OPEC+ has once again captured the oil market’s attention with its decision to gradually raise output from April 2025, a move that was long anticipated but remained uncertain due to shifting geopolitical and economic factors. Oil prices had already been under pressure in recent weeks, with Brent crude sliding below $71 per barrel and WTI hovering around $67.8 per barrel. The decline reflects broader market sentiment that global supply is more than adequate, and any additional barrels from OPEC+ could intensify the bearish outlook. However, the true impact of this production hike extends far beyond just crude prices—it directly influences the trajectory of U.S. shale activity, particularly the Frac Spread Count (FSC) and overall completion dynamics.

The latest data from Primary Vision highlights a measured increase in U.S. frac activity, with FSC ticking up to 210 active spreads. While this marks a modest weekly gain, the year-over-year decline remains stark, with 53 fewer spreads in operation compared to the same period last year. Frac Job Count (FJC) has dipped slightly, falling by three week-over-week to 222, reinforcing the cautious approach taken by shale producers. Despite the upward revision in OPEC+ production quotas, U.S. operators have yet to signal an aggressive response. Instead, the data suggests that capital discipline continues to outweigh any temptation to chase volume growth, particularly given the downward pressure on prices.

The decision by OPEC+ to gradually unwind 2.2 million barrels per day (bpd) of production cuts over the next 18 months underscores a belief that market fundamentals remain strong enough to absorb additional supply. However, internal divisions within the cartel are evident. Countries like the UAE and Russia have been pushing to ramp up output, leveraging their growing production capacities, while Saudi Arabia has remained hesitant, wary of triggering a supply glut that could push prices even lower. Complicating matters further, geopolitical developments—including Trump’s potential easing of sanctions on Russia and his renewed focus on curbing Iranian oil exports—have injected further volatility into an already unpredictable market.

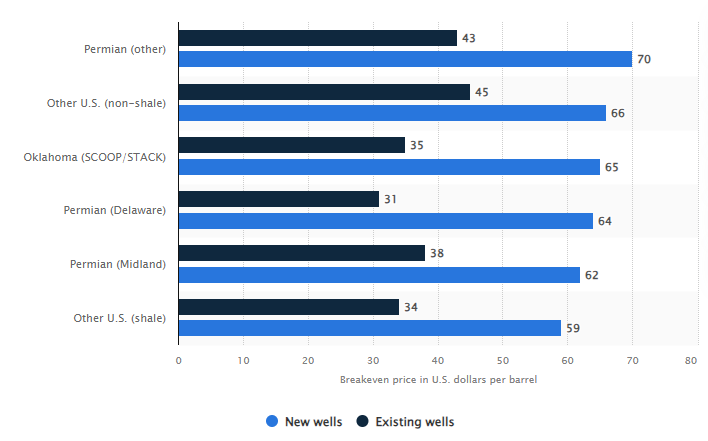

If WTI prices continue to decline toward $65 per barrel, regions with higher breakeven prices, such as parts of the Bakken and Eagle Ford, may experience a more pronounced reduction in fracking activity. Operators in these areas might scale back operations to maintain profitability, leading to a potential decrease in the FSC. Conversely, the Permian Basin, with its lower breakeven prices, may maintain steadier activity levels despite the price drop. It’s important to note that while breakeven prices provide a threshold for profitability, operators also consider factors such as cash flow, debt obligations, and investor expectations when making operational decisions. Therefore, the response to declining oil prices can vary among companies, even within the same basin.

Source: STATISTA – Average WTI price needed for U.S. oil and gas producers to stay profitable by well status in selected U.S. oilfields as of 2024

With completions activity remaining subdued, many service providers are keeping equipment idle rather than deploying spreads at uneconomical rates. With marketed hydraulic horsepower (HHP) still exceeding active demand, pricing power for completion services remains weak. Any additional pullback in activity could place further strain on the service sector, forcing consolidation or fleet retirements to restore balance. The current environment is markedly different from previous cycles, where operators responded to price volatility with rapid shifts in drilling intensity. Instead, today’s shale industry remains more measured, prioritizing returns over production growth, and this discipline could extend the lag between price signals and frac activity.

Looking ahead, the response from shale producers will depend on whether OPEC+ remains committed to its production increases or if the group recalibrates its policy in response to market weakness. If global demand shows signs of softening further, or if geopolitical risks disrupt supply chains in unexpected ways, OPEC+ could reconsider the pace of its output hike, potentially offering price support. Until then, the U.S. frac market remains in a holding pattern, with operators balancing efficiency-driven completions against uncertain price conditions. The coming months will reveal whether the recent uptick in FSC represents a short-term adjustment or if it signals a more sustained shift in completion trends. Either way, Primary Vision’s data will continue to provide critical insights into how the shale industry adapts to this evolving landscape.