Market Outlook

We have already discussed Liberty Energy’s (LBRT) Q3 2024 financial performance in our recent article. Here is an outline of its strategies and outlook. LBRT anticipates softer-than-usual year-end activity levels and pricing. However, the company expects hydraulic fracturing activity to increase in 2025 because drilling activity appears to have bottomed out in the market. So, Liberty plans to reduce its deployed frac spreads by ~5% temporarily and will reactivate those fleets in the long term in a “disciplined fashion.”

As I discussed in my previous articles, LBRT has a competitive advantage in e-fracking as it transitions fleet to next-generation digiTechnologies. It also expects its capex for the completion services to decline in 2025. So, its FCF can increase in FY2025 compared to FY2024. It will lower capex by adjusting its capital spending targets to fund potential new power opportunities.

LBRT’s Frac Strategy

After 9M 2024, LBRT sees the trend of producer consolidation, longer lateral wells, and concentration of activity in high-graded acreage to dominate completion activity. The decline in completion activity is in response to uncertainty in energy markets. However, a growing global demand for oil and natural gas will eventually lead to higher activity levels in the long term. According to management estimates, the frac efficiency is at its highest. However, this can decelerate due to equipment attrition, cannibalization, and idling of fleets, which will tighten the balance between frac demand and supply. Oilfield services companies can invest in leading-edge service technologies. In the short term, frac pricing can decline due to soft year-end frac activity. The company maintained a flat deployed frac spread count over the past two months and plans to reduce its deployed frac count modestly.

The company’s per fleet frac profitability remained above the cyclical high in 2018, while its management has confidence in the quality of the current cycle and a healthier frac market. During this period, it invested in developing new markets and led technology innovation. The company recently entered partnerships to develop the new gas-rich Beetaloo Basin in Australia, while Liberty Advanced Equipment Technologies delivered its first digiPrime pumps in Q3.

Other Key Investment Areas

It also invested in Liberty pump technology, including power ends, fluid ends, and ancillary equipment. In the PropX division (acquired three years ago), a premier provider of wet sand handling technology, it deployed its new damp pile delivery system, which optimizes damp sand piles for high throughput frac locations. In Liberty Power Innovations (or LPI), fuel gas operations commenced in the DJ Basin, with the first CNG sales in July. This should help bring its frac fleet CNG fueling services to critical mass.

The company also treats field gas for certain customers in the Haynesville, Permian, and other basins. The natural gas pricing outlook has improved in recent weeks due to producer curtailments and strong domestic power generation demand. The commissioning of LNG export facilities should stimulate gas activity in 2025.

Financial Performance And Balance Sheet

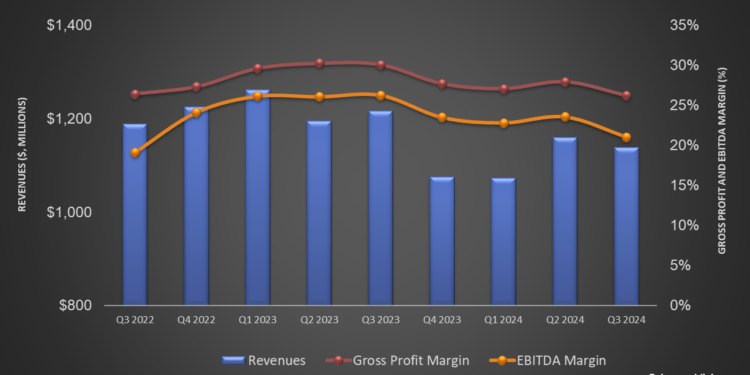

LBRT’s revenues increased by 2% quarter-over-quarter in Q3, while its adjusted EBITDA declined by 9%. Read more about LBRT’s performance in our short article. The company’s debt-to-equity, however, decreased to 0.06x as of September 30, 2024. During Q3, it repurchased 1.2% of its outstanding shares and has repurchased and retired 14.3% of its shares since July 2022.

During Q3, it increased its share repurchases relative to the prior quarter while it announced a 14% increase in its quarterly cash dividend. It balances its return of capital program with disciplined investment in innovative businesses and leading-edge technologies. In Q4, it plans to spend $200 million on digiTechnologies, completion of dual fuel technology upgrades, and demand for wet sand handling equipment.

Relative Valuation

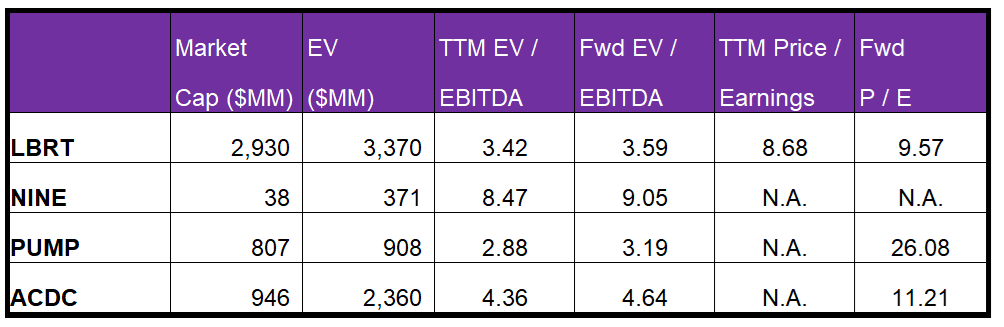

Liberty is currently trading at an EV/EBITDA multiple of 3.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is slightly higher. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of 15.7x.

LBRT’s forward EV/EBITDA multiple expansion versus the current EV/EBITDA is lower than its peers because the company’s EBITDA is expected to decline less sharply than its peers in the next four quarters. This typically results in a moderately higher EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is lower than its peers’ (NINE, PUMP, and ACDC) average of 5.4x. So, the stock is undervalued compared to its peers.

Final Commentary

LBRT expects a sharper-than-usual Q4 activity decline this year. So, it plans to temporarily reduce its deployed fleets by ~5% as completion services decline. The current drilling and completion market features producer consolidation, longer lateral wells, and high-graded acreage. Lower upstream capex can keep frac pricing depressed in Q4. However, it expects hydraulic fracturing activity to increase in 2025. Oilfield services companies can focus on leading-edge service technologies as LBRT invests in power ends, fluid ends, and ancillary equipment. Its fuel gas operations in the DJ Basin and the recent CNG sales can help bring its frac fleet CNG fueling services to critical mass.

LBRT accelerated its share repurchases relative to the prior quarter while it announced a 14% increase in its quarterly cash dividend in Q3. The company’s cash flows decreased noticeably in 9M 2024. Despite that, it continued to generate return capital to shareholders. The stock is relatively undervalued compared to its peers at this level.

Premium/Monthly

————————————————————————————————————-