The last week has been interesting especially when it comes to the international rhetoric. Pelosi’s visit to Taiwan has increased the likelihoods of another round of trade war. On the other hand, challenges for Europe continues to mount as amongst the impending energy crisis the region is experiencing one of the worst droughts further threatening energy security. Oil prices seem to have stabilized but the bigger picture tells that volatility will remain high.

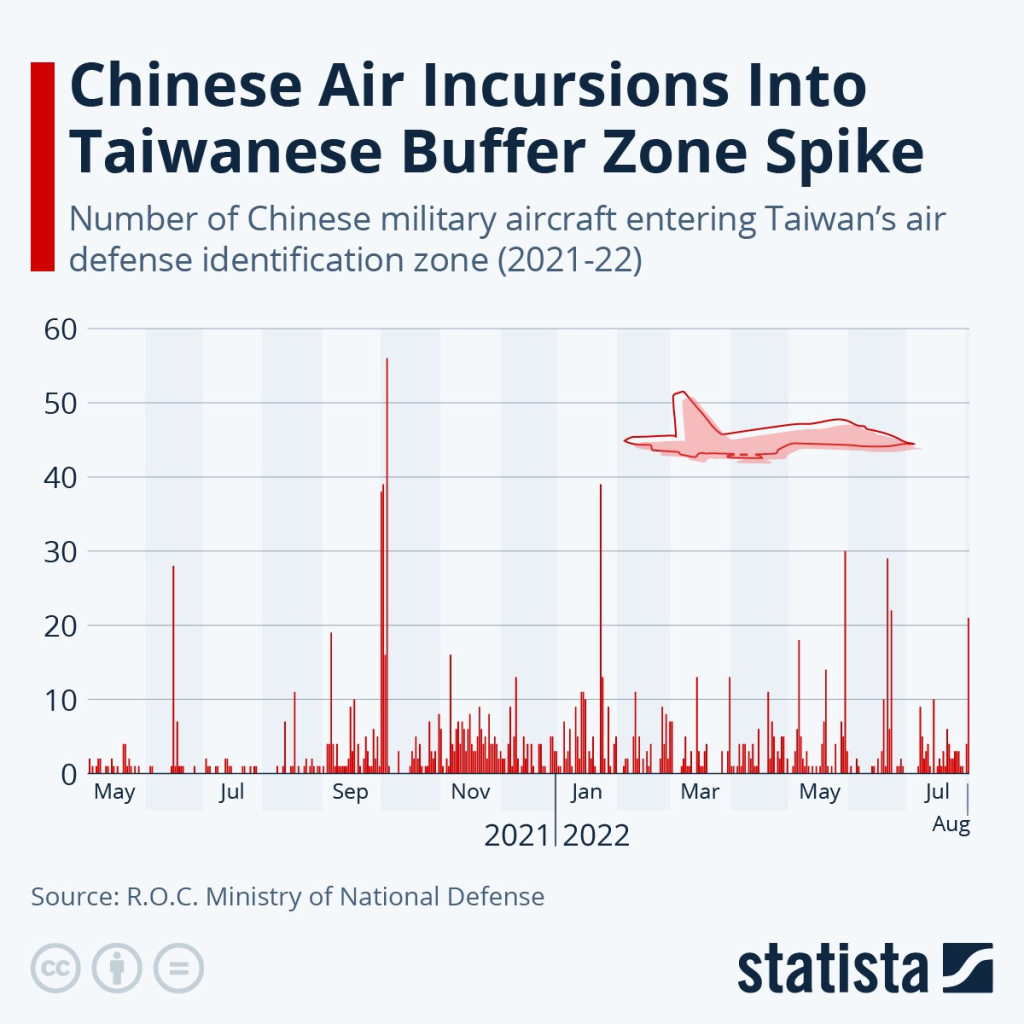

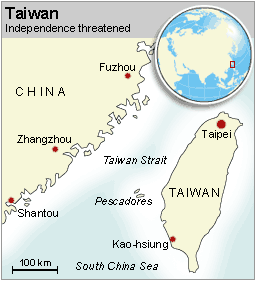

Nancy Pelosi’s visit to China welcomed all sorts of commentaries. My personal opinion is that not only the visit was ill-planned but also unwarranted given the geopolitical backdrop the world is living in. There has been a strong, stringent response from China both in actions and words. China told U.S. that “those who play with fire get burned” and that “we hope that the U.S. understands this”. China also carried out military drills and repeated its stance to annex Taiwan if not by peaceful means then force.

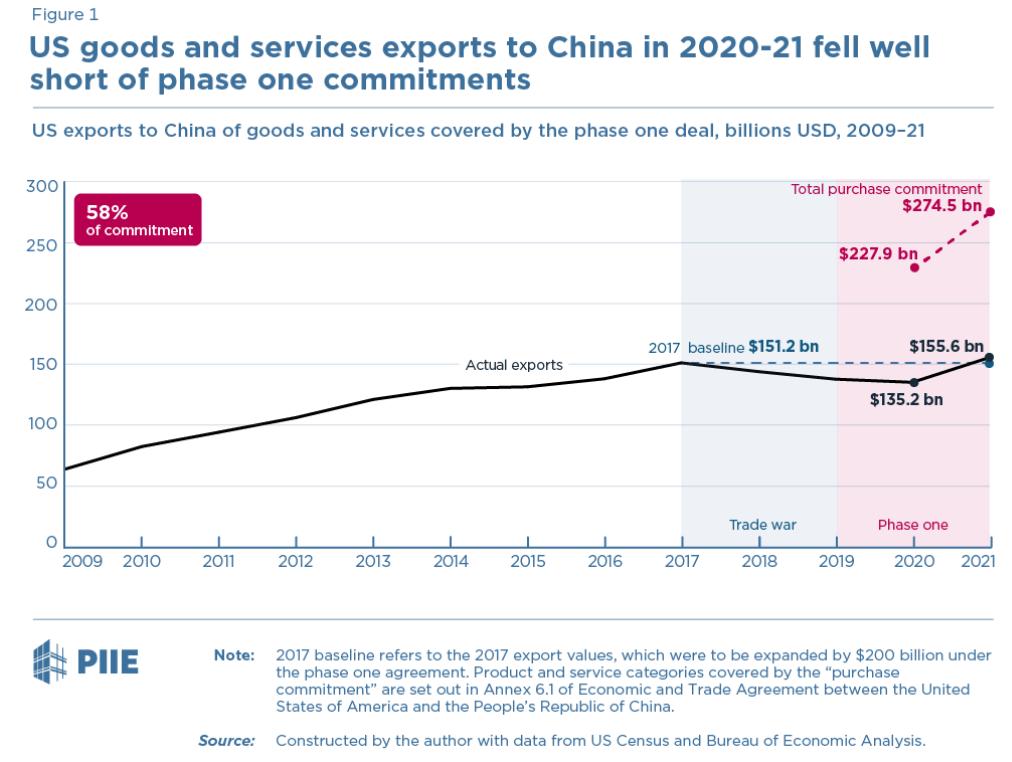

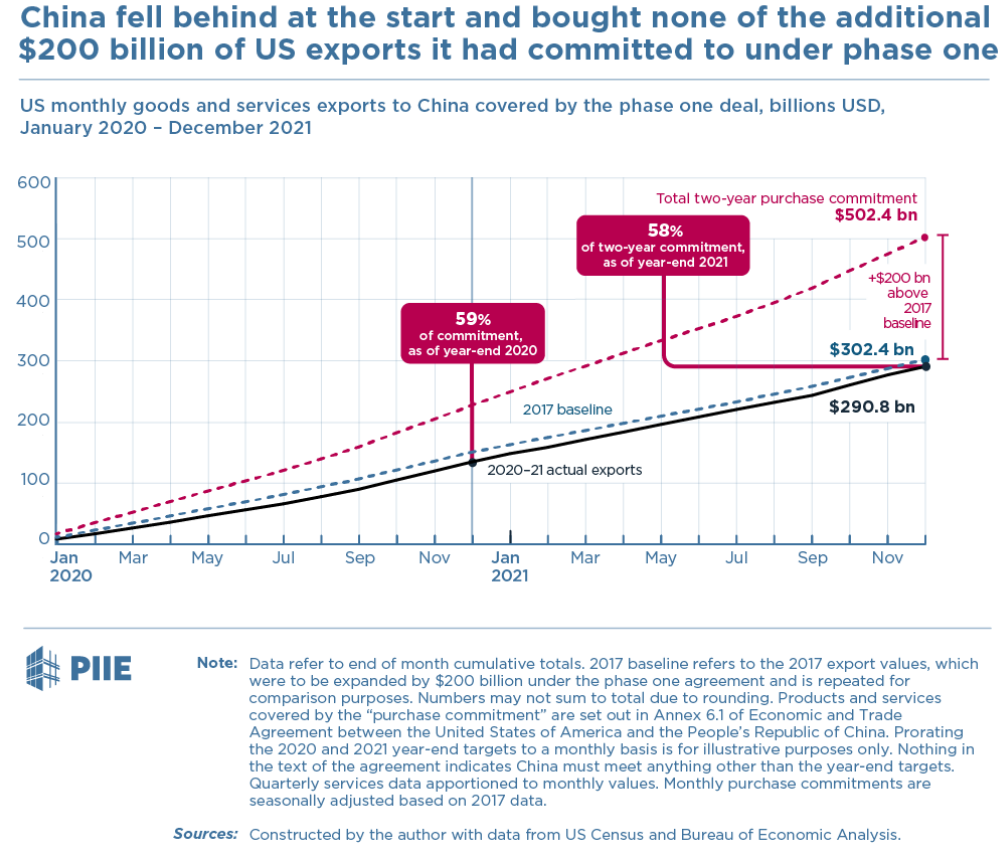

China has also accused U.S. of being the ‘main instigator’ in Ukrainian conflict. Pelosi has also warned that U.S. cannot allow China to behave as such against Taiwan and should stop pressurizing China. Such tough exchange of rhetoric only means that we will see some sort of escalation between two largest economies of the world. I have repeated this many a times in my articles that trade war remains a tailrisk to the Post-Covid global economic recovery. Reuters recently reported that Biden administration is rethinking their earlier approach where they wanted to ease some tariffs on China and may even impose more in a clear sign that both sides are warming up for another bout of trade war.

The tariffs imposed by Trump stills holds however the Exclusion List that had more than 2,200 products expired as Biden took over. So far only 352 of the import categories in that Exclusion List has been revised by the U.S. Trade Representative Katherine Tai. Trump imposed a total of $370 bn tariffs on China.

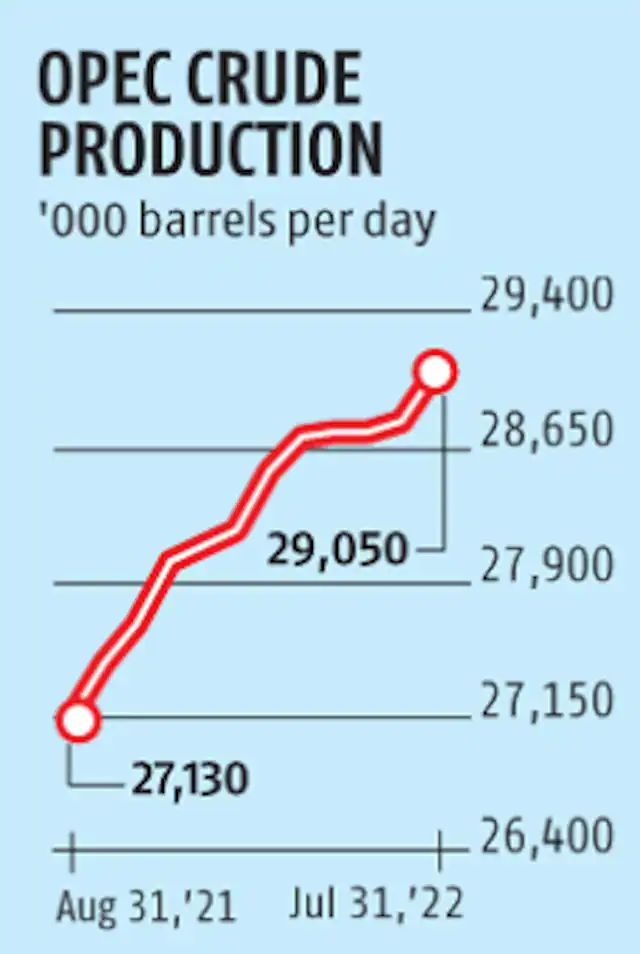

Now we shift to oil markets. Both benchmarks, Brent and WTI, closed the week with a 3.4 percent and 3.5 percent gain respectively. Supply disruptions in Gulf of Mexico also helped to buoy the prices. However, oil fell about 2 percent on news that it will ease soon. The demand side picture is not looking very promising. OPEC recently lowered its demand estimates by 260,000 bpd bringing it down to 100.03 mbpd. The group cited slowing global economies as the main reason. IEA, on the contrary, raised its demand projections by 380,000 bpd to 2.1 mbpd. With the aboe discussion in background I believe volatility will remain high.

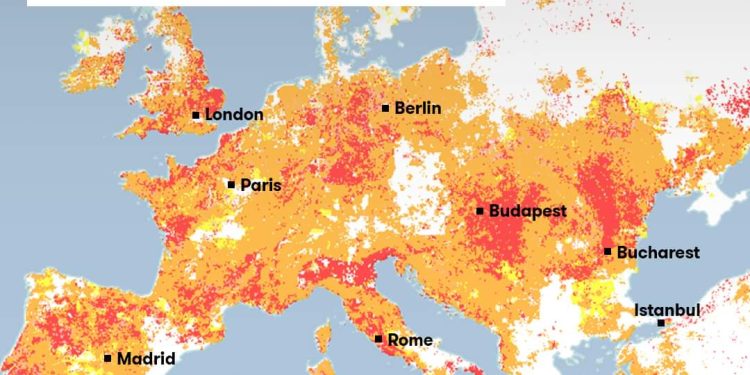

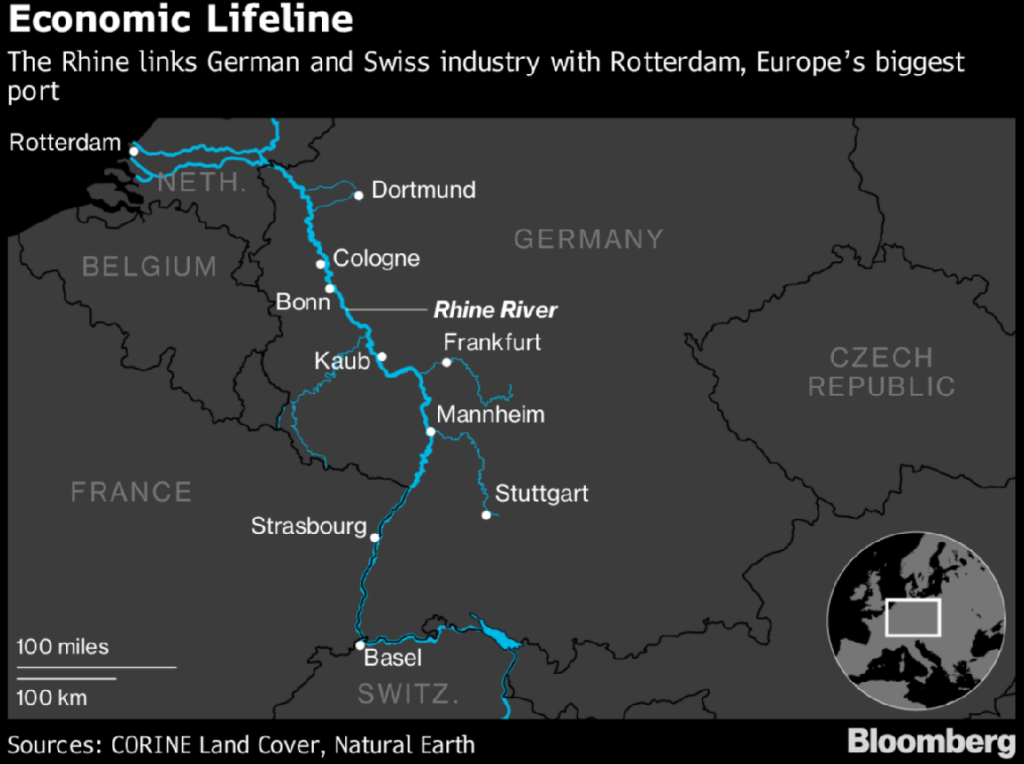

Finally, making a short trip to Europe that is facing one of the worst droughts. Almost 60 percent of EU and UK have been suffering from drought per the European Drought Observatory. Mark talks aboout this in our recent Frac Spread Count show as well.

For instance, in Italy, where the snowfall this year was 70 percent less than last year, Lake Garda has dried up and is at its lowest level ever recorded! European Comission’s Joint Research Center has warned that the droughts will exacerbate and affect 47 percent of the whole continent. France, UK, Portugal and other European countries are battling with wildfires, drying rivers and unusal weather patterns in what seems an almost apocalyptic rendition of news events. This ties with the greater issue of energy security and that relates also to the current sanctions and impending energy crisis. It is all connected (one way or the other).

I’ll conclude here. The key word for the next few months will be high volatility. Watch out for it!