The risk of recession may appear diminished in recent economic forecasts, but the market’s optimism may be premature. Despite Wall Street economists predicting a drop to sub-1% growth earlier this year, the data presents a more nuanced reality. Notably, multiple indicators with a strong track record of forecasting recessions are still flashing warnings.

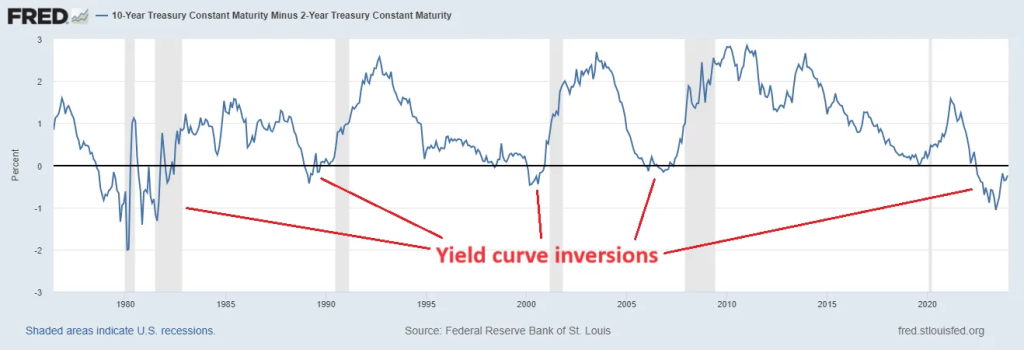

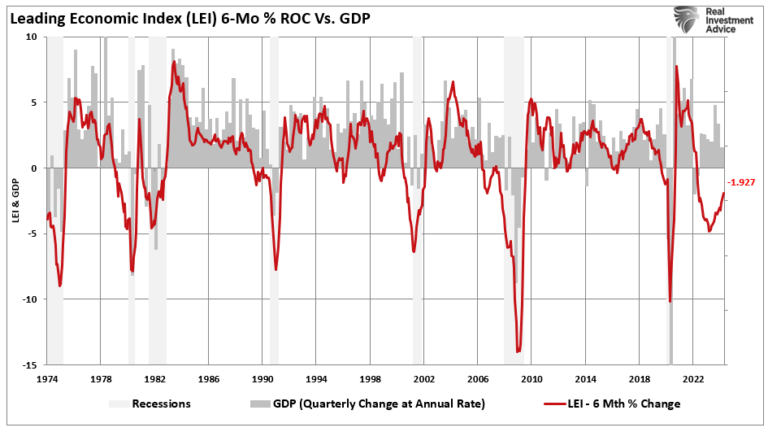

Take the yield curve inversion, for instance. The spread between the 10-year Treasury bond and the 3-Month Treasury bill has been inverted for an unprecedented length of time, yet a recession has not occurred. This anomaly defies historical patterns, as such inversions have typically signaled impending recessions. Similarly, the Leading Economic Index (LEI) has consistently posted negative readings, traditionally a harbinger of recession. The Federal Reserve’s aggressive rate-hiking campaign, another typical recession precursor, has also failed to tip the economy into recession.

One key factor that has bolstered the economy against these recessionary pressures is substantial fiscal support from various legislative measures. The Inflation Reduction Act, the CHIPs Act, stimulus checks, and tax credits have provided a significant boost to economic growth. These measures acted as an economic adrenaline shot, propelling growth rates to nearly 18% at the post-pandemic peak. However, as this fiscal stimulus wanes, the economy’s underlying vulnerabilities are becoming more apparent.

Recent economic data paints a mixed picture. The Philadelphia Fed Index, a measure of regional manufacturing activity, showed a sharp decline in May, with the diffusion index for current general activity dropping 11 points to 4.5. New orders and shipments indices turned negative, signaling potential slowdowns ahead. U.S. industrial production was flat in April, and factory output fell by 0.3%, further indicating weakening industrial activity. The Conference Board Leading Economic Index (LEI) for the U.S. decreased by 0.6% in April, following a 0.3% decline in March. This ongoing deterioration suggests that softer economic conditions are on the horizon, with elevated inflation, high interest rates, rising household debt, and depleted pandemic savings expected to weigh on the economy through 2024. Real GDP growth is projected to slow to under 1% over the Q2 to Q3 2024 period.

Market-based indicators are also flashing caution. The yield curve inversion, particularly the spread between the 10-year and 2-year Treasury notes, is experiencing its longest inversion in history. Historically, this has been a near-perfect recession predictor. Additionally, tightening lending standards by banks, a decrease in the Federal Reserve’s balance sheet, shrinking M2 money supply, and negative ISM surveys all point to a weakening economy.

Consumer financial health remains precarious. With 78% of consumers living paycheck to paycheck and a significant portion holding minimal savings, the consumer base appears strained. Target’s recent earnings report, showing a 3% decline in year-over-year sales, highlights the impact of high prices on consumer behavior. The broader market is bifurcated, with the Dow Jones Industrial Average hitting all-time highs while the Russell 2000 remains down 15% from its peak in late 2021.

For investors, these mixed signals suggest a cautious approach. The continued divergence in economic forecasts, such as the International Energy Agency’s (IEA) revised oil demand growth forecast down to 1.1 million barrels per day for 2024, contrasts sharply with OPEC’s forecast of a 2.25 million barrels per day increase. This discrepancy underscores the uncertainty surrounding future demand projections.

Geopolitical tensions, such as the fire at Russia’s Tuapse oil refinery following Ukrainian drone attacks, introduce supply uncertainties. Despite these tensions, U.S. crude prices have seen slight upticks, supported by stabilizing job market data which could prompt the Federal Reserve to consider interest rate cuts by autumn.

As we navigate through 2024, the economic landscape is marked by contrasting indicators and underlying uncertainties. While consensus estimates downplay the risk of an imminent recession, the persistent warning signs from historically reliable indicators cannot be ignored. Investors should remain vigilant, closely monitoring economic data and market signals to navigate the complex and shifting economic terrain. The interplay between fiscal policies, consumer behavior, and global market dynamics will be crucial in shaping the economic outlook for the remainder of the year.