As the year is about to end, the calls for a recession are getting louder. In this short article we discuss the latest on recessionary perspectives and prospects along with the developments in oil markets.

Recessionary fears

In 2024, the financial market is facing uncertainty due to differing predictions about a potential U.S. recession and its global impact. Investment banks and asset managers are divided in their forecasts for stock markets and currencies, contrasting sharply with last year’s more unified expectation of a U.S. recession and subsequent rapid rate cuts, which did not occur. Instead, the U.S. economy saw a 5.2% growth in the third quarter of this year.

This division among experts has led to a wide range of predictions regarding the U.S. interest rate trajectory and the performance of global assets influenced by the Federal Reserve’s policies. As a result, market participants are preparing for a volatile start to the year, following a strong rally in stocks and bonds last month, driven by a short-lived consensus on declining inflation and interest rates.

Sonja Laud, Chief Investment Officer at Legal & General Investment Management, highlighted the market’s focus on whether the U.S. will experience a severe downturn or a milder slowdown. She pointed out that the current uncertainty around interest rate forecasts could lead to significant market volatility. Additionally, options trading data indicates a growing interest among investors in safeguarding their portfolios against potential stock market fluctuations. This trend reflects the broader market’s concern about the unclear economic narrative and the potential for substantial changes in the financial landscape.

Jobs report

November’s jobs report in the U.S. presented a mixed picture, raising questions about the state of the economy and the likelihood of a recession. Nonfarm Payrolls (NFP) increased by 199k, aligning closely with the expected 185k, but the more surprising Household Survey (HS) showed a significant rise of 747k, countering October’s 348k decline. This led to a drop in the Unemployment Rate (U3) from 3.9% to 3.7%, a change that could influence the Federal Reserve’s hawkish stance in its upcoming meeting.

However, the report’s details reveal inconsistencies. For instance, in the NFP, non-cyclical sectors like government and education/health accounted for most of the job gains, leaving only 21k from cyclically sensitive sectors. Additionally, there were 35k downward revisions to previous NFP reports, contributing to a total of 372k negative revisions year-to-date. Retail employment saw a significant drop, and the leisure/hospitality sector’s numbers in the NFP report contradicted the ADP payroll report’s findings, suggesting possible inaccuracies.

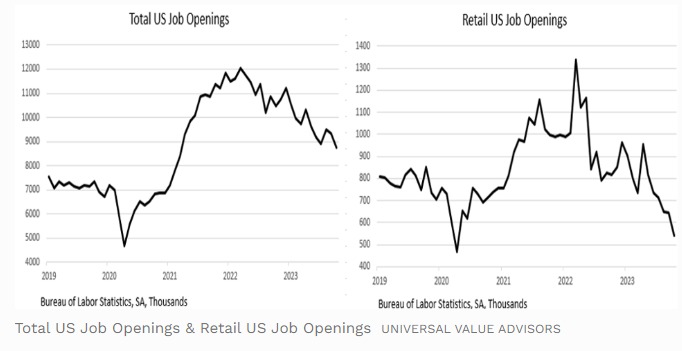

Other employment indicators also point to a weakening labor market. The JOLTS report for October indicated a decrease in job openings, particularly in retail. Consumer sentiment surveys and PMI data also reflect a challenging job market, with job listings from major recruiting firms declining.

The Federal Reserve is likely to consider these mixed signals carefully. Recent declines in the 10-Year T-Note yield and crude oil prices, despite geopolitical tensions and OPEC+ actions, suggest changing market conditions. The Fed may push back against market expectations of imminent rate cuts, using the latest jobs data to justify a more cautious approach. This complex economic landscape indicates that while the headline numbers seem strong, underlying data suggests a weakening labor market, keeping the possibility of a recession in play.

Oil Markets

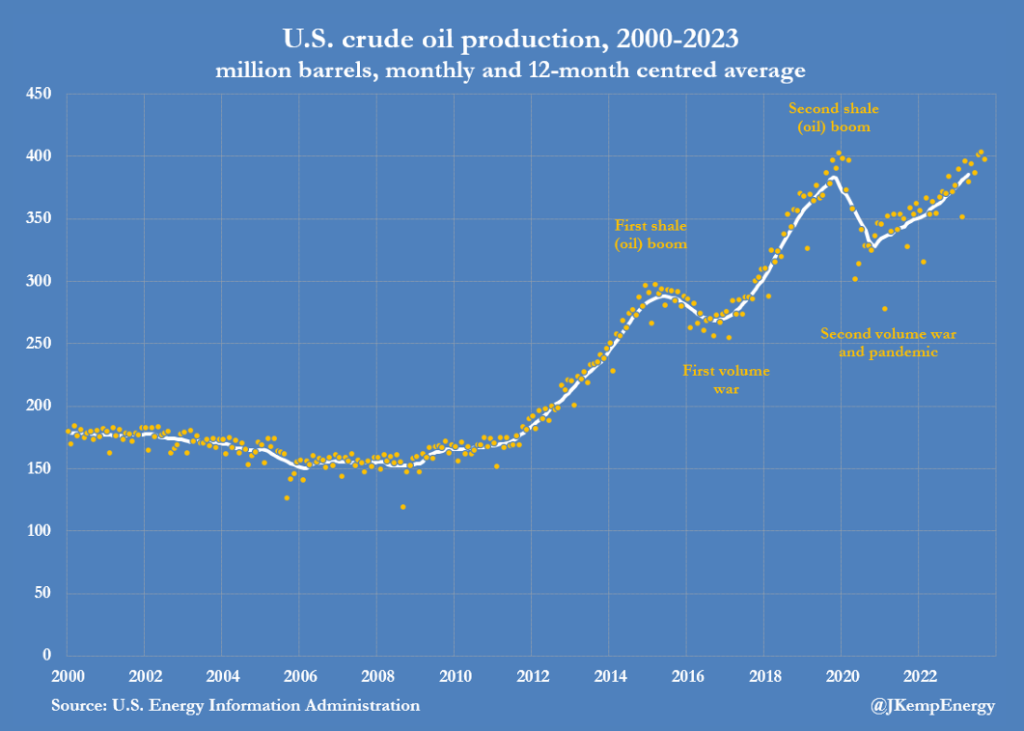

U.S. crude oil production reached a record high for the second consecutive month in September, posing a challenge to Saudi Arabia and OPEC⁺ as they reduce their output to elevate prices. This increase in U.S. production, which rose by 224,000 barrels per day (b/d) to 13.24 million b/d in September, has been supported by OPEC⁺ cuts since late 2022, preventing a deeper price slump and allowing the U.S. to gain more market share.

This growth in U.S. production, along with OPEC⁺ cuts, has led to an accumulation of crude inventories and a softening of prices. The U.S. has benefited from these cuts, which have kept prices relatively high, stabilizing them despite market fluctuations.

Saudi Arabia and its OPEC⁺ partners have resumed their role as swing producers, while U.S. shale firms and other non-OPEC non-shale (NONS) producers benefit as free riders. OPEC has historically tried to include fast-growing rival producers in its production-control arrangements to maintain effective market control. Currently, Saudi Arabia and OPEC⁺ are opting to integrate rivals into their system rather than engage in a volume war.

Chinese imports

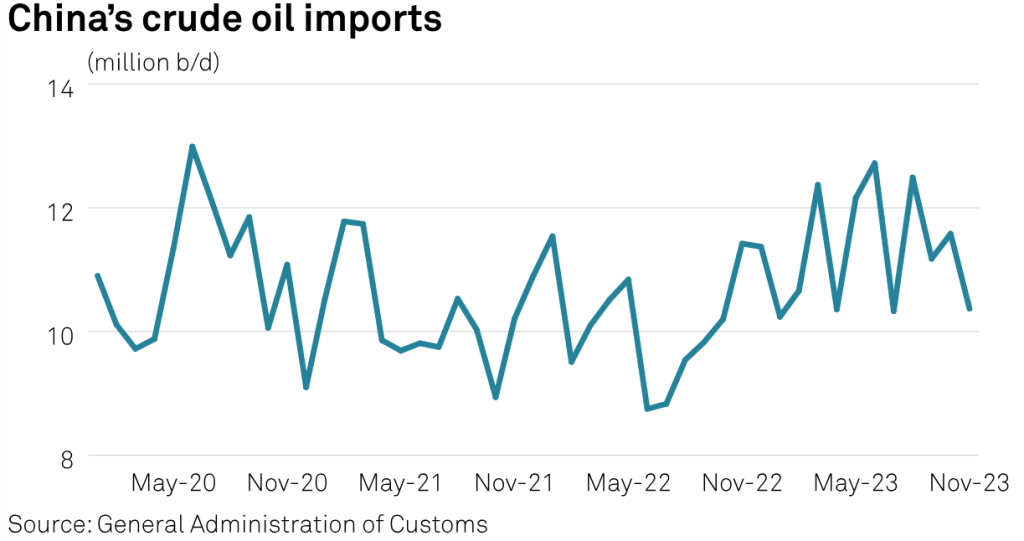

In November, China, the world’s largest oil importer, experienced a significant drop in crude oil imports, indicating the impact of high prices on demand. The country imported 42.445 million metric tons, equivalent to 10.33 million barrels per day (bpd), marking a 10.4% decrease from October’s 11.53 million bpd and a 9.3% decline from the same month last year. This downturn challenges the bullish demand forecasts made by industry authorities like OPEC and the International Energy Agency (IEA).

Despite expectations that China would be a key driver of global oil demand growth this year, contributing significantly to the 2.3 million bpd increase projected by the IEA and the 2.46 million bpd rise anticipated by OPEC, the actual figures tell a different story. While China’s crude oil imports grew by 12.1% in the first 11 months of the year, this increase amounted to only 1.21 million bpd, falling short of the IEA’s forecast of 1.8 million bpd demand growth for China in 2023.

It’s important to note that demand growth and import growth are not synonymous, especially considering China’s modest increase in domestic crude output in 2023. Additionally, despite drawing from stockpiles in three of the first ten months of 2023, China has overall built up its inventories this year, further complicating the demand picture.