Market Trends

Monday Macro View: What does the latest job report mean for U.S. and global economy?

Next week’s events are shaping up to be pivotal for the U.S. economy, and by extension, the global economic landscape....

Read moreDetailsKLX Energy Services: Q3 TAKE THREE

Q4 revenues to decline significantly. Activity can recover marginally in 2025. Revenue increased; EBITDA margin contracted, cash flows turned negative...

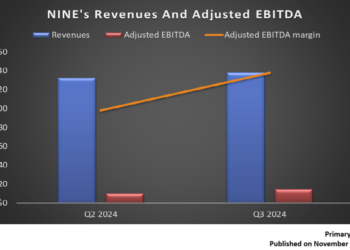

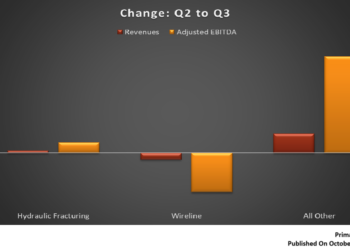

Read moreDetailsNine Energy Service: Q3 TAKE THREE

Expect revenue and profitability to decline in Q4. A moderate activity recovery expected in 2025. Cash flows turned negative in...

Read moreDetailsSpecial Report: Outlook of Shale Industry 2025

As we move into 2025, the U.S. shale oil landscape is experiencing winds of change given the ever-fickle global economic...

Read moreDetailsProPetro Holding: Q3 TAKE THREE

Plans to add two more frac spreads in the short term and deploy more electric assets in the future. Recorded...

Read moreDetailsMarket Sentiment Tracker: US Job Market Cooling Down

The latest U.S. economic indicators reflect a mixed landscape. Durable goods orders slipped by 0.8% in September, marking a second...

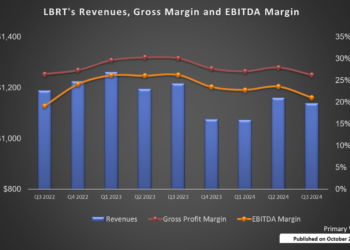

Read moreDetailsLiberty Energy’s Perspective in Q3: KEY Takeaways

Plans to temporarily reduce its deployed frac spreads. Frac pricing can decline due to soft year-end frac activity. LPI commenced...

Read moreDetailsMonday Macro View: Is Shale Investment Peaking?

The U.S. shale industry continues to evolve in a landscape defined by fluctuating oil prices, investor expectations, and shifting political...

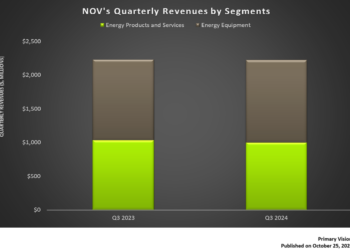

Read moreDetailsNOV: Q3 TAKE THREE

A cautious approach for FY2025 as the energy price reflects uncertainty and operators exercise capex restraint. A 1.1x book-to-bill ratio...

Read moreDetailsTechnipFMC: Q3 TAKE THREE

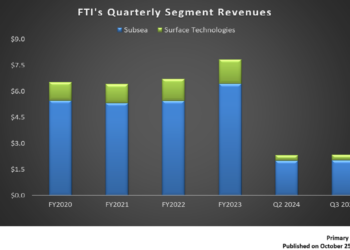

Book-to-bill ratio decreased in Q3 from Q2. FTI is optimistic about the subsea market outlook. Cash flows strengthened in 9M...

Read moreDetails