Amidst growing optimism among economists, news of falling inflation rates provides a glimmer of hope for the world economy. The once-feared specter of an impending American recession appeared inevitable as the Federal Reserve persistently raised interest rates to combat inflation. Concurrently, other central banks grappled with inflationary challenges exacerbated by a surging dollar, causing particular strain on emerging markets reliant on borrowing and trading with the US currency.

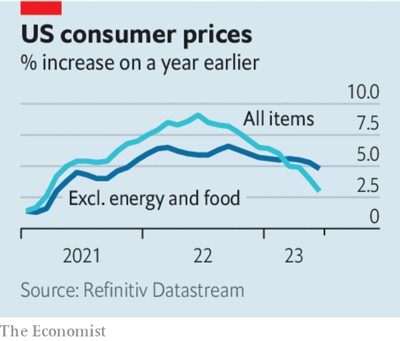

Thankfully, recent data unveils a decline in America’s annual inflation rate to 3% in June, fueling expectations that the upcoming rate hike scheduled for July 26th might be the last in this tightening cycle. Such encouraging prospects have also sparked the possibility of other central banks easing their policies (we talked about this in our previous article). Consequently, stock markets are buoyant, bond yields are falling, and the US dollar flirts with its weakest position since the commencement of rate increases.

However, this current wave of optimism seems paradoxical, given the global economy’s evident slowdown. China’s economy, for instance, grew by a mere 0.8% in the second quarter compared to the previous three months, despite optimistic projections following the government’s relaxation of its strict “zero-covid” policy. Similarly, the rebound in global manufacturing faltered as consumers emerged from lockdowns and shifted spending habits towards dining out while scaling back home-office equipment purchases. Though the US economy demonstrated robust growth in the first half of the year, most forecasts anticipate a forthcoming deceleration.

Yet, amidst the slowdown, a glimmer of hope remains for overheated economies like the US. The anticipated growth moderation, effectively reducing inflation without plummeting into recession, represents the best-case scenario. Additionally, China’s underwhelming reopening surprisingly did not lead to the feared surge in global commodities prices, owing to Europe’s shift towards liquefied natural gas imports, consequently benefiting Europe after replacing Russian gas supplies.

Despite these positive indicators, a cautious approach is imperative, as the world economy has not yet secured a smooth “soft landing.” Three core reasons contribute to this uncertainty. Firstly, inflation continues to hover significantly above the 2% targets set by central banks. While the US headline inflation rate decreased primarily due to declining energy prices, excluding food and energy items reveals a persistent 4.8% increase compared to a year ago. Similarly, the euro zone faces even higher inflation figures at 5.5%, with both economies grappling with wage growth surpassing productivity growth.

Secondly, though the current cooling-off period provides some benefits, hidden costs may emerge in due course. The US labor market has managed to adapt without major layoffs, primarily by reducing job vacancies, resulting in diminished wage growth. However, the sustainability of this trend remains uncertain, and concerns loom regarding the potential surge in layoffs when companies opt to shed unnecessary labor. Several countries have already witnessed a reduction in average hours worked, suggesting firms might be retaining excess labor, which could lead to abrupt layoffs when deemed unsustainable.

Thirdly, divergence among major economies necessitates vigilance from policymakers. While the Federal Reserve feels pressure easing, other regions are on high alert. Britain may have celebrated a significant drop in annual inflation in June, but underlying price and wage growth hovering around 7% raises concerns. Japan has just embarked on monetary tightening, and with rising inflation, the Bank of Japan contemplates adjustments to its bond yield cap by the end of July. Concerns regarding China’s economic growth are still well founded.

China reported second-quarter gross domestic product (GDP) growth of 6.3% from a year ago, falling short of expectations. The slowdown in economic growth comes amidst a complex geopolitical and economic international environment. Notably, analysts had predicted a 7.3% increase in second-quarter GDP.Youth unemployment has also reached a concerning record, with the unemployment rate among individuals aged 16 to 24 reaching 21.3% in June.

The Covid-19 pandemic’s prolonged impact has created distortions in China’s economic data, making it essential to consider the context when interpreting growth figures. The economy’s current performance only shows improvement from the depths of the lockdown.

When compared with growth rate after Covid policies were terminated the above figure represents only a 3 percent growth rate. Consumer prices are down signaling deflation, exports are also down.

The future path of inflation and interest rates remains shrouded in uncertainty for the world economy. The world economy has yet to navigate through its current situation unscathed, necessitating careful monitoring and prudent actions.

Further indicators hinting towards a slowdown

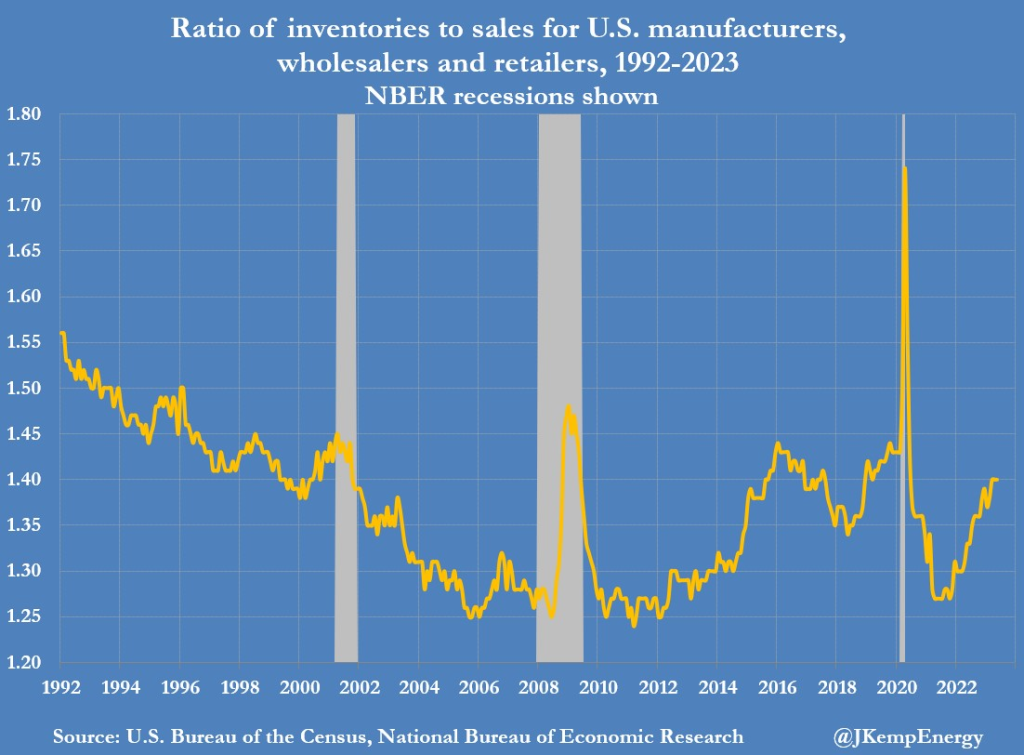

US business inventories have continued to stay elevated, driven by a slowdown in consumer spending and corporate investment in goods. As of May 2023, manufacturers, wholesalers, and retailers are holding inventories equivalent to an average of 1.40 months of sales, a rise from 1.33 months in May 2022. Stocks held at retailers have also increased to 1.30 months, up from 1.23 months in 2022. This trend signals potential concerns for the US economy as excess inventory levels may lead to reduced production and could weigh on economic growth.

Check out more in our ECON show