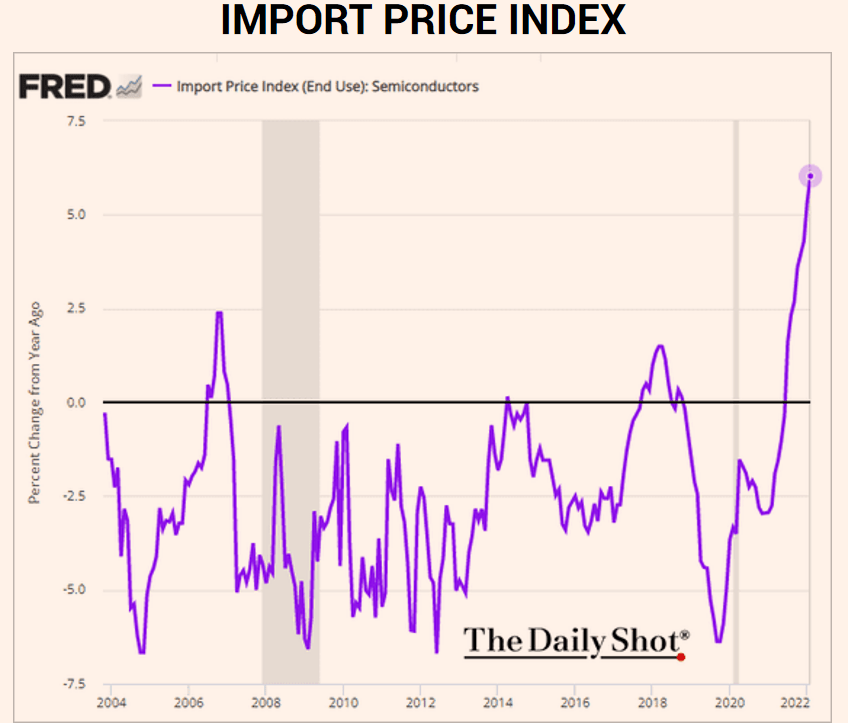

Unfortunately, the Russian-Ukrainian situation seems not to settle down anytime soon. The fighting has continued however, the positive development is that Ukrainian forces have been able to fight back. Equally concerning is the economic fallout of this war especially in terms of energy crisis and food inflation – the latter is rarely discussed (but Mark has been mentioning it ad nauseam in our ECON shows). The energy crisis is creating all sorts of problems particularly in the European continent. Besides rising gas prices, the cost of living has increased tremendously. I have been personally speaking to people in the UK, Netherlands and Germany and trust me that they are not happy. Many faced issues in heating their homes! Similalry, discussions with my friends and acquaintances from Asia and South East Asia along with MENA region gave a realistic outlook of how inflated food prices have been hurting the common man. For instance, in Egypt, 70 percent of wheat comes from Russia, Ukraine. Few weeks ago 8 containers headed to Asia couldn’t make it there due to issues on Black Sea. Meanwhile, in Pakistan car prices were increased yet another time and it now feels that it is almost a bubble waiting to go burst. The chart below shows why should we expect car prices, inter alia, to go higher. Semi-conductor prices are going berserk!

Sri Lanka is facing a dull blown economic crisis as the country is left with no reserves to import all the essential items it is dependent upon. So much so they had to cancel examinations because they couldn’t pay for paper!

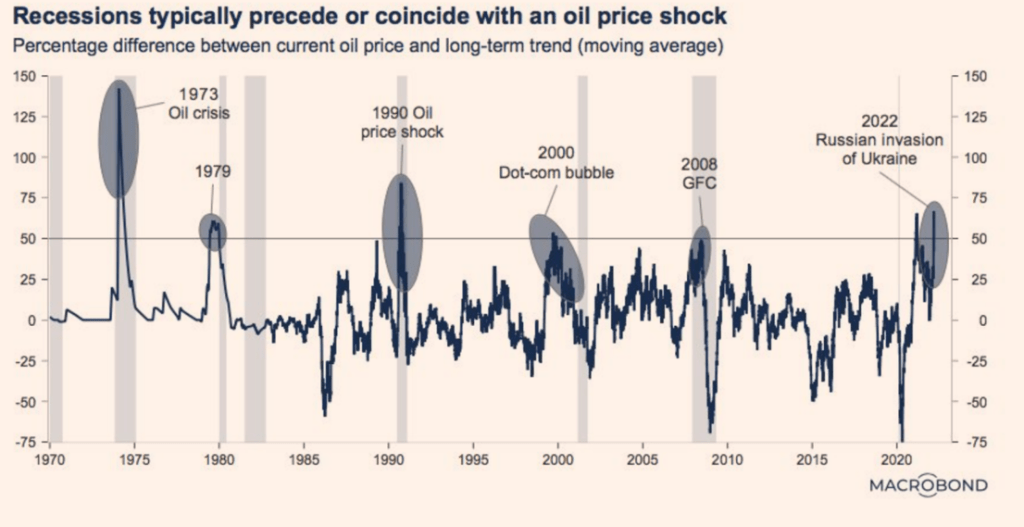

Also, let’s not forget the sea-saw of oil prices lately. I have continued to hold that prices will not stabilize until there is an Iran deal but also the overall mileu should be conducive. A prolonged escalation will diffuse the impact of the announcement of a successful JCPOA. What is worrying is that oil prices are spiking at a very wrong time. There global debt has risen to 315 percent of world GDP and out of this recent increase (it hit 265 percent in 2020), more than 80 percent has been from the emerging markets! Rising interest rates will appreciate the dollar against basket of other currencies and can make it very difficult for EMDEs to service their debt.

The effect of all these developments mentioned above and what we at Primary Vision have been talking about especially in regards to an impending crisis – which I personally believe will be a redux of 2008 only worse – can be seen happening, unfortunately, in Sri Lanka lately. The country is undergoing a full blown economic crisis. The crisis has been brewing since 2019 and in September 2021 there was news how revenue by tourism sector that contributes 10 percent to their economy has fallen to $2 million/month from $480 million/month 2 years ago. Foreign Direct Investment has fallen fto $548 million in 2020 from $1.6 bn in 2018 and $793 million in 2019. Inflation has hit 15 percent while food inflation is at almost 26 percent.

It is essentially a Balance of Payments (BoP) crisis as reserves have fallen 70 percent in last 2 years and now stands only at a paltry $2.5 billion. The country has $4 billion of payments due this year by July in international bonds and other debt servicing. However, and unfortunately, this isn’t only a special case but was discussed at length by Mark Rossano and I at Primary Vision Network – Frac Spread Count ECON shows and research articles. We will see such crisis happening especially in the developing world as the global economy grapples with elevated inflationary pressures. Rising U. S. interest rates, soaring oil prices and threat to food security will only exacerbate this.

Sri Lanka is expected to default on its debt and is in talks with International Monetary Fund and The World Bank to avert such a development.