My macro review from Thursday is copied and pasted below under the same title. Let me know if you have any questions!

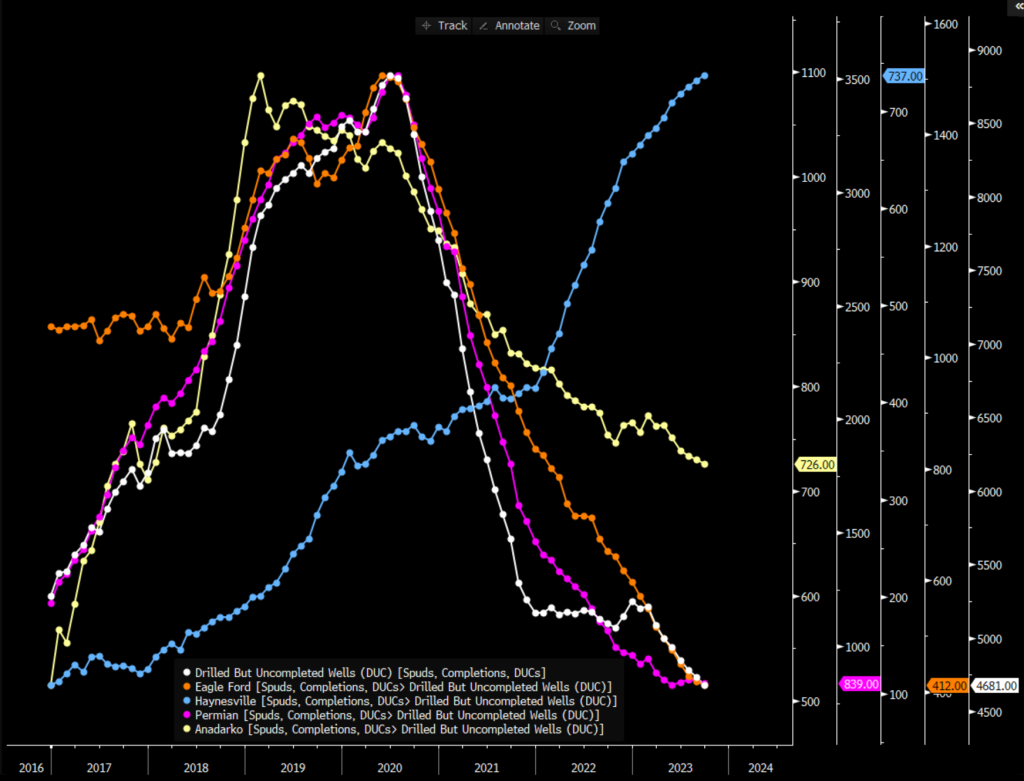

Completion activity shifted higher again driven by the Permian and Western Gulf. Two of the core areas we highlighted at the beginning of October, and we see another round of increases before things slowdown into Thanksgiving. Active completion crews have increased in the Permian with another bump likely coming next week as running spreads finished the week strong. There should be enough juice left to get the Permian to 150, and the national total to 280-285 before things slow down.

DUC counts have stabilized in the biggest basins, and as rig counts flatline- completion activity will maintain strength into the middle of November. The Permian and Eagle Ford have flatlined, which will help keep crews busy.

The strength in the crude market will remain in this band as we continue to have geopolitical uncertainty. I expect to see some more deals structured with Venezuela to replace some of the heavy crude barrels that was originating from the Middle East. There will be a renewed “clamp” down on Iranian barrels, but they need to replace it somewhere- with VZ the easiest location. The biggest unknown in the U.S. will be the “normal” seasonal slowdown between Thanksgiving and New Years. This six-week period normally has a drop in activity, but given the low starting point- it will be interesting to see the percentage drop. There is a good chance we see “more” activity than normal given the efficiency of operation and low starting point.

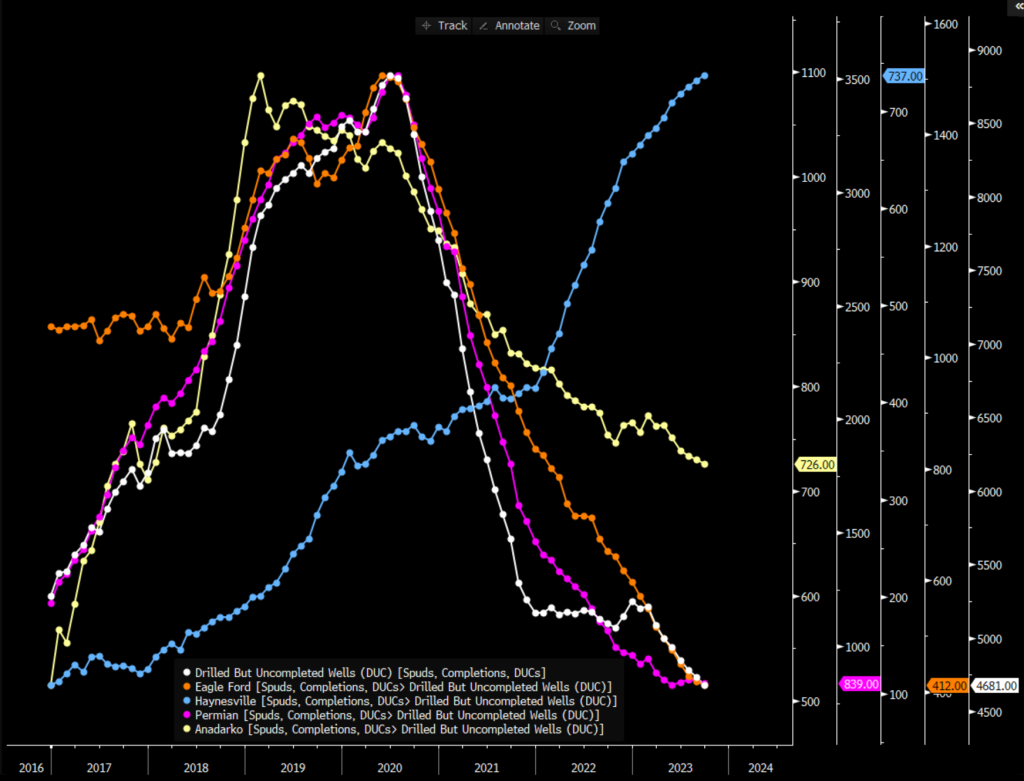

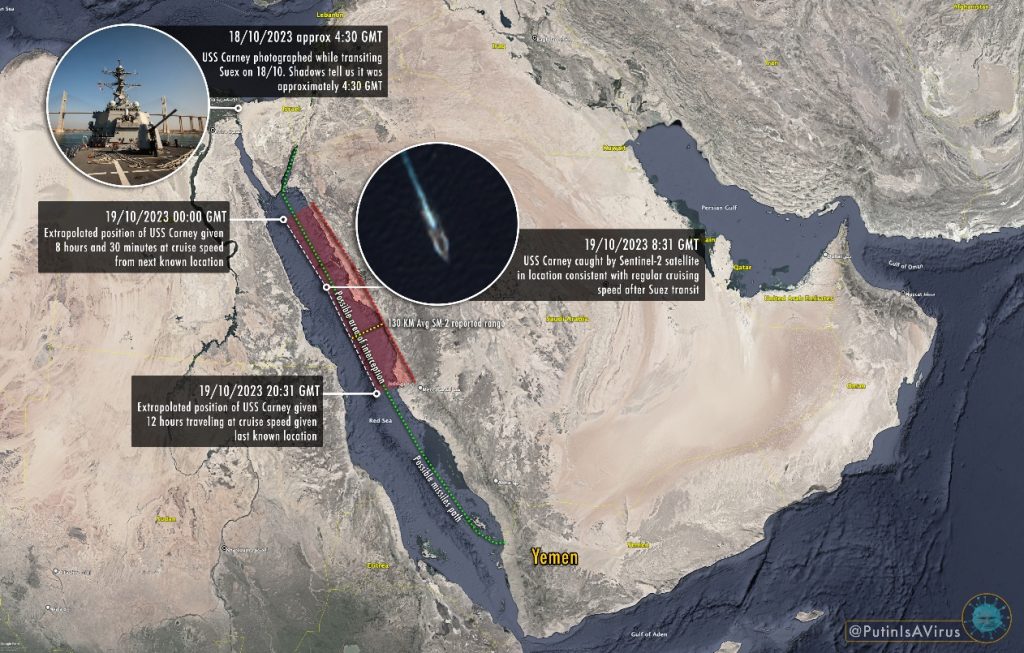

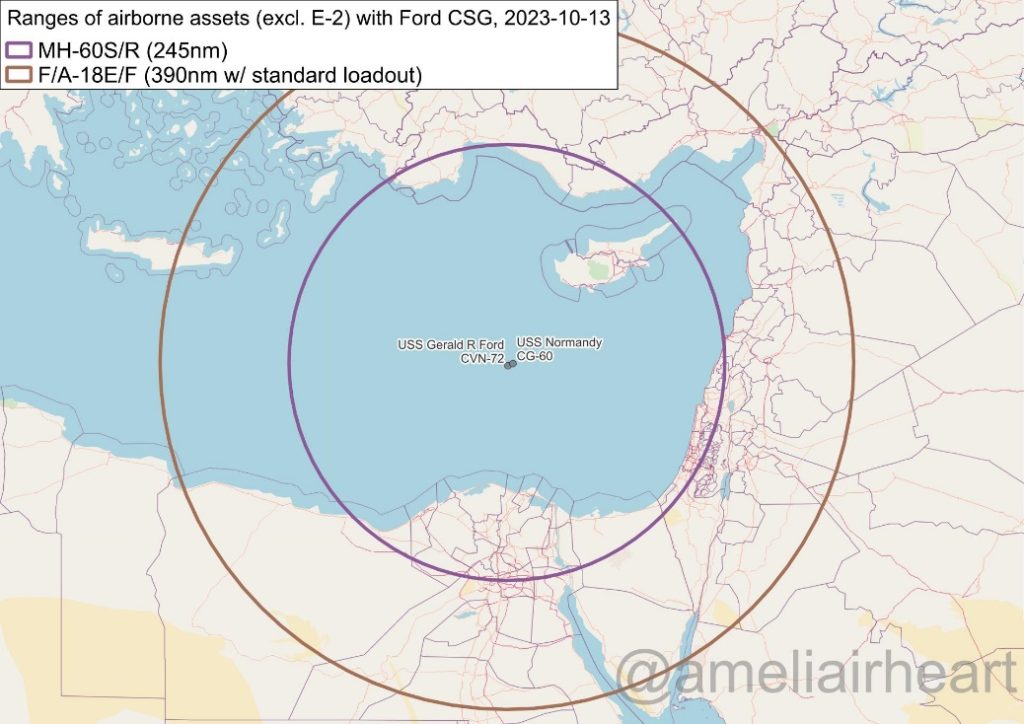

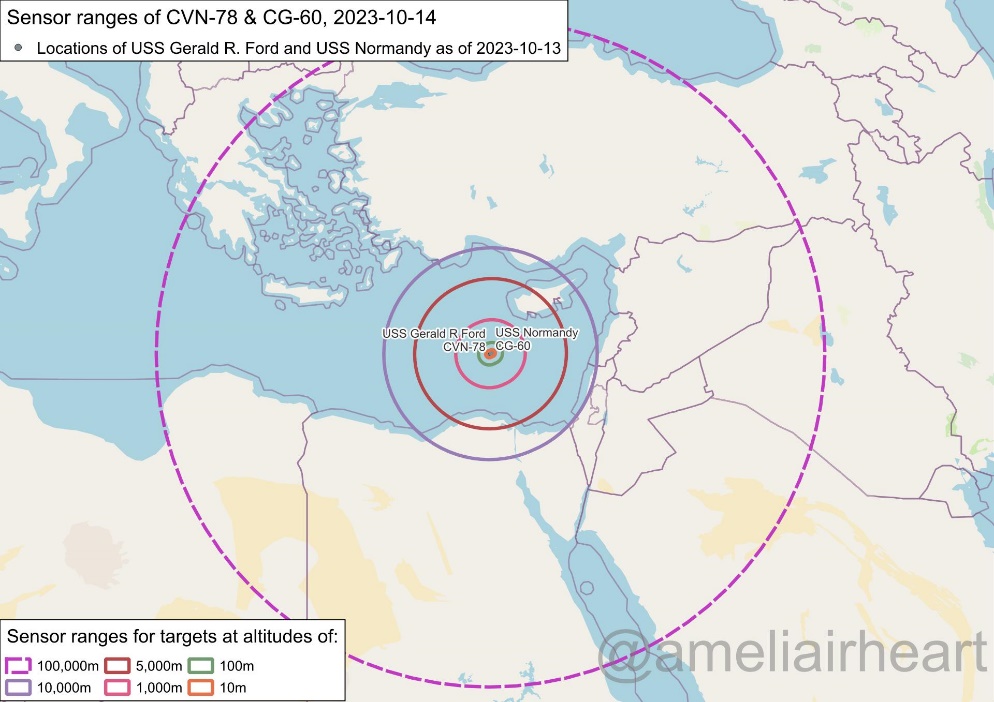

The crude markets responded to the news that the USS Carney shot down several missiles and drones destined for Israel. There were some rumors that they were targeting the vessels, but given the location of the intercept- it’s HIGHLY unlikely Yemen Houthis have the sophistication to hit a vessel 100’s of miles away. We have stated on multiple occasions that the U.S. is moving assets into position in order to provide protection against drones and missiles coming from outside influence.

The goal for the U.S. is to create broad “rings” of coverage that can overlap creating redundancy as well as blanket coverage. The Iron Dome can handle small rocket fire, but the bigger missile assets that the Houthis have in their possession require bigger assets to take down. We also had a big misreporting about the hospital in Gaza, which created broad protests across the Middle East and pockets in Europe and U.S. It’s important to weigh the OSINT and SIGINT messaging because both sides will have an agenda. There was commentary that it was “impossible” to know if it was an Israel missile or errant rocket from Hamas. The first thing to look at is the location of the strike, size of the crater, and video footage of the region. Once daylight hit- it became clear that the hospital wasn’t hit, but a parking lot/ courtyard was the actual strike point. The depth of the crater was minimal, and the damage was caused more by cars catching fire vs anything else. This was followed by video footage showing a rocket attack that had a trajectory over the hospital, and you could see one of them fall of trajectory that is quickly followed by the explosion near the hospital.

Some are saying- there was no way to know- but realistically- there was. The hospital staff and medical director could have diffused the situation by saying it hit the parking lot and it has a shallow crater. Instead, the Hamas controlled medical ministry said that the hospital was hit in an Israel attack with 100’s wounded. Instead of trying to confirm, every news outlet ran with a story that just didn’t make much sense. This is the problem in the “fog of war” and every news agency is looking to run the story first. Plus- both sides will have their own agenda to maintain public perception. Just stay vigilant when trying to trade the news in the market- especially when an Israel ground invasion is likely going to happen this weekend.

Brent prices have held their geopolitical premium addition following the attacks on U.S. assets in the region. There were several attacks (between 7-9 depending on the reports) against U.S. bases and forces in Iraq and Syria, and we will likely see additional rocket attacks in the next few weeks. The C-RAM was able to shoot down one of the two rockets fired, but there will be more to come.

Many of the buildings the Iranian proxies utilize were vacated last week- ahead of the Israel push and attacks on U.S. assets. There has been a call for a swift reaction from the U.S., but it makes sense to stay alert and have a unified strike at the time of our choosing. Why hit an empty building when you can wait for the responsible parties to go “back to the office.”

There are going to be many difficult decisions to make over the coming months, and it’s going to make crude prices respond in kind. We believe prices will “live” in the $90-$92 range with obvious extensions higher in the near term. The “pops” higher should be short lived as the impacts to the actual crude market is minimal in the near term. It doesn’t mean that there won’t be escalation points, but the slowdown in WAF buying and additional presences of Brazil and VZ crude will help “soften” the blow of geopolitical fear. Here is a brief synopsis of the physical market in WAF:

Nigerian barrels for prompt supply have weakened as strong backwardation, shrinking refinery margins and seasonal maintenance all hurt differentials, according to traders specializing in the grades. November’s West African offer levels are higher, but trade has yet to begin in earnest aside from Angola.

- No bids/offers for WAF on Platts window

WAF SPOT MARKET:

- Vitol lowered an offer of Nigeria’s Agbami for early-November arrival to Dated +$2.90 on Platts on Oct. 3 before withdrawing it, from Dated +$3.15 on Oct. 2

- Strong backwardation in Dated Brent is cutting into differentials for prompt barrels, according to traders

- NOTE: Brent’s December-January spread +8c to backwardation of $1.73/bbl on Oct. 3

- OIL BAROMETERS: Gasoline Slumps Again; Brent Options Bearish

- Nigeria’s offer levels are being touted at $1 to $2/bbl in excess of the country’s latest OSPs, which already were boosted to 13-month highs for Qua Iboe and Bonny Light

- Relatively few November barrels have traded so far, and some October barrels are still outstanding, traders said

- Indications may be too high to secure buyers, particularly for the lighter grades; middle distillate-rich grades are performing better

- November’s offer levels are stronger too for the Republic of the Congo’s Djeno crude at Dated Brent +$1/bbl, but no deals have been seen as yet

- NOTE: Djeno was pegged at small premiums of as much as 50c against Dated on Aug. 29

- One exception is Angola, where Sonangol briskly sold four spot cargoes through last week at premiums of as much as $1.50/bbl above listed offer levels

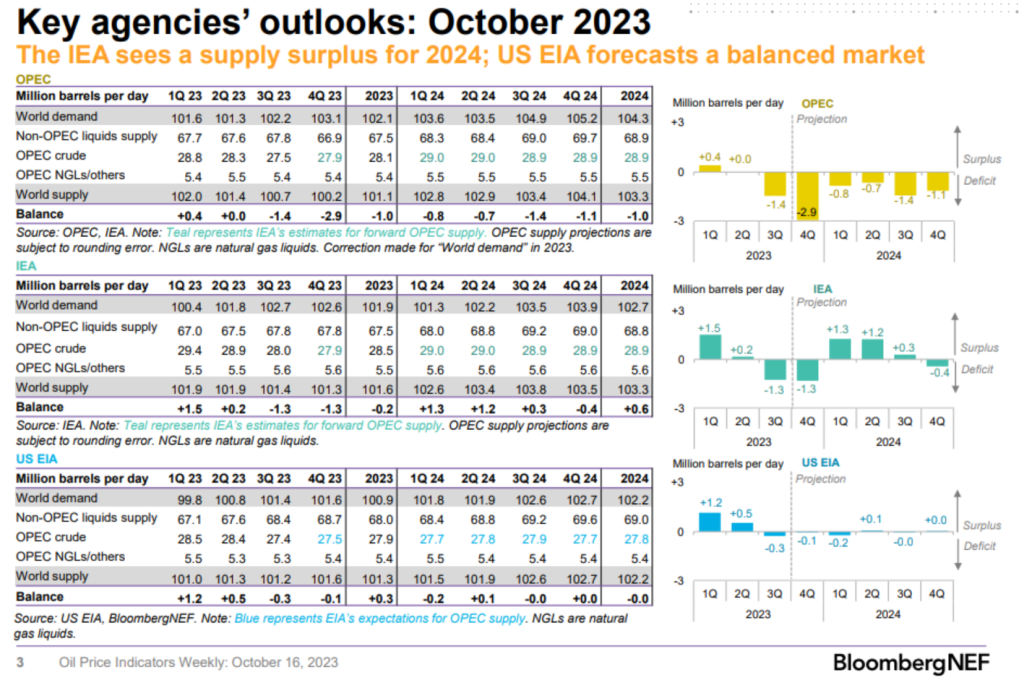

The crude demand situation remains precarious with growing concerns around the 2024 backdrop. We have stated from the beginning that demand was overstated, and we are now seeing some of the larger organizations adjust their estimates. The geopolitical risk and current OPEC+ voluntary cuts will be enough to keep Brent above $90 in the near term, but the broader softness in the market will keep the “spikes” capped. We will keep our finger on the pulse of potential changes as the U.S. responds to Iranian aggression.

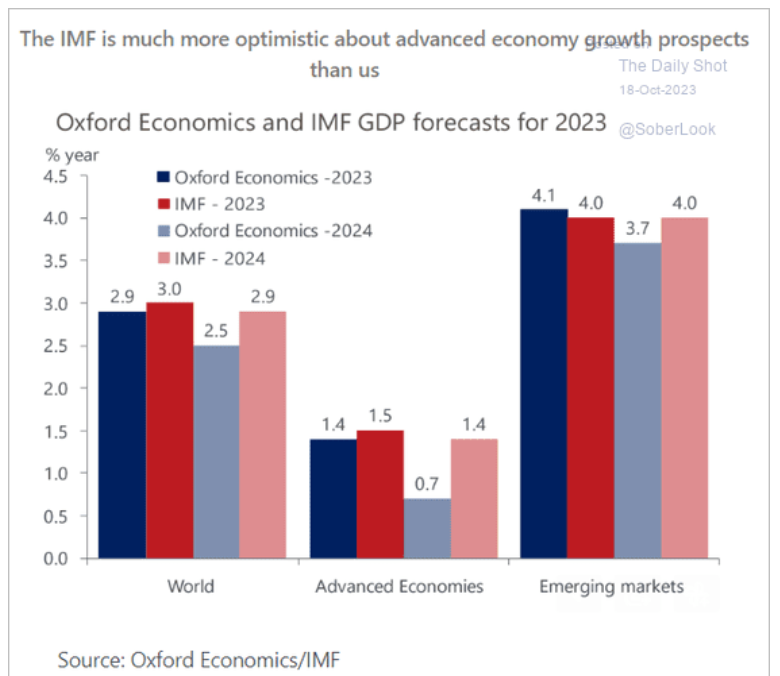

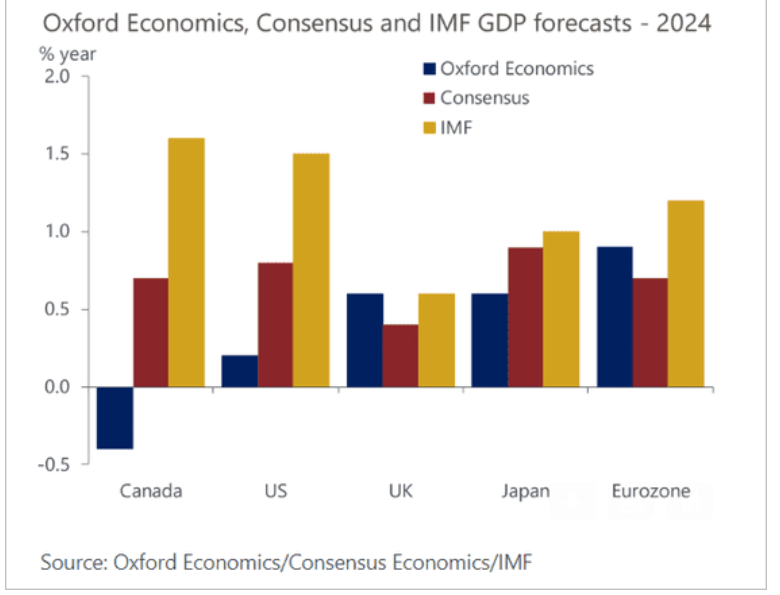

The shifts in 2024 are becoming more pronounced as firms reduce their GDP expectations. Below are some samples of Oxford vs IMF.

I still believe that expectations remain too high- especially for emerging markets as rates rise and inflation expectations pivot back up.

The “rate pain” is far from over when you look abroad, as I highlight below in the insights, I wrote to C6 investors at the beginning of the week. I attached them below.

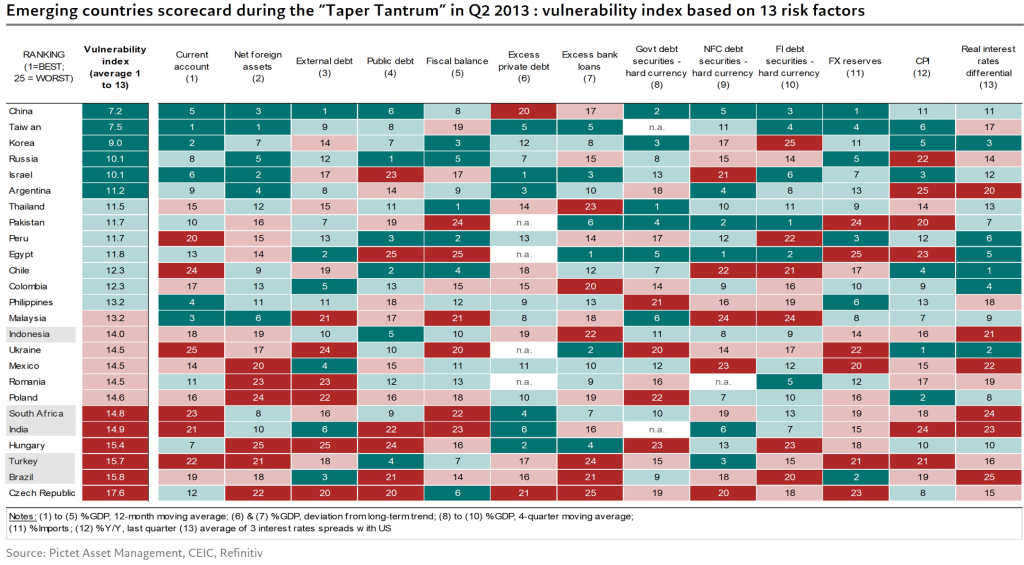

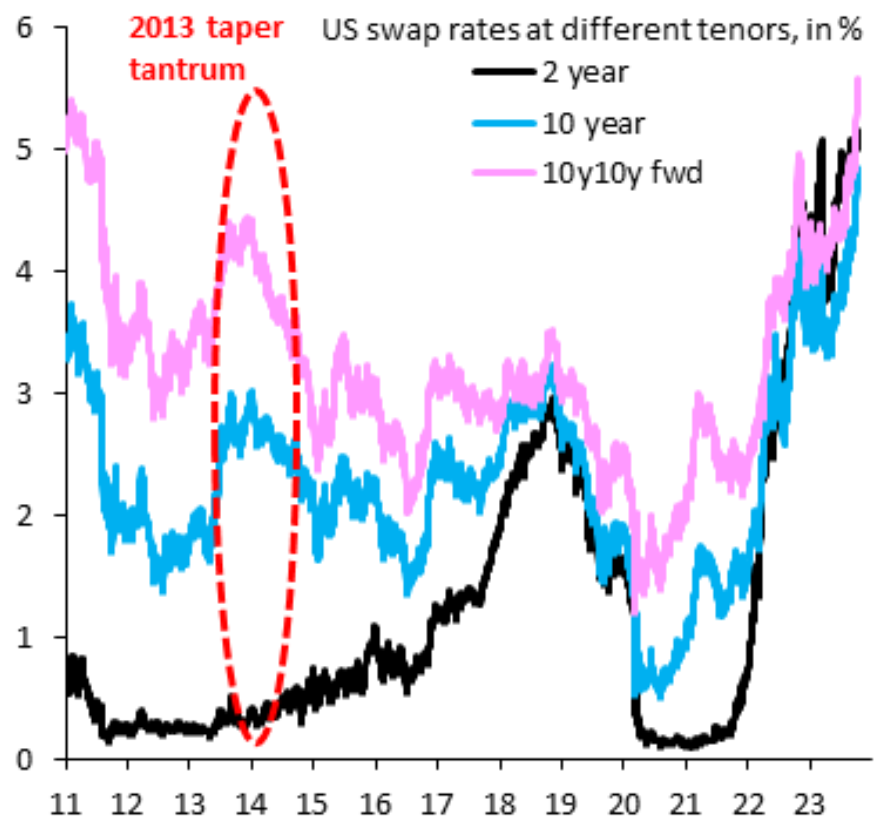

The market always overestimates the impacts of rates and inflation. We saw it in the taper tantrum of 2013, which pales in comparison to today on many levels- including rate of change and current yield placement.

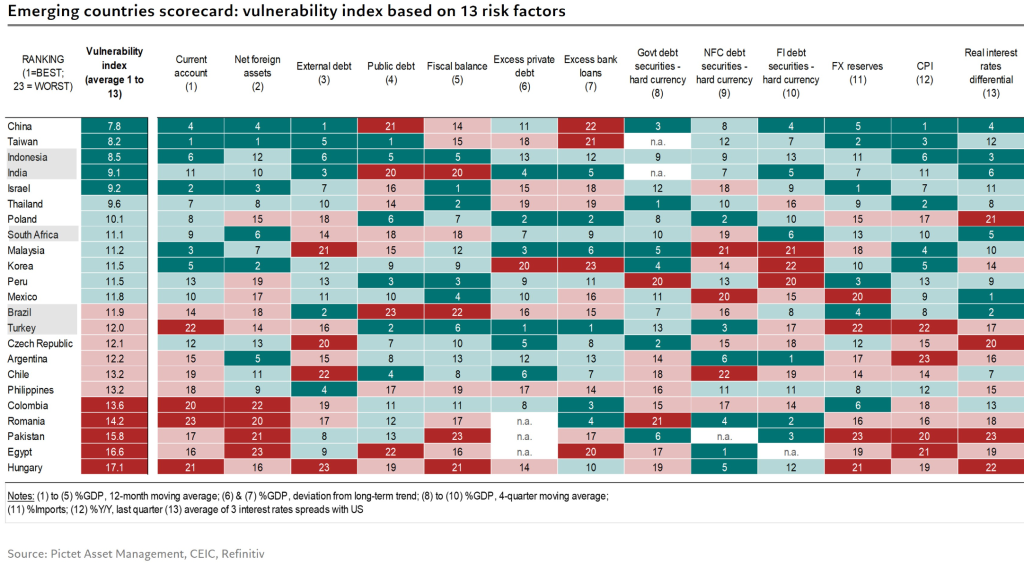

Some countries have taken steps to protect themselves, but the expectations are still lofty on their ability to insulate. The above chart shows the perceived protection point, and it’s important to look at Egypt in both charts. The one below is the assessment during Q2’23- Egypt is a point of concern.

The issues surrounding Japan and potential break of 150 JPY/USD is a big catalyst for pain across the global- especially in Asia. So even though some of the ASEAN and other Asian nations look “okay,” there are always black swans with Japan being the biggest.

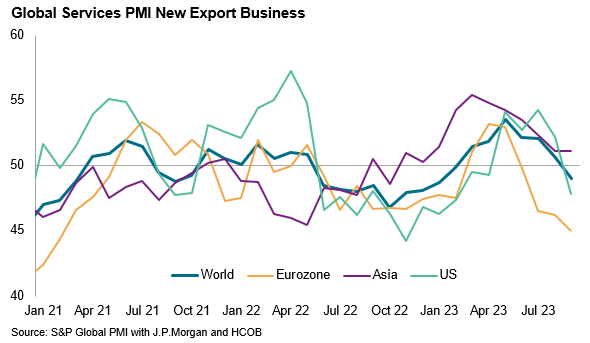

In the major markets (especially the U.S.), the biggest place to watch remains services. A key leading indicator has flipped negative with more pressure coming from Europe and the U.S.

These are key areas of pressure when we talk about general growth and problems brewing at the consumer level.

Macro Review

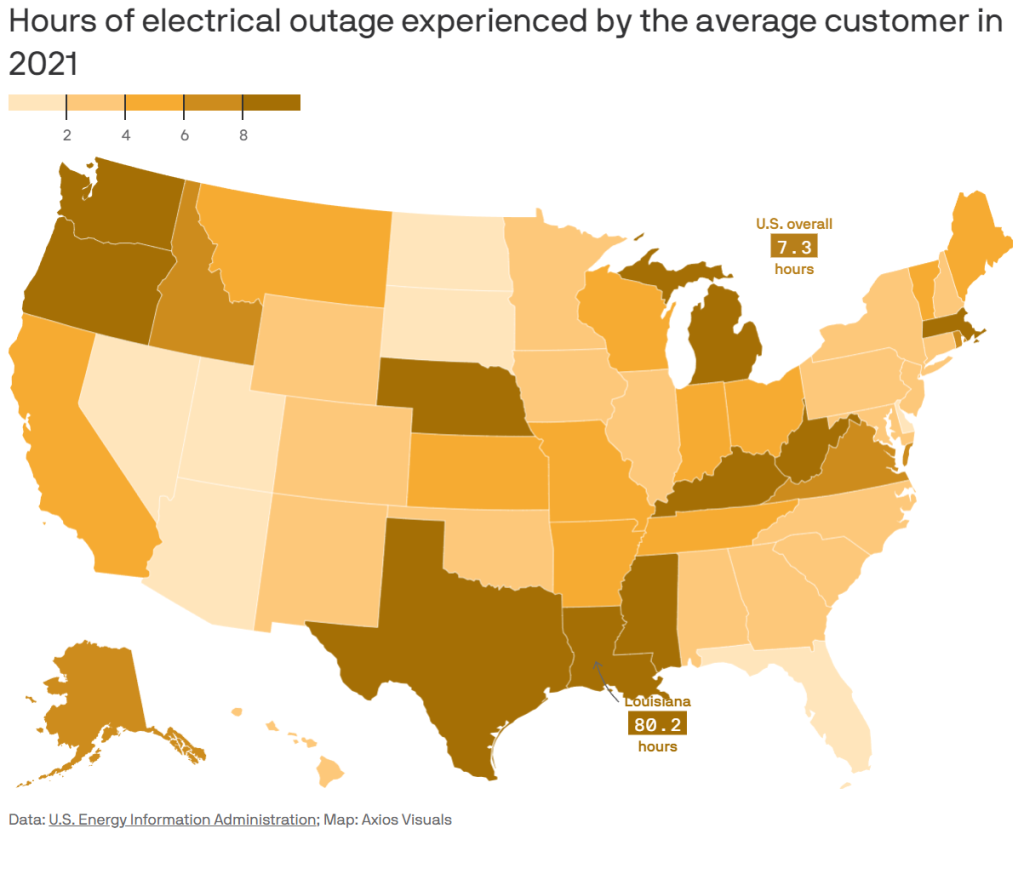

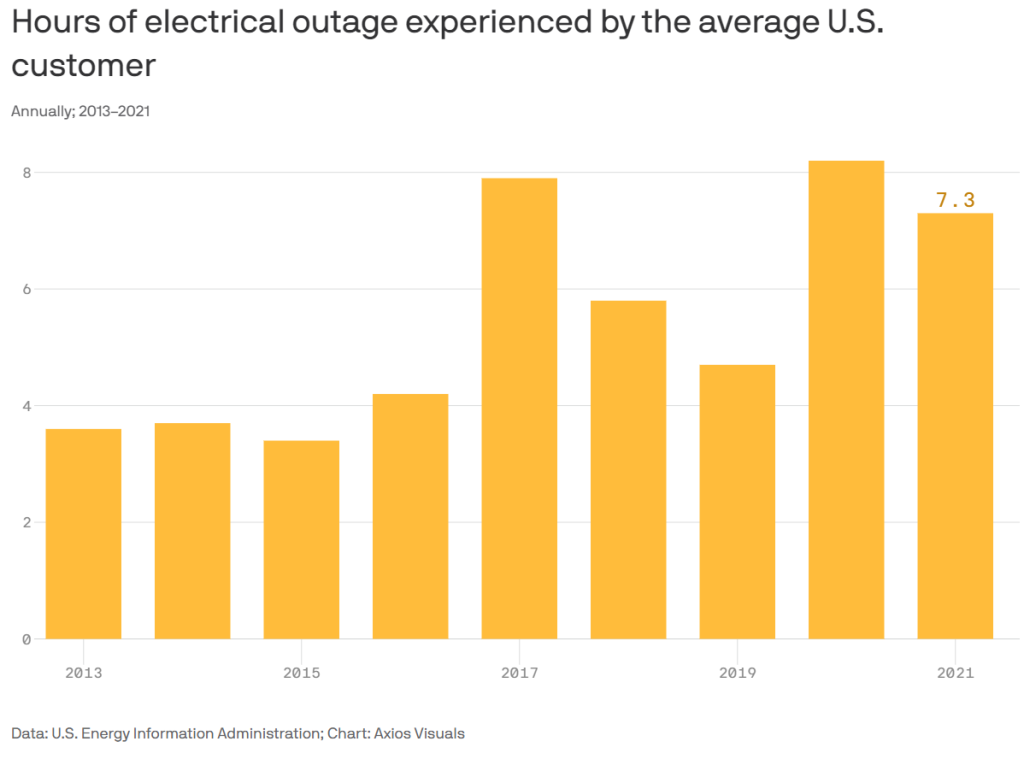

Energy and food security is paramount to a successful economy, and we have structured our fund to deploy capital to acquire companies and assets in various forms. This enables us to survive through varying market and interest rate cycles. On the power front, the U.S. is experiencing a rise in power outages as the grid comes under additional strain from underperforming wind and solar, and accelerated reduction of coal base load. The reduction of reliable baseload power increases the reliance on “peaker plants” (assets that come online only during high demand periods), which decreases the resiliency of the grid.

Even when you adjust for weather conditions, the number of electrical outages is rising. Artesian is in a prime position to capitalize on the fragility of the Northern region with consistent power generation capabilities. We currently own assets in Connecticut and Massachusetts, while expanding our footprint into New Hampshire. These states are seeing an increase of interruptions driven by the rising demand under electrification mandates and growing reliance on LNG and diesel.

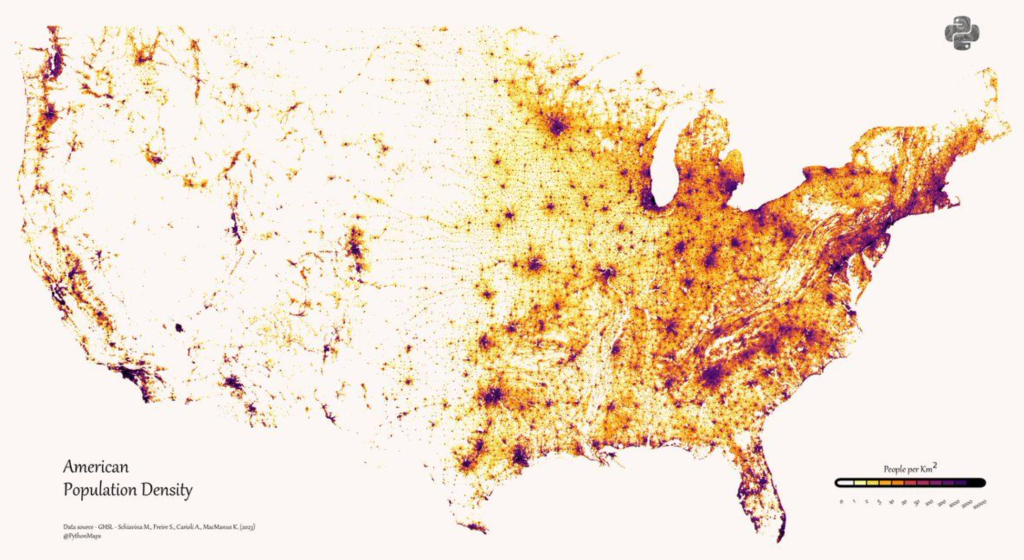

It’s important to account for the shifting migration patterns and expansion of industries in the U.S. as near-shoring/on-shoring accelerates. We have positioned ourselves in regions that will benefit from the population and power demand pivots. Our three pillar regions have seen the most influx of not only people, but also industrial expansion.

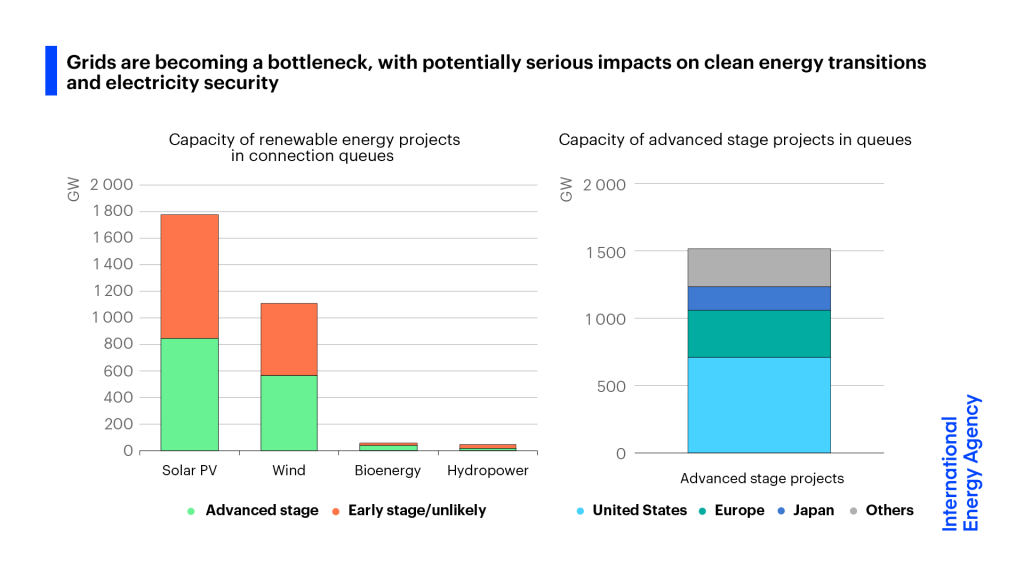

Utility companies are allowed to raise prices to compensate for inflation and the cost of maintaining their system. As borrowing costs rise and inflation remains sticky, electricity costs will stay on an upward trajectory—especially as planned solar expansions pause. Another key issue is the ability to connect into the grid itself, or “interconnects.” This is a huge bottleneck driven by cost, equipment shortages, and projects that are no longer viable. The shift is creating a problem for utility companies that expected this power to be available, but the likelihood of it coming to market diminishes every month.

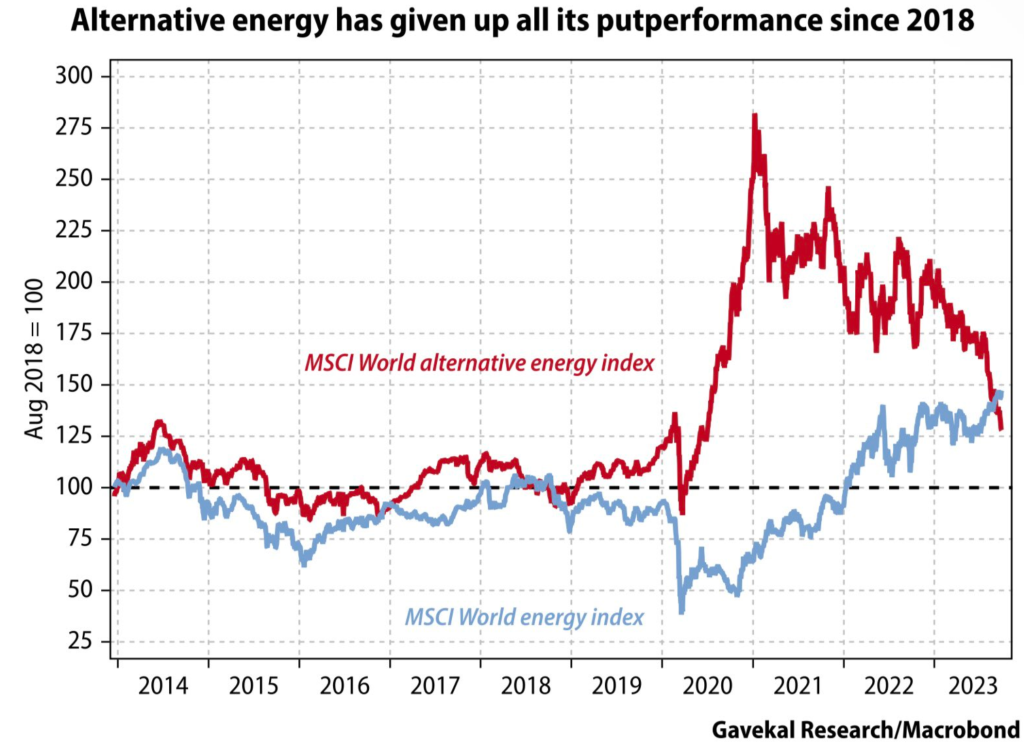

A large part of planned solar and wind farms was supported by subsidies and artificially low rates. As the 10-year pushes to our near-term target of 5% and inflation re-accelerates, the financing costs are prohibitive for the planned new facilities. Utility companies have petitioned local, state, and federal governments to delay the decommissioning of coal plants while new assessments are made on the power availability across the U.S. Significant write-downs from Siemens and Orsted are helping to highlight the reality of some solutions. This has pushed a bigger correction that will keep trending over the next few quarters.

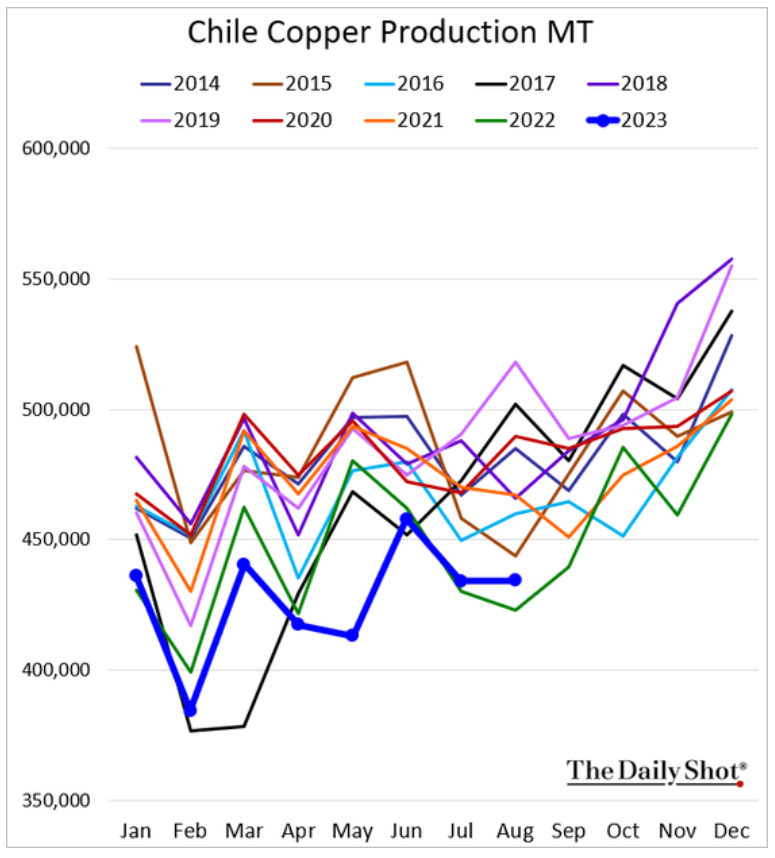

Another big issue is the availability of pivotal materials to expand generating capacity, as well as transmission/wireline. Chile is the largest producer of copper in the world, and they are trending in the wrong direction to meet the growing needs of the world.

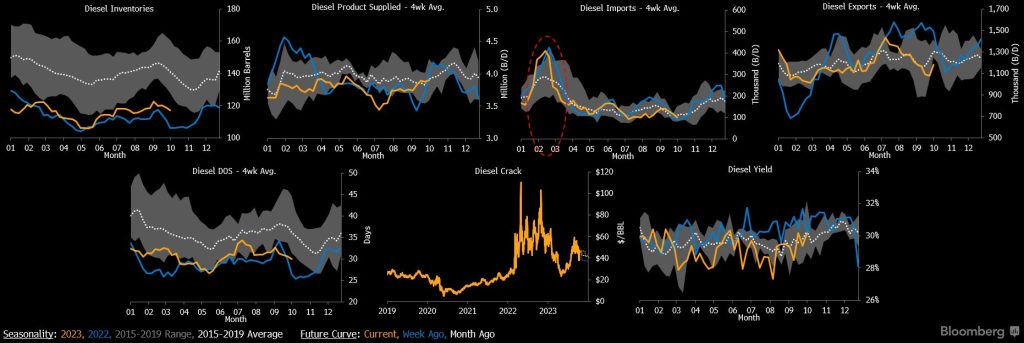

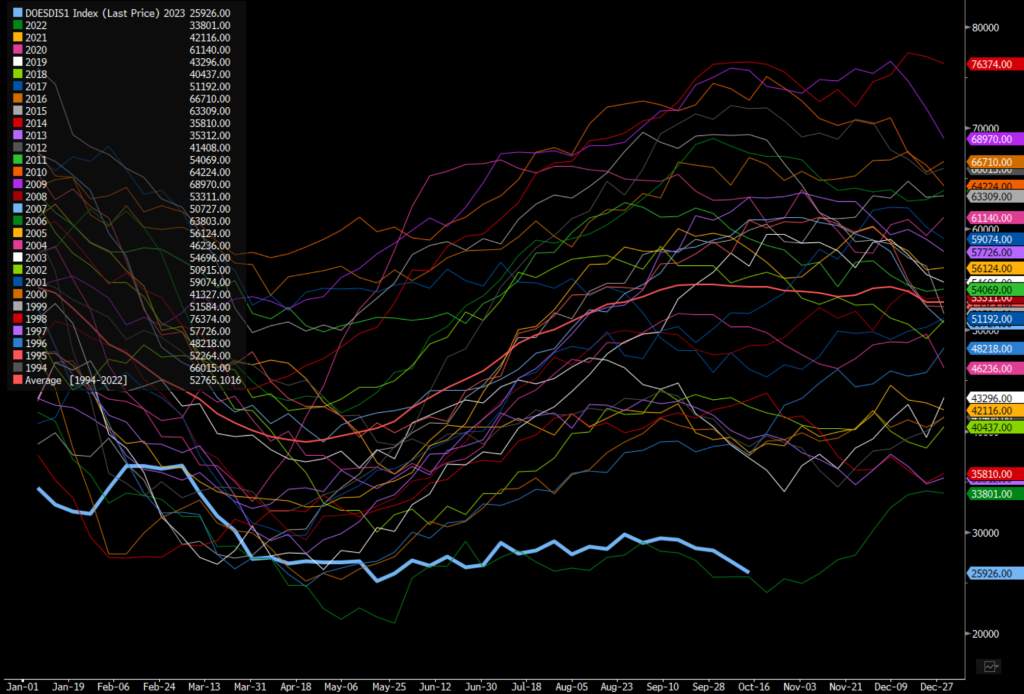

There is a lot of “hope” in the world that solutions will magically appear, but we are only focused on tangible solutions that deliver sustainable results. A key piece of information that has been missing from the “sustainability” push is the drive to find cash flowing companies that can survive without subsidies. The world sits with a record low amount of distillate in storage as we head into winter with the worst of it hitting the East Coast. The East Coast uses the most heating oil in the U.S. and relies on it to run power gen sets during extreme cold when natural gas “freeze offs” occur.

Distillate Storage in the East Coast

This year’s winter months will see another round of increased costs for consumers, as well as power prices shifting higher again. As of October 1 2023, Rhode Island approved a 25% increase in consumer power prices, and they won’t be the last to increase rates. C6 Infrastructure Partners has made it a point to purchase hydroelectric assets in these regions, where we will capitalize on the mismatch in the market. Our expansion in the New England market will enable us to capture most of this winter season, and at favorable rates given our access to USDA loans. We will be able to replicate this process in other focus areas.

——————————————————————————————————————————————

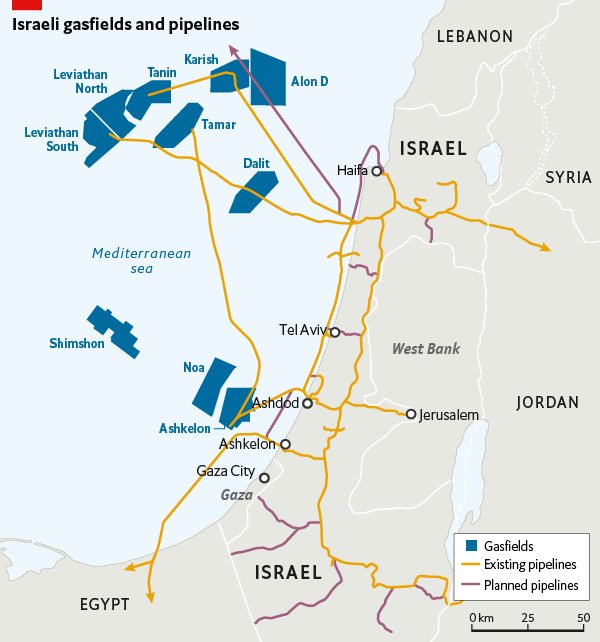

On the food/ fertilizer front, the world continues to fall short on food availability as geopolitics and wars disrupt fertilizer movements. We have already discussed the importance of Russia and Belarus for potash and nitrogen, and Israel adds another layer of pressure as they are the fourth largest potash provider in the world. The main port used for export is Ashdod, which has been shuttered due to rocket attacks and the coming invasion of Gaza. Ashkelon has also been shut, which is the gateway for natural gas to move into Egypt for LNG export. Europe is facing multiple stress points on natural gas availability, with Israel reductions and the tampering of the Baltic-connector.

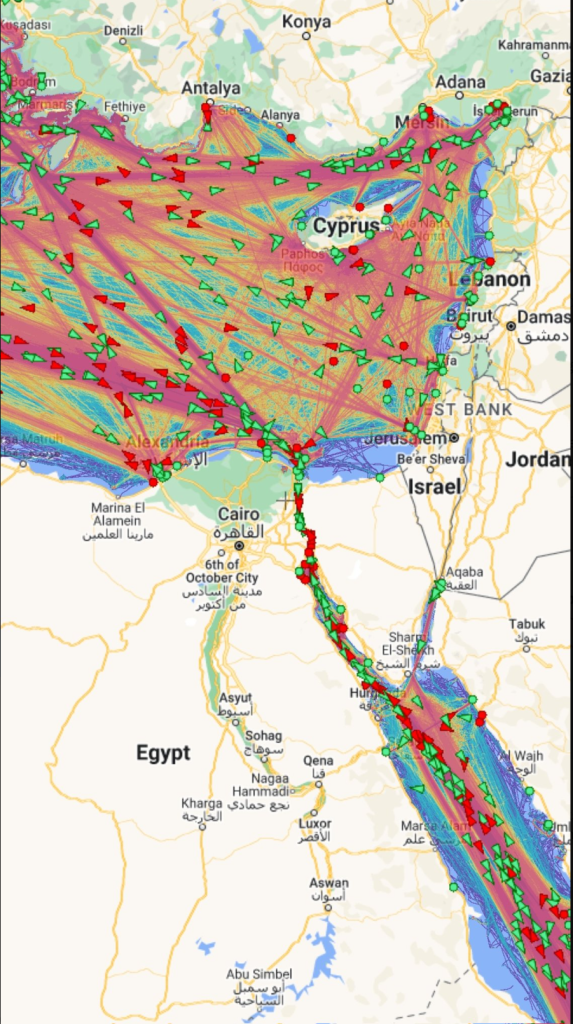

Europe also relies heavily on LNG that flows through the Suez Canal, which is in the crosshairs of the ongoing conflict in Israel/Gaza. Ships enter the Red Sea through the Gulf of Aden where they risk problems from the Houthis in Yemen. This is the next potential pinch point, which sees a significant amount of traffic that is vital to the West.

The U.S. military has created a “layered” approach of assets that can strike rapidly in the region to protect pivotal waterways. The reach has expanded, with U.S. Airforce’s forward deployed in Jordan and the surrounding region.

While Israel’s iron dome is sufficient against rockets, it does not have the capacity to intercept larger missiles that could originate in Iran. The presence of the USS Gerald Ford and USS Normandy allows our THAAD systems to do a lot of the heavy lifting.

The support is important because Iran (in theory) can hit all of these pinch points with their missile arsenal.

The reason we focus so much on this topic is due to the level of products that traverse these waterways. For those who want to see the normal vessel traffic flows in the region, the below chart puts the level of importance into context. This specific density data is from 2021, but the routes are consistent. And one can see in the second image, the current conflict reveals the major weaknesses of the India-Middle East-Europe Economic Corridor. Israel has normalized relations with the UAE and Bahrain and were in the process of negotiating terms with Saudi Arabia. The Gaza situation has paused those negotiations, but the economic importance is huge for India and ASEAN nations. The jumping off point into Europe and the U.S. was Israel/Jordan, and in the long term, we don’t see that initiative changing.

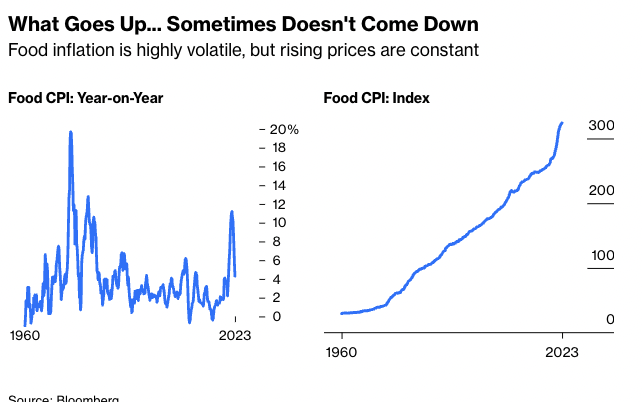

The LNG flowing through this region is pivotal to power electrical grids, but it’s also a key lynchpin for fertilizers: ammonia and nitrogen. The biggest flaw in the market is that many do not appreciate the energy intensity required to create plant nutrients, and how it’s a pivotal part of energy infrastructure. Every time food prices surge, they set a “new normal” versus the previous starting point. Since 2016, we never went back to a “normal” market as fertilizer prices rose, yields wavered, and populations grew. During the same period, there has been a surge in food scarcity, creating a need to pave a new path that is low cost and yield enhancing. While the year over year costs may not capture it, the month over month chart helps to highlight the aggressive move we have seen over the last 60+ years.

Even as things “normalize,” food prices are pausing at some of the highest we’ve seen since 1990.

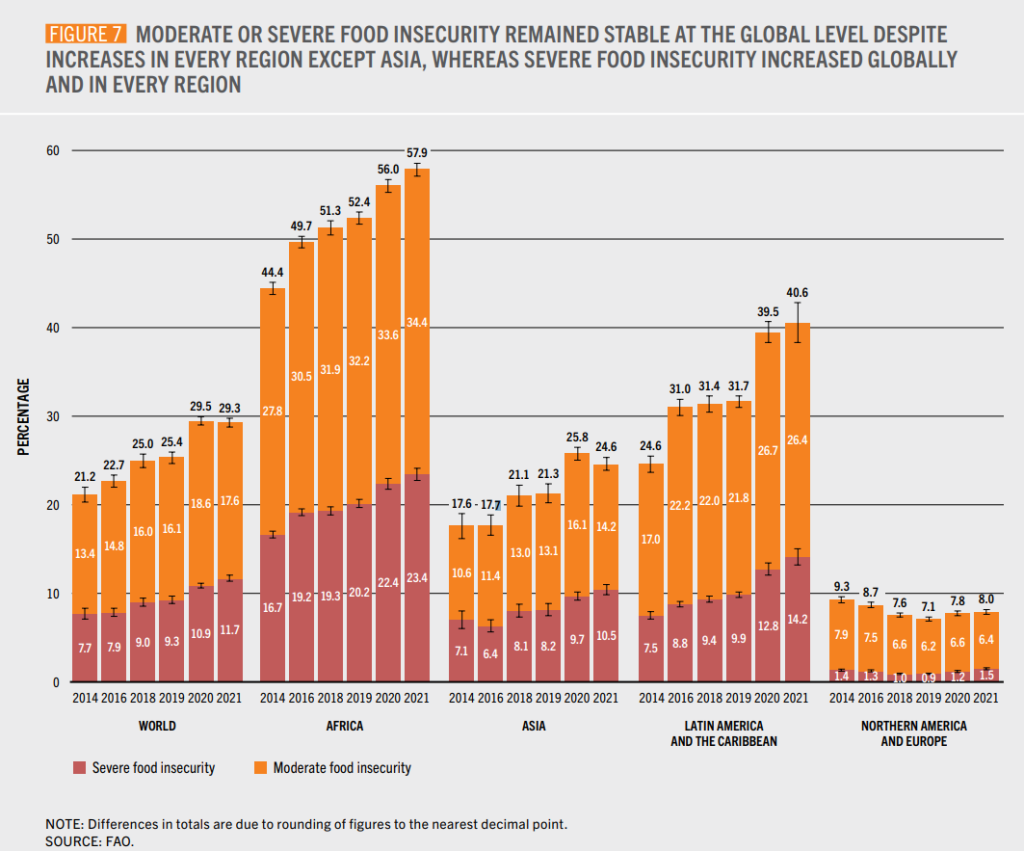

Around the world, we have seen a steady increase in moderate to severe food security as categorized by starvation and malnutrition. Another key function that has to be addressed is soil health and ways to amend the damage done around the world. This must come from a change in farming practices as well as eco-friendly or non-synthetic solutions.

I’m sure you are aware this is FAR from an easy task given the cost and difficulty of creating these solutions. Lucky for C6 Infrastructure Partners, our investment in Sultech is a highly valuable asset in this space. Their product hits every measure: renewable, sustainable, eco-friendly, and organic. All these characteristics are achieved while being 60% (based on current fertilizer prices) cheaper than the alternative, while increasing yield up to 40%. They can sell product to ALL farmers instead of this foolish focus on the “cool” toys such as drones and AI. These tech initiatives are great, but something that only the richest farmers and countries can afford. It’s imperative that we get back to basics to deliver a long-term solution to an expanding problem.

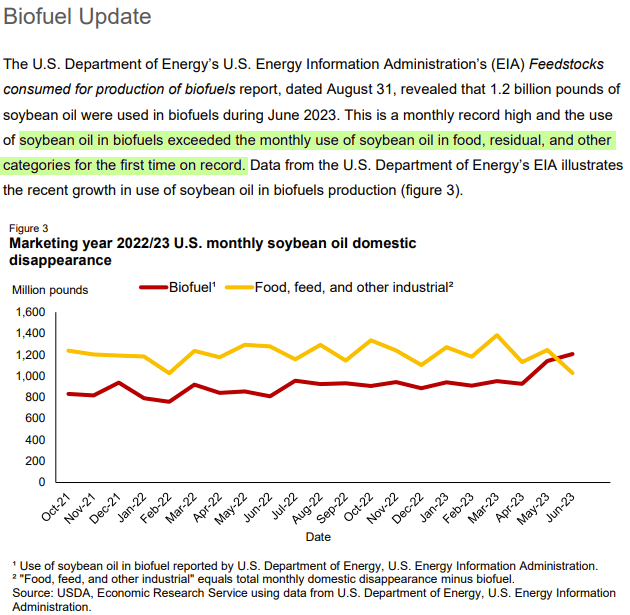

As we described above, the global distillate market has structurally shifted, with refining capacity falling in the U.S. and Europe as new facilities are being built in China and the Middle East. We are becoming more reliant on “unstable” regions as our distillate storage falls to some of the lowest levels on record. Every region needs to find ways to address their energy independence and utilize the raw materials available. In North America, there has been a push to utilize more soy and corn oil, which means we are consuming food for fuel. We are now putting more domestic soybean oil into biofuels than the food and feed markets.

As we described above, the last thing we should be doing is turning food into fuel. The focus should be shifting to utilize waste products to create alternatives that work with our current infrastructure. The EV dream is falling flat, driven by electricity prices and raw materials shortages, so we will be left with refined products for decades to come. The distillate shortfall is structural in the U.S.—especially on the East Coast. It’s driven by a lack of refining capacity, tightness in the global market, and shortage of “distillate heavy” crude grades. There is nothing but risks around every turn with the below highlighting just a few:

- East Coast distillate volumes are at 2022 levels, which is tied for the lowest amount on record

- European storage is near a record low, with only 2022 being worse

- Russia still has a ban on some distillate volumes, tightening the market further

- Iran is pushing for an oil embargo (which is unlikely, but enough to push geopolitical risk premiums higher in brent)

- U.S. exports of distillate products is falling and unlikely to rise given the premiums received within the U.S. Even with incentives to keep products internal, there remains political and physical limitations on moving product. Colonial pipelines one and two have limits on capacity, truck and rail can be cost prohibitive, and Jones Act restrictions keep volumes on the water limited.

- Israel vs Gaza is only going to get worse, with an invasion likely by this weekend

Even a normal winter is going to create a huge problem for the U.S.: it’s time to get serious about long-term solutions.

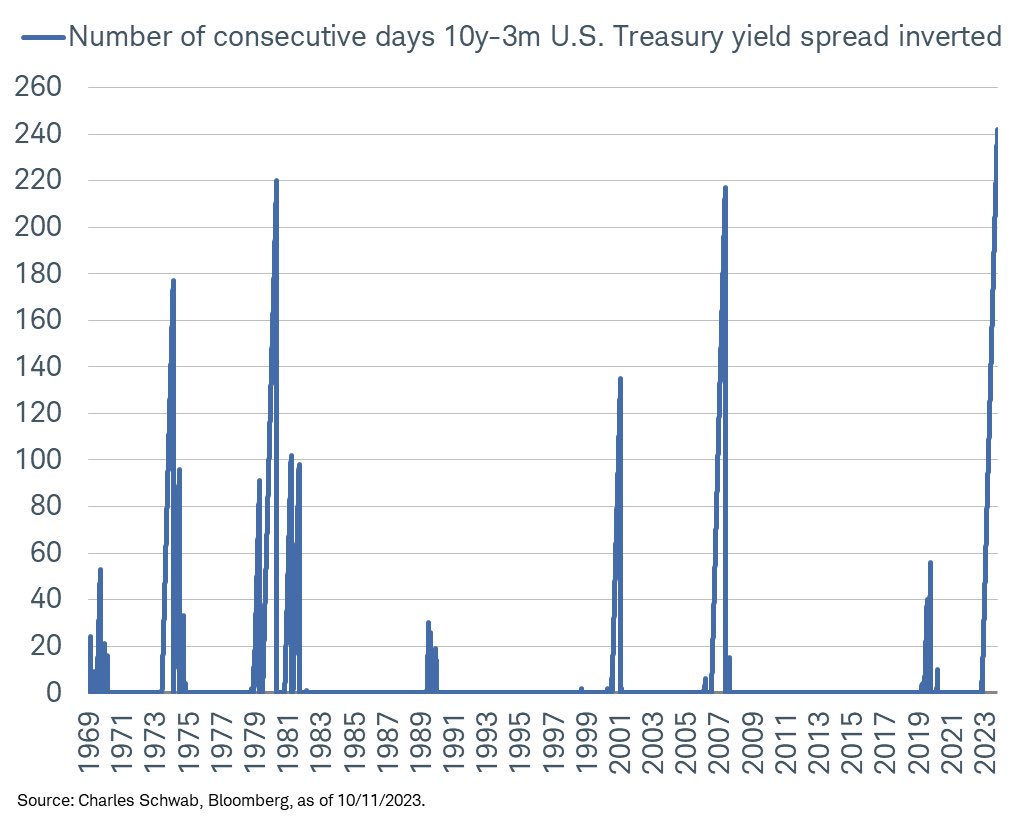

For those that have been following us, we have been spot on when it comes to inflation, yield, and central bank actions. Borrowing costs will continue going up as the yield curve shifts higher—especially the pivotal U.S. 10-year bond. The 10y and 3m inversion has now set a new record for consecutive days in this position, and if you look at the years, it never leads to a positive outcome.

The last time we had this level of panic in the bond market, the Fed rolled out “Yield Control” and started other forms of quantitative easing. The rate of change in this move is way more aggressive than the taper tantrum of 2013, and we are still pressing higher as bond auctions remain weak. Even in the face of rising yields, the Fed has no choice but to hold tight, following 15+ years of terrible policy. ZIRP (zero interest rate policy) and QE infinity has pushed us right up against the wall defined by the Law of Diminishing Returns.

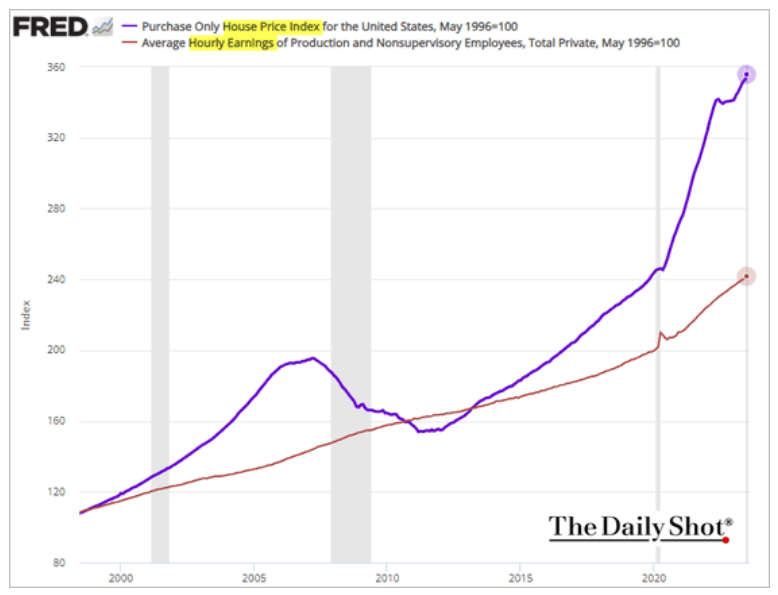

After over a decade of easy monetary policy, there is so much liquidity remaining in the system that the Fed has to keep policy tight. Powell is concerned about a wage price spiral, and as inflation re-accelerates, he will have to hold firm in an attempt to bring asset prices back down. The below chart helps to highlight the uphill battle they face after purchasing mortgage-backed securities (MBS) for years, even though home prices were not at risk.

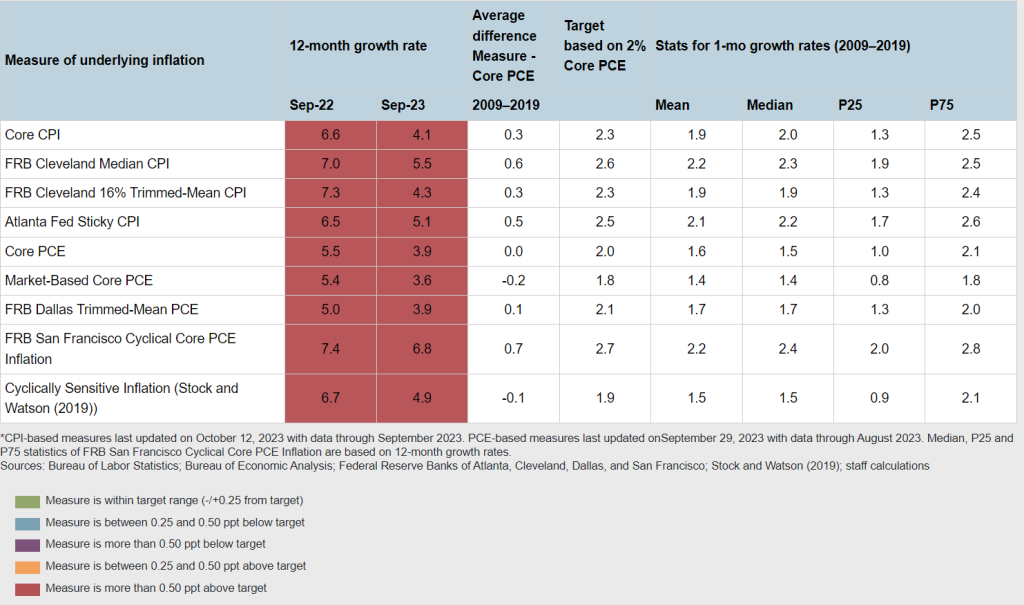

Every metric across inflation—especially M/M—is pushing higher, with “sticky” inflation shifting higher and PPI (produce price index: a key leading indicator on consumer inflation) has topped estimates for several months in a row. This will keep the Fed and other central banks tied to their elevated rates.

We initially thought that Powell would raise rates one more time in November, but given the current geopolitical client, he will likely pause. But this doesn’t mean another raise isn’t on the horizon, especially as inflation pushes higher again.

Borrowing costs are moving higher for everyone but hit hardest on zombie companies and Emerging Markets. We don’t see this stress being alleviated, instead we see the pressure ramping up in key areas. An important country to watch is Japan (the birthplace of QE) as the BoJ attempts to keep the Yen/USD cross below 150 and their 10-year below 1%. They are pushing on a string that is ready to break and send a panic through the currency and bond markets.

It is important to appreciate that we modeled a Fed Funds Rate above 4% and a 10-year north of 5% when we began constructing the C6 portfolio. The current inflation and rates environment is a “mystery” to some that don’t have our collective experience. We were involved in public and private investing before the ZIRP experiment came into full effect. This has allowed us to be realistic about the market, and how the yield curve will react to the coming central bank tightness. Our focus remains on finding opportunities that generate significant cash flow and can weather a global slowdown. Electricity, fertilizer, and industrial products (especially diesel) are well positioned to have supportive pricing and market interest. While our borrowing costs will rise with everyone else, we have tapped U.S. government-backed money with fixed interest rates. All of our investments generate significant cash flow and can support additional interest expenses. Inflation and pricing pressures are here to stay, and while asset prices may weaken, we have created a balanced portfolio to capitalize on inflation, stagflation, and the inevitable deflation. Even we thought stagflation would have set in by now, but the level of poor monetary policy and geopolitical risk is instead breaking inflation back to the highs. This will prolong the pain well into 2024 and enable us to purchase assets at favorable prices. Many companies and investment firms are stuck being over levered and will have to sell assets to manage their cash flow needs and duration exposure. We will be there to capitalize on the errors of other.