On March 6, 2018, Seeking Alpha reported that Halliburton’s frac’ing fleet was surging across the country. This is, of course, a great news story for the American oil and gas industry. The U.S. government’s statistical agency expects both oil and gas to hit record levels of production in 2018, and almost all of the growth is coming from frac’ing. Halliburton is a huge part of this, though there is some disagreement over just how fast Halliburton is ramping up.

Who Knows What Halliburton is Doing?

Halliburton has a strong foothold on fracturing services in the United States (see information box below). They’re required by law to make some disclosures, but the company is not in the business of publicizing all of its work. As a result, industry watchers are left to make their best estimates about what Halliburton is doing.

Q1-2017 - HAL Market Share by Frac Job: 28% - HAL Market Share by Active Spreads: 18% Q2-2017 - HAL Market Share by Frac Job: 27% - HAL Market Share by Active Spreads: 20% Q3-2017 - HAL Market Share by Frac Job: 28% - HAL Market Share by Active Spreads: 20% Q4-2017* - HAL Market Share by Frac Job: 28% - HAL Market Share by Active Spreads: 20% *data incomplete

Our company, Primary Vision, uses sophisticated analytics to project real-time data on active frac’ingoperations from lagging data sets.

The article states that Halliburton grew its frac’ing fleet by 700,000 horsepower in 2017, giving it a total of more than four million horsepower of frac’ing equipment under its control. The information in that article was supplied by Rystad, a Norwegian based company that offers consulting services and business intelligence to the oil and gas space.

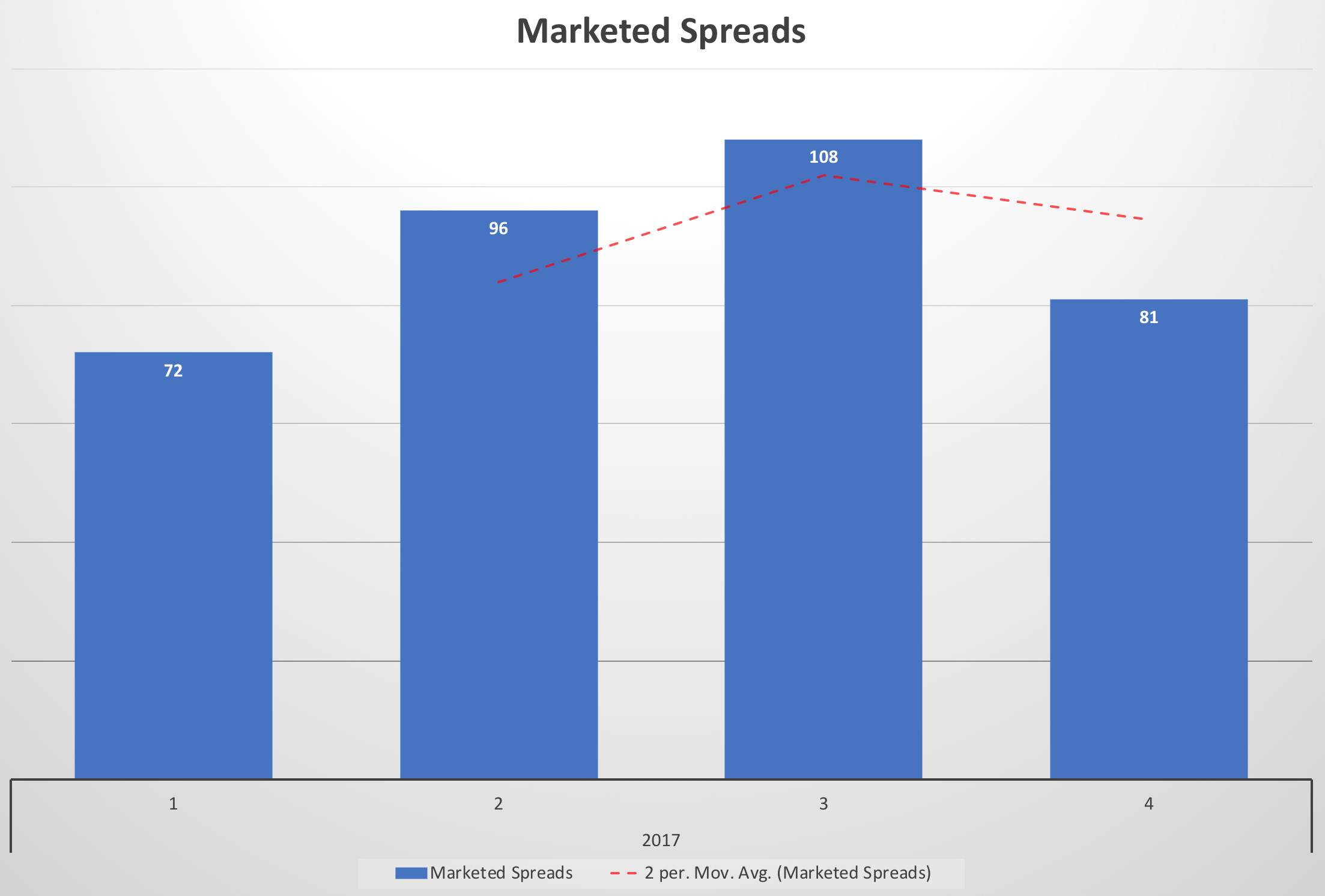

We have a slightly different view. Primary Vision estimates that Halliburton currently has 115-120 marketed frac’ing operations, called frac spreads as of the writing of this blog. Each spread is powered by roughly 36,000 horsepower of pumping equipment and also contains other necessary equipment, like data trucks, storage tanks, and frac’ing fluid blenders. Our estimates of both Halliburton’s active (108) and marketed spread count (115-120) ramped up much faster than others. We think the company actually increased its fleet operations over the course of 2017 by about 1.2 million horsepower, not 700,000.

helpful definitions… Frac Spread – A frac spread (or sometimes referred to as a frac fleet)is a set number of equipment that a pressure pumper (oil field servicecompany) uses for hydraulic fracturing. This includes a combination of fracturing pumps (also referred to as frac pumps and/or pumping units), data trucks, storage tanks, chemical additive and hydration units, blenders and other equipment needed to perform a frac stimulation. Active Spread – Equipment that a pressure pumper has working or active in the field. Marketed Spread – Equipment that a pressure pumper has ready to work and available to work but might be in transition or in process of being deployed.

We estimate that Halliburton went from 72 to 108 active spreads between the first and third quarters of 2017. This run up, coincidentally or not, correlates closely with a March 2017 announcement that two competing frac’ing companies, Schlumberger and Weatherford, were going to create a joint venture called “OneStim.” That idea was abandoned at the end of 2017, with Schlumberger instead simply buying Weatherford’s assets.

Where is the Extra Capacity Coming From?

One unique strength of Halliburton is that the company manufactures its own frac’ing pumps. The latest and greatest version is the Q10 pump, which is the centerpiece of the company’s “Frac of the Future” system. Halliburton reportedly began replacing its pumps with Q10s in 2013. When oil prices really began to crash in 2014 the company appears to have accelerated its retirement of the older pumping systems. The company said some of its older equipment was being retired permanently while other equipment was being “cold-stacked” and could be brought back into service later. In 2016, then CEO Dave Lesar, (he retired on June 1st of 2017 and was replaced by Jeff Miller) said that if the market ever turned around, Halliburton would have “multiple levers” it could pull, including accelerating the manufacturing and deployment of the Q10s and presumably also reactivating some of its older equipment (ie. Grizzly™ pumps).

We believe that Halliburton has activated more of the old equipment than other analysts are assuming. These assets were quickly deployed in response to both improved market conditions and presumably also the threat of competition from the likes of OneStim, other competitors as well as new entries such as Pro Frac, and Alamo Pressure Pumping. As a result, Halliburton’s industry-leading frac’ing fleet contains a mix of both new and old pumps. We estimate that Halliburton has approximately 4.2 million horsepower marketed.

Looking for data like this?

Many businesses need to know exactly how much frac’ing is happening in the U.S. and Canda. Primary vision’s flagship product, the Frac Spread Count, provides both high-level aggregations of industry-wide data and detailed information on each service provider’s activity in each region. Our Frac Spread Count has grown in popularity since its inception in 2013.

Learn more:

http://www.pvmic.com/frac-spread-count

http://www.fracspreadcount.com/

contact Primary Vision directly: info@pvmic.com