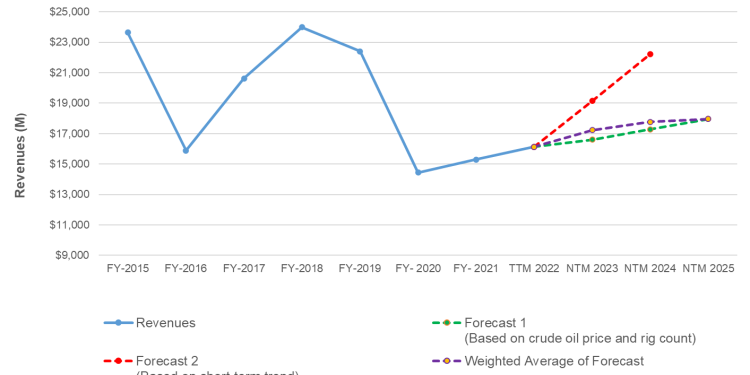

- The revenue estimate is firm for NTM 2023 but may slow down after that

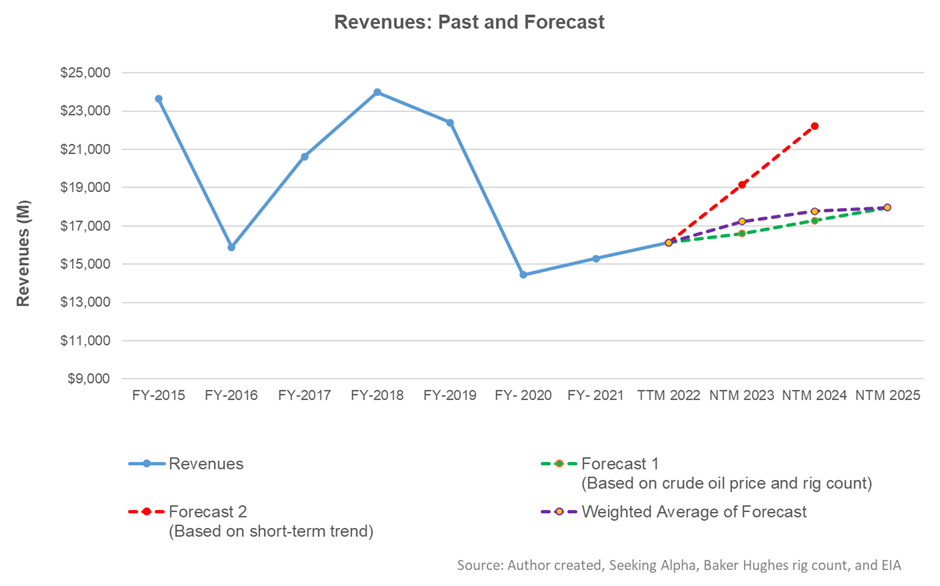

- EBITDA can stay muted in the next couple of years

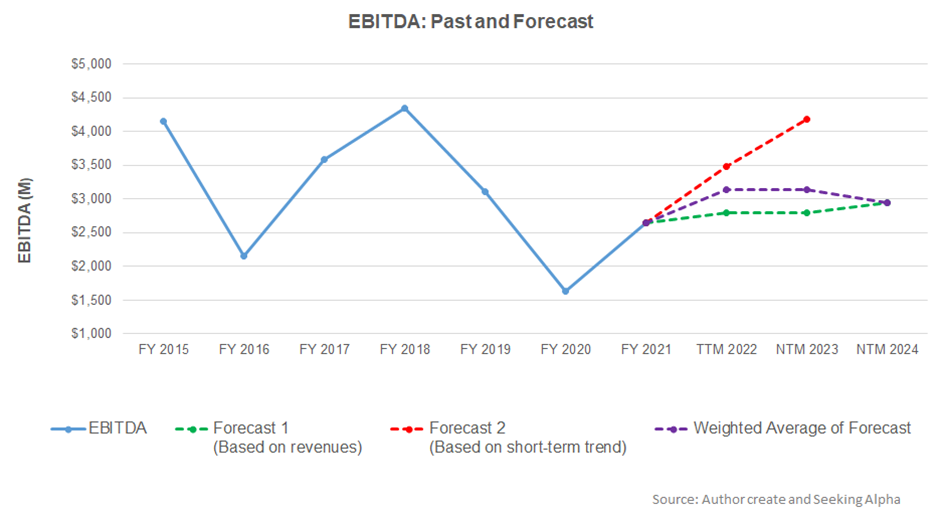

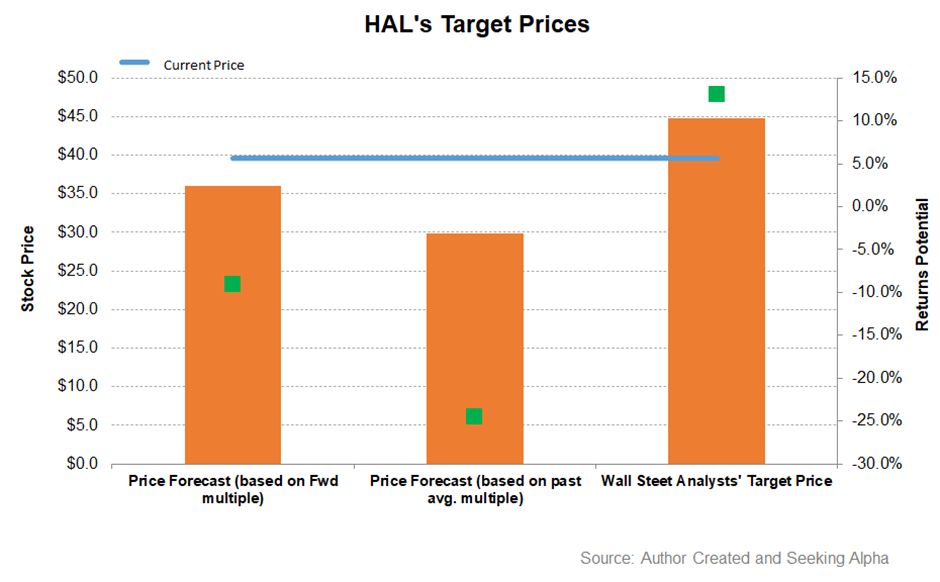

- The stock has a mild downward bias at the current level

Part 1 of this article discussed Halliburton’s (HAL) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation among the crude oil price, global rig count, and HAL’s reported revenues for the past seven years and the previous eight-quarters, revenues will increase relatively sharply in the next 12 months (NTM 2023). The revenue growth rate may decelerate in the following two years.

Based on the regression model using the average forecast revenues, the company’s EBITDA is expected to remain unchanged in NTM 2023. However, in NTM 2024, it can decrease.

Target Price And Relative Valuation

Returns potential using HAL’s forward EV/EBITDA multiple (12.4x) is higher (9% downside) than the returns potential using the past average multiple (23% downside). The Wall Street analysts have higher return expectations (13% upside).

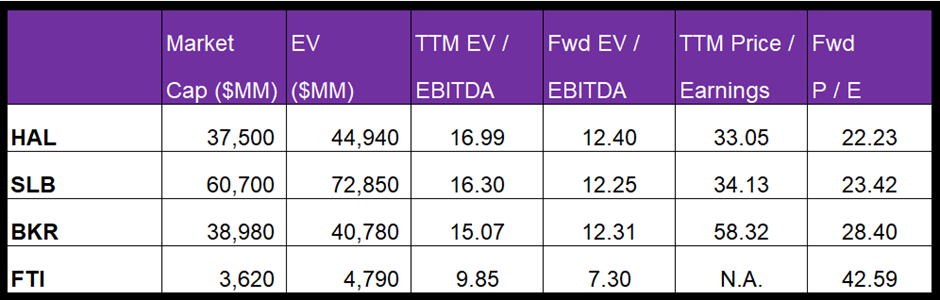

Halliburton’s forward EV-to-EBITDA multiple contraction versus the adjusted trailing 12-month EV/EBITDA is steeper because sell-side analysts expect HAL’s EBITDA to increase more sharply than its peers in the next four quarters. This typically results in a higher EV/EBITDA multiple compared to peers. The stock’s EV/EBITDA multiple (17x) is higher than its peers’ (SLB, BHGE, and FTI) average of 13.7x. So, the stock is reasonably valued, with a moderate downside bias, versus its peers at this level.

What’s The Take On HAL?

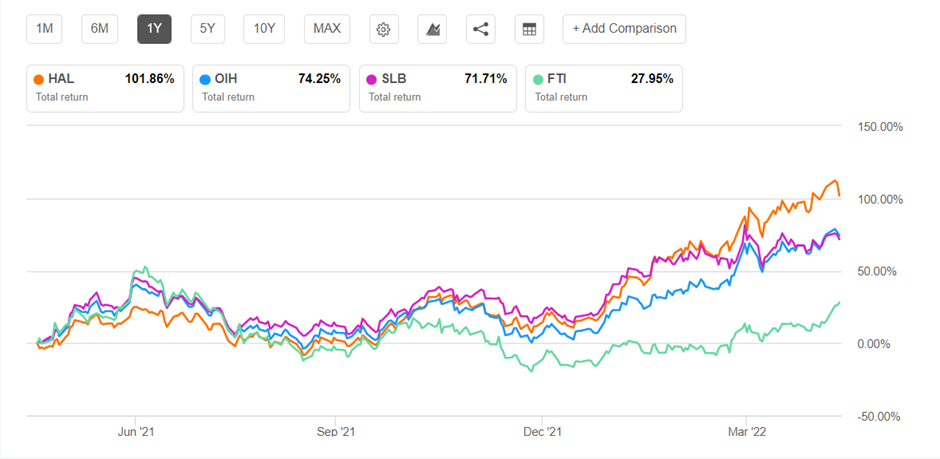

Even though the crude oil price stays strong, there is a for bit of uncertainty underlies investors’ sentiment, given the geopolitical scenario. In the current environment, energy operators seek returns potential, which can sometimes compensate for the lack of topline growth. Given the context, we expect HAL’s wellbore services will attract more capex. Although the company’s management believes it’s in for a possible multi-year upcycle, it prioritizes short-cycle projects, which entails collaborating and engineering solutions to maximize its asset value. The typical recipient of the recovery will be the onshore shale production-related services, including frac services, which should see pricing going higher. HAL’s Zeus eFleets and SmartFleet Intelligent Fracturing System have been quite prolific in this context. So, the stock price outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

On the other hand, infrastructure investments may stay low. The offshore production, typically more capital intensive, will likely stay subdued. Although HAL is deleveraging the balance sheet, it’s still higher than some peers. On top of that, negative cash flows have compounded its problems in early-2022. We think the stock is reasonably valued, although, given the fundamentals and stock price run-up, returns can stay muted in the short term before it makes any robust recovery.