This week’s Market Sentiment Tracker looks at various variables from three main economic engines. The point is to continue to update our readers about the main developments and help them gauge the future trajectory of global economy. We are entering very interesting (read volatile) time as we near 2025.

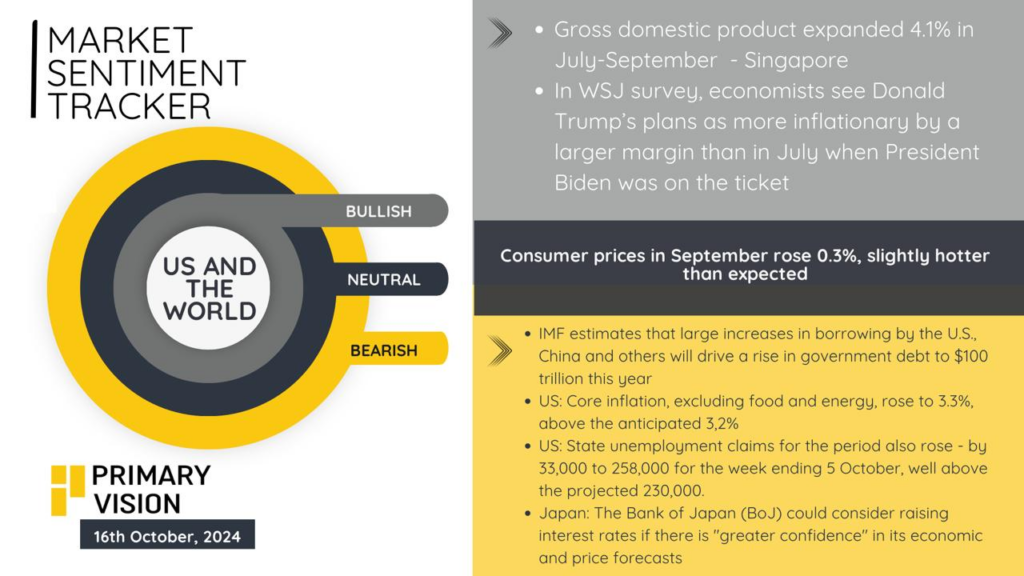

Looking at the U.S. and the world we see that in September, U.S. core inflation, excluding food and energy, ticked up to 3.3%, just above the anticipated 3.2%. The month also saw state unemployment claims rise unexpectedly—33,000 claims were added, bringing the total to 258,000 for the week ending October 5th, surpassing the projected 230,000. Meanwhile, the IMF warns that global borrowing, particularly in the U.S. and China, could surge government debt to $100 trillion this year. Japan’s central bank might consider rate hikes if there’s stronger confidence in its economic outlook. This is in contrast to Singapore’s economy, which grew an impressive 4.1% in Q3.

Additionally, the WSJ survey indicates economists see Donald Trump’s plans as more inflationary than President Biden’s by a larger margin compared to the same survey in July.

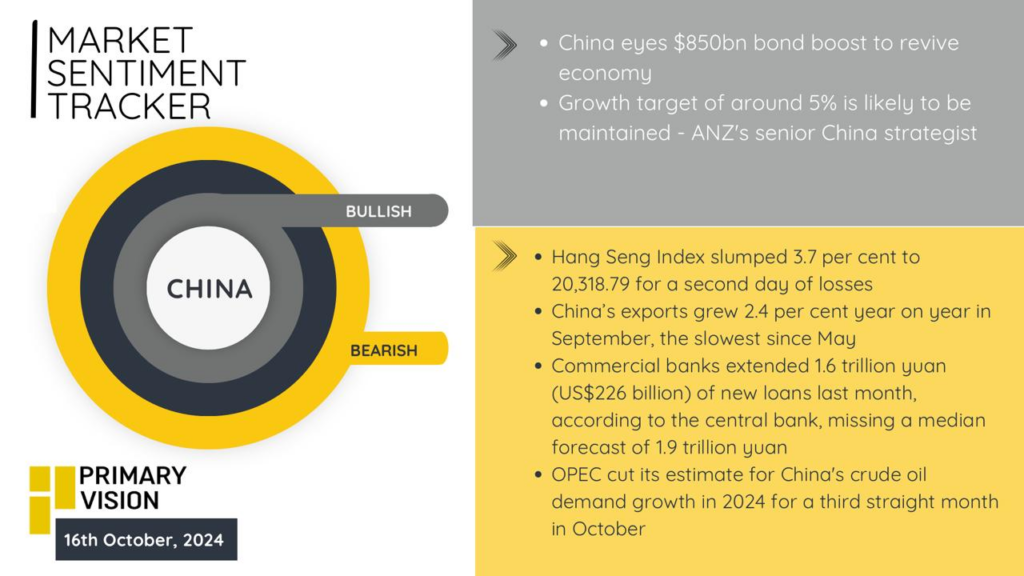

Turning out attention to China – which is probably the most important story when it comes to global economy and particularly oil markets we see that the Hang Seng Index fell sharply by 3.7%, closing at 20,318.79, marking its second consecutive day of losses. Meanwhile, China’s export growth slowed to 2.4% year-on-year in September, the weakest increase since May. Commercial banks extended 1.6 trillion yuan (US$226 billion) in new loans during the same month, falling short of the expected 1.9 trillion yuan forecast. This shortfall highlights the ongoing liquidity challenges.

China is also pursuing a massive $850 billion bond boost to help revive its slowing economy, and OPEC’s revised estimates for Chinese crude oil demand have seen downward adjustments for the third consecutive month in October. Despite these concerns, China’s growth target of around 5% is still expected to hold, according to ANZ’s senior China strategist. The combination of weak exports and underwhelming loan extensions points to sluggish recovery momentum heading into the fourth quarter.

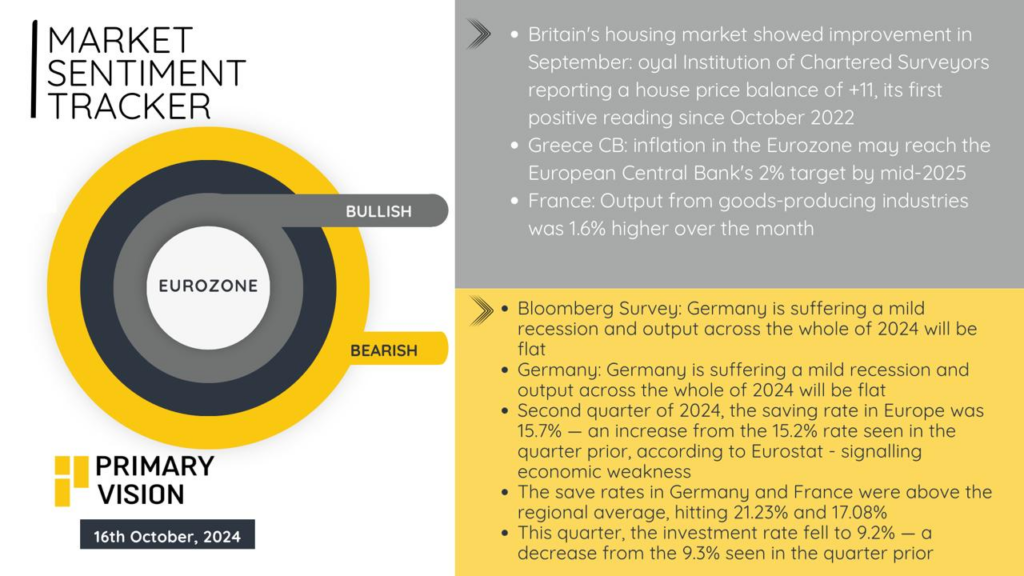

Finally, Eurozone continue to face stagflationary pressures. Germany’s economy is experiencing a mild recession, with output expected to remain flat for 2024, according to a Bloomberg survey. Saving rates in Europe rose to 15.7% in Q2 2024, up from 15.2% the prior quarter, signaling consumer caution amid economic uncertainty. Germany and France reported above-average saving rates, at 21.23% and 17.08%, respectively, reflecting households holding back on spending. Investment, however, saw a downturn with the rate falling to 9.2% in Q3, a slight decrease from 9.3% in the previous quarter.

Britain’s housing market showed signs of improvement in September, with the Royal Institution of Chartered Surveyors reporting a house price balance of +11—the first positive reading since October 2022. Inflation in the Eurozone, according to Greece’s Central Bank, is projected to reach the European Central Bank’s 2% target by mid-2025. Meanwhile, France’s industrial output rose by 1.6% month-over-month, offering a small yet positive indicator amidst the wider regional slowdown.

I will see you all next week with more data! So far the MST continues to point towards the fact that red flags remain and there are pockets of concerns spread across the world economy! We need to be cautious.