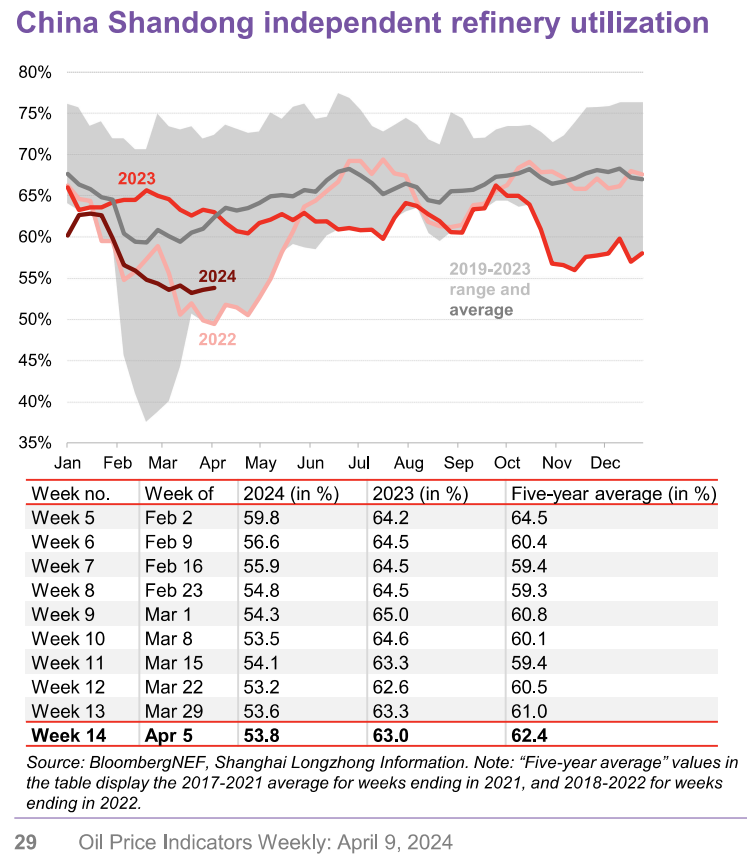

The crude market remains volatile in a tight range as competing forces push the futures market around. There is about $5-$7 of geopolitical premium that is sitting in the market, and whenever Iran responds- depending on the reaction- will either cause a spike and fade or a straight drop. The IEA has reduced their oil demand forecast for this year and estimated even slower growth in 2025 due to weak economic outlook. They also claim that EV’s popularity will impact demand, but EV sales have all but collapsed and most car companies are slashing production on their EV lines. Oil imports into China were strong as refiners took advantage of some pricing, and to bring in crude ahead of maintenance season. The turnarounds have already begun due to weak internal demand, which has kept run rates low. This also pushed state and private facilities to enter into turn arounds “sooner” than normal due to weak internal margins. The problem is- I don’t see a big step up in runs because crack spreads have been under pressure in Asia. I see some support in crack spreads in the near term as Russian product shifts out of Asia near term and maintenance season gains steam in the region. Gasoline will remain heavy, but I expect to see some recovery on the distillate side as Russian product shifts around.

The biggest opportunity right now will be to buy distillate cracks here because they are a bit overblown to the downside. I think you wait to short crude- depending on the response, gasoline cracks are far too strong, and distillate cracks are too weak. Lots of trading opportunities over the next few days!

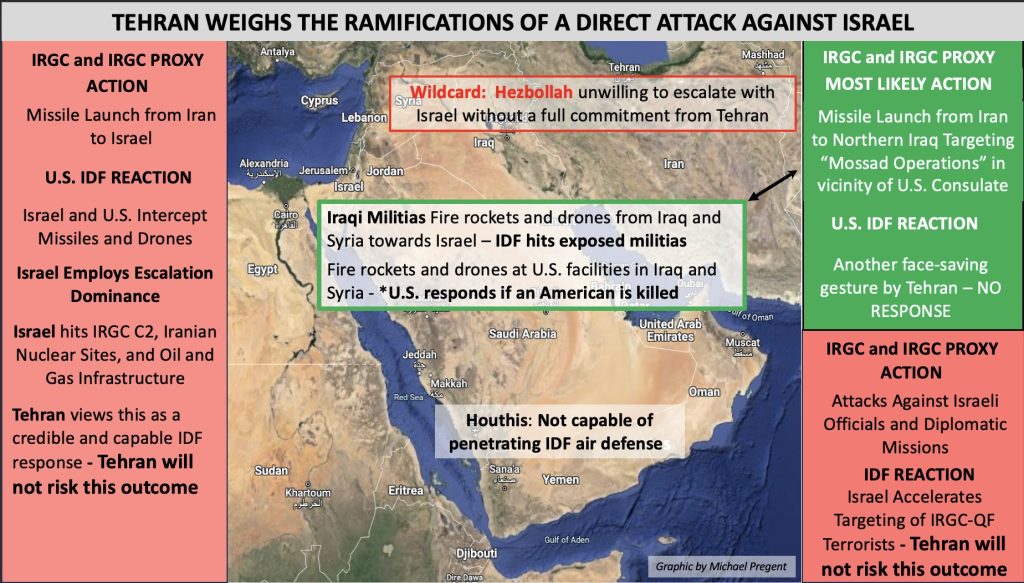

Geopolitics will remain front and center over the next several days. Multiple countries have issued warnings for travel to and around Israel. The U.S. has also moved assets closer to Israel’s shores including a missile ship (equipped with THAAD) and the Ike Strike Group in the Red Sea. The Iranian spy ship Behshad has “gone dark,” which just means it turned off the AIS transponder. Until Iran responds, Brent will trade in the $91-$93 range, but if the response is “muted” it will fall by about $5. Iran has told the U.S. through back channels (apparently) the response won’t be an escalation, but who knows until it happens.

- There’s been a chance in the intelligence data indicating a limited response from Iran. I still think it’s too early to make that final assessment until next week. My view has always been that ANY response would come after the Eid holiday, and many people in the Middle East celebrate an “extended” Eid. This puts Iran’s response into next week.

- U.S./Israel Intelligence has flipped back and forth on this with a response that there was a “stand-down” and now a ramp of military activity.

- Iran claimed to have closed the airspace in Iran and around Tehran, but the actually flight data showed something different. The United States, European, and Regional Allies reportedly believe that a Large-Scale Coordinated Missile and One-Way “Suicide” Drone Attack against Israel by Iran and Iranian-Backed Proxy Groups across the Region is currently Imminent.

- The above followed only 48 hours after the below report was released.

- “U.S. Intelligence Officials are reported to now believe that Iran will not launch a Direct Attack against Israeli Territory as a Response to last Monday’s Airstrike on the Embassy Compound in Damascus; but will instead Order its Proxy Groups across the Middle East, like the Houthis, Hezbollah, and the Islamic Resistance in Iraq, to launch a Large-Scale Simultaneous Strike this week against Israel utilizing One-Way “Suicide” Drone and Missiles. According to Officials, the Reason for this change of Intent by Iran is a Fear by the Regime that any Direct Attack against Israeli Territory will be used by the United States and Israel for Justification to launch Major Strikes against Iran.”

- Iran claimed to have closed the airspace in Iran and around Tehran, but the actually flight data showed something different. The United States, European, and Regional Allies reportedly believe that a Large-Scale Coordinated Missile and One-Way “Suicide” Drone Attack against Israel by Iran and Iranian-Backed Proxy Groups across the Region is currently Imminent.

- Eid is April 9th-10th, which is always a pause point for activities.

Israel has maintained assets airborne for the last 48 hours and “rapid readiness,” which means planes can be in the air in under 10 minutes. The U.S. has moved all assets in the region to high alert, and the head of U.S. central command is currently in Israel. Iran has said that “If the U.S. defends or responds to an attack on Israel, it will be fair game in future attacks from Iran and their proxies.” I still believe that a responds will be “muted” but Brent will keep

There is a good chance their “fear” is well founded, and it would also be confirmation about their underlying weakness. For the last several years, I’ve been saying that the regime is faltering, and they are rapidly losing power. The U.S. and Israel (especially Israel) have been eliminating many high-ranking officials across different internal and proxy organizations. I discuss more of this here: https://primaryvision.co/2023/10/10/how-big-of-a-threat-is-iran/.

The demand/ physical market is showing some mixed signs, but some of them are skewing a bit more bullish:

- India’s IOC purchased US oil via tender, skipping its typical option of West African supply for the second time in recent weeks. Most North Sea and West African arbitrage opportunities to Asia are very poor due higher oil prices coinciding with a narrow WTI-Brent spread and an expanding Brent-Dubai EFS, according to Sparta Commodities.

I was surprised to see some of these U.S. tenders, but China has bid up some of the North Sea cargoes helping to push WTI into a profitable arbitrage. As India purchases more U.S., it leaves more Russian and WAF cargoes in the water. This is a problem as Russian crude production is up, and India imported a near record high from Russia. So now, India is claiming to “reject” these cargoes based on sanctions, but this is more grand standing to drive down prices.

- North Sea, West African Crude Arbitrage to Asia Is Weak: Sparta

- Some complex margins for West Africa in the Far East are negative on an outright basis, partly because of a relatively weak Asian gasoil market

- These barrels are now pointing to alternative destinations like the US Gulf and the US Atlantic Coast

- Despite anticipation of the ramp-up of Nigeria’s Dangote refinery, West African available crude cargoes “appear ample in May while April has been struggling to clear”

- “West African barrels are essentially the least economic grades into Far East currently and margins also lag North Sea crudes into the Americas”

- Differentials may need to ease further, putting pressure on northwest Europe, before refinery demand gets substantially stronger following peak maintenance.

I discussed on Monday how I thought WAF differentials would need to come down, and this is more confirmation that prices will comes down a bit. This also comes after Libya cut OSPs: “Libya reduced its Es Sider OSP for April to a discount of 55c/bbl to Dated Brent, compared with a discount of 10c/bbl for March: price list.” There is also planned maintenance on the CPC oil terminal that should conclude by April 11th: The CPC oil terminal on Russia’s Black Sea coast halted crude loadings Tuesday for planned maintenance and connection of new equipment for the Tengiz-Novorossiysk pipeline.

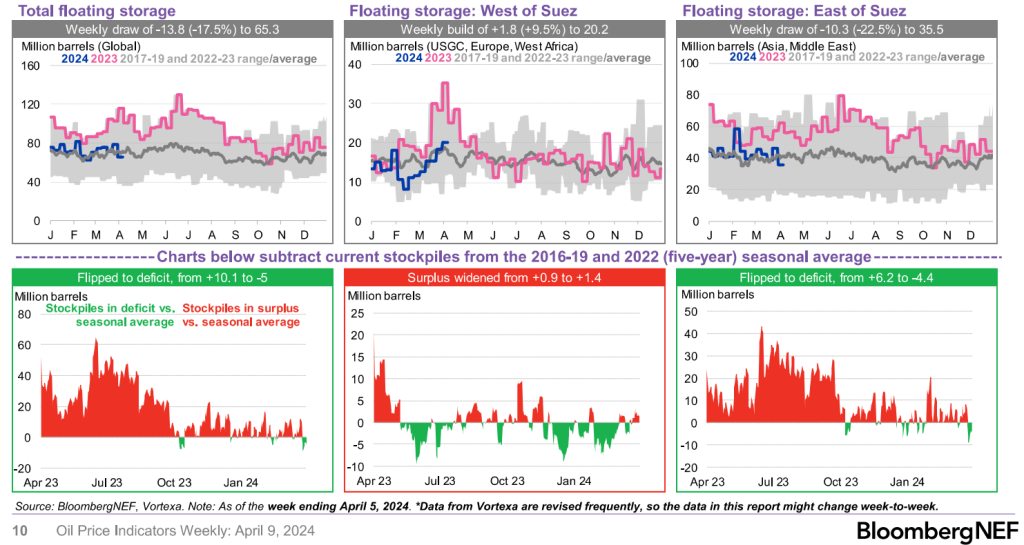

It will be important to see how storage looks over the next few weeks, especially as some parts of the world go into their turnaround.

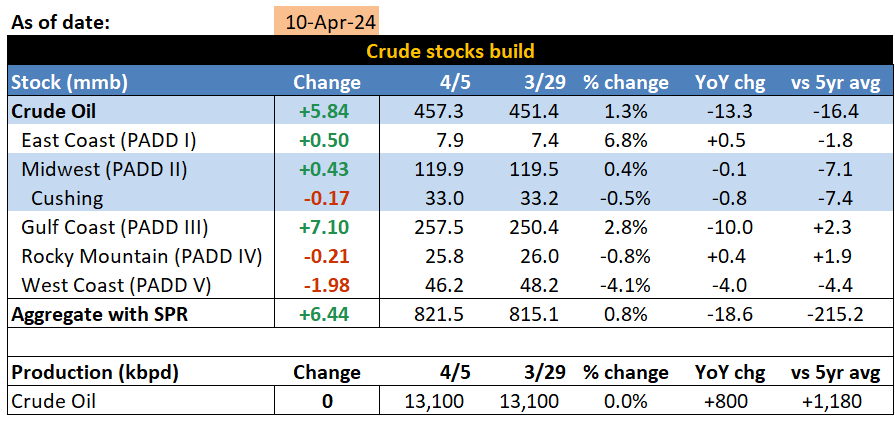

U.S crude builds will continue to accelerate driven by PADD3 and the reduction in exports.

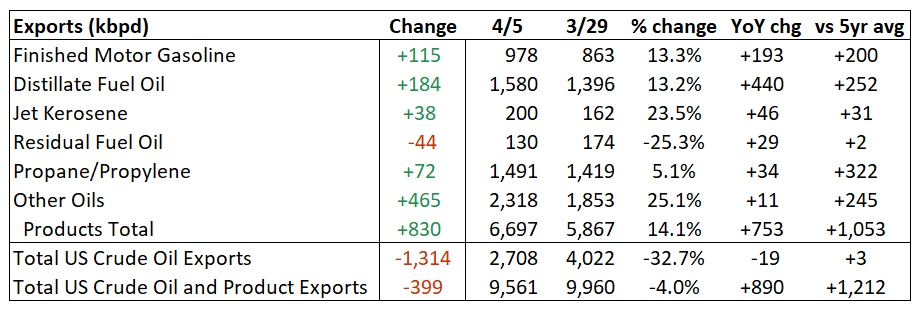

The exports of crude have moved a bit too low, so there will be a bounce given the Asian purchases- but it will be disappointing. The exports of products will slow as the arb has closed, as some additional product moves into U.S. export markets.

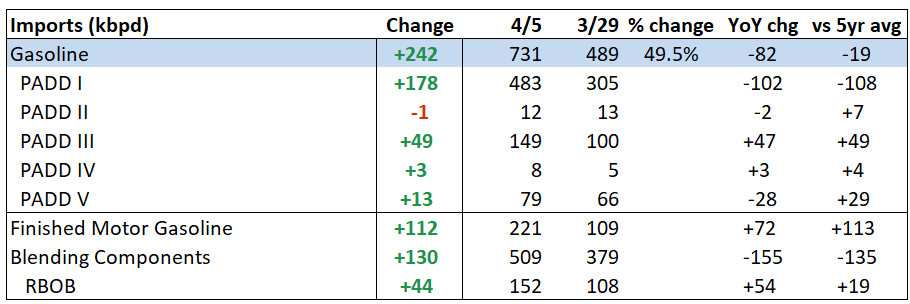

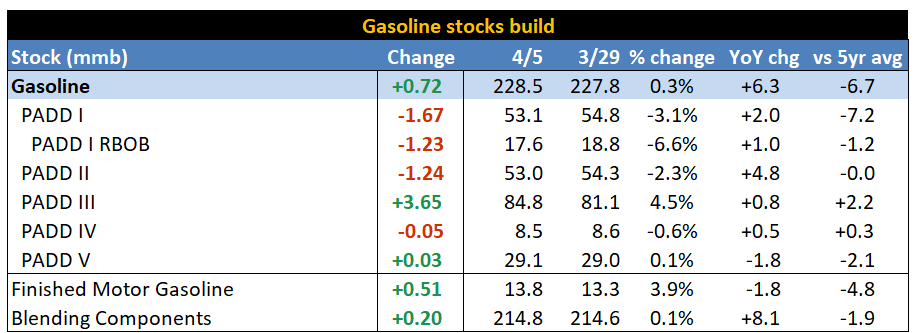

Additional gasoline imports will continue, and we will see a push closer to 900k barrels a day as we move through April. The arb between the East Coast (PADD1) and Europe blew wide open.

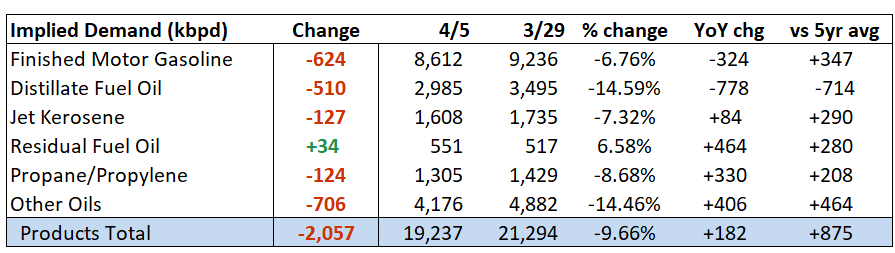

Implied demand in the U.S. reversed lower, and we expect gasoline to remain depressed over the next few weeks. Prices of gasoline are moving higher, and it will impact the underlying purchase. Distillate on the other hand had an overreaction to the downside and will likely have a strong bounce this week. Gasoline crack spreads are overvalued here, and we expect more pressure on the spreads in the near term.

The slowdown in gasoline demand, increase in refiner runs, and spike in imports will push builds higher and take out the 5-year average.

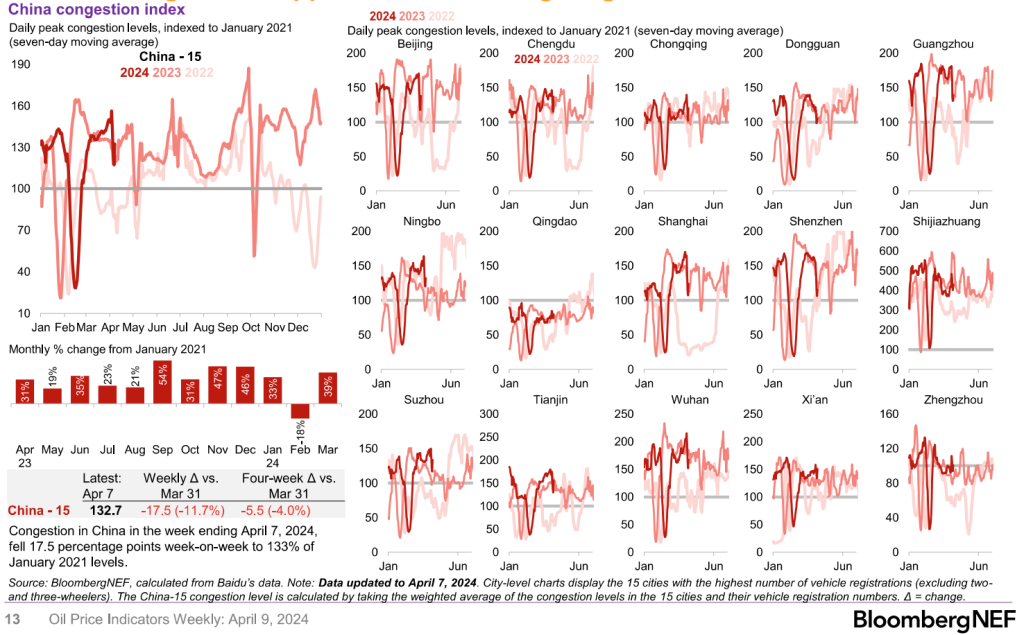

China is also experiencing a slowdown in demand that is inline with previous shifts for the holiday season. The below shifts happened inline with our expectations, and we will see a bounce back along 2023 figures as we go through the remainder of April.

I expect to see pressure remain on refinery runs in China, which will keep things depressed versus 2023 levels. The bigger issue is the slowdown in state-owned refiners, which will leave additional crude in the market.

This will push stockpiles higher- especially in the floating market. Total storage has moved back to the 17-19 average, and I don’t see much deviation from this in the near term. The bigger piece to watch will be the builds creeping into the products market.

The floating market in WAF is pushing higher, and I expect to see more builds in the floating Asian markets.

When we look at the broader market, time spreads are pulling back with the biggest headwind in WAF right now. There has been some additional demand for Suezmax in the USGC for Europe, which is making freight expensive for WAF. “West African Suezmax rates into Europe climbed to the highest since mid-January. The region’s Suezmax market is getting a lift from tighter capacity in the Atlantic Basin due to strong US Gulf fixture volumes, according to Jefferies.” There will have to be additional reductions in differentials (reduced WAF pricing) in order to see volumes clear. This supports our view that US exports are a bit low and will bounce, but also the physical market has gotten ahead of itself and will see price cuts. “Brent futures ran too hot and left a myriad of miss-pricing across the regions. WAF to heavy to move at these diffs, Atlantic barrels no longer working for the long haul (curve structure) and Urals still hitting the market.” This is keeping US barrels local and WAF stuck.

The slowdown really started mid-last week as hesitation on purchases creeped into the market. This is when we normally see the start of summer run purchases, and things have slowed at the current pricing structure. European weak demand is going to be a bigger overhang, and as the geopolitical risk passes- I expect to see a crude shift back to about $85/$86.

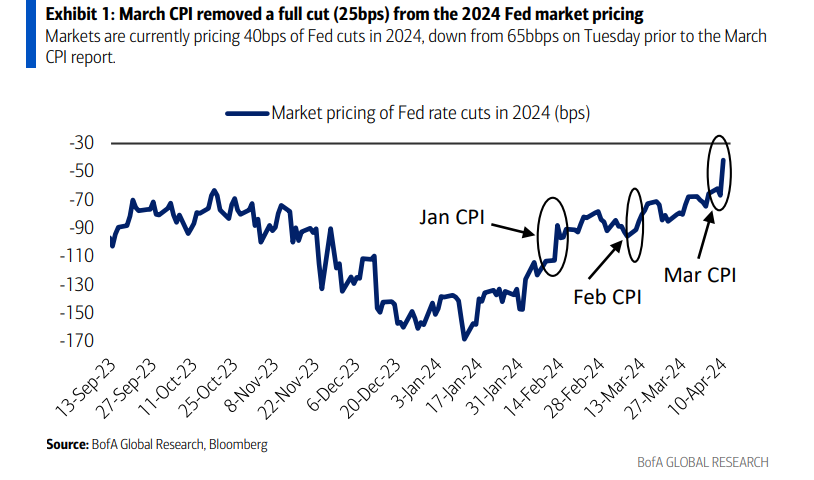

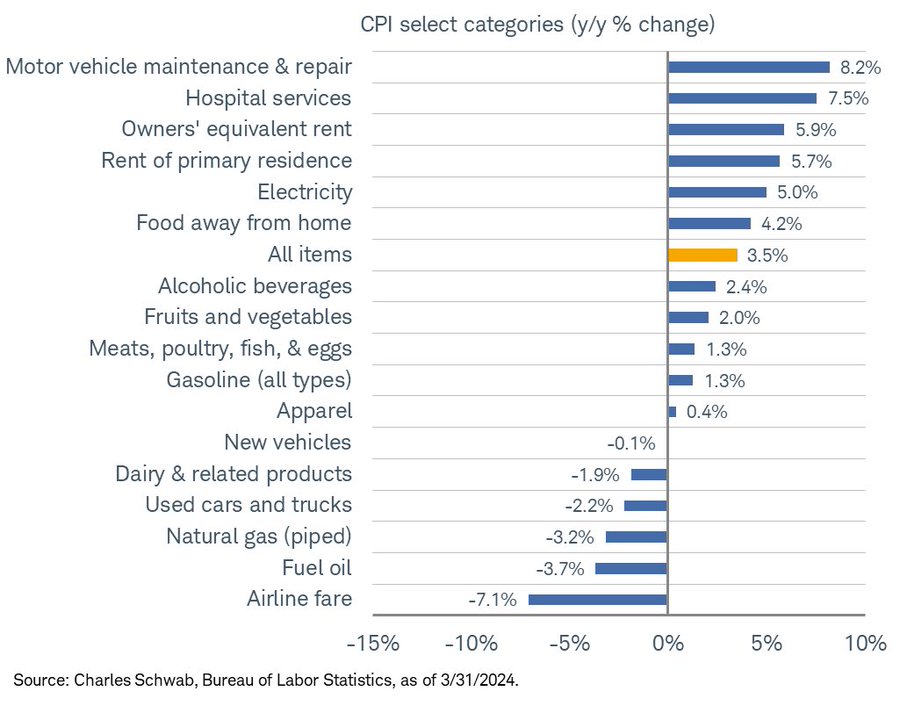

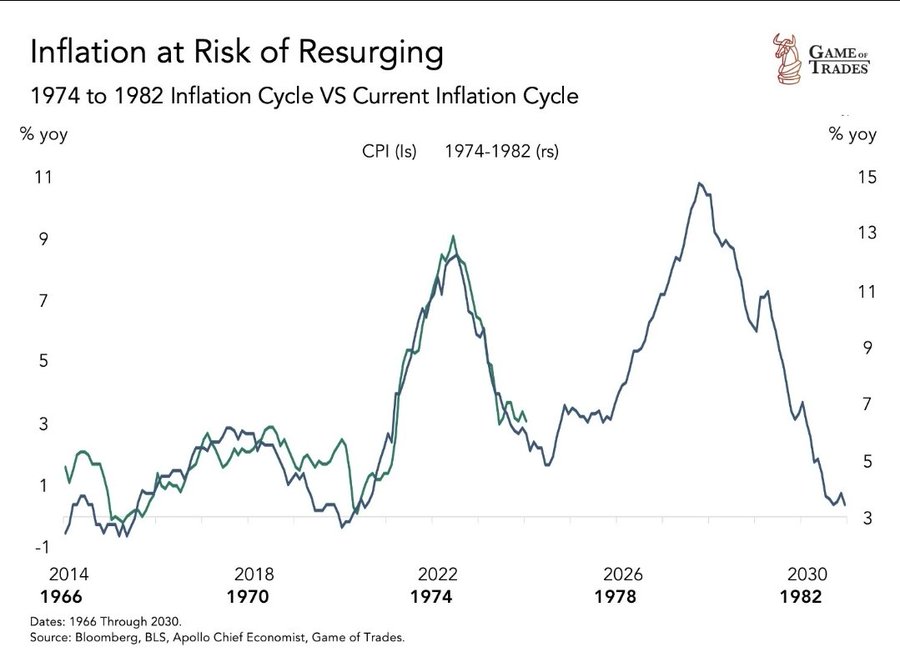

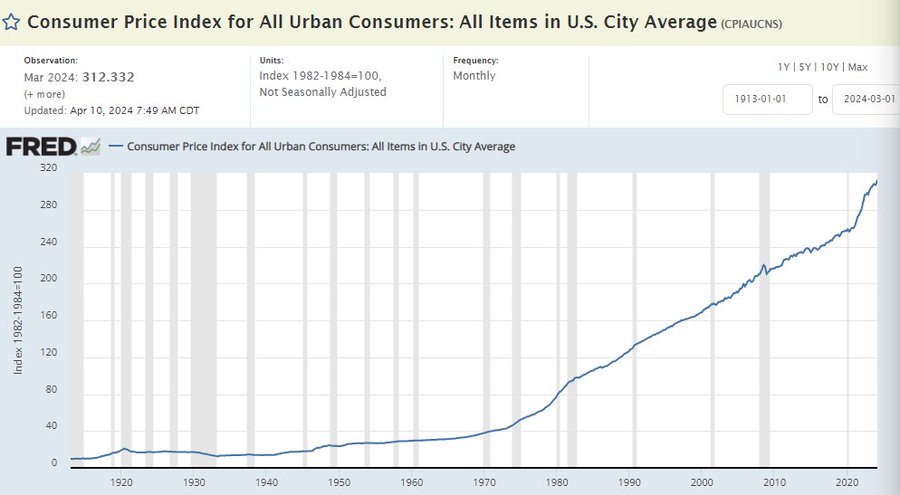

The market continues to price in a very robust spring/summer demand, but I think there is an overestimate of demand strength. Data points to more issues hitting the underlying economy and the consumer. Inflation came in well above expectations in the U.S., and the market FINALLY priced out Fed rate cuts in the near term. Gold has pushed to new all time highs with treasury bond yields making another push up: Markets are currently pricing 40bps of Fed cuts in 2024, down from 65bbps on Tuesday prior to the March CPI report.

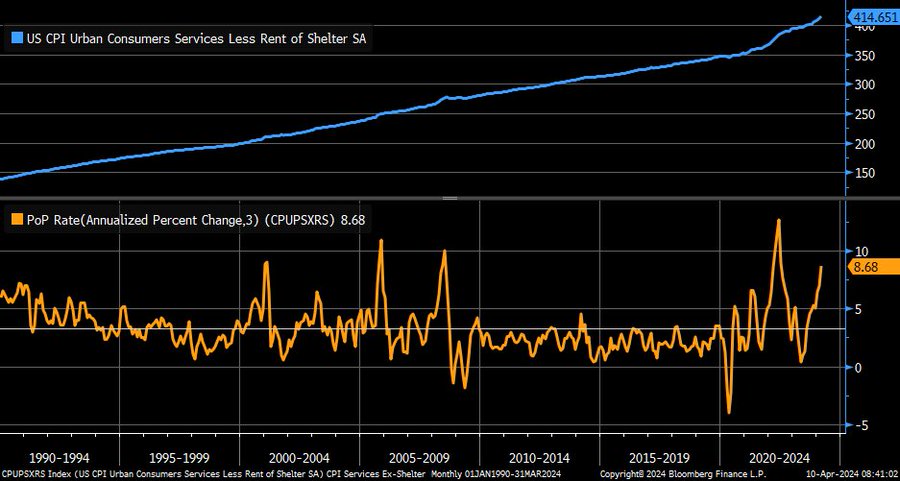

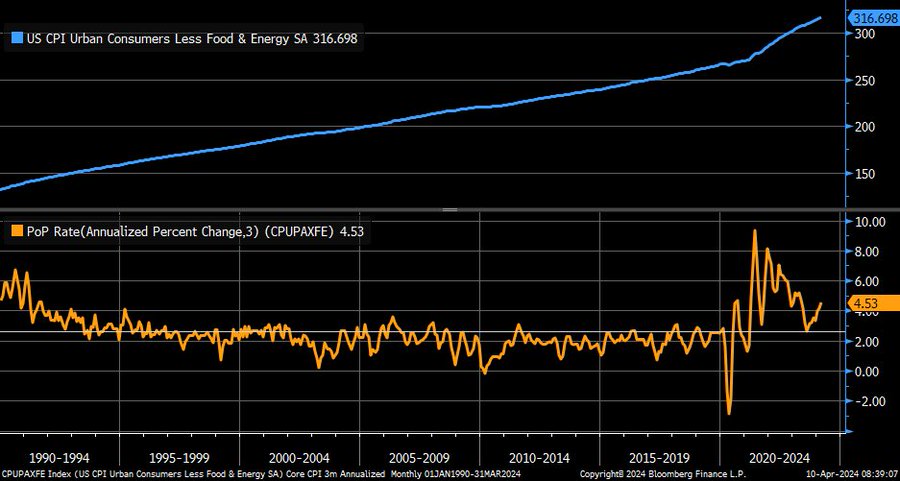

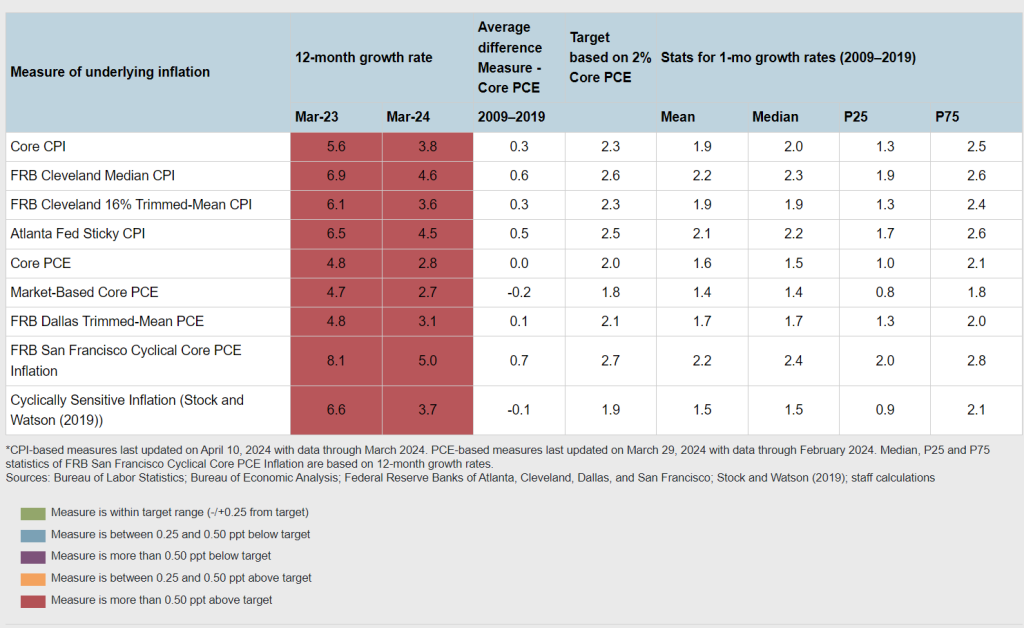

I still believe that two rate cuts are too aggressive, and we could see one or none this year given inflation moved higher. The market continues to show a shift in expectations, and we’ve seen 10-year yields, gold, and USD respond because of it. Inflation is running hot on pretty much every metric- especially when looking at 3/6 month annualized changes. Looking at CPI services ex-rent of shelter, 3-month annualized change has shot up to +8.7%.

Inflation picked up across every metric tracked by the Fed, and even though they are “playing” with the PCE/ PPI data- it won’t be enough to hide how quickly pricing is shifting higher.

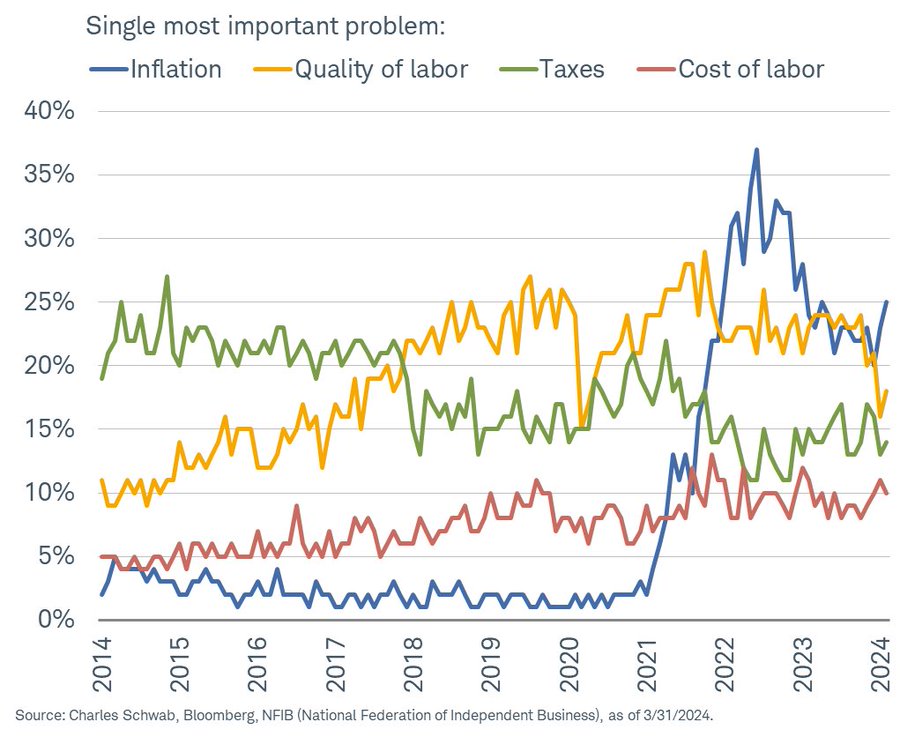

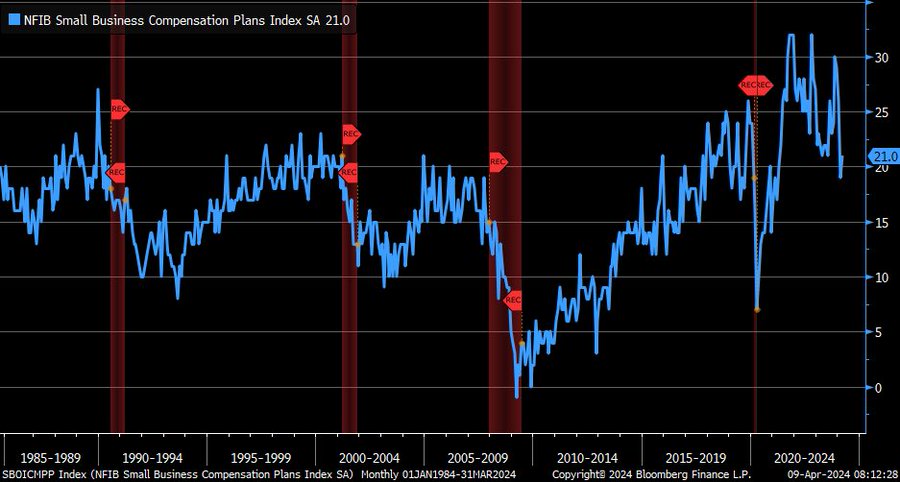

Small businesses represent about 44% of the U.S. economy, and they are signaling more issues ahead. Inflation has spiked up again hard, which is a sign that small businesses will be moving prices up once again. They will try to push through as much of their cost as possible, and it shows up in here first.

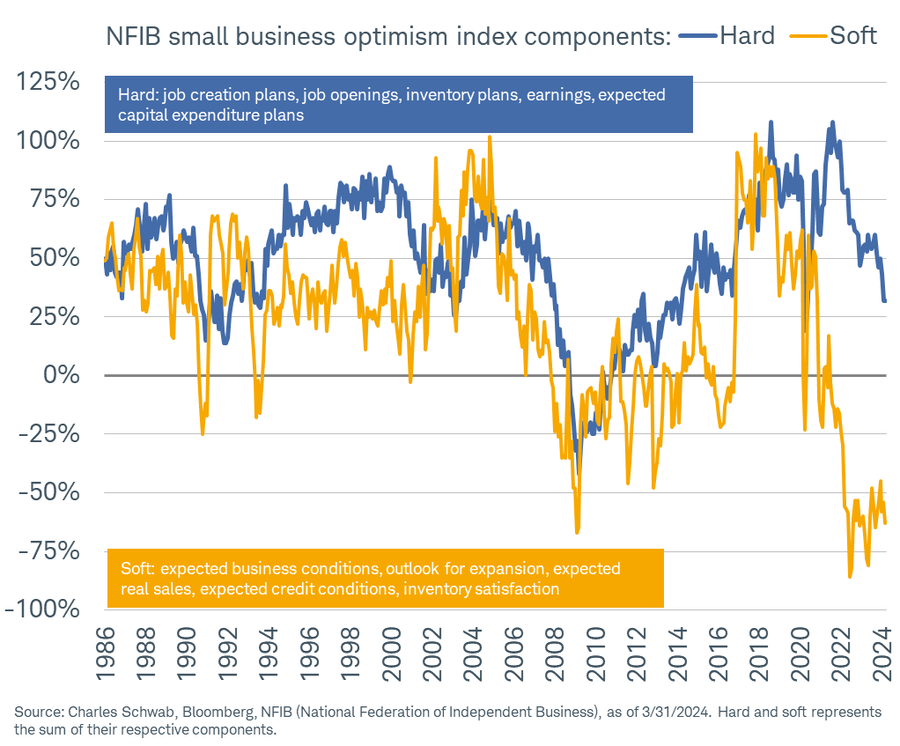

The inflation issue comes on the back of worsening components about their underlying business. Hard components in NFIB small business optimism are at their weakest since the 2020 recession Soft components are hovering near the GFC lows (but have improved from the most recent trough in 2022).

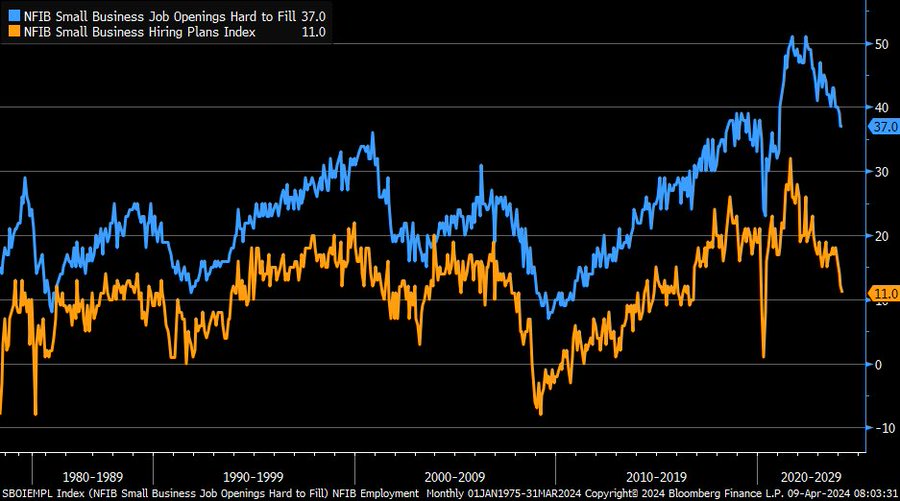

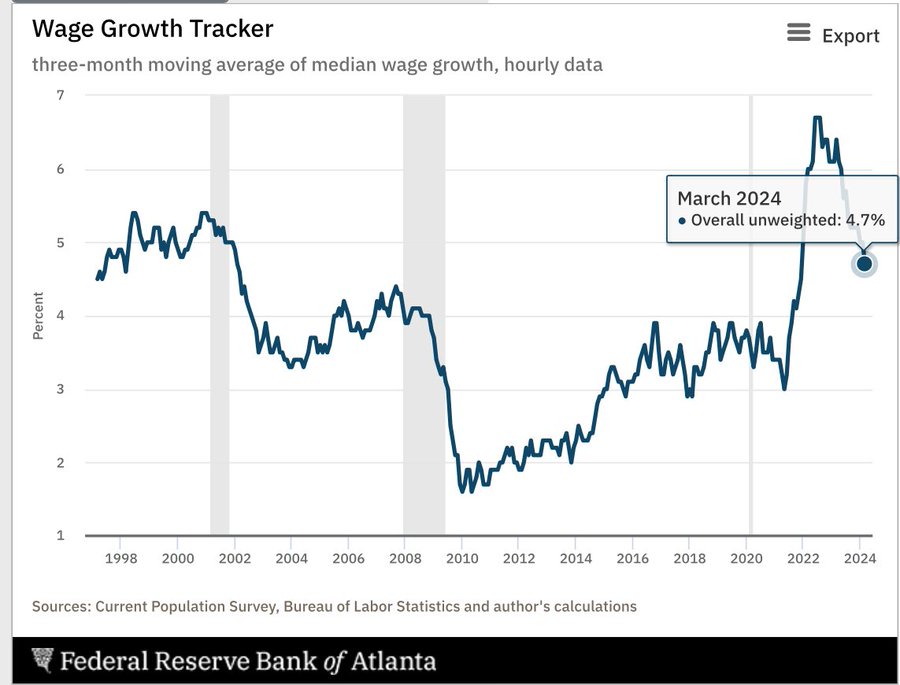

Even as labor markets get “better” when it comes to labor availability (which should result in lower wages- reduced price pressure/inflation) it still remains at near all-time highs. Yes, it has clearly come off the highs, but still at a point we’ve never seen before. Labor market indicators in NFIB small business optimism survey continue to soften … shrinking share of respondents saying job openings are hard to fill (blue) and that they’re expecting to hire more (orange)

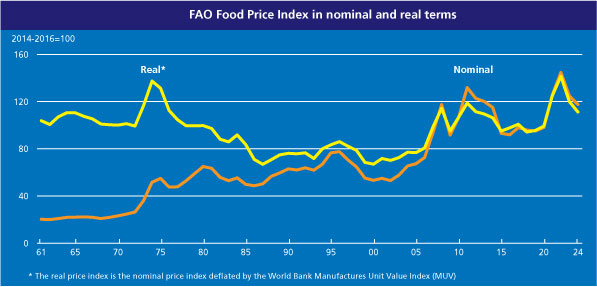

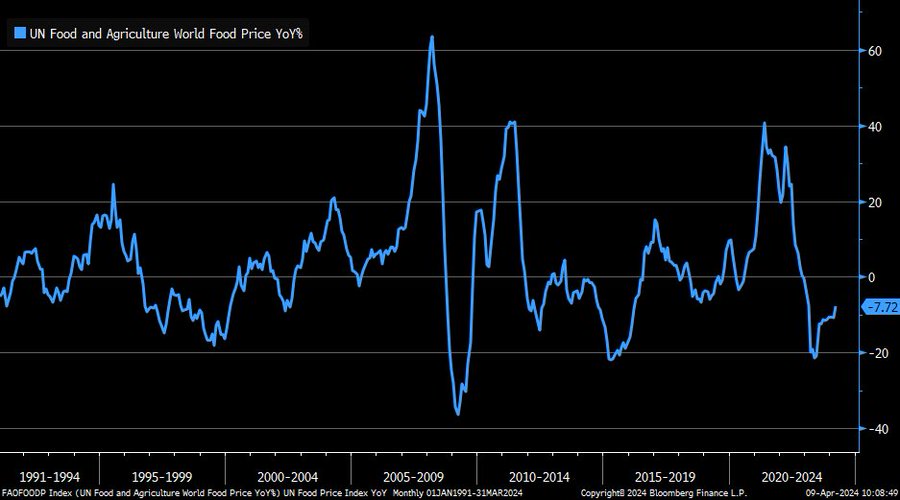

Food prices are shifting back higher as we move into the Q3 with more pressure to the upside.

A WSJ analysis found that a commonly purchased basket of supermarket goods increased in price by 36.5% over the past 4 years (+8.1% per year), much higher than US Government CPI figures which show food price inflation of 24.9% (+5.7%/year).

Things might look “ok” still on a year/year basis, but the pivots are moving in the wrong direction. Food is a huge impact for Emerging Markets that are already getting hit hard with 10-year treasury rates moving higher, surging USD, and commodities. This all shows a weakening consumer that will struggle and ultimately reduce total crude demand.

The percentage of Small businesses owners planning to raise worker compensation has dropped sharply from peak and moved up a bit in March … any further deterioration would start to look consistent with what has happened in prior recessions. It has clearly come down, but it’s bouncing back up and holding here. It’s off the highs but still elevated from previous peaks.

The price track will continue until we get a bigger degradation of sales. It’s starting to hit on the retail sales pace, but it’s still slow to materialize. We see this gaining a ton of momentum over the coming months given credit card rates and defaults, car delinquencies, and other pressure points. Poor sales starting to move up more meaningfully as top issue for NFIB small businesses … not overwhelming relative to prior downturns, but year/year trend (orange) is picking up some steam.

These key factors are going to keep all of these categories shifting in the WRONG direction, especially as the “easier” comps (higher prices from COVID) fall away.

The University of Michigan consumer expectations dropped, and it’s likely because of the rising prices they’re seeing again. Consumers have seen gasoline prices rise as well as insurance and other services that are shifting higher. We’ve been saying that inflation (based on the way the Fed/ CPI is calculated) will remain between 3%-4% for much longer than they want.

UMich 77.9, Exp. 79.0, Last 79.4 1Y inflation exp 3.1%, Exp. 2.9% 5-10Y inflation exp. 3.0%, Exp. 2.8%

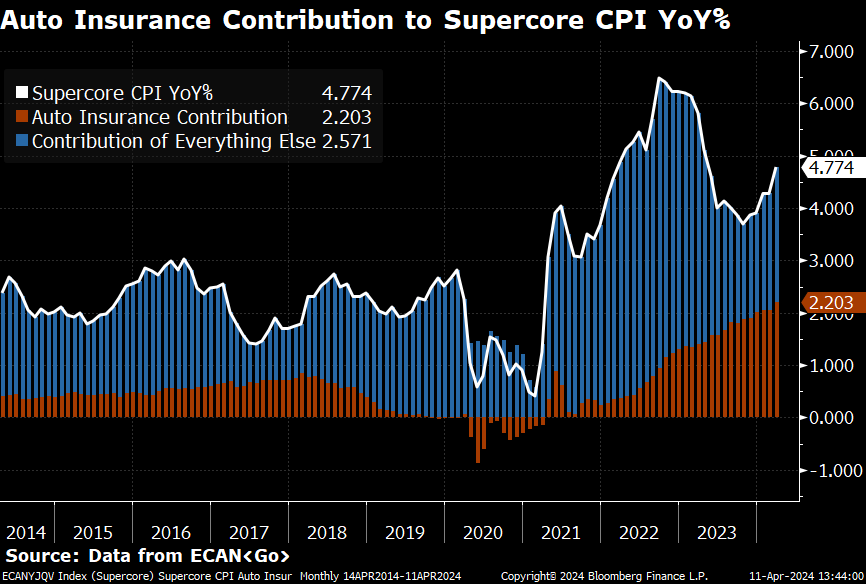

Here’s auto-insurance shifting:

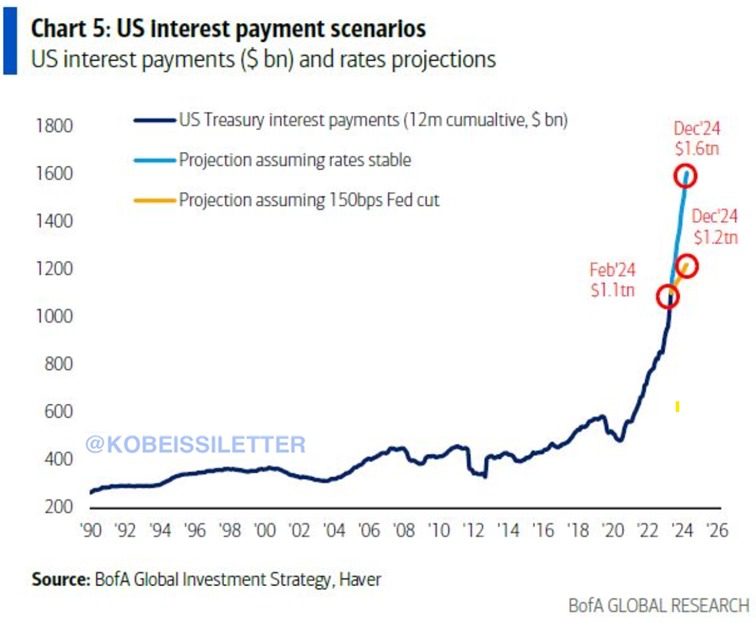

Even as the Fed keeps rates elevated, the government is running a steep deficit that is pumping money into the system. It’s coming by way of fiscal stimulus even as monetary tightening (QT) remains the basis of how things sit. This spending is going to put the U.S. in a TERRIBLE position when you look at interest expense, and a significant amount of new money will have to go to interest.

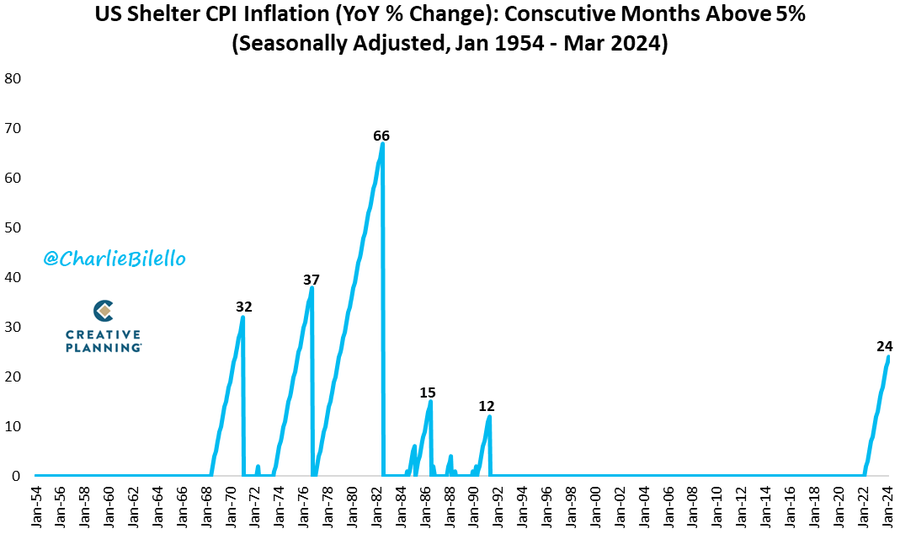

Another key driver is the shelter side of CPI: Shelter CPI has now been above 5% for 24 consecutive months, the longest period of elevated housing inflation since the early 1980s.

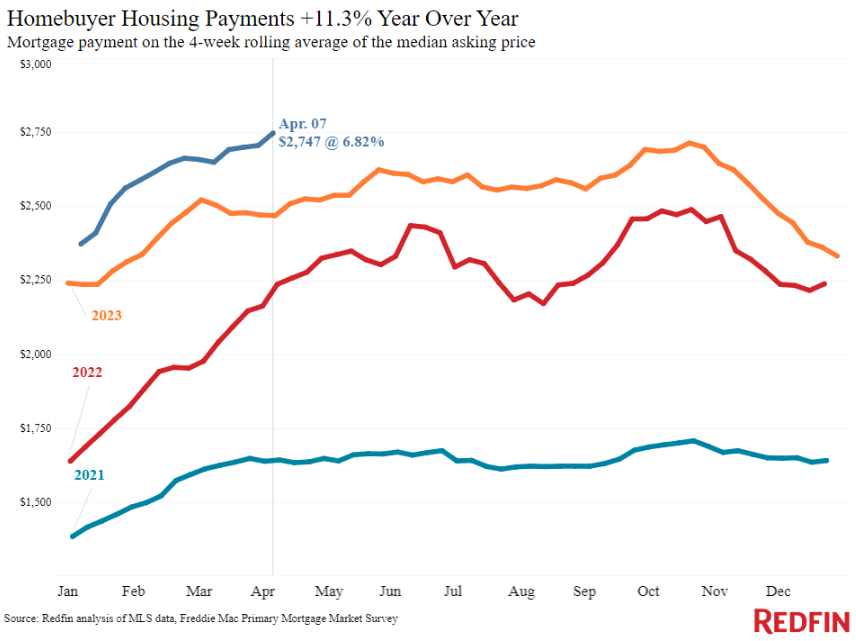

The cost continues to EXPLODE higher, and it will keep people paying all cash or sitting on the sidelines. We have now reached a point where 44% of renters (Redfin survey) believe they will never be able to afford a home.

Monthly mortgage payment needed to buy the median priced home for sale in the US…

- April 2020:$1,480

- April 2021: $1,690

- April 2022: $2,400

- April 2023: $2,550

- April 2024: $2,750

That’s an 86% increase over the last 4 years.

Note: this doesn’t include all of the other costs of homeownership which have skyrocketed higher as well (property taxes, insurance, maintenance, etc.). “The average annual home insurance cost rose about 20% between 2021 and 2023 to $2,377, according to insurance-shopping site Insurify, which projects another 6% increase in 2024.”

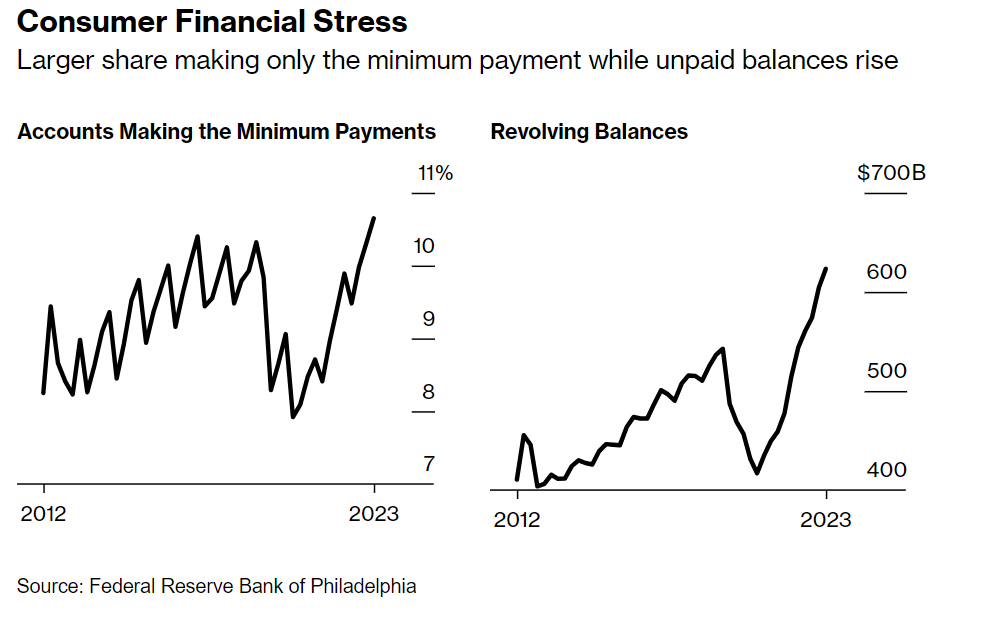

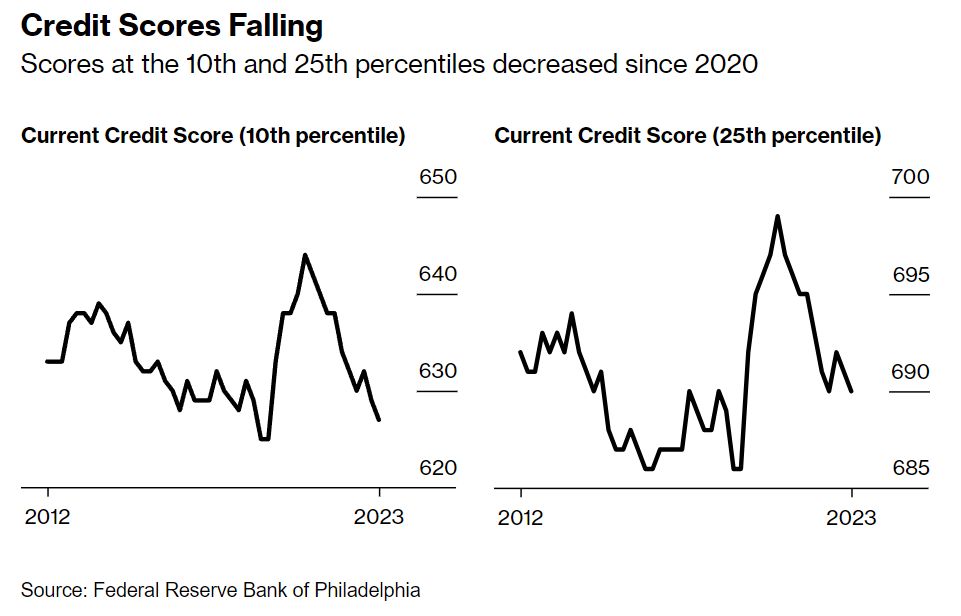

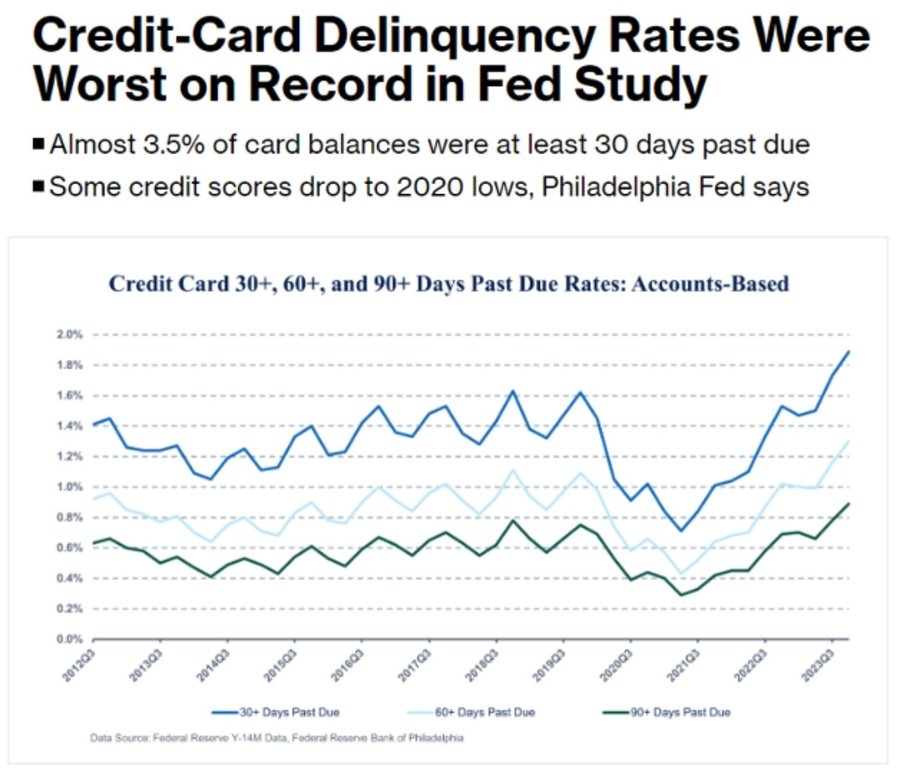

Here is a quick wrap up on the U.S. credit card side of the equation: US credit-card delinquency rates were the highest on record in the fourth quarter, according to a Federal Reserve Bank of Philadelphia report. Almost 3.5% of card balances were at least 30 days past due as of the end of December, the Philadelphia Fed said. That’s the highest figure in the data series going back to 2012, and up by about 30 basis points from the previous quarter. The share of debts that are 60 and 90 days late also climbed.

Based on the level of outstanding credit and delinquency, credit scores are falling across the board.

As long as inflation tracks the 1970’s playbook, the Fed will be sitting on the sidelines, which will keep rates moving higher for all things including- mortgages, credit cards, auto loan- and other critical lending metrics for consumers.

This pressure will keep delinquencies moving higher.

The issues are getting worse as wages shift lower once again. They still remain elevated versus previous years, but this will put way more pressure on consumer’s balance sheets.

Here is the relentless climb higher below!

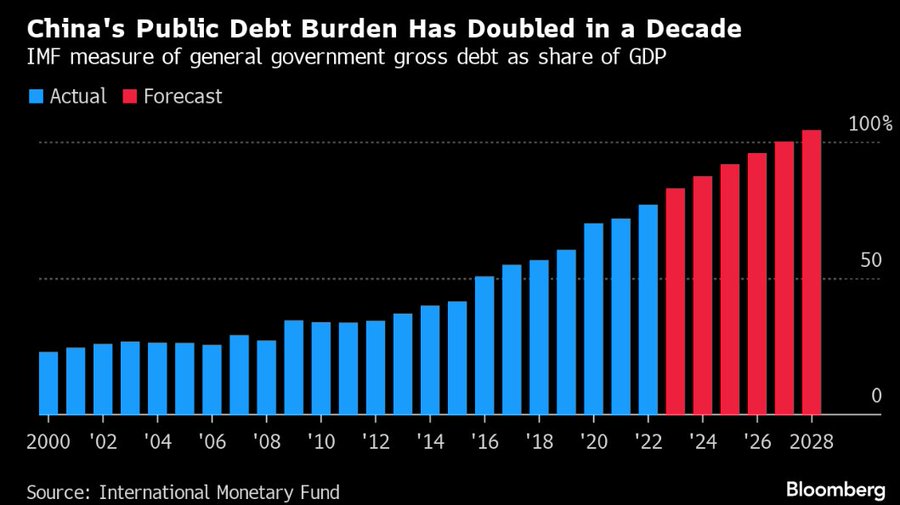

The world’s global debt burden keeps making all time highs, so even as I pick on the U.S.- we are BY NO MEANS ALONE! Following Moody’s in December, #Fitch Ratings revised the #China #debt outlook to negative from stable. China’s pace of debt accumulation is very problematic. Public debt has more than doubled since the Great Financial Crisis and is heading to above 100% of GDP. More importantly, total debt has ballooned from 133% in 2008 to 272%(!) in 2022. It will have risen again in 2023. The current 10-year Chinese bond #yield is at 2.29%, which is extremely low for a country that expects to grow by 5% annually. Coincidence? Of course not! China has the same debt sustainability issues as every other major economy, and rating agencies must act.

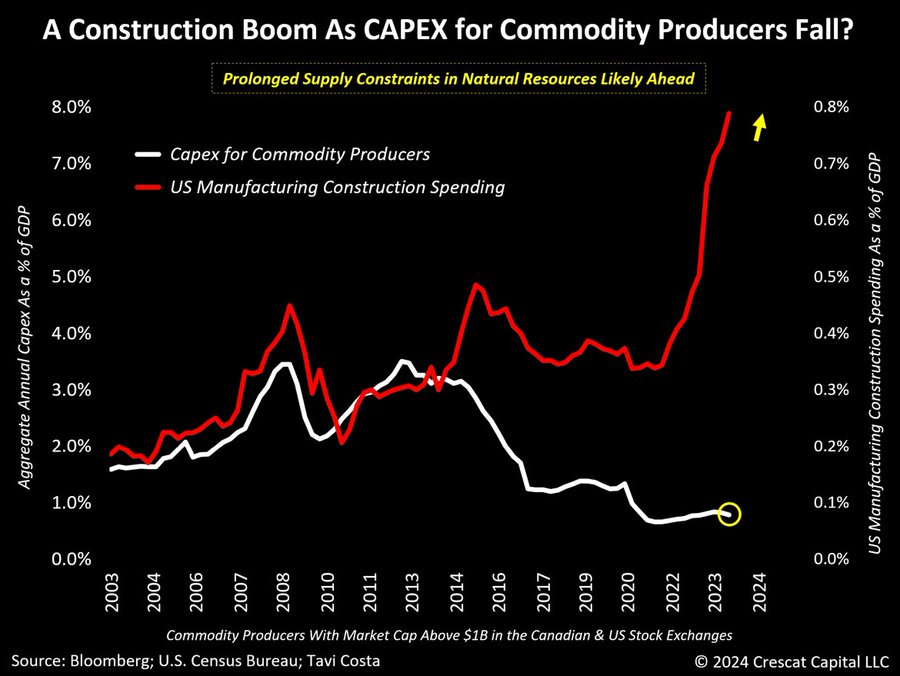

Even as these pressure points persist, we will see shortages in the commodities world. We need more natural resources, but money isn’t going to work in that part of the supply chain.

The last point that we want to discuss is the debacle at the BoJ as the Yen weakened against the dollar to the worst in history. The market will keep pushing the Yen to the brink of disaster and force the BoJ to gun rates higher. The “Invisible Hand” is going to make them close the carry trade, which is going to make U.S. treasury and note auctions more and more “sloppy.” Even as the BoJ tries, they won’t be able to stave off a failed bond auction that will reverberate through the system. My view is- even if the Fed were to cut rates at the end of the year- they’ve lost control of yield. The interest/debt load of the U.S. is working against them, which only gets worse if other central banks (especially Japanese traders) sell down some of their treasury positions. What’s remarkable about the decline in Treasuries is that it hasn’t *yet* been driven by foreign central banks selling. Their position in US debt instruments remains the largest in history. Just imagine if they were to begin exerting selling pressure as well.

The issues in this market are FAR from over, if anything, they are just beginning. You just need to look at the bond market/ gold to see what comes next… pain.