Industry Outlook

We discussed our initial thoughts about Nine Energy Service’s (NINE) Q2 2023 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook.

The US drilling and completion activity softened in the US in 2023, affecting oilfield services companies. The US rig count was down by 14% from January to June, resulting in pricing pressure for the oilfield services companies. Much of the decline occurred in Q2 at Haynesville, Eagle Ford, or the natural gas-heavy basins. Year-to-date, rig count decreased by 23% and 20%, respectively, in these regions. In Q2, completion wells, and newly drilled wells were down by 8% and 5%, respectively.

In the Northeast, the rig count was more stable. Despite that, the pricing problem and completion delays led to asset underutilization. This adversely affected NINE’s revenues and margin in the completion tools and wireline business.

NINE’s Strategy And Outlook

In 6M 2023, NINE’s sales of Stinger dissolvable units outperformed its previous year’s sales by 50%. A large international order led to higher completion tool revenue in Q2. The performance was remarkable, given the lower activity level in the Haynesville shale, where dissolvable frac plugs are intensely used. Also, the company’s wireline sales were challenged by the pricing pressure. Read more about the company in our previous article here.

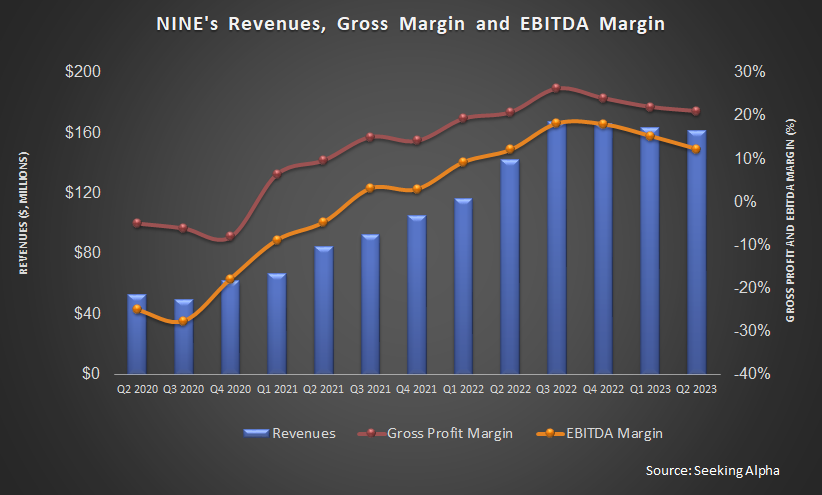

The company aims to stay capital-light to minimize capital risks in an environment where the industry cycles have become shorter. Given the pricing pressure, NINE’s management estimates that its Q3 sales will be down compared to Q2. It expects to record $145 million in revenues (at the guidance mid-point), which would be 10% lower than Q2. It also expects adjusted EBITDA and adjusted EBITDA margin to decline.

Q2 Drivers

NINE’s revenues from cementing jobs decreased by “single digits” in Q2 after decreasing by 3% in Q1. Lower drilling activity in Eagle Ford and Haynesville accounted for the fall. Revenues from the completion tool were up in Q2 due to higher international orders, partially offset by lower dissolvable pug sales in North America.

But the company’s management believes that Haynesville’s activity will rebound in the medium term due to improved natural gas exports. In the wireline business, pricing continued to pose a challenge. The pricing weakness affected the company’s financial performance in the Permian and Northeast, where it can translate into lower margins. A rig count recovery in Haynesville can also improve the coiled tubing performance in Q3.

Cash Flows And Liquidity

NINE’s cash flow from operations turned positive in 1H 2023, which led to its free cash flow turning positive. An increase in cash collections accounted for the cash flow rise in 1H 2023. Due to negative shareholders’ equity and a reasonably high net debt ($292 million), the stock is financially risky. Its liquidity (cash and cash equivalents plus availability under the revolving credit facility) was $60 million as of June 30, 2023.

Relative Valuation

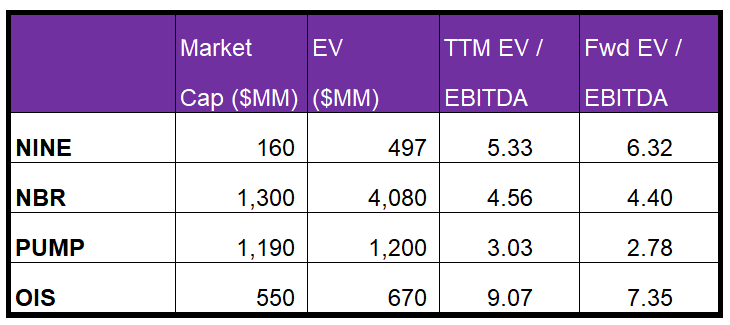

NINE is currently trading at an EV/EBITDA multiple of 5.3x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 6.3x.

NINE’s forward EV/EBITDA multiple compared to the current EV/EBITDA is expected to expand versus a contraction for its peers. This implies that its EBITDA is expected to decrease compared to a rise in EBITDA for its peers in the next year. This typically results in a much lower EV/EBITDA multiple than its peers. However, the stock’s EV/EBITDA multiple is similar to its peers’ (NBR, PUMP, and OIS) average. So, the stock is overvalued versus its peers.

Final Commentary

The drilling activity precipitated in Haynesville and Eagle Ford – two natural gas-heavy basins in the first half of 2023. Plus, the company’s wireline sales were challenged by pricing pressure. The pricing problem and completion activity delays led to asset underutilization in Q2.

On the positive side, NINE’s sales of Stinger dissolvable units increased significantly due to a large international order of completion tools. A working capital improvement turned its cash flows positive in 1H 2023. However, the stock is financially risky due to negative shareholders’ equity and a reasonably high net debt ($292 million). The stock is relatively overvalued versus its peers.