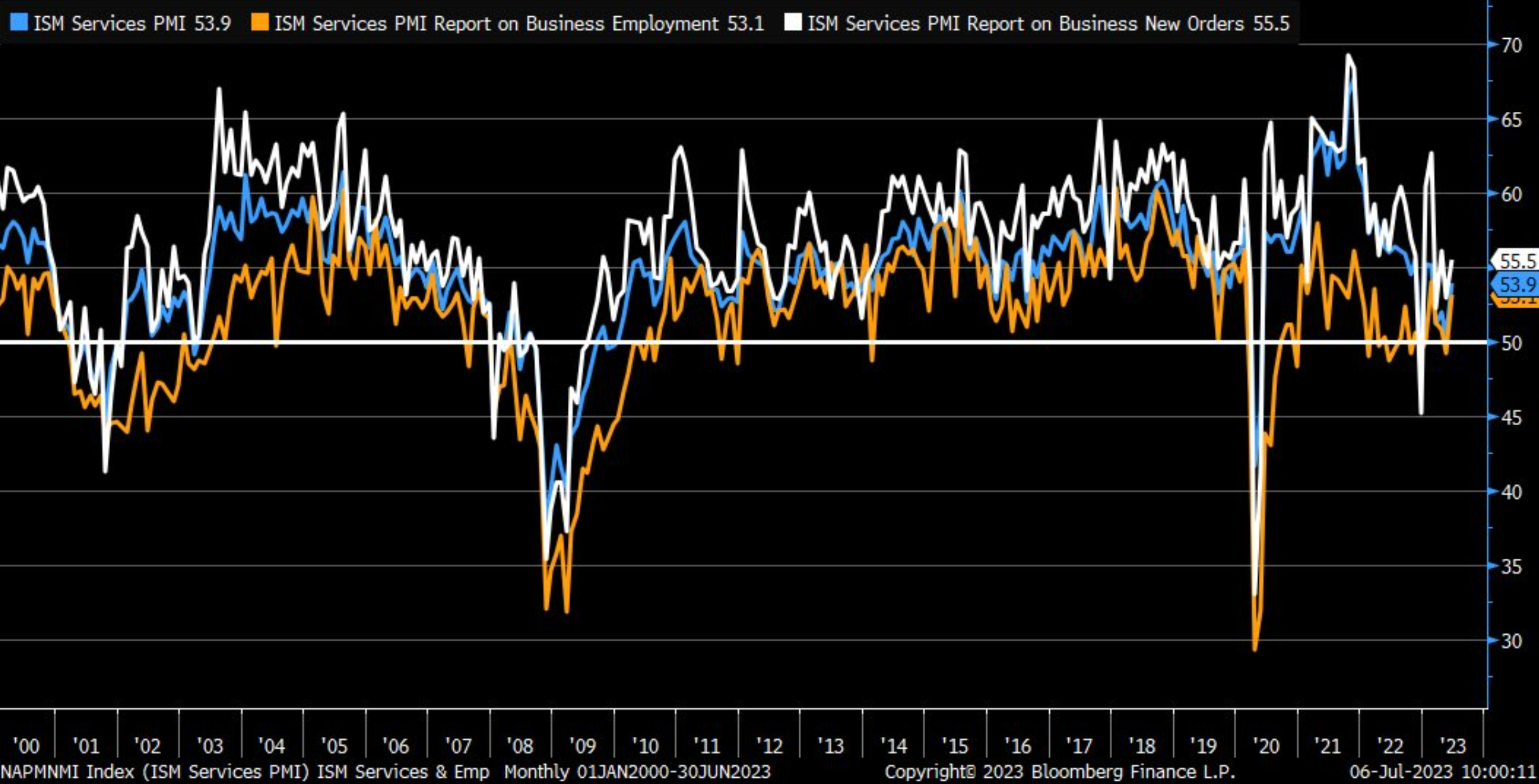

The service ISM data came in better than expected, and supports more action from the Fed. It also highlights the steep bifurcation between manufacturing/industrial activity vs services. The data also shows more price expansion (inflation), while activity had a nice bounce. “June ISM Services at 53.9 (highest in 4 months) vs. 51.2 est. & 50.3 prior; new orders rose to 55.5 vs. 52.9 prior; prices paid fell to 54.1; business activity jumped to 59.2 from 51.5; supplier deliveries lower at 47.6; employment rose to 53.1.”

The world is still facing a crop problem as yields come under more pressure from broad droughts and heat waves. We will go through more of that next week as well as a macro and U.S. economic update.