Volatility, uncertainty, and shifting fundamentals—these are the forces shaping today’s oil and energy markets. As Brent crude flirts with the $70 threshold and OPEC+ recalibrates its production strategy, the U.S. shale industry faces a pressing question: Can frac activity hold steady if oil prices keep sliding? Meanwhile, global supply chains are being reshuffled, with Brazil’s regulatory crackdown on offshore drilling and Asia’s crude import slump adding new layers of complexity. In this issue, we break down the critical developments driving the energy sector. From TechnipFMC’s strategic outlook in 2025 to ProPetro’s evolving frac strategy and the broader macroeconomic signals that hint at a potential global slowdown—these stories aren’t just news. They’re indicators of where the market is heading next.

1. MMV: How Far Can U.S. Frac Activity Hold if Oil Prices Keep Falling? – PREMIUM

With oil prices under pressure and OPEC+ increasing output, the U.S. shale industry is at a crossroads. Can frac activity remain resilient, or will capital discipline force a slowdown? This article unpacks the latest data on Frac Spread Count (FSC) and what it signals for the future of shale production.

2. MST: Could Trade Tensions and Economic Contractions Signal a Global Recession Ahead? – PREMIUM

With Europe’s economic struggles, China’s deflationary concerns, and U.S. market volatility, global recession fears are mounting. Is this the beginning of a major downturn, or just a temporary slowdown? This article explores the warning signs and what they mean for markets worldwide.

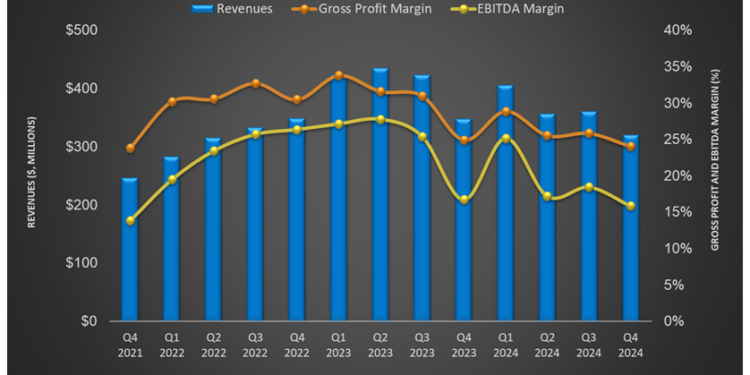

3. ProPetro’s Perspective in Q4: KEY Takeaways – PREMIUM

ProPetro is holding its frac spread steady, but the real story is its push into electric fracs and natural gas-fueled power generation. Will this strategic shift give the company an edge in an evolving industry? This article breaks down what investors and industry players need to know.

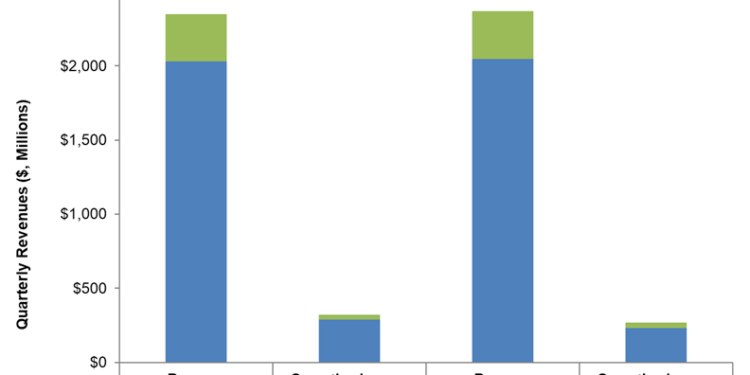

4. TechnipFMC: Q4 TAKE THREE – PREMIUM

TechnipFMC is navigating a booming subsea market with a growing order backlog and cutting-edge technology like Subsea 2.0. But will its momentum carry into 2025, or will headwinds like seasonality and shifting industry dynamics slow its progress? Dive into the company’s financials, strategy, and what to watch in the months ahead.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co