Market Trends

TechnipFMC’s Perspective in Q1: KEY Takeaways

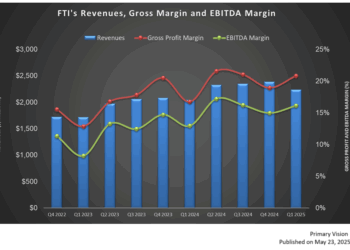

iEPCI and Subsea 2.0: FTI’s dominant drivers in 2025. How will its Q2 financial performance play out? How will it...

Read moreDetailsMarket Sentiment Tracker: Stimulus, Sentiment, or Stalling

The latest round of global economic data offers a revealing snapshot of divergence beneath the surface. While some sectors and...

Read moreDetailsMonday Macro View: How Much Longer Can the Uinta Hold On? Enterprise Subscribers

The Uinta Basin isn’t often the center of industry attention, but it should be—because what’s happening there right now is...

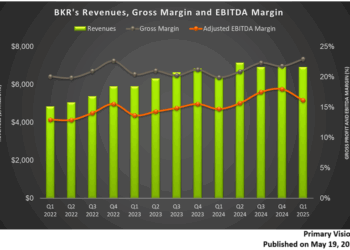

Read moreDetailsBaker Hughes’s Perspective in Q1: KEY Takeaways

What are the industry challenges? Q2’05 performance expectations: Up or down? Will the tariff spoil the results?

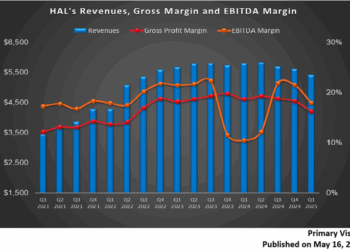

Read moreDetailsHalliburton’s Perspective in Q1: KEY Takeaways

Tariff Changes: How will it affect HAL’s near-term performance? Take a look at Halliburton’s electric frac evolution. How will international...

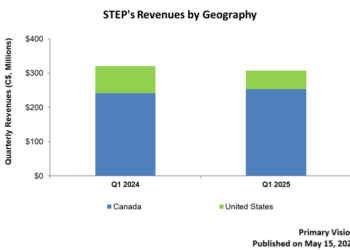

Read moreDetailsSTEP Energy Services: Q1 TAKE THREE

Exits the US fracturing business due to adverse business conditions. Share of dual-fuel horsepower kept rising in its portfolio. Weaknesses...

Read moreDetailsMarket Sentiment Tracker: Demand Holds, Cracks Widen

Recent economic data offers a revealing snapshot of three major economies: the U.S., Europe, and China. Each is showing signs...

Read moreDetailsMonday Macro View: What is the connection between Frac Job Count and OPEC’s production? Enterprise Subscribers

A few months ago, I explored the evolving relationship between WTI crude prices and the U.S. Frac Spread Count (FSC),...

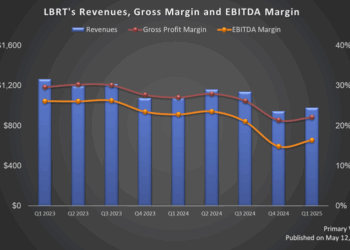

Read moreDetailsLiberty Energy’s Perspective in Q1: KEY Takeaways

Will LBRT continue to focus on the power generation business? Natural gas-heavy regions to offset North American market weakness? How...

Read moreDetailsKLX Energy Services: Q1 TAKE THREE

Will KLXE’s Q2 performance improve? What are the concerns in 2025? EBITDA margin contracted, and cash flows turned negative in...

Read moreDetails