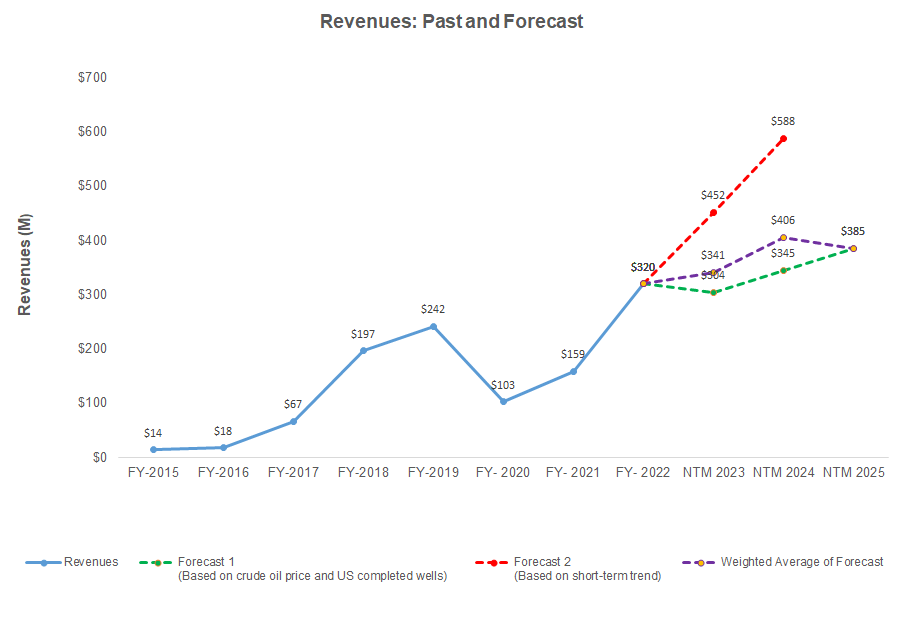

- Our regression estimate suggests accelerating revenue growth between NTM 2023 and NTM 2024.

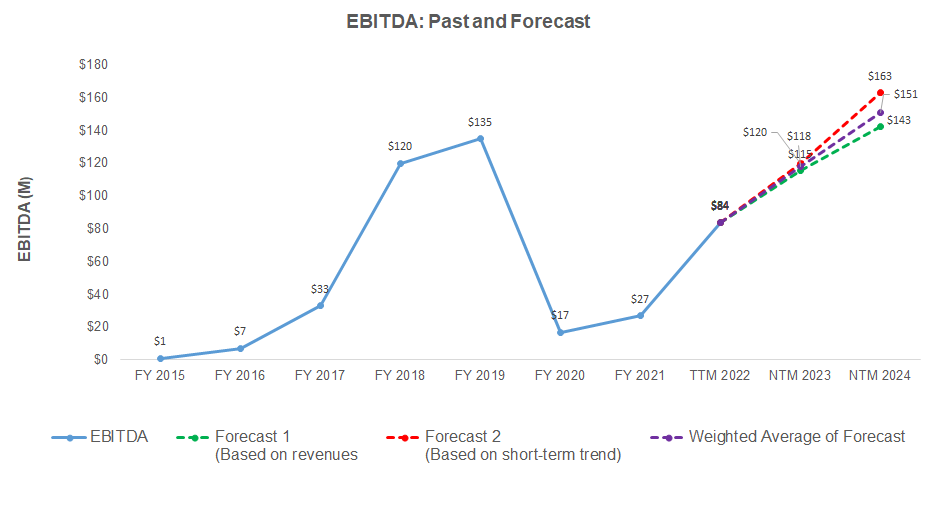

- According to the model, the EBITDA can increase significantly in NTM 2023, but growth may decelerate in NTM 2024.

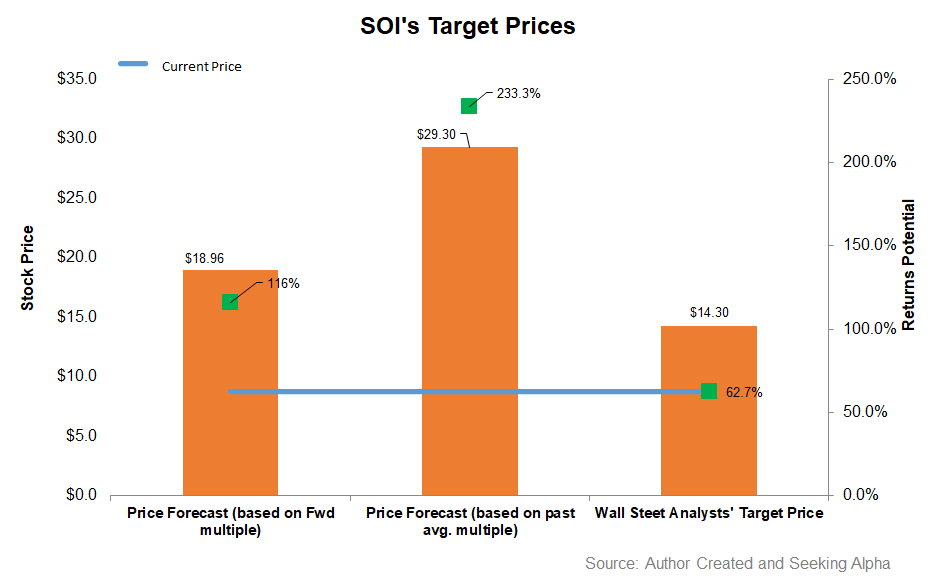

- The relative valuation suggests the stock is overvalued at this level.

Part 1 of this article discussed Solaris Oilfield Infrastructure’s (SOI) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation between crude oil price, US completed well count, and SOI’s reported revenues for the past eight years and the previous four quarters, we expect revenues to increase by 7% in the next twelve months (or NTM) 2023 and further 19% in NTM 2024. However, the model suggests revenues can decline in NTM 2025. For the short-term trend, we have also considered seasonality.

Based on a simple regression model using the average forecast revenues, we expect the company’s EBITDA to increase by 40% in NTM 2023. The model suggests the EBITDA growth rate can decelerate to 28% in NTM 2024.

Target Price And Relative Valuation

Returns potential using the past average multiple (10.9x) is higher (233% upside) than the return potential based on the forward multiple (116% upside). The sell-side analysts expect lower returns (63% upside).

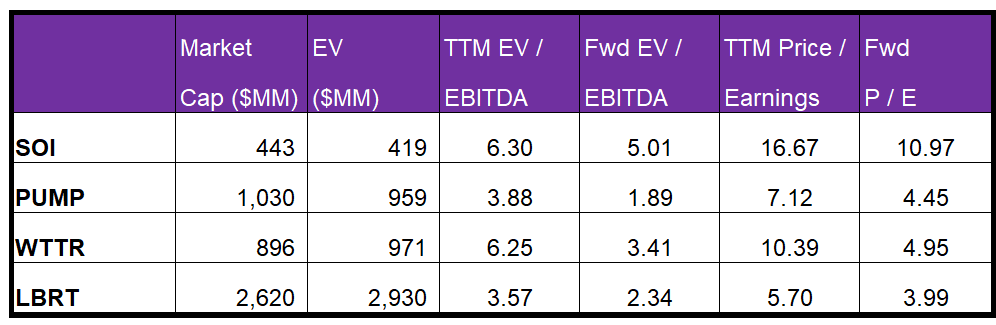

SOI’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is less steep, typically resulting in a lower EV/EBITDA multiple than peers. The company’s EV/EBITDA multiple (6.3x) is higher than its peers’ (PUMP, WTTR, and LBRT) average of 4.6x. So, the stock is overvalued at the current level.

The sell-side analysts’ target price for SOI is $14.3, which, at the current price, has a return potential of 63%. Out of five sell-side analysts rating SOI, three rated it a “buy” or a “strong buy,” two rated it a “hold,” and none a “sell.”

What’s The Take On SOI?

Over the past few years, Solaris continued to invest in top fill systems, belly dump, and AutoBlend – its electric hydrated delivery system. Such technologies allowed it to broaden the customer base and pull-through sand silo work to gain longer-term visibility. Approximately seven incremental top-fill units will be fully utilized in Q1 2023. The share of electric truck fleets would increase considerably in the medium-term, which, in turn, can improve the return potential of a fully integrated system on a per frac crew basis. Following the steady drivers, its stock price performed marginally outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

However, natural gas-directed completion activity can be adversely affected in the near term as natural gas prices keep falling. So, the company’s short-term growth potential is limited, although it plans to make it up by margin expansion through advanced technology. It has robust liquidity and very low debt. Also, its free cash flows remained negative in FY2022, which can turn around in FY2023. The stock is relatively overvalued versus its peers. Investors might want to “hold” with expectations of marginally lower returns in the near term.