It is interesting to notice that amidst the fear of recession some hopes of its evasion have emerged. Some prominent economists have come to the front saying that the problem of inflation is behind us while others are seeing soft landing. I will provide the summary of their viewpoints below, however, data from global economy isn’t supportive of the same argument. While it can be acknowledged that inflation have reduced from 9 percent to 4 percent falling economic indicators still provide a basis for a recessionary case. The effects of the global monetary policy tightening will (and has to) reverberate even if we accept the premise that inflation isn’t sticky anymore.

Inflation no longer an issue:

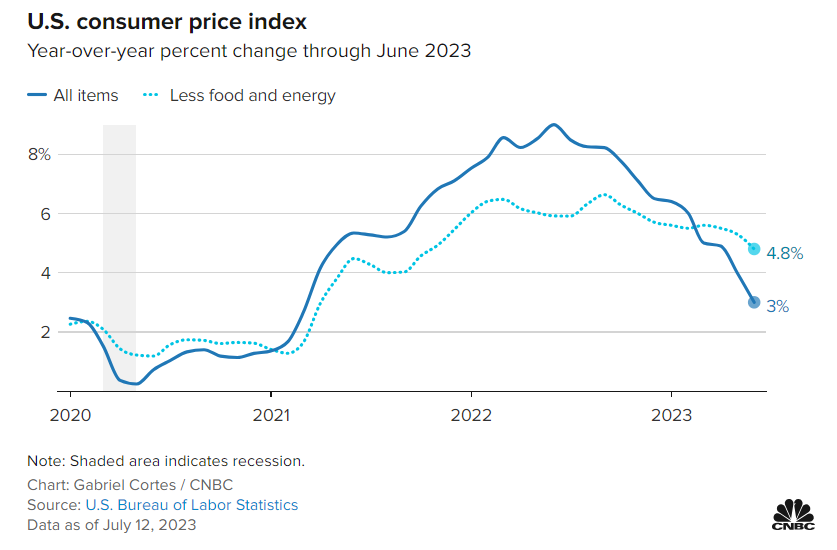

According to veteran economist Steve Hanke, the United States no longer faces an inflation problem. Hanke highlights that the contraction of the money supply by minus 4% on a year-over-year basis in the country is one of the reasons supporting this view. The June inflation rate in the US was lower than expected at 3%, marking the smallest year-on-year increase in two years. The core consumer price index, which excludes volatile food and energy prices, rose by 4.8% from the previous year and 0.2% month-on-month.

These latest figures could provide some flexibility for the Federal Reserve as it determines its interest rate policy direction. The US producer price index is set to be released soon, and if it shows further price declines, it could influence the Fed’s decision to end its rate hiking cycle soon.

Currently, traders are anticipating a 92.4% chance of a rate increase at the Fed’s July meeting, according to the CME FedWatch tool. Hanke points out that historically, the producer price index tends to rise first, followed by the consumer price index, and then the core gradually increases. However, the situation has reversed, with producer price indexes and consumer price indexes falling significantly while the core lags behind. Hanke believes that as long as the Federal Reserve continues with quantitative tightening, all of these measures will continue to decrease.

While central bank policymakers primarily focus on core inflation, which remains above the Fed’s annual target of 2%, Hanke suggests that if the Fed maintains its current approach, it can reach the 2% range quickly. He dismisses the notion that the Federal Reserve chair is facing a challenging problem or that it will be a long fight, emphasizing that things are not as “sticky” as portrayed.

Paul Krugman says we can easily avoid a hard landing and that a soft landing seems “amazingly within reach”.

Nobel laureate economist Paul Krugman believes that a soft landing for the economy, characterized by a return to normal levels of inflation without a spike in unemployment, is now remarkably within reach. He cites the recent consumer price index (CPI) data, which showed a 3% increase in June compared to the previous year, lower than Wall Street’s expectations and indicating a continued slowdown from the peak rate of 9% in 2022. Krugman sees this CPI report as a strong indication of an impending soft landing, which now appears more likely than not.

Krugman delves into the inflation numbers and highlights that the headline inflation rate has been distorted by earlier energy price spikes, while the core rate of inflation has been affected by shifts in remote work that impacted shelter costs. Instead, he focuses on the “supercore” rate, which excludes shelter and used cars, and notes that it stood at 3.5% over the past year and 2.7% on an annual basis over the past six months, nearing the Federal Reserve’s 2% target rate.

Despite concerns in the past that reining in inflation would lead to a prolonged period of high unemployment, Krugman argues that the economy’s recent period of running hot has muted the negative effects of raising interest rates. He also suggests that cooling inflation may be a result of the disappearance of COVID-19 disruptions.

However, Krugman acknowledges the possibility of a downturn and warns that the latest CPI data may contain noisy statistics that could skew perspectives. Some economists caution that dealing with the remaining margin of high inflation may be more challenging. Yet, Krugman remains skeptical and points out that underlying inflation has continued to fall despite previous warnings about the “last mile” in fighting inflation.

While Krugman notes that a recession is still possible, he emphasizes that it may not be necessary to achieve the 2% inflation target, as monetary policy often has delayed effects. Overall, the June inflation data supports the argument for a soft landing, prompting a reevaluation of economic policies in recent years. If the burst of inflation experienced in 2021-22 proves to be temporary and ends without significant suffering, it would suggest that recent economic policies have been largely effective.

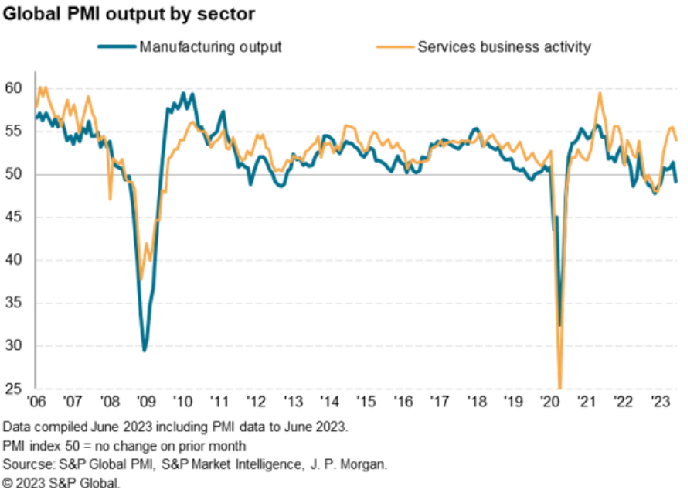

A Look at the Global Manufacturing Data

Let’s recap what Mark Rossano discussed in the latest ECON show – segment 1.

Global Manufacturing Slows Further as Service is Resilient – Part 1 – YouTube

Furthermore, this segment provides more insight on this slowdown in inflation. It is actually that the pace of inflation has slowed.

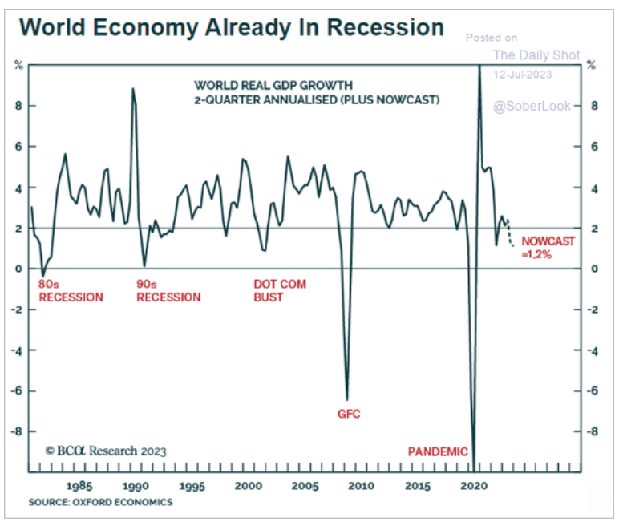

The world economy is already in recession!

One of the important things to notice – which has also been the continuous theme of my LinkedIn posts and Monday Macro View shows – is the falling activity in the real economy. The following chart helps explain this:

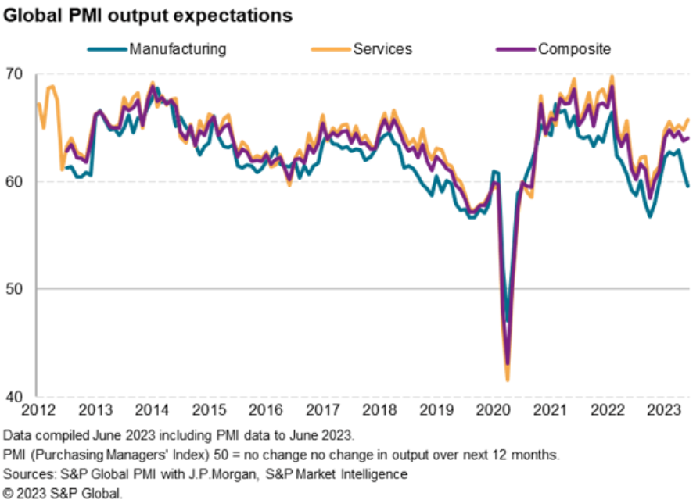

The expectations are also not that promising.

I will keep it short this time. I will see you all tomorrow on the Monday Macro View.

Happy Reading, Happy Sunday!