By Mark Rossano

Crude prices have remained range bound with competing pressure points up and down. U.S. production has hit the top end of our target-11.7M barrels a day as we head into 2022. We expect to see more rig activation as companies ramp capacity to build DUC inventory to kick off Q1/Q2 strong. Costs continue to shift higher across raw materials and labor with little slowdown in the coming few quarters. Raw material prices should stop going higher, but we don’t see a big price shift lower on key steel, parts, and general equipment throughout next year. This will keep internal inflationary pressures elevated as wages also drift higher with OFS seeing a large run up in wage pressure (chart on it below). Inflation is sitting at a 39 year high, which will give way into stagflation as the “rate of change” of inflation slows. The physical crude market remains a broad overhang as movements of product slowed in January following Asia purchases being curbed.

Angola is still seeking buyers for about a quarter of its crude exports for loading next month, said traders familiar with the matter. China’s independent refiners have been buying less over the past week, they said.

• Angola has yet to sell 9-10 cargoes of crude for January loading out of 37 scheduled

o That’s slightly weaker than a month ago when 8 shipments for December were yet to find buyers out of 37 planned, according to estimates compiled on Nov. 9

Two cargoes of Djeno crude are still seeking buyers from six planned shipments

• That compares with 1-3 December shipments being unsold out of seven scheduled as of Nov. 18

• The next Djeno loading program for February is due around Dec. 24

India’s November Demand for Oil Products Falls Most in 15 Months

India’s oil-product consumption in November fell 11% y/y, down the most since August 2020, to 17.1 million tons, according to provisional data published by the oil ministry’s Petroleum Planning & Analysis Cell.

• Gasoline consumption was at 2.65 million tons, -0.7% y/y, down the most since February

• Diesel consumption was at 6.51 million tons, -7.6% y/y, down the most since February

• Naphtha consumption was at 1.13 million tons, -19% y/y, down the most since August 2020

• LPG consumption was at 2.34 million tons, -0.4% y/y, down the most since May

• Petcoke consumption -12% y/y to 1 million tons, the lowest since April

This also comes on the back of another record of fuel oil in China’s storage.

The shift in PADD3 U.S. storage continues with more crude being left in PADD2 and Cushing as well as in floating storage. Refiners along the GoM will keep managing flows to marry refinery runs to avoid big spikes of crude and product storage to minimize their year end tax bill. The flooding in Canada and fully operating Line 3 has kept imports from CA into the U.S. robust, which will remain the case through at least year end. This will also keep exports elevated averaging between 2.8M-2.9M to help balance out storage- especially as we see some additional flows into Europe.

Loading schedules remain fairly stable here with some one off December cargoes likely to get added, but for the most part- most of it will be locked in. Russia flows moved back over 4M, which is the first time since June ’21 and before that it was April ’20. Norway’s 2nd phase of expansion is estimated to be completed by Q4’22, which will bring on about another 250k barrels a day with all of it being pushed into the international market. We did get some prices moving higher in the North Sea with Forties strengthening 15c after dropping 25c at the end of last week/beginning of this week. So we are still fairly range bound, which is also being played out in the crude paper markets.

The crude futures market remains around $71, and the end of year inflation trade adjustment will be the biggest driver. We don’t see a lot of upside risk in the near term, but a likely degrossing event as institutional investors factor in Powell and the Fed’s next steps. A large part of the inflation trade was unwound starting the Friday after Thanksgiving and continuing into the following week. There should be some stability at this pricing level, but as Cushing grows and global crude purchases remain sluggish into yearend- we expect a drift lower to about $67. The chart (on a technical basis) is starting to turn a bit more bearish, so this is just a word of caution to those still long to make sure you maintain some tight stops.

• China and Evergrande Update

It is now “official” that Evergrande has defaulted, but what happens next is the great unknown given the country resides in China. For those that have been through Chinese bankruptcies (myself included), the course of the proceedings, who is involved, and the underlying “waterfall” can change at the drop of a hat. All of a sudden you get layered by some government or local agency that was NEVER in the cap table, or you will be pressured (at risk of losing all recovery) to sign a reduced equitized position in order to move into the reorg. There are countless stories out there that highlight the underlying risks and difficulty of recovering your investment- even if it was purchased at depressed pricing. Evergrande has now moved into restructuring after “Fitch said the company had not responded to its own request for confirmation about whether it had met or missed an $82 million payment to bondholders due on Monday, which prompted the ratings firm’s Thursday move.” This Evergrande move also follows closely to Kaisa: “Fitch on Thursday also put Kaisa, another large and distressed developer, into its “restricted default” category after the company failed to pay bondholders $400 million earlier this week.” The writing has been on the wall for some time as the government pushed Evergrande executives to pledge personal capital and assets to use as collateral against new borrowings. This was a last-ditch effort to avoid bankruptcy, but as the government sent a “working group” it became clear that a structural default was a foregone conclusion. The question now: What comes next?

The CCP has softened a bit on their views of the property market. The government is moving to support the commercial housing market, but I think that means in restructuring and not as the companies currently sit. This is a huge problem because every asset has millions if not billions in Wealth Management Products (WMPs.) How does the government make the consumer whole? Many of these consumers poured their life savings into these products that are not effectively worthless. This is why consumption and property are so closely linked (in my view) as many have lost the ability to spend. The WMP works as a fundraising scheme for the development company. For example, Evergrande is looking to build 1k units. They finance it through pre-sales, bank/ investor debt, and issuing WMPs to retail customers. Retail investors give money and in exchange receive a cash flowing vehicle financed either through rent or the final sale (completion) of the entity. There are many times that the WMP buyer is also a buyer of one of the units, which means they are exposed on two sides: presale down payment AND a wealth management product. The government can step-in and push for a restructuring to push the company to complete these unfinished projects. There is a huge disconnect between finished and uncompleted assets that it will be difficult to get the full backlog completed in any type of meaningful (or realistic) time frame. This will leave people with near total loss or at least money that won’t be returned for years to come.

We have been discussing a RRR (Reserve Requirement Rate) cut for months, and it was finally delivered this week. My view was a cut would be focused on the Small and Rural banks because the big banks have been able to maintain operations more effectively. This would also direct more money into the micro and SMID capital companies. Instead, it was a broad cut that will unlock about 1.2T Yuan. The reason for the sweeping reduction was to offset the maturity of a 950B Yuan medium-term lending facility. So the net liquidity injection is about 250B Yuan, which coincides with the period the PBoC normally starts increasing available capital into year end. The key will be- how much is left in the system in January? Typically, the PBoC will make more capital available in front of month, quarter, or year end and spends the following 10 days removing the excess liquidity in increments to not shock the system.

The CCP has already increased the amount of tax cuts and tariff forgiveness in order to inject capital to local companies. This is why we have seen a fairly limited amount of demand for borrowing/credit from companies. China Beige Book came to a very similar conclusion with the below chart showing the pent-up demand for credit in China. There has only been a small adjustment higher in demand for capital as we head into Q4. We don’t see a huge shift next year either as Jan/Feb slows a bit more than seasonal norms given the Winter Olympics taking center stage as well as the Communist Congress that will likely (in my opinion- DEFINITELY) see Xi named President for life.

The borrowing for Chinese firms also remains low for micro and SMID capital companies while large firms saw a big uptick. The increase at the large scale has been driven by the property developers that have been struggling to raise capital and were finally given the green light by the CCP to hit the onshore market. This led to the Q4 spike while the rest of the firms have seen a steady DECLINE in borrowing demand. The growth of capital in the country remains lukewarm as many companies and governments are already struggling under a mount of debt. As banks keep trying to reduce their leverage ratios, there has been an increase in loan rejections at the SME level and decreasing loan activity in the back half of Q4. None of which points to a lot of strength heading into Q1 on a credit impulse side.

While there hasn’t been a big increase in credit impulses, there has been a stabilizing factor that has been rolled out as the PBoC tries to manage liquidity levels around current levels. We do see a drift higher in available cash, but it will be measured to maintain a “prudent” level as the PBoC has been stressing. This is why we do agree with the below chart that we will see a bounce, but not an aggressive bounce implied by the dotted line. Instead, we are seeing signs it remains negative and hangs around the region seen in ’15 to’16. This will allow for some growth from current levels, but still maintain a restrictive stance on monetary growth to reduce excess liquidity that still remains.in the system.

The underlying indicators still point to a “tighter” policy stance as we head into 2022. This will keep a lid on PBoC actions as debt and underlying leverage remains a key focal point.

The dashboard above did show some signs of a liquidity boost, which has been persistent for several months and why we always believed a RRR was likely into year end. But, we the new data on CPI and PPI still show a lot of inflationary pressure across the system, which is happening in a restrictive monetary policy. While we see some divergence between the PBoC and Fed next year, it won’t be a sweeping shift in easy monetary policy but rather a measured approach to keep things fairly tight.

Economic pressure remains in China especially on the consumer as service PMI weakened further, and we believe it falls further to around 50-51 as retail spending stays tight. Companies have been raising prices internally to try to pass on some of the rising costs, but the CCP has tried to limit the amount passed thru by offering up incentives and tax reductions to help offset. By reducing taxes/ tariffs further, it is cutting another key revenue stream for local/regional governments that are already cash strapped and now being asked to invest in more infrastructure projects.

“In the face of an economic slowdown, a rebound in infrastructure investment is expected as China will enhance its financial support, said Wang Tao, director of Asian economic research at UBS. Thanks to vaccine boosters and better administration, the Covid-19 situation in the country could be eased, prompting consumers to spend the money they have saved for so long, Wang added.” We have been discussing the LGFV (Local Government Financial Vehicles) and SPBs (Special Purpose Bonds) that are completely underwater and a huge driver of why governments are struggling. A large part of current tax revenue is being used to pay for the loans/ bonds, so even though there may be a “directive” to invest more on infrastructure- I don’t see it all that likely. It will be difficult for governments to invest in broad based projects- especially since they have been complaining about the lack of viable projects to even invest the current allotments of SPBs.

Many of these governments are still unsure of the fallout from the real estate sector, and what kind of losses or write downs they may be taking. The defaults are still far from over with more pressure coming over the next few months.

There is still a huge funding gap that the government is watching when it comes to developers’ ability to raise capital. Governments may have to divert capital to these areas, and file it under “infrastructure” to keep assets somewhat solvent and avoid a huge default.

Land sales have also been a way for local governments to raise proceeds, but as the pressure has grown on developers and the backlog of projects- land sales have fallen through a floor.

Both investment fronds have come under pressure as land newly acquired has diminished. We don’t see a huge shift higher, but more of a stabilizing function- which echoes our earlier views when considering the PBoC focus. The central banks wants to stem.

Inflationary pressures also limit the amount of easing that can be rolled out from the PBoC as there is still a lot of slack in the system. All leading to a more “measured” approach to addressing 2022, and ways to stimulate the economy going forward.

There is still downward momentum on commodities given the leading indicator of credit impulses, and while we see a bit of a bounce- there is still a large amount of mispricing. China isn’t heading into a broad easing cycle, so there still remains little support for where commodities are currently prices. There is a lot of downward pressure that will cycle into the market as the “reflation” trade comes undone, which really kicked off the Friday after Thanksgiving.

• U.S. Stagflation to Take Hold

This leads broadly into the stagflation backdrop as we see a lot of countering pressure points on a global level- especially in the U.S. Sticky inflation remains a big driver higher as the backdrop of wages, rent, and other key input costs remain elevated with little to bring prices down in the near to medium term. We are seeing the pace of price increases slow, and we expect to see that trend continue through Dec and into Jan/Feb of 2022. This will give way to another acceleration next year as costs flip from supply chain driven to broader wage inflation. Some of the recent spikes will abate, but not into a deflationary trajectory, but rather small growth (.1%) to flat expansion. This is going to be a problem as the Fed faces the need to accelerate tapering and increase rate hikes

I still believe that three rate hikes are in play, but at least two will happen next year as the focus remains on addressing inflationary pressures. Powell is getting more concerned now because of the prolonged shift that is now driving up “Sticky” inflation with little to stop the rising tide. While “flexible” inflation will slow, it won’t do anything to stop the rise of sticky inflation over the coming months. This keeps me firmly in the “at least” two rate hike camp and an accelerated taper.

The flattening of the curve helps to really drive home that we will see some more aggressive action from the Fed because the yield curve has never flattened without an actual rate hike. The Fed has become more of a “reactionary” entity and not “proactive” so the positioning of the curve essentially gives them the green light to take action.

The movements by the Fed and central banks globally have pulled forward a large part of the business cycle. We are coming to a point of reversal when we look at ISM Manufacturing and the business cycle. Based on the leading indicators, we don’t expect a huge drop in ISM data, but rather a sideways move that will drift lower as price increases slow/slightly reverse, and consumers slow down their purchases. This will bring down “new orders” and give companies a chance to keep catching up on backlog and add a bit more to inventory. This is just another indicator showing a broader slowdown is coming in the U.S. economy, but it also has bigger implications as other countries are facing a similar “Cooling off” when it comes to internal economic growth expectations. Global economic data continues to surprise to the downside while inflation surprises to the upside- putting a lot of pressure on next year’s economic growth projections. The issues will only expand as central banks raise rates and governments reduce spending, which will create a fiscal and monetary drag on economic growth.

Some of the more flexible inflation contributors can adjust lower- especially on the gasoline side. There could be reductions, but they won’t be large deflationary drops- rather a moderation from current extremes. But, the less flexible- healthcare, housing, utilities, remaining contributors remain elevated and will still grow while some other components normalize. This will keep pricing and underlying inflation locked higher and giving way to a stagflation backdrop.

This will start to weigh on corporate margins as consumers slow their spending and balk at the elevated prices. So far- companies have been able to pass on costs to customers, but that ability is starting to slow as we have seen from various surveys: Univ of Michigan, Consumer Confidence, Gallup and other checks on the health and willingness of the consumer to spend.

U.S. consumer prices rose 6.2% in the 12 months through October, the most since 1990. The new data on corporate earnings suggest business can comfortably pass on all its higher costs, which means there may be more inflationary pressure to come. “If profits are strong, there’s going to be continued demand for workers, and in a tight labor market there’s going to be continued upward pressure on wages and compensation,” says Robert C. King, director of research at the Jerome Levy Forecasting Center in Mount Kisco, New York.

The drive higher in wages- even as supply chain costs ease- will keep underlying costs elevated for companies across the globe. Participation rate remains lack luster as productivity also comes under pressure.

Weaker picture in 3Q21 than initially reported … productivity -5.2% vs. initial -5.0% (now worst rate since 1960); unit labor costs +9.6% vs. initial +8.3%. The lack of participation and the loss of productivity is hitting margins directly when we look internally at some of these companies and underlying margin.

The unemployment picture has improved, but right inline with our expectations from March 2020. We expected a quick bounce off the bottom, but a very slow/languishing recovery back to “normal.”

Wage growth shifted higher again- especially for the lowest earners, but when we look at the data adjusted for inflation- the picture isn’t as good. The shortfall of wages vs inflation is going to keep upward momentum on the underlying CPI calculation as companies try to adjust for inflation. But, we have already heard from Google that they won’t be adjusting all wages for inflation. This just means that living standards will be under pressure as some employees won’t be able to keep up with the rising cost of living.

There has been wage pressure across most industries, and while it slows in some areas- it will accelerate in others keeping upward momentum on these key pieces of the calculation and one of the biggest expenses for a company.

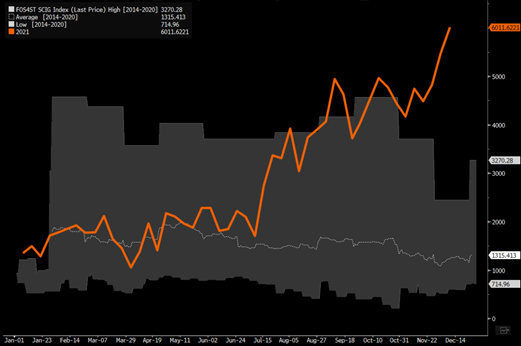

Oilfield services (Energy Equipment & Services) will remain a big overhang as we head into ’22, which will get another push higher as parts, equipment, and raw materials remain elevated. This will push OFS pricing higher as it is passed on to the E&P companies. We expect to see some normalizing prices out of hospitality and other wage risk areas, but we see most (if not all) the slack getting picked up across other parts of the chart above.

Savings have normalized back to Dec 2019 levels, so the excess cash people had in their bank accounts has now been drained and wages are not keeping up with inflation. This will drive broader shortfalls on spending, and the slow down in consumption will help the supply chain catch up with itself.

The U.S. has been able to pas on the most cost out of the OECD countries, but the ability to keep passing them on is diminishing- especially as savings normalizes and wages fail to keep pace.

We have started to see the rate of price changes slow in some key leading indicators, but they aren’t falling- just going sideways. There is still a lot of cost throughout the system that is going to also get imported into the U.S. as PPI and wholesale prices rise exponentially with our key trade partners.

China, South Korea, Japan, Europe… essentially all countries are seeing their PPI and wholesale prices shift higher or at least hold the all time highs. This will result in elevated export prices, which will get imported into the U.S. and across the supply chain. If say Japan imports components from China/ SK that will increase the underlying price of the final good that will be shipped into the U.S. market. The push higher in costs will attempt to get pushed through with price increases, and because there is pressure across the system- we aren’t going to see this reverse course any time soon. Instead, there are many counterpoints that will keep things elevated- wages, rent, housing, and raw material (semi-finished goods). It won’t be enough to drive inflation that much higher, but it will be enough to keep the pressure and maintain a “stagflationary” backdrop.

This will keep the “sticky” inflationary pressure higher even as the flexible inflation cools off after reaching a new record and the highest since 1982.

There is a lot of conflicting points that are emerging that leads us into the stagflation camp. The easy monetary policy is only increasing the pressure across the system, which is why Powell will be accelerating the taper process. Because the U.S. has spent the last 40 years exporting inflation and our underlying supply chain, we will be impacted by other countries and their inflationary pressures. So while the Fed will react, their effectiveness will be limited as the move has been parabolic in the U.S. and around the world.

We do remain in a raising rate cycle- globally speaking- which will help slow some price increase, but it will also increase the fiscal drag on the Emerging Market world. The cut to spending will have broad impacts around the world, but will bite hardest at the emerging market level.

The emerging market pressure is growing with Turkey the poster child for mismanaged policy and what can happen to the underlying economy. The earnings cycle is already rolling over- with little to provide support over the next few quarters.

The inflation surprises will have to cool down before investors start to increase flows into these countries, but that will take more aggressive policy action and a broader slowdown.

2022 is going to be a difficult year with competing trends on a global economic level. Supply chains will start to ease as we head into Q3 next year, which will be helped as retail slows down their spending/purchases. But, corporations and wholesalers have a record low amount of inventory, and will use some price softness to pick up some spare inventory. This will provide a bump to the GDP calculation and the underlying economy, but it will be lumpy and not consistent depending on price. The bigger problem will be a slow China and a struggling Emerging Market that will keep the pace of the global economy capped. A lot to discuss in the weeks ahead and to kick off 2022.