Frac’ing Update

In our short article, we discussed our initial thoughts about ProPetro Holding’s (PUMP) Q3 2023 performance a few days ago. This article will dive deeper into the industry and its current outlook. In 2023, PUMP prioritized lowering capex to improve free cash flows. This followed its previous strategy of transitioning the hydraulic fracturing assets to more efficient and lower-emissions equipment. The company’s investment in this process amounted to nearly $1 billion over the past two years. On top of that, in Q3, it deployed its FORCE electric frac spread. Currently, PUMP has seven Tier IV DGB dual-fuel fleets and one electric fleet operating. It also plans to deploy its second FORCE electric frac before the end of 2023, while two more electric frac spreads are expected to be deployed in 1H 2024.

In Q3, PUMP’s effective frac fleet utilization fell to 15.4 from 15.9 a quarter earlier. The current utilization exceeded its previous guidance of 14 to 15 fleets. However, it stacked a frac spread in Q3. It is now only committed to running fleets that earn a full cycle cash-on-cash return. So, the company will continue to pursue disciplined capital deployment for the long term to reduce capital requirements and improve its operating costs. So, in Q4, its effective frac spread count can fall to 13 to 14 fleets.

Acquisitions

PUMP’s acquisition of Silvertip Wireline business in November 2022 has boosted its earnings and free cash flows. It entered into the wireline services through the acquisition. Over the past years, its adjusted EPS increased by 29%. As a part of a balanced capital allocation strategy, it will likely continue to pursue strategic transactions. Recently, it executed a letter of intent for a small bolt-on acquisition that would help it expand the cementing business.

Industry Outlook

Despite the pushback on pricing and utilization over the past few quarters, PUMP’s management remains bullish over the North American onshore service potential for the next several years. Over the medium term, it expects crude oil prices and rig count to improve in 1H 2024 compared to 2H 2023. The upstream E&P industry, however, will see growth stagnate or may decline marginally. Because of the capex constraint, operators will push for higher efficiency. The recent transactions in the E&P space (the XOM-PXD merger and CVX-HES potential merger) were triggered by the growth cap in the upstream space and validated PUMP’s disciplined approach to capital deployment.

As I pointed out in my previous article, the fracking industry went through equipment attrition, supply chain constraints, and a resulting equipment discipline over the past year. Low pricing caused PUMP to stack or sideline frac spreads. The company decided against running equipment at sub-economic levels.

Q3 Results And Drivers

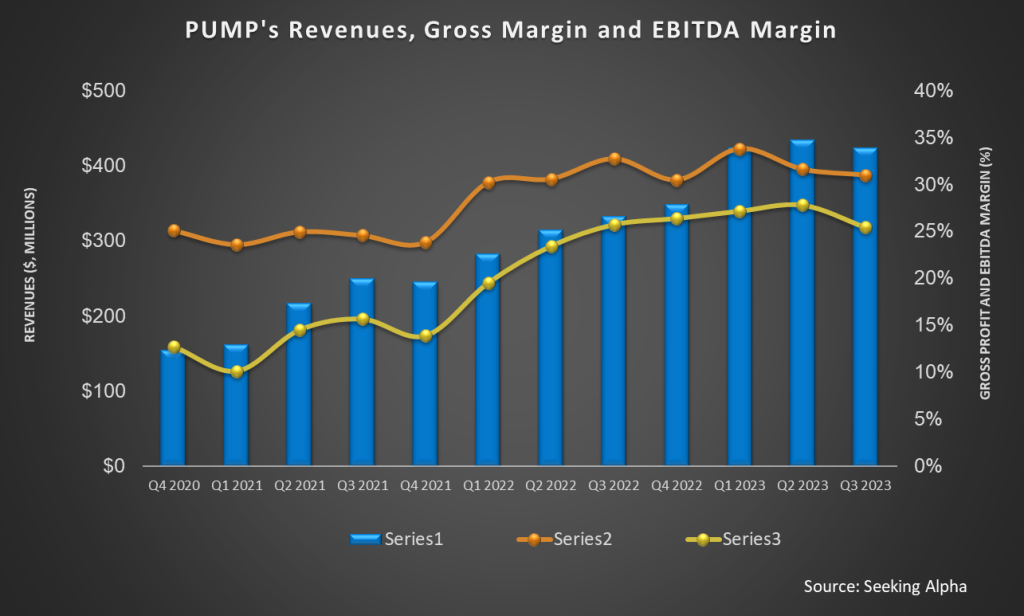

Quarter-over-quarter, PUMP’s revenues decreased by 2.6% in Q3, while its adjusted EBITDA decreased by 11%. Decreased asset utilization, adverse pricing, and job mix in the hydraulic fracturing and wireline businesses in the cementing business led to a revenue loss. Lower hydraulic fracturing and wireline businesses caused the gross profit decline.

Cash Flows, Debt, And Repurchase

PUMP’s cash flow from operations increased steeply in 9M 2023, but FCF stayed negative. However, due to lower capex, its FCF improved compared to a year earlier. Completing its transition from legacy equipment to next-generation assets will reduce capital requirements. In FY2023, the company expects to incur $300 million in capex, which would be 18% lower than a year ago. It can decrease further in FY2024. As of September 30, 2023, PUMP’s liquidity (cash & equivalents plus available capacity under the revolving credit facility) is $170 million. With the continued decline in capital spending, liquidity can continue to improve into 2024, boosting its capital return strategy.

During Q3, PUMP retired 1.9 million shares for $19 million in repurchases. Its share price increased by ~50% since the repurchase program’s inception. It also paid down $15 million of the revolving credit during Q3. With stronger finance, it has enhanced its M&A market. The management also believes “ProPetro trades at a discount relative to its intrinsic value.”

Relative Valuation

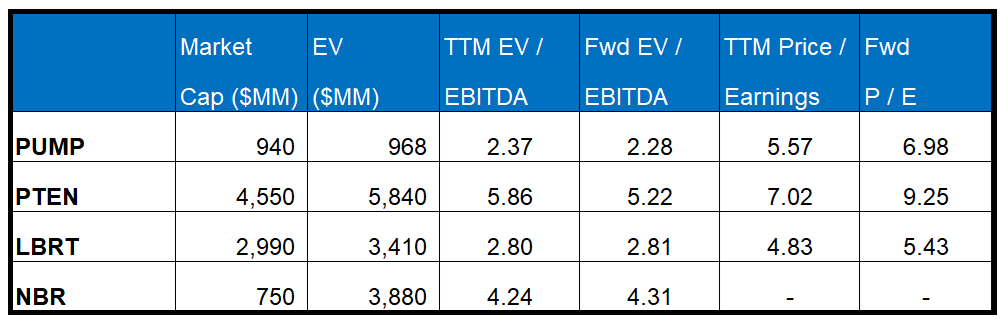

PUMP is currently trading at an EV/EBITDA multiple of 2.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 2.3x. The current multiple is below its five-year average EV/EBITDA of 4.0x.

PUMP’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is steeper than peers because its EBITDA is expected to increase more sharply than its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. However, the stock’s EV/EBITDA multiple is lower than its peers’ (PTEN, LBRT, and NBR) average. So, the stock is undervalued versus its peers.

Final Commentary

After Q3, PUMP has seven Tier IV DGB dual-fuel fleets and one electric fleet operating. It also plans to deploy three more electric frac spreads by 1H 2024. It continues to pursue disciplined capital deployment to reduce capital requirements as it retired a freak spread in Q3. As a result of such a disciplined approach, it can reduce its frac fleet utilization to 13-14 frac spreads in 2023 from ~16 in Q2. The strategy resonates with upstream operators’ outlook, which entails pushing for higher efficiency because of capex constraints.

On top of that, it will likely continue pursuing strategic transactions as a part of a balanced capital allocation strategy. It will spend less on capex in FY2023, which should improve its free cash flow in FY2023. The persistent capital return strategy with an enhanced balance sheet will support its strategy of pursuing small bolt-on acquisitions. The stock is undervalued versus its peers.