Industry Outlook

We discussed our initial thoughts about NOV’s (NOV) Q3 2023 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook.

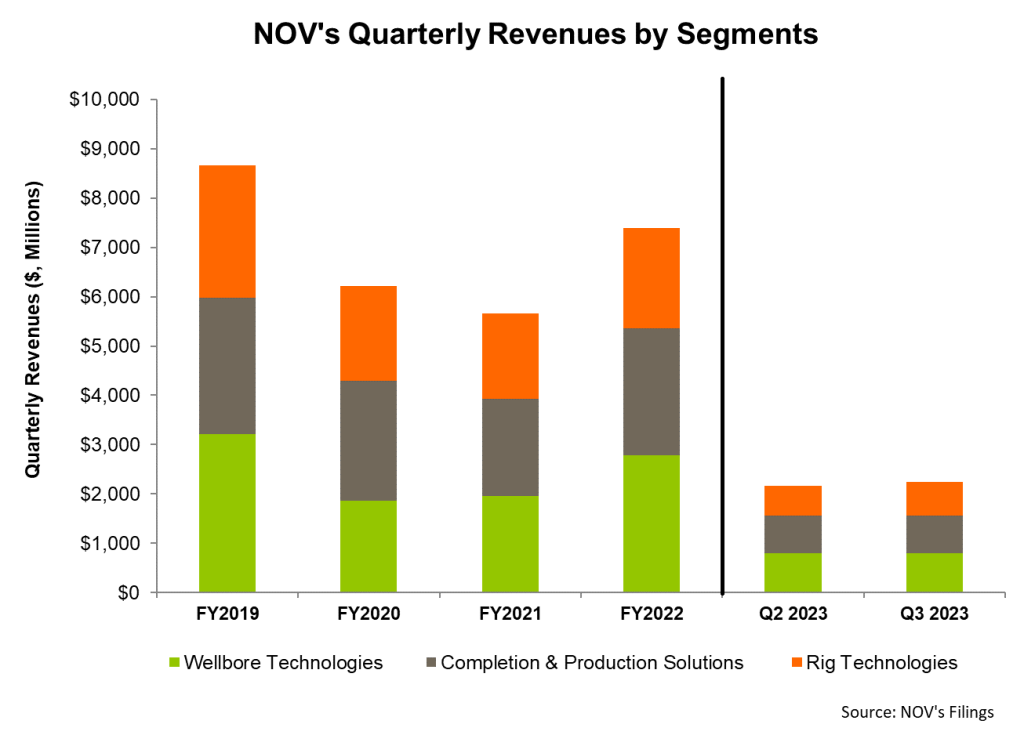

After Q3, NOV’s management expects the underinvestment in the oilfield services industry to result in reasonably higher maintenance spending and asset reinvestment. This, along with an improved supply chain and a higher margin backlog, can also improve OFS companies’ margins. From Q1 2021 through Q3 2023, the company’s revenues increased by 25% annually. During this period, it saw higher bids for new drilling motors, composite pipe designs, and wired drill pipe high-speed connections. The company has been selective about choosing its product portfolio, so that requires less capital-intensive production.

Completion And Frac’ing Outlook

On the completion side, NOV’s Intervention & Stimulation Equipment business saw a double-digit revenue drop due to a fall in deliveries of pressure-pumping equipment. Softer drilling and completion-related activity in the US caused the decrease. However, higher shipments of process and wireline equipment partially offset the adverse effects. In North America, many operators replaced or upgraded fracking equipment with energy-efficient units.

During Q3, the company booked orders for 25,000 hydraulic horsepower of eFrac equipment. The higher efficiency of the eFrac technology helped replace their conventional pumping units. While the total demand for pressure pumping, wireline, and coiled tubing equipment was reduced, the replacement demand for eFrac technology remained high. A higher demand for new eFrac products pushed NOV’s book-to-bill ratio above 1x in Q3.

Outlook For Other Segments

You may read about NOV’s Q3 performance in our recent article here. Here is an outline of its segment outlook. In Wellbore Technologies, NOV expects international and offshore energy activities to increase, while the US onshore activities will likely taper. Revenue for its Wellbore Technologies segment can increase by 46%, and margins can rise to the “low-to-mid-20% range.” In the Completion & Production Solutions segment, offshore markets will more than offset the activity drawdown in North America, resulting in a 2%-4% revenue rise. Its EBITDA margin can improve by 100 to 300 basis points in Q4.

In Rig Technologies, profitability and cash flow are expected to improve. In the aftermarket operations, the company sees opportunities rising as customers dig deeper into their stacks for rig reactivations. The primary drivers will be rising exploration activity and continued growth in the Middle East. Aftermarket comprised 56% of the Rig Technologies segment revenues. The segment revenue can increase by 1%-3% while the EBITDA margin can reach the “mid-30% range.’

Various Strategies And Challenges

In Q3, NOV has a growing pipeline of tenders on top of a solid and stable backlog. Its backlogs consisted of $3 billion for rigs with a book-to-bill of 102%. In the Completion & Production Solutions segment, the backlog was $1.6 billion, with a book-to-bill of 106%. The company expects that during an up-cycle, higher demand for capital equipment, carrying higher margins, will translate to overall higher margins and returns for NOV. However, its operating margin is still below the level that would produce adequate returns. So, the company will look to manage its costs and pricing more effectively to improve margin.

With this objective, it has recently streamlined its operating segments from three to two segments. From the start of 2024, its two segments will be known as Energy Equipment and Energy Products and Services. Such operational realignment strategies are a part of the $75 million cost reduction program that would make its business more efficient while capitalizing on the new technologies.

Capex And Leverage

NOV’s cash flow from operations remained negative but improved in 9M 2023 compared to a year ago. So, its FCF also remained negative. As the global supply chain dissipates, raw material and component deliveries accelerated, resulting in higher requirements for net working capital. However, the trend can reverse in Q1 2024 when product shipment improves. So, the company’s cash flows can improve in 2024. The company expects to generate positive cash flows in 2024.

Its liquidity totaled $2.64 billion as of September 30, 2023 (excluding working capital). Its debt-to-equity (0.31x) exceeds its competitors (CHX, FTI, and WHD). Given the debt level and liquidity, the company is relatively free from financial risks, although negative cash flows can be a concern.

Relative Valuation

NOV is currently trading at an EV/EBITDA multiple of 9.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 9.4x. The current multiple is lower than its past five-year average EV/EBITDA multiple of 31.2x.

NOV’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is less steep than peers because its EBITDA is expected to increase less sharply than its peers in the next year. This typically results in a lower EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is slightly lower than its peers’ (CHX, FTI, and WHD) average. So, the stock is reasonably valued versus its peers.

Final Commentary

NOV is currently focusing on a selective product portfolio, requiring less capital-intensive production. Higher shipments of process and wireline equipment, steady replacement of hydraulic horsepower with eFrac equipment, aftermarket operations, and rising exploration activity in the Middle East will become its dominant drivers in the medium-to-long term. NOV’s book-to-bill ratio was above 1x in Q3, which indicates a healthy order environment and revenue visibility.

However, the company’s Completion & Production Solutions segment operating margin remains below the level that would produce sufficiently adequate returns. Its cash flows remained negative in 9M 2023 due to higher requirements for net working capital. However, easing the supply chain can improve product shipment, resulting in positive cash flows in Q1 2024. Its leverage is low, and the company has robust liquidity. The stock is reasonably valued versus its peers.