Global Economic Overview: Navigating Tensions, Ascent, and Debt

In the ever-evolving global economic landscape, several developments have emerged that demand our attention. As an economic analyst, I’ve been closely monitoring these shifts, and this week’s overview aims to provide a comprehensive understanding of these events and their implications.

Middle East Tensions and the Oil Market

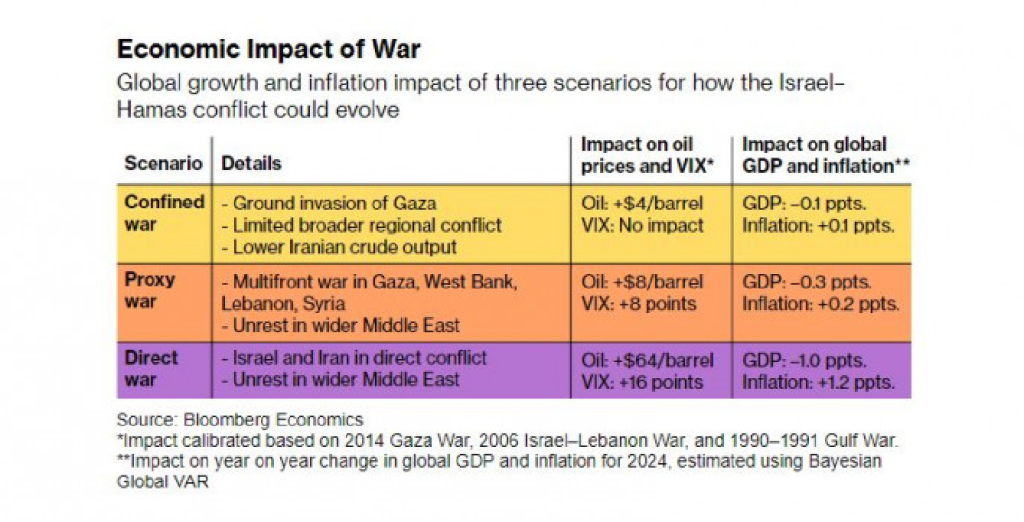

The Middle East, a linchpin in the global oil supply chain, is currently witnessing escalating tensions. The conflict between Israel and Hamas has already resulted in thousands of casualties. Historically, such conflicts have had profound economic implications. For instance, the Arab-Israeli war of 1973 led to an oil embargo that caused oil prices to quadruple, ushering in years of stagflation in industrial economies. Today, there’s a palpable fear that a direct confrontation between Israel and Iran could push oil prices to an unprecedented $150 a barrel. Such a surge could potentially reduce global growth to 1.7%, translating to a $1 trillion contraction in world output.

China’s Economic Ascent and Energy Security

China’s meteoric rise in the global economic hierarchy has been accompanied by an insatiable appetite for oil. Since 2017, it has been the world’s largest oil importer. Its bilateral trade with Iran stood at about $20 billion in 2020. The recently inked 25-year cooperation agreement could further deepen their ties, with China potentially investing up to $400 billion in various Iranian sectors, including oil.

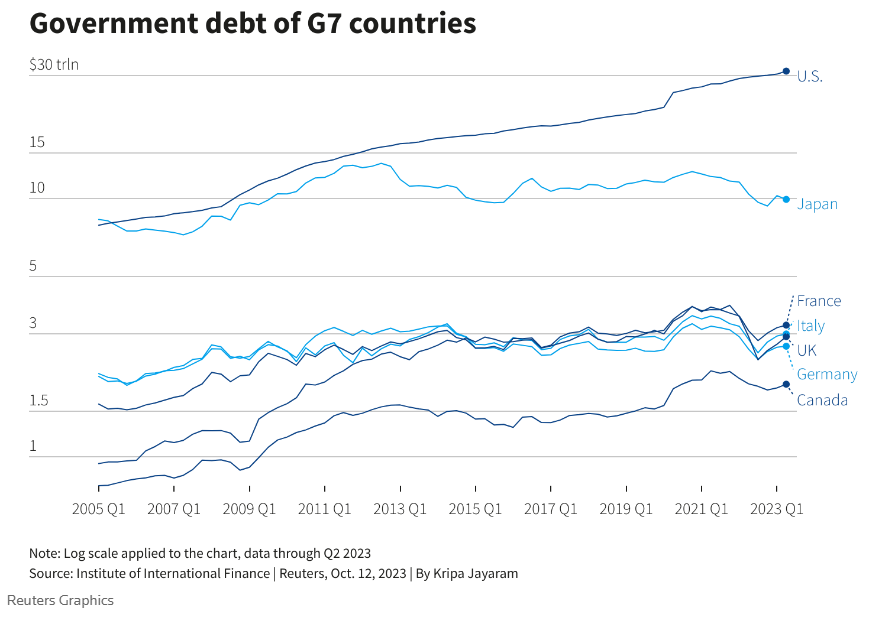

The Looming Shadow of Global Debt

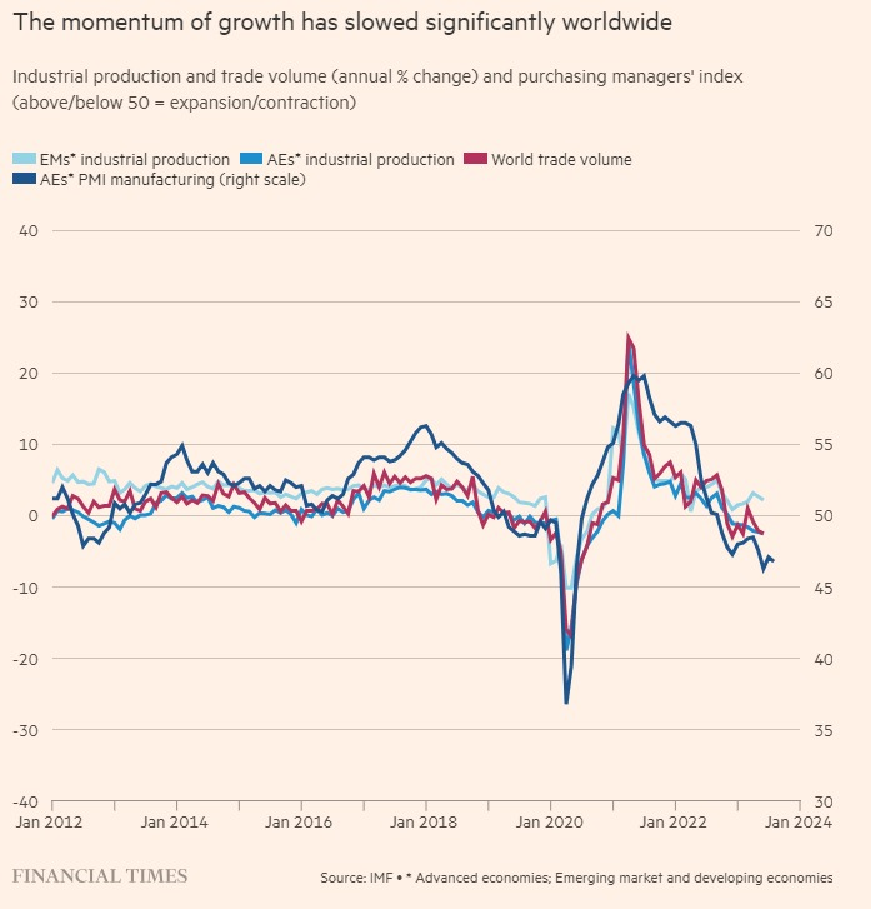

Global debt levels have surged to a staggering $226 trillion, equivalent to 256% of the world’s GDP. This debt accumulation, accelerated by the pandemic, has outpaced the global economic growth rate. Advanced economies, like the U.S., have seen their debt-to-GDP ratio soar to 432%, while emerging markets and developing economies have reached 250%. Such high debt levels pose significant risks, potentially hampering economic recovery and increasing vulnerabilities in the financial system.

Inflation Concerns and Market Dynamics

The global economy, already grappling with the aftermath of Russia’s invasion of Ukraine, is showing signs of inflationary pressures. In the U.S., inflation rates have touched a 30-year high. Bloomberg Economics’ projections indicate that oil prices could rise anywhere from $3 to $4 in a localized conflict to a staggering $150 per barrel in a widespread confrontation. Such a scenario could lead to a 10% jump in oil prices, reaching about $94 a barrel, especially if the conflict engulfs neighboring countries.

Investor Confidence Amidst Uncertainty

Despite the economic recovery signs, the risk of rising oil prices and dwindling confidence threatens to reverse this year’s gains. The global debt situation, combined with uncertainties in the Middle East, could have long-term implications for investor confidence and market stability. In wrapping up, the interconnectedness of today’s global economy means regional tensions can have worldwide repercussions. The Middle East’s geopolitical dynamics, China’s strategic maneuvers, soaring global debt, and rising inflation are all pieces of a complex puzzle. Investors and policymakers must remain astute, ensuring they’re equipped to navigate the challenges that lie ahead