Key Drivers And Challenges

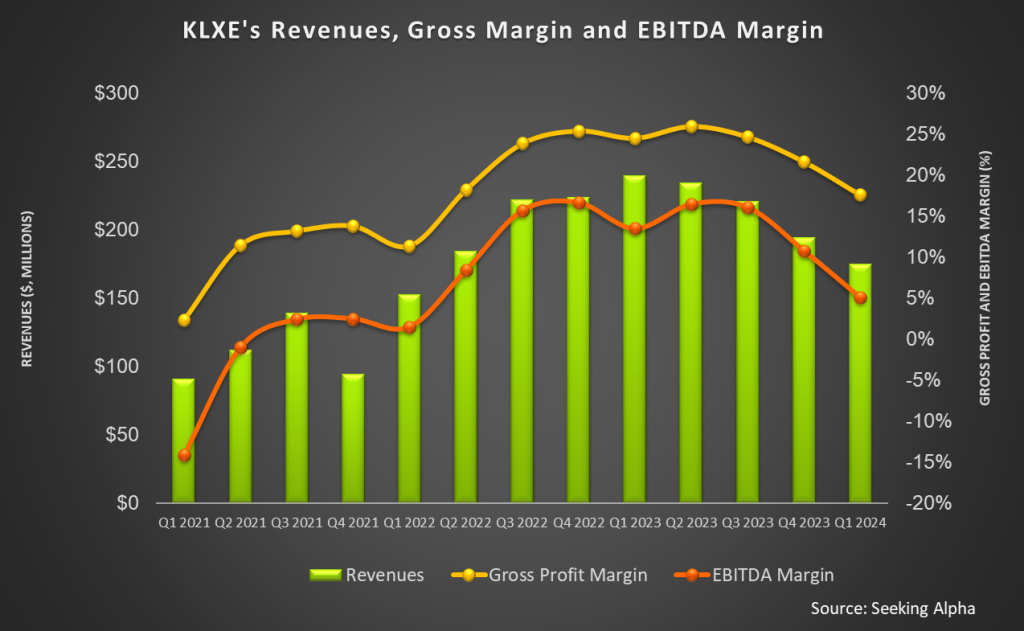

Our short article discussed our initial thoughts about KLX Energy Services’ (KLXE) Q1 2024 performance a few days ago. There, we discussed how KLXE’s technologically advanced products like OraclE-SRT (downhole thru tubing extended reach tool), the KLX PhantM Dissolvable frac plugs, and SpectrA drilling motors are making a difference to the energy operators’ drilling exercises. Its coiled tubing, thru-tubing, and dissolvable frac plug products have put it at the forefront of extended-reach completion capabilities. As a result, its adjusted EBITDA and adjusted EBITDA margin recorded substantial growth in Q1 2024.

However, the company faces operational challenges in the Rockies, Mid-Con, and Permian due to the severe weather conditions. The implementation of safety standards led to lower asset utilization in the Rockies. The typical weather adversity in Q1 and low utilization constrained the operators’ budget finalization. Despite a steady crude oil price and increased crude-directed activity, the upstream companies have kept capex under leash. The other serious concern for KLXE is the decline in natural gas prices. In Haynesville, lower natural gas prices caused an 18% fall in rig count. Several energy companies have curtailed activities and production in the natural gas-heavy basins in 2024.

Q2 Outlook

Since the start of Q2, activity and utilization appear to be improving for KLXE’s higher-margin product service lines. The company also initiated several cost-cutting measures. These factors will likely lead to a higher operating margin in Q2. The company will align its cost structure with the movement in the market conditions to keep the margin stable. In the long term, the company expects investment in LNG to increase demand for natural gas through 2050. If the US LNG export demand rises, it will positively impact the US onshore natural gas-directed activity. So, service pricing and utilization should improve in all the key US basins.

In Q2, KLXE expects revenue to increase by 5%-15% compared to Q1. Its adjusted EBITDA margins can range between 9% and 11% compared to 6.9% in Q1.

Q1 Performance Drivers

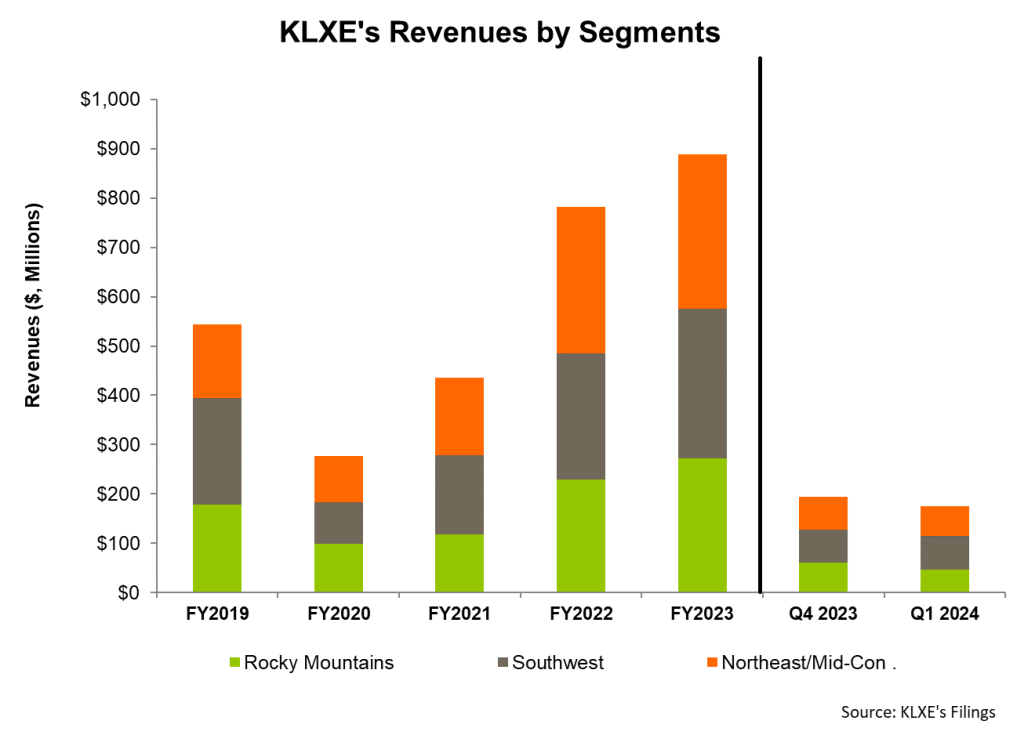

Our short article discussed KLXE’s year-over-year topline and margin by geography in Q1 2024. The Southwest represented 40% of Q1 revenue, while the Mid-Con Northeast represented 34%. The Rockies generated 26% of the revenue. So, its share of revenues from the Southwest increased while the Rockies fell due to seasonality.

Although the company saw a 10% sequential decline in total revenue, three product lines, namely coiled tubing, frac rental, and flowback, experienced sequential revenue increases. Also, during Q1, it implemented several changes to its fixed cost structure related to third-party costs and insurance. So, its margins can improve in Q2.

Cash Flows And Debt

KLXE’s cash flow from operations and free cash flow stayed negative and deteriorated further in Q1 2024 compared to a quarter ago. An extra payroll run and elevated payroll taxes in Q1 put pressure on the cash flow from operations in Q1 2024. Its FY2024 capex budget is in the range of $50 million to $55 million, which is 10% below its original forecast range.

Its debt level remained unchanged in Q1 compared to a quarter ago. As of March 31, 2024, KLXE’s leverage (debt-to-equity) was very high, at 16.8x, due to low and deteriorated shareholders’ equity. As of that date, the company’s liquidity was $128 million.

Relative Valuation

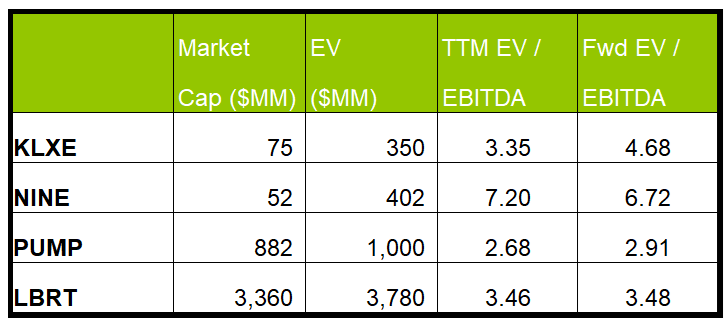

KLXE is currently trading at an EV/EBITDA multiple of 3.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is higher (4.7x).

KLXE’s forward EV/EBITDA multiple expansion versus the current EV/EBITDA is significantly steeper than its peers because its EBITDA is expected to decrease more sharply than its peers in the next year. This typically results in a much lower EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is lower than its peers’ (NINE, NEX, and LBRT) average (4.4x). So, the stock is reasonably valued, with a negative bias, versus its peers.

Final Commentary

In Q1, KLXE’s extended reach completion capabilities helped it improve its operating profit margin. Demand for its coiled tubing, thru-tubing, and dissolvable frac plug products has recently increased. Its current focus is deploying higher-margin product service lines and lowering the cost structure. However, the weakness of natural gas prices and the slowdown of activity in several natural gas-loaded basins can continue to offset the growth prospects in the near term.

As the adverse effects of seasonality relent, KLXE’s topline and margin will likely get better in Q2. Carrying a high working capital load pushed its cash flows further south in Q1. The company’s shareholders’ equity deteriorated further in Q1, making its balance sheet risky. Compared to its peers, the stock is reasonably valued, with a negative bias.