The world is going through an extraordinarily tough time lately. The story remains the same: high inflation, rising interest rates by central banks and when you combine this with the amount of money supply post pandemic and record high leveraged money along-with mortgages in housing sector, we get a recipe for an impending crisis. There has been a debate that whether this inflation is sticky or flexible (as in will go away easily). The recent figures of U.S. CPI (at more than 8.5 percent) indicates that this is stickier than thought and not “transitory” at all. Hence, the world is expecting even a further aggressive strategy by the Federal Reserve Bank of America.

Fed increased interest rates by 75 basis point in June, the highest in 28 years, giving an impression that we might be in for a Volcker shock (Paul Volcker increased rates to 20 percent during 1970s Stagflation ushering in a recession). It isn’t only the Fed but there has been 80 increases in the first 6 months of 2022, a record high.

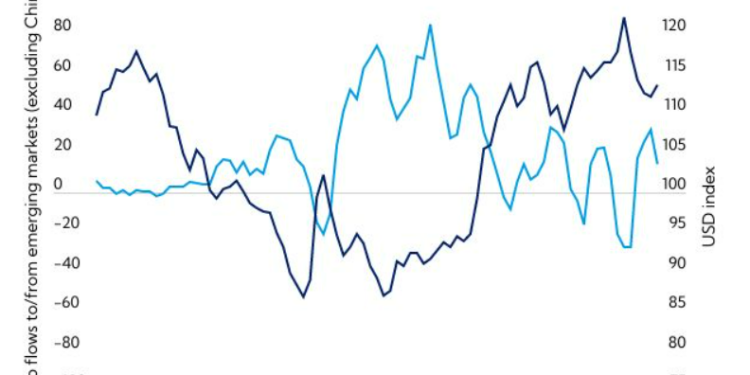

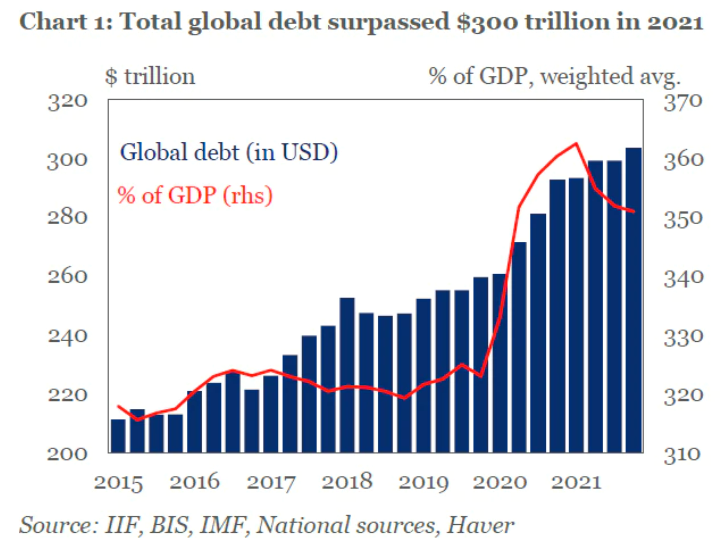

Among many other things, such rising rates by the Fed can have dire consequences for emerging markets as they accumulated a record amount of debt post pandemic. According to International Institute of Finance (IIF), the total amount of debt has increased to $303 trillion with the 80 percent of addition in 2021 coming from emerging markets whose total debt has reached a worrying $100 trillion (read that again, a $100 trillion).

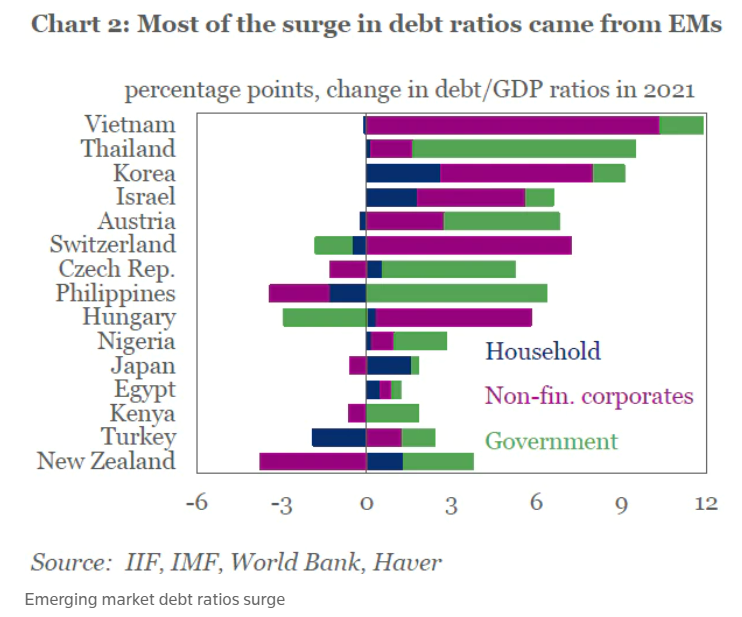

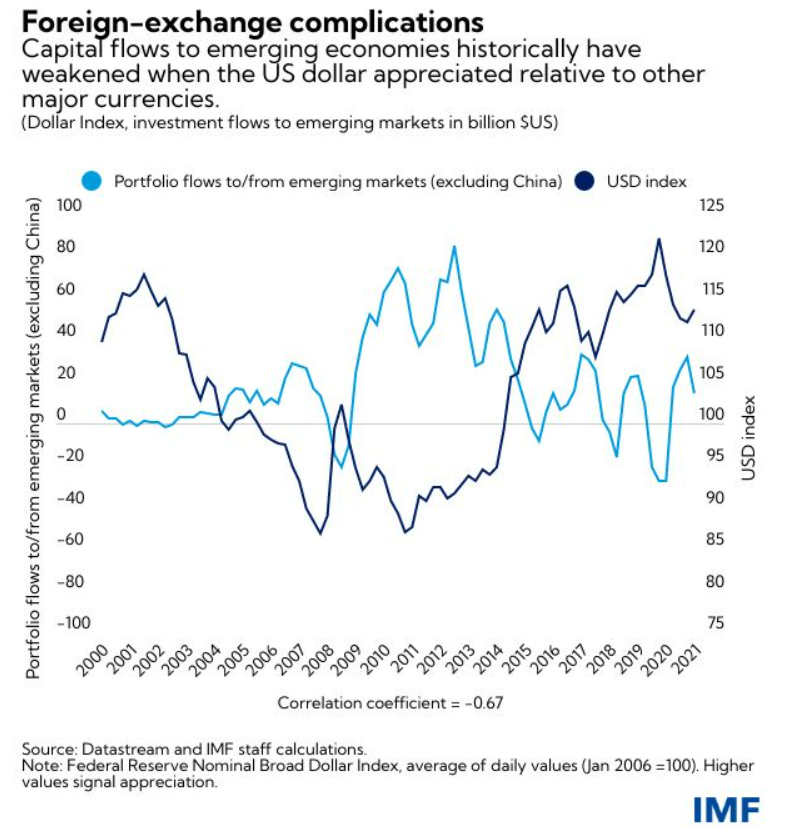

The speed at which U.S. is increasing interest rates can spell serious trouble for these countries as not only they face external pressure in the form of rising rates but due to rising food prices and ensuing socio-political unrest their own currency has depreciated steeply. That puts extra pressure on the national exchequer and as many emerging markets have a trade deficit (more imports than exports), it reduces their reserves to dangerous levels. Similar thing happened in Sri Lanka and is happening in Pakistan. The almighty dollar is getting strong. The US Dollar index recently touched a two decade high at 105 percent against a basket of other currencies.

One may expect a wave of defaults coming from the Emerging markets soon.

Now shifting topics, let’s talk about everyone’s favorite way of getting rich quick – Bitcoin. The digital currency has taken a beating from the past few weeks and as Nassim Taleb has correctly remarked, failed to be proven a hedge against inflation.

Recently, Bitcoin dropped below the psychologically important level of $20,000. At the time of writing (Sunday) it stands at $18,575. According to Coinmarketcap.com Bitcoin has lost more than $2 trillion of its total valuation. From $3 trillion it is now at $834 billion. Bitcoin has lost more than 70 percent of its value since reaching its peak. All of this is happening as central banks are raising interest rates to stay clear from inflation. More importantly, the fact that the main users of cryptocurrency remains to be tax evaders, organized crime, etcetera, its legitimacy will always be on a shaky ground. Fruthermore, a steep selloff has further bolstered the case for more regulation of the industry which will only serve to further reduce the value of the digital currency. The only reason, it seems, of buying bitcoin is its price. When price is falling, the reason gets weaker.

Well, that’s it for today. Hope you enjoyed reading it. If you did kindly subscribe to our Youtube channel as well, where Mark spills some extraordinary gems every Wednesday, Thursday and Friday.

Speaking of which, Mark talked at length about What Happens to Global Debt as Fed Hikes Rate here in this latest video. Go check it out.