Explaining The Drilling Outlook

We discussed our initial thoughts about Patterson-UTI Energy’s (PTEN) Q1 2024 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook. PTEN’s management expects “high oil prices” in the US shale market to lead to a modest demand uptick. Although natural gas prices declined recently and activity reductions continued in Q2, in the Northeast, it should remain steady from Q2 through the rest of the year. Increased LNG exports and growing demand for power in the US will extend the use of natural gas in the coming months.

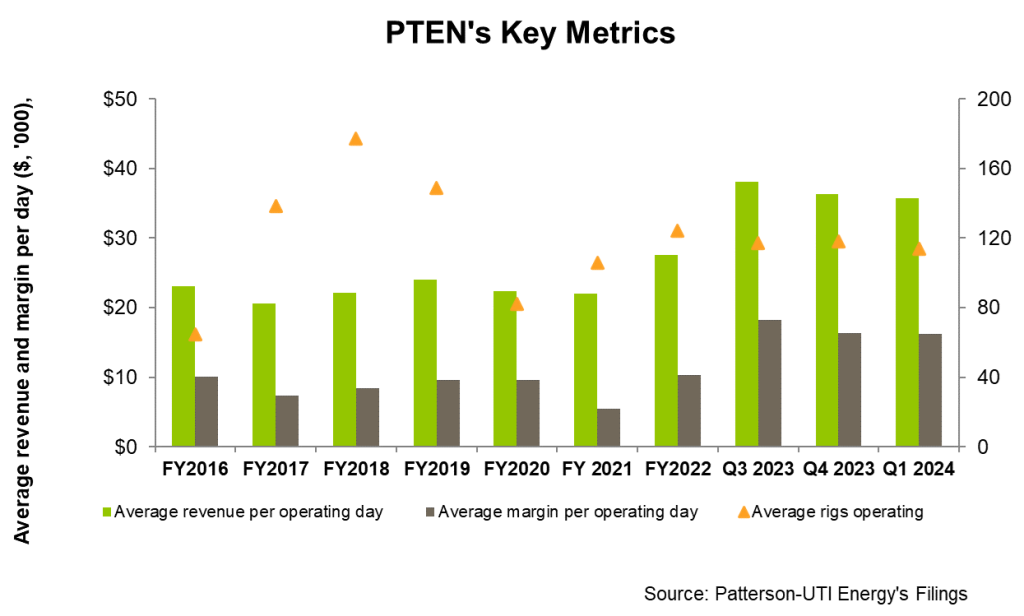

Despite the activity recovery, PTEN’s management sees a moderate rig count softness in the coming days as a result of low natural gas prices and customer consolidation in the energy sector. This should increase the demand for Tier 1 drilling assets where the company believes it can outperform the market. Plus, it will continue to high-grade the rigs. It expects to average 114 active rigs in Q2 compared to 121 active rigs in Q1. Nearly 80% of its active rigs are Tier 1, while the rest 20% are Tier 2. It plans to reduce the amount of horsepower overall because its requirements for Tier 2 will fade.

Frac Drivers

Following the NEX integration, as we discussed in our previous article, PTEN is on course to achieve additional synergies compared to the pre-merger anticipation. As the merger creates value, it expects to achieve its $200 million annualized synergy target faster than initially expected. The company’s transition to natural gas-powered frac equipment will lead to many merger synergies. In April, it deployed Emerald electric frac equipment, which it integrated with its power solutions in West Texas. These equipment typically average over 21 hours per day. It plans to grow its electric frac horsepower to 140,000 HHP by 2H 2024. Nearly 80% of its fleets will be able to be powered by natural gas. As it introduces efrac and natural gas-powered drac spreads, it expects its nameplate horsepower to continue to decline as it retires the legacy diesel-powered frac spreads. So, in Q2, the company expects revenues and adjusted gross profits to fall by 9% and 14%, respectively, compared to Q1.

PTEN’s cementing business underperformed early in 2024, but it should be relatively steady for the rest of the year, with the possibility of a recovery in Q3. So, Q2 will market a “low point” for frac activity in the year, followed by low customer utilization. On the other hand, the company’s Drilling Products segment appears to be brightening despite a flattish US onshore market, which should benefit Alterra’s international business. Strong performance in the Middle East and the company’s foray into the North Sea will drive this segment’s performance. So, in Q2, the company expects the financial performance to remain unchanged. In the international market, the company should perform well, which should offset the typical seasonality in Canada.

Capex And Leverage

PTEN’s cash flow from operations increased by 56% in Q1 2024 compared to a year ago. Its capex increased by 93% during the quarter, which led to a meagre 19% rise in free cash flow from a year ago.

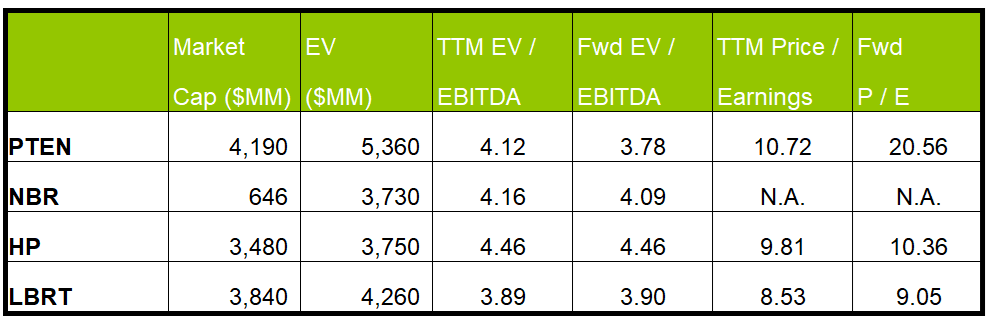

Share repurchases and dividends returned $130 million to shareholders in Q1, and the company plans to return $400 million annually. The company plans to accelerate its share repurchase program because it perceives a dislocation between its share price and its view on intrinsic value. PTEN’s liquidity was $718 million as of March 31, 2024 (excluding working capital). Its debt-to-equity (0.26x) is much lower than that of its competitors (NBR, HP, and LBRT).

Relative Valuation

PTEN is currently trading at an EV/EBITDA multiple of 4.1x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 3.8x. The current multiple is lower than its past five-year average EV/EBITDA multiple of 8.6x.

PTEN’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is in contrast to its peers because the company’s EBITDA is expected to rise sharply, whereas EBITDA for its peers is expected to remain unchanged in the next year. This typically results in a higher EV/EBITDA multiple. The stock’s EV/EBITDA multiple is slightly lower than its peers’ (NBR, HP, and LBRT) average. So, the stock is undervalued versus its peers.

Final Commentary

PTEN continues to focus on drilling rig upgrades. A majority of its rigs are Tier 1, and the share of Tier 1 rigs will increase. On the completions side, it deployed Emerald electric frac equipment in April and plans to grow its electric frac horsepower to 140,000 HHP by 2H 2024. Nearly 80% of its frac spreads will be able to be powered by natural gas. The company’s bottom line will also aided by accelerated synergy realization from the NEX merger.

However, its overall fracking and drilling capacity can decline in Q2 as natural gas prices act as a disincentive to increase production. On the other hand, the company’s medium-term outlook remains relatively bullish as natural gas demand is set to rebound. However, its cash flows and negative shareholder equity were a concern in Q1. The stock is relatively undervalued versus its peers.