- Despite the current economic headwinds, Mammoth Energy gives sufficient importance to the infrastructure business as its trusts its integrated business model to deliver advantages

- Its oilfield equipment business will hold steady as the industry activity strengthens and utilization stabilizes

- However, uncertainty over the account receivable from PREPA continues to spell concerns

- Cash flows deteriorated in FY2021, a higher capex can test TUSK’s financial strength in 2022

The Infrastructure Business Prospects And Challenges

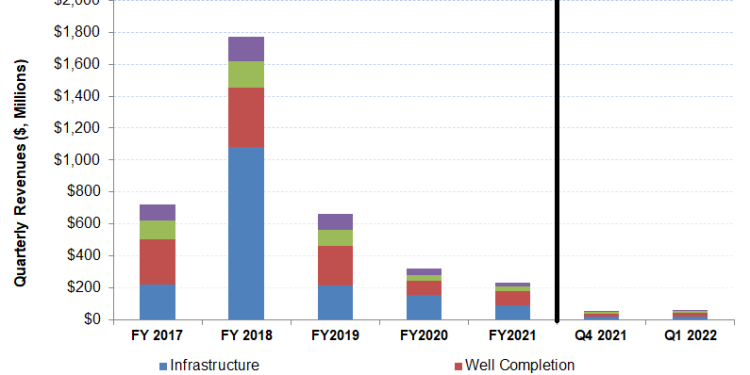

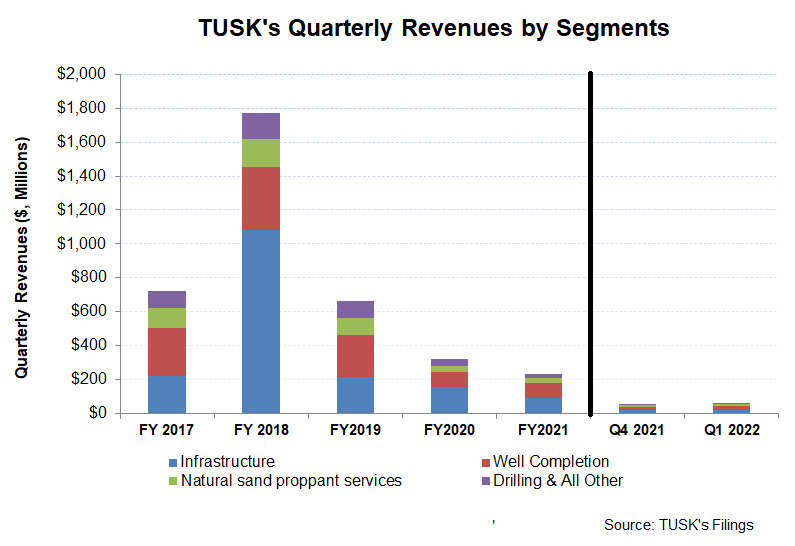

Mammoth Energy Services (TUSK) once again strengthens its infrastructure business, including repairing, hardening, modernizing the electric grid, and shifting towards renewables. The Infrastructure segment accounted for 36% of its Q1 2022 revenues, up from 34% a quarter ago. Its vertical integration through the engineering, procurement, and construction (or EPC) capabilities and manufacturing & equipment refurbishment facility holds the edge in a competitive landscape.

In 2022, the management sees opportunities in fiber maintenance, installation contracts, and MSAs (master service agreements). Its integrated business model has the advantage of rapidly scaling operations and controlling costs. So, the company has strategically structured its service opportunities for growth across the country.

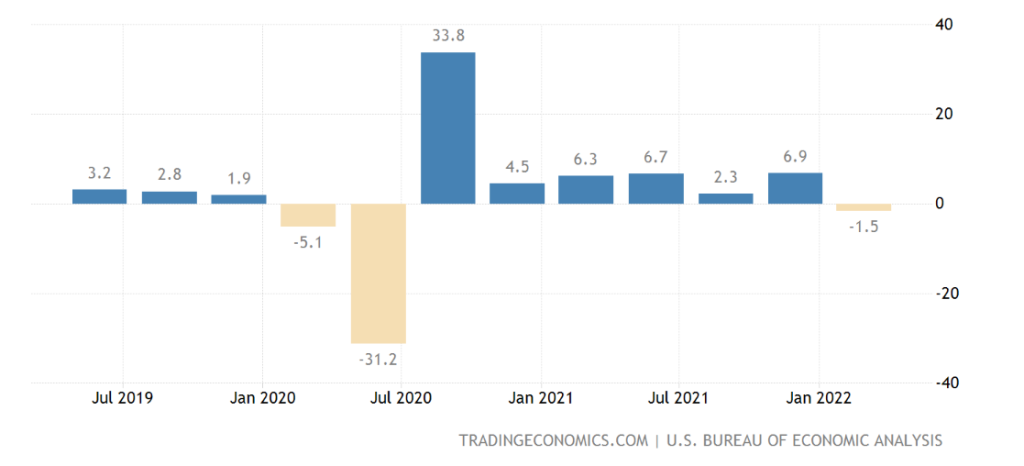

However, the US real GDP growth rate shrunk by 1.5% in Q1, after a positive growth rate (6.9% up) in the previous quarter. While nonfood and nonautomotive consumer goods imports surged, nondurable goods exports dropped, putting pressure on the trade balance. Also, mining, utilities, and construction were contracted during the quarter. These are the current headwinds that TUSK will face in the near-to-medium term.

Oilfield Services: Industry And Outlook

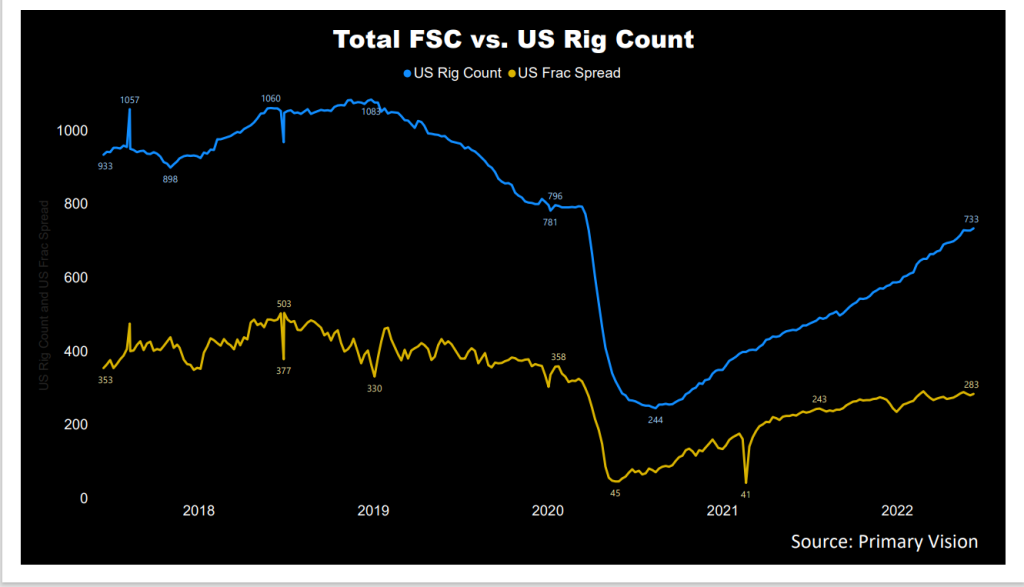

An improved oil and natural gas commodity pricing is a robust driver for the oilfield services sector. The crude oil price, which shot up over the geopolitical crisis related to the Russian oil supply and Ukrainian, is still volatile. From Q1 to Q2, it moved up by 18%. Demand has continued to recover as COVID-19 flattened. The Well Completion segment (38% of revenues) is still the front runner in TUSK’s portfolio. From January 2022 to April 2022, the drilled and completed well count was higher (18% and 4% up, respectively), while the drilled but uncompleted (or DUC) wells declined by 7%.

Year-to-date, the active frac spread count went up by 16%, according to Primary Vision’s estimates. The Permian underperformed the trend with a 12% higher frac spread count. Many shales saw higher frac spread count addition during this period. Mammoth Energy operated two hydraulic fracturing fleets in 2021 and added a third fleet in April. In the sand business, too, pricing improved in Q1. The recovery in the count is an encouraging sign to keep the topline busy in the coming quarters.

PREPA Payment Update

Please read my previous article to learn about TUSK’s engagement and repayment trouble in the energy restoration project in Puerto Rico through PREPA. In the latest development regarding the company’s past engagement related to the electricity transmission & distribution services in Puerto Rico, TUSK called on members of the Financial Oversight and Management Board for Puerto Rico in March. The company wants FOMB to take action to get repaid $340 million owed related to the restoration of power in Puerto Rico.

As of February 28, 2022, Mammoth, through Cobra, is owed $344 million. Until now, PREPA has submitted approximately $90 million in invoices to FEMA. Earlier, Puerto Rico’s governor Gov. Pedro Pierluisi attempted to terminate the $8.3 billion bankruptcy agreement to allow PREPA to emerge from the bankruptcy and pay its creditors. It remains a matter of debate whether TUSK will be able to receive its entire receivable from PREPA.

Recent Drivers: Q1 2022

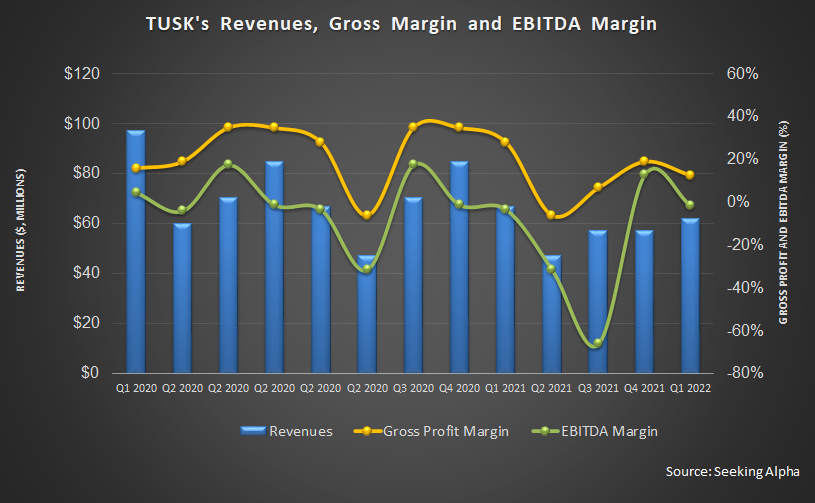

Despite industry indicators going from strength to strength, utilization remained at 1.6 fleets on average between Q4 2021 and Q1 2022. Nonetheless, it was an improvement from 0.9 fleets a year ago. Revenues in the company’s Infrastructure and the Well Completion segments increased in Q1 2022. The favorable macroeconomic landscape and TUSK’s operational improvements led to the growth in these segments.

Revenues from the Natural Sand segment declined (by 15%) quarter-over-quarter due to a decline in storm activity, which resulted in lower storm restoration revenue. However, a 22% higher sand volume and 21% higher pricing mitigated much of the pressure on the top line. However, the adjusted EBITDA deteriorated and even turned to a loss in Q1 as frac fleet count and utilization remained unchanged while input costs went up. The Drilling segment and the Other segment, in comparison, turned to an EBITDA profit in Q1 (revenues up by 29% sequentially).

Low Leverage, FCF Deteriorated, Capex To Rise

As of March 31, 2022, TUSK’s liquidity (excluding working capital but including revolving credit facility available) was $20 million. I discussed TUSK’s financial and liquidity risks related to PREPA accounts receivable in my previous article.

TUSK’s cash flow from operations (or CFO) turned negative in Q1 2022 versus a positive CFO a year ago, led by lower year-over-year revenues and adverse timing of cash inflows for accounts receivable. As a result, free cash flow remained negative. The company’s leverage (debt-to-equity) is low (0.20x). The management has doubled the FY2022 capex budget to $12 million from its previous estimate. It expects spending on well completions will pick up in 2H 2022 and account for most of the FY2022 capex. Given the cash flow situation and the prevailing risks over the PREPA repayment, a higher capex can test TUSK’s financial strength in any adverse changes in the PREPA matter.

Learn about TUSK’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.