The energy markets reacted briefly to the OPEC+ news of a delayed production returning to the market. We’ve been at the front of the line discussing how these cuts were going to be very difficult to bring back to the market. “Eight OPEC+ members will now extend their 2.2 million-barrel-per day voluntary production decline into the first quarter and will begin hiking production incrementally between April and September 2026. Several OPEC+ members will also be postponing the unwinding of a second 1.7-million-barrels-per-day cut until the end of 2026. This latter production decline was previously only set to last through 2025.”[1] Every agency has pointed to bearish supply vs demand data in 2025 that result in sizeable builds across the board. When we look at early demand indications and economic data, it isn’t a stretch to see a lot of this year’s sluggishness carry well into next year. If anything, it will likely get worse through the first half of next year. Chinese stimulus will fall short just given the structural problems that exist throughout the country. The weak Chinese and U.S. economies will remain the biggest overhang as we head into next year.

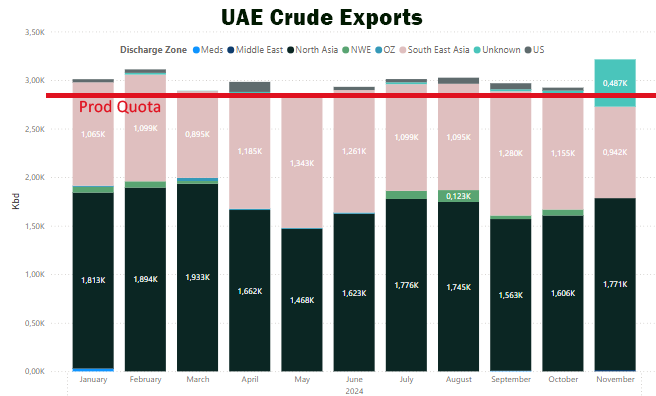

There is also a significant amount of spare capacity in the market with OPEC+ sitting on about 6M barrels a day. The UAE has been investing heavily in their production, and they will keep looking to expand their export profile. The UAE has been (not so quietly) producing above their quota, and we don’t see this adjusting in the near term. It will likely only get worse as more investments are completed and come to market. The physical market has been indicating that we are currently balanced with little panic in either direction.

We will see a very range bound 2025 with little ability to send crude pricing much higher. The risk remains to the downside given the economic backdrop in the market, and I don’t believe there is enough political will within OPEC+ to cut further. Weak demand and economic softness really caps the upside while supply “discipline” keeps the floor. Our base case is that the economic worsens next year, which will pull down the crude prices. Even with the OPEC+ shift, crude markets barely moved higher and brent is already pushing against $70. We believe that the current brent range will be $68-$74 through the rest of this year and into Q1’25. Depending on holiday activity, we could see a break below $68 in late Jan, but for now- we believe that is the current Brent trading range.

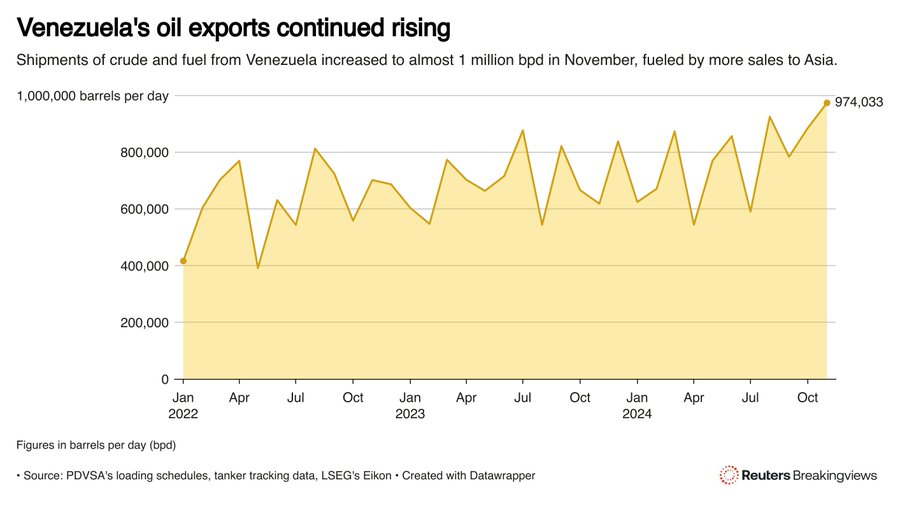

We know there is some non-OPEC production coming online, but as we said earlier- you don’t have to look much past OPEC to see supply growth: “So much focus on the “Non OPEC” supply growth, when in reality VE+Libya+Iraq+Kz+UAE are growing in absolute terms at a faster clip than the rest of the world.” A large part of this production is heading into China, and we should see more Russian and VZ crude move into Asis.

As Trump takes office, we expect to see tighter sanctions against Iran and anyone helping move western equipment into Russia. There has already been a sizeable shift since his election victory, but it will likely ratchet down harder once he is officially in office. This will help take some barrels off the market, but it won’t be able to offset the growth in other areas and soft demand.

I think this is a crazy backdrop when we look at the these items:

- Stocks: all-time highs

- Home Prices: all-time highs

- Bitcoin: all-time highs

- National Debt: all-time highs

- Core CPI Inflation: >3% for 42 straight months, longest run of high inflation since early 1990s

- Fed: cutting rates again in 2 weeks

If you had asked me a few years ago, do you think the Fed would cut into that kind of environment? I would have told you how insane you sounded and the absurdity of the comment, YET here we are! The Fed will likely cut at a time where tightness and restraint is paramount, and this will keep the flames beneath inflation. A second wave of inflation is all but confirmed, as the global economic backdrop continues to crack all over the place.

When you put the above bullet points into perspective, I don’t disagree with any of these potential “gray swan” events Nomura put out.

- Nvidia crash

- Carry implosion

- US 10YY > 6%

- US growth shock

- Geopolitics gets out of hand

- China stimulus falls short

We’ve already been VERY adamant and written extensively on 2-6 with a big focus on each of those topics individually. I don’t think we are going to see a 10yr at or above 6%, but the carry implosion would have knock-on effects that could easily drive it higher. Chinese stimulus has and will continue to fall short as they run headfirst into the Law of Diminishing Returns, which is something the U.S. is now facing.

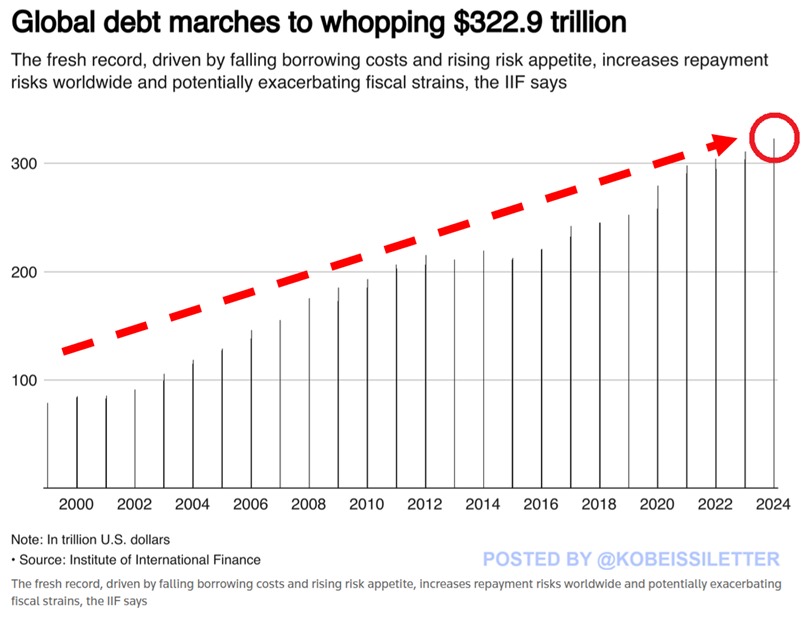

Whether or not the Fed raises rates, we are heading straight into stagflation that will last much longer than the market expects. Many of these issues are not restricted to just the U.S. as the world has a broad debt problem.

Total world debt officially hit a record $323 trillion in Q3 2024.

- Over the last 3 quarters, global debt has skyrocketed by $12 TRILLION, according to the Institute of International Finance (IIF).

- In just two decades, global debt has TRIPLED.

- Moreover, global Debt-to-GDP now stands at 326% and remains above pre-pandemic levels.

- Furthermore, debt in emerging markets reached a near record $105 trillion, or 245% of GDP. Debt is skyrocketing around the globe.

When you look at the risks outlined by Nomura and the global debt breakdown, it becomes a bit easier to understand why the “Carry-trade” and Chinese failed stimulus is the most likely options. The EM debt scenario is the biggest bubble that will have larger ramifications across dollar strength and yields. The U.S. especially the US Dollar still remain the “best” options in a terrible scenario.

The U.S. “safety” status- while intact and supported by weakness in other areas- isn’t immune to math. The U.S national Debt is heading in a crazy direction that is resulting in massive interest payments. The figures below are just staggering and based on the current backdrop- have no real path of change. This is really the only thing holding us up, and tariffs are “backhanded way” to slow consumption by raising prices for the cheaper options

Inflation in the U.S. is being driven by many things- government stimulus and lose monetary policy. While monetary policy was “tight” for a short period of time, government spending NEVER slowed down (as you can see above), and now we have the Fed cutting rates and LOOSENING monetary policy. This is probably one of the worst scenarios we could face from an inflationary perspective, and I don’t think it’s likely that Trump reduces spending. I would love if that were the case and we got at least closer to balancing the budget- but it’s highlight unlikely. We will see spending reductions and cuts in other areas, but I don’t think it’s likely to see bigger reductions.

When we look at the geopolitics, there have bene some sizeable shifts that I believe will lead to peace and not additional conflict. I’m by no means saying that the current conflicts are ending tomorrow or even in 2025, but the shifts on the chess board are meaningful.

- In Syria, the rebels have made significant headway quickly passing through Aleppo. They’ve quickly progressed into Hama, and taken possession of MiGs and unguided bombs.

- Russia has been evacuating for a few weeks, and I believe this was the impotence for the actions of the rebels.

- Russia started by pulling back equipment from the front and moving equipment onto freighters.

- The last thing to be pulled out is normally anti-missile/aircraft defenses and they are now enroute to the port of Tartous.

- There are rumors that Assad has fled the country, but it’s unconfirmed at this point.

- There is going to be a lot of jockeying for position in the make-up of the future government given the conflicted interests between Turkey and the U.S. and their proxies on the ground.

- The Turkish backed SNA and U.S. backed SDF will likely be fighting for broader influence.

- Turkey recognizes the Kurds as terrorists (some worse than others), but it will be interesting to see how this shakes out.

- Israel has been bombing chemical facilities and storage as Assad’s soldiers’ retreat. They don’t want the weapons to fall into the wrong hands.

- Iran has to be watching this with concern as Israel effectively destroyed all of their missile and air defense, and it’s VERY unlikely they get replacements from Russia.

- Hezbollah is also going to lose one of their main corridors to get equipment- so this will also have broader ramifications for Hezbollah, Hamas, and Houthis.

- Africa is shifting a bit as well as several countries tell France they have to leave, but don’t think Russia is going to backfill some of these areas. Russia is pull information from MENA in order to redirect it back to Ukraine.

Fighting will continue across the board- but Russia retreating will usher in a sizeable change. I’ve said this countless times, but Iran’s regime will fall by 2030. I think we are much closer to peace in the region than we’ve ever been (I know- famous last words), but nothing ever happens in a straight line. There will be peaks and valleys along the way, but the path has been set for the better.

The GCC (Gulf Cooperation Council) will play a pivotal role in shaping this going forward, which is why I believe Qatar has remained very quiet. They’ve found themselves on the wrong side of history multiple times over the last two decades, and I think they are waiting to see how everything unfolds.

The China story will develop as Trump prepares to take office, but we will likely see some pivots in the first quarter.

We will write more on this next week and a breakdown of some of the proposed Trump tariffs.

- https://www.cnbc.com/2024/12/05/opec-members-to-delay-oil-production-increase-until-april.html