- Halliburton sees higher capex and US onshore rig count growth from the private operators in 2022

- It will prioritize short-cycle projects and many international regions driven by the crude oil price incentives

- Its completion tool order book increased substantially, which improves its revenue visibility in 2022

- HAL will curtain long-term investment, which can adversely affect its offshore energy service activities

- Negative cash flows are a concern, although it plans to improve free cash flows by the end of the year

The Medium-Term vs. Short Term Outlook

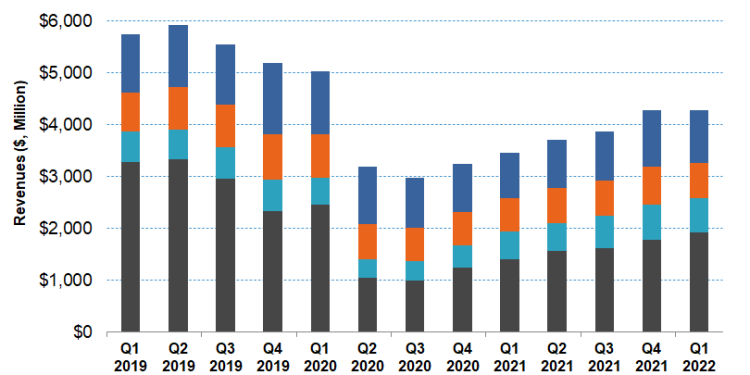

After the first quarter of 2022, HAL’s management revised North America capex to increase by over 35% year-over-year, up from 25% in the previous estimate. Much of the US onshore rig count growth will come from the private operators. So, it expects free cash flow generated in the US will increase in 2022. However, the Drilling and Evaluation division may stall due to lower software sales, although global drilling activity recovery can mitigate the headwinds and result in low- to mid-single-digits sales growth in Q2. Operating margin, however, may contract by 125 to 175 basis points. In the Completions and Production division, pricing will improve rapidly in North America. The completion tool order book increased by 50% year-on-year in Q1. As a result, revenue can grow in the mid-teens while margins improve by 350 to 400 basis points. Also, in 2H 20222, the international market is likely to see new projects, particularly in the Middle East. So, the division can see profit margin improve in Q2.

Explaining The Short-cycle vs. Long-cycle Strategies

Two of the prominent strategies for HAL are cash flow maximization in North America and integration of automation and digital technologies. The spurt in crude oil price and inventory reduction is a testimony to a possible multi-year upcycle that the company’s management had anticipated a couple of quarters ago. However, there is a marked shift from what was experienced in its earlier recovery cycles. This time, the operators look to prioritize short-cycle projects. They will maintain investment flexibility and prefer development over exploration. Since these companies will shy away from long-term investment, offshore production, typically more capital intensive, will likely stay subdued while onshore shale production will accelerate. However, the downside to short-term activities driven by rapid price response is the threat of undersupply, which will continue to elevate crude oil prices.

In the current environment, return requirements, the ESG commitments, and regulatory pressure drive energy operators’ investments. Given the context, we expect HAL’s wellbore services will attract more capex while infrastructure investments may stay low. Therefore, Halliburton will collaborate and engineer solutions to maximize its asset value.

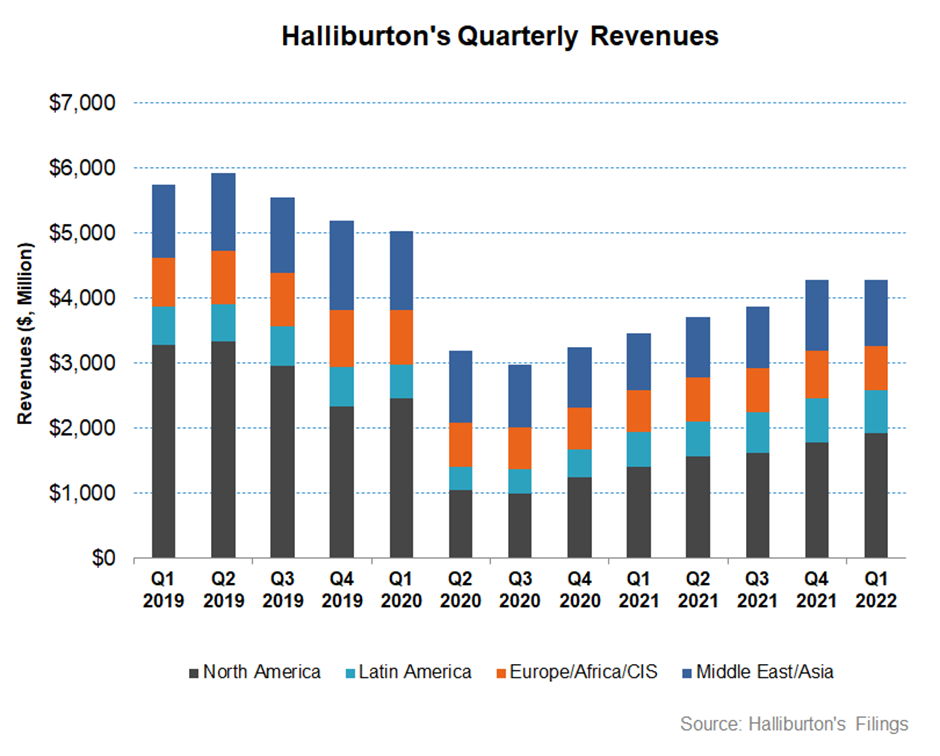

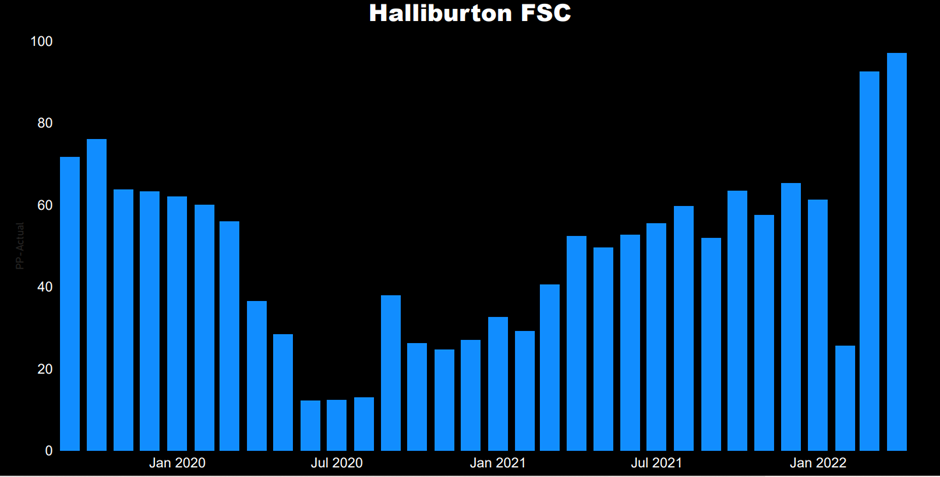

According to Primary Vision’s forecast, the frac spread count (or FSC) reached 269 by mid-April and increased by 3% since 2022. Halliburton’s FSC, which dropped during mid-2021, has increased significantly compared to a year ago. From January to April of this year, it has gone up steadily. This was despite that fact in the US, the frac fleet activity went relatively dull in Q1 due to seasonality and the supply chain disruption. As a result of such impressive performance, HAL’s frac fleet remained sold out. In North America, the frac market structure has improved for the large pressure-pumping companies that hold much of the market share. Also, as outside capital dried up due to the lack of returns in the past few years, profitability has improved for the firms with proprietary capital structures as pricing went higher. However, there can be downward pressure on frac spread operation in the short term with regard to utilization and frac pricing per stage.

The other key differentiator in today’s environment has been the efficient combination of electric fleets, dual fuel, and Tier 4 diesel pumps. HAL’s Zeus eFleets and SmartFleet Intelligent Fracturing System have been quite prolific in this context. The use of SmartFleet resulted in a six-fold increase in the number of stages for some of its operators. So, technology will be the key to driving margin even if the revenue growth slows down, and Halliburton will be the prime beneficiary.

What Do The Industry Indicators Suggest?

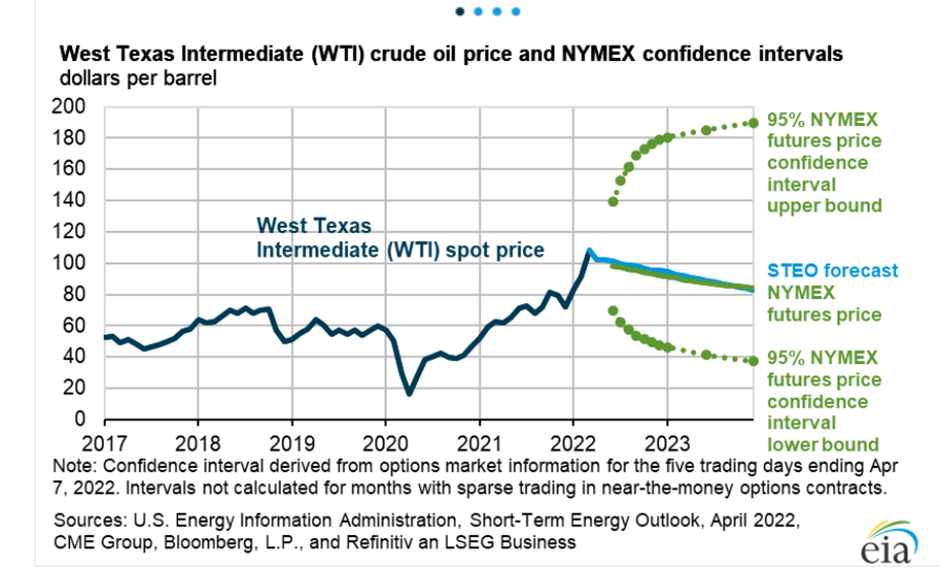

According to the EIA’s Short Term Energy Outlook, the Brent crude oil price can decrease by ~8% in Q2 compared to the March-average level. By 2023, it may fall even further. Although a significant amount of uncertainty is unaccounted for due to the current geopolitical situation in Ukraine, the potential for further oil supply disruptions and low oil inventories can push prices higher. On the other hand, the global economic contraction can keep prices checked.

According to the EIA’s Drilling Productivity Report, US shale oil production is due to a 2.8% rise, on average, by May 2022. The drilled wells went up by 70% in the past year, while the drilled but uncompleted (or DUC) wells have declined by 38%. The DUCs backlog will deplete in 2022 as the drilling activities accelerate. Therefore, the upstream activity is reasonably in favor of energy production growth.

The Russian Operation Risks

In March, HAL announced that it would suspend its future business in Russia as part of a sanction related to the Ukraine-Russia conflict. More recently, the company has indicated that if the Russian government seized its assets, it would amount to $340 million and would reduce its future earnings. Many other oilfield services firms including Baker Hughes (BKR) faces similar risks surrounding their engagements in Russia.

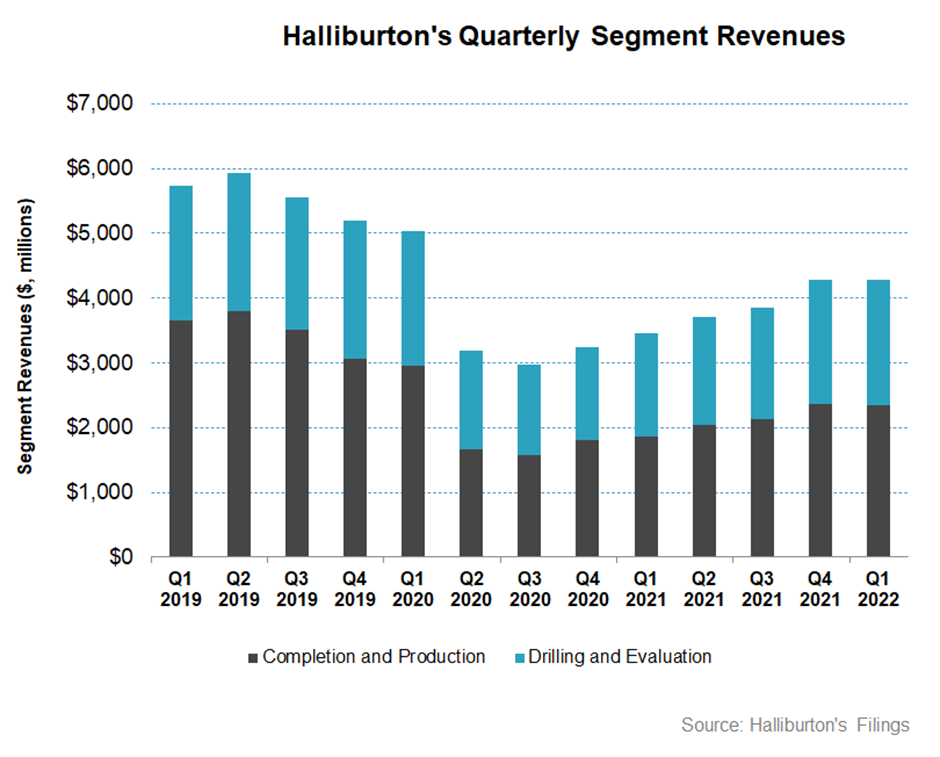

Analyzing The Division Performances

In Q1 2022, Halliburton’s Completion and Production division revenue remained unchanged compared to Q4 2021. However, pressure pumping services and completion tool sales increased in North American land and the Middle East/Asia region. However, Europe saw sales dropping in most service lines, while lower completion tool sales in Asia mitigated the topline growth.

Quarter-over-quarter, HAL’s Drilling and Evaluation division revenue growth was a mere 0.5% in Q1. Drilling activity increased in all regions, and wireline activity and project activity increased in many international markets during the quarter. There were, however, some headwinds from lower project management activity in Iraq and lower fluid services in the Caribbean, Brunei, and Mozambique. The operating income margin also expanded here (152 basis points up).

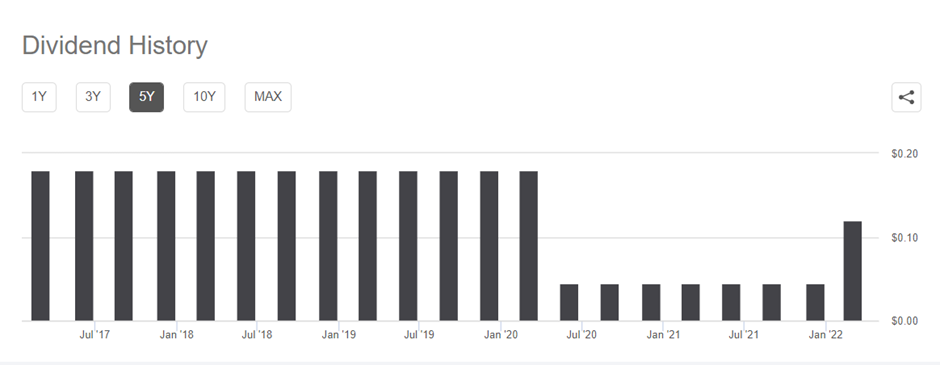

Dividend And Dividend Yield

Halliburton pays an annual dividend of $0.48 per share, translating to a 1.15% forward dividend yield. In comparison, Schlumberger (SLB) pays a yearly dividend of $0.50, which equals a forward dividend yield of 1.14%.

Free Cash Flow Deteriorated In Q1 2022

HAL’s cash flow from operations (or CFO) turned negative in Q1 2022 compared to a positive CFO a year ago. Although revenue increased in the past year, investment in working capital led to a cash flow decrease. On top of that, the capex increased substantially (82% up). As a result, free cash flow turned steeply negative in Q1 2022. Nonetheless, the management expects cash flow to be back-end loaded, which means it expects to generate strong FCF in 2H 2022.

HAL’s debt-to-equity is 1.21x, which is lower than Schlumberger’s (SLB) (1.0x), but higher than TecnipFMC’s (FTI) (0.56x), and Baker Hughes’s (BKR) (0.40x). Recently, it retired 60% of its $1 billion of debt maturing in 2025. However, with a steep cash flow deterioration, it will not be easy for the company to keep up with the recently raised dividend and debt deleveraging.

Learn about HAL’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.