In this week’s Monday Macro View, we are going to take stock of the recent developments in global economy that are hinting towards further contraction or slowdown especially in major economies such as the Eurozone that seems to be teetering on the brink of a recession.

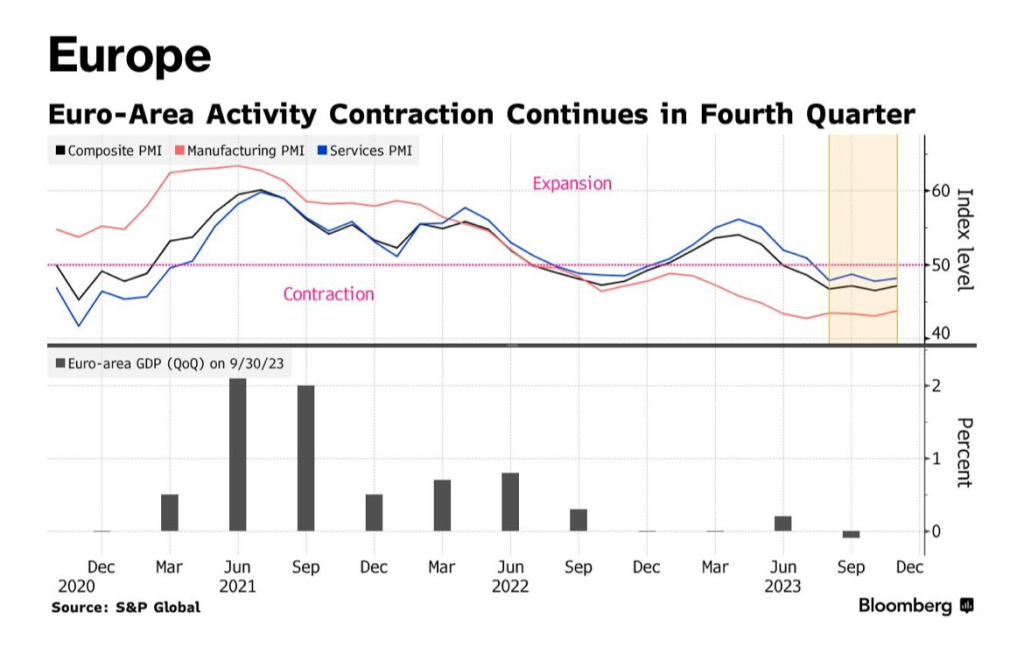

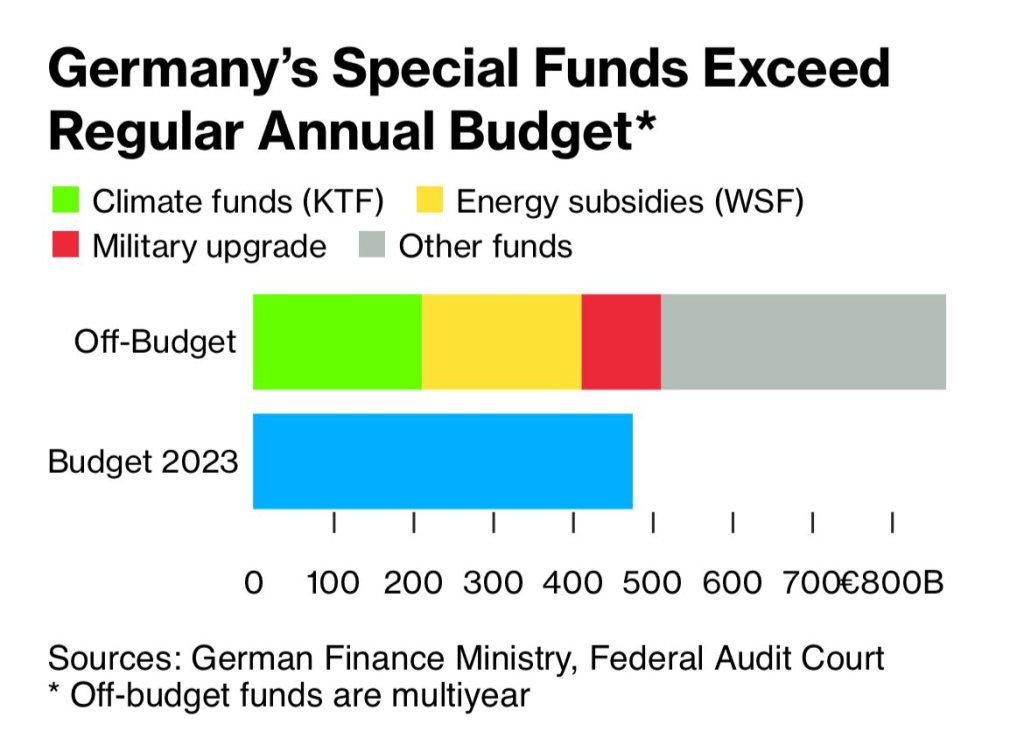

Activity in the Eurozone and therein of the major economies such as Germany and France continue to register declines. I have written in detail about this in my article for Euronews but here is a summary: The current economic situation in Europe is marked by uncertainty, with rising rents, mortgages, and energy prices creating challenging conditions that feel akin to a recession. The eurozone, having experienced contraction in early 2023 after a shrinkage in late 2022, appears to be in a recessionary phase, as typically defined by economists. This is further evidenced by the HCOB’s Composite Purchasing Manager’s Index (PMI), which stood at 47.1 in November, indicating contraction, particularly in the manufacturing sector. Additionally, a decrease in bank lending and an uptick in loan defaults signal economic stress.

The European Union has revised its growth forecast for the eurozone down to 0.6%, with rising interest rates and persistent high energy prices contributing to a volatile economic environment. The IMF anticipates a modest recovery in 2024, but this is contingent on stable oil and gas prices. Meanwhile, indicators such as weak consumer spending and retail sales, coupled with an accelerated slowdown in business activity, particularly in the services sector, point towards ongoing economic challenges. While the timing of a full-blown recession remains uncertain, the potential for significant economic downturns in Europe looms large, underscoring the precarious state of the global economy.

This can also be seen by rising bad debts as highlighted by ECB in a recent report.

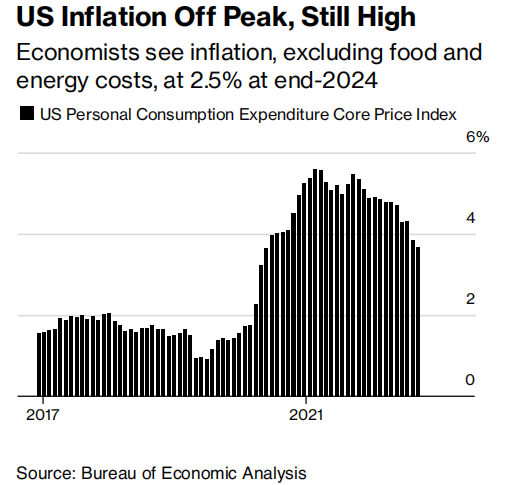

U.S. economy appears resilient but not from the point of view of manufacturing activity – it has been in contraction for 13 straight months, slipping 0.9% in November. The fight has inflation has yielded some results but the rate at which it has come down might slow down next year. The expectations for Personal Consumption Expenditure (PCE) was seen to be at 2.5 percent up from 2.4 estimated in last year’s survey.

In November, China’s manufacturing sector experienced its second straight month of reduced business activity. The purchasing managers index fell to 49.4, placing it in the 13th percentile of all months since 2011, a slight decrease from October’s 49.4 (15th percentile) and September’s 50.2 (38th percentile). This downturn indicates that manufacturing activity has shrunk in seven out of the last eight months, signaling a departure from the brief stabilization observed during the third quarter.

Overall, major indicators of the global economy are screaming a slowdown. The current economic conditions remind of the famous play, Waiting for Godot. Just like Godot, we are waiting for Recession. It is already here. We just have to look closely.