NINE’s Strategies

We discussed our initial thoughts about Nine Energy Service’s (NINE) Q3 2024 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook. During Q3, the US rig count declined by 3% due to low natural gas prices. This led to lower activity levels in Haynesville and Northeast. On top of that, the US completion activity slowed down. Despite that, NINE’s revenues grew by 4% in Q3 as it increased its market share by approximately 23% in the cementing business using advanced cement slurries. Quarter-over-quarter, cementing jobs increased by 9% in Q3.

The company reevaluated pricing versus market share balance and reduced vendor consolidation and rationalization to improve profitability. Its completion tool sales increased in international markets, although lower activity levels in Northeast and Haynesville mitigated the growth. It commercialized its pincer hybrid frac plug and frac dart. The company estimates that a pincer hybrid frac plug uses ~50% less material and lower plug drill-out times. This significantly reduces time and bit wear for its customers.

Another innovation, Scorpion with Frac Dart, allows operators to reinitiate pump-down operations if the guns do not fire in the post-plug setting. These factors kept demand for such products relatively high. So, even though it generated 50% of its wireline revenue from the Northeast, which witnessed a slowdown, revenue remained steady. In the Permian, the company gained market share. Its Coiled tubing revenue increased by approximately 5% due to better utilization and increased days worked.

Q4 and FY2025 Outlook

In Q4, NINE expects a “moderate slowdown” due to operators’ budget exhaustion, typical seasonality, and a decrease in international tool sales. It expects revenues and adjusted EBITDA to decline compared to Q3. In the long term, demand for natural gas will likely increase due to higher power demands from AI and the rise of LNG exports.

The management anticipates a moderate activity pickup in 2025 on account of improved commodity prices and customers’ budget resetting. With a recovery in natural gas prices, natural gas-led activity can increase. An enhanced natural gas activity can become an essential catalyst as the Northeast and Haynesville account for 30%-35% of the company’s revenues.

Q3 Financials

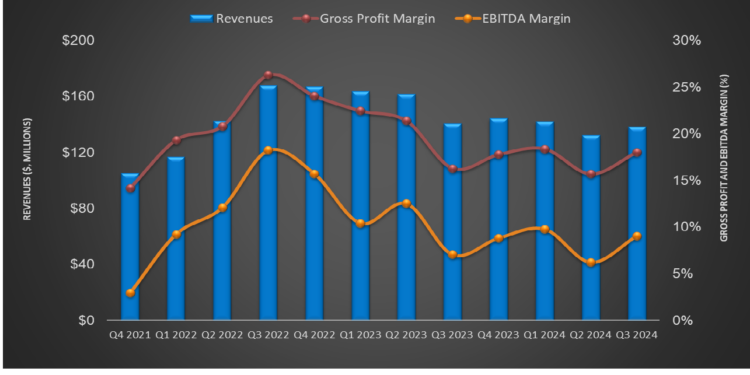

Quarter-over-quarter, NINE’s revenues increased by 4.3% in Q3, while its adjusted EBITDA margin expanded by ~300 basis points. The cementing business outperformed its other operations, increasing by 12% during Q3. NINE’s cash flows turned negative in Q3 compared to a positive CFO a quarter ago.

Due to negative shareholders’ equity, its debt-to-equity remained negative as of September 30, 2024. It had a total liquidity of $43.3 million as of that date. During Q3, it paid $5 million on its ABL credit facility. Also, during Q3, it repurchased shares worth $1.4 million.

Relative Valuation

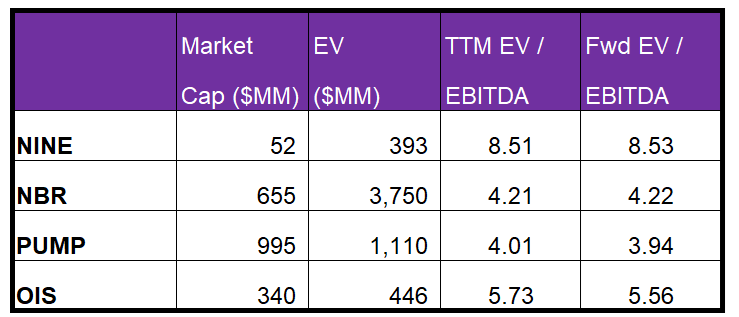

NINE is currently trading at an EV/EBITDA multiple of 8.5x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is nearly unchanged.

NINE’s forward EV/EBITDA multiple compared to the current EV/EBITDA is expected to remain unchanged compared to a slight fall in the multiple for its peers. This implies that its EBITDA is expected to remain unchanged compared to a small hike in EBITDA for its peers in the next year. This typically results in a lower EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is higher than peers’ (NBR, PUMP, and OIS) average. So, the stock is relatively overvalued compared to its peers.

Final Commentary

During Q3, NINE focused on offering innovative products and cost containment. In the Permian, the company gained market share. It commercialized pincer hybrid frac plug and frac dart. Higher demand for such advanced products helped offset lower sales from Haynesville and Northeast. Revenues from coiled tubing also improved in Q3. In 2025, natural gas-led activity is expected to increase as natural gas prices recover.

On the other hand, low natural gas prices and activity adversely affected its sales in Haynesville and Northeast. NINE’s cash flows turned negative in Q3. Due to negative shareholders’ equity, its debt-to-equity has remained negative. The stock is relatively overvalued compared to its peers.

Premium/Monthly

————————————————————————————————————-