As we move into 2025, the U.S. shale oil landscape is experiencing winds of change given the ever-fickle global economic indicators and growing pressure on going green. This has made the sector mature and forward looking in its approach. Companies are no longer riding the wave of explosive growth that defined the last decade. Instead, the approach is becoming more nuanced — marked by strategic asset management, international diversification, and technological investments to drive efficiency. The plans of major fracking companies offer insight into this shift, and what it means for the future direction of U.S. shale oil production as it closely aligns with the overall supply side of the equation and as an extension speaks about how the changing dynamics in the U.S. oil industry might have a bearing on the OPEC+’s decision regarding their production cuts.

Let’s start! Take ACDC, for instance. The company’s strategy to invest in diesel substitution equipment powered by natural gas is a clear move to improve its cost structure and environmental footprint. However, data shows their average active fleet declined in Q2, with utilization rates slipping. This aligns with the broader trend in the sector where companies are pulling back on aggressive expansion and instead focusing on fine-tuning their existing operations. If utilization improves in Q3 as projected, it could serve as a benchmark for other players trying to adapt to an environment where oil prices are expected to be under pressure.

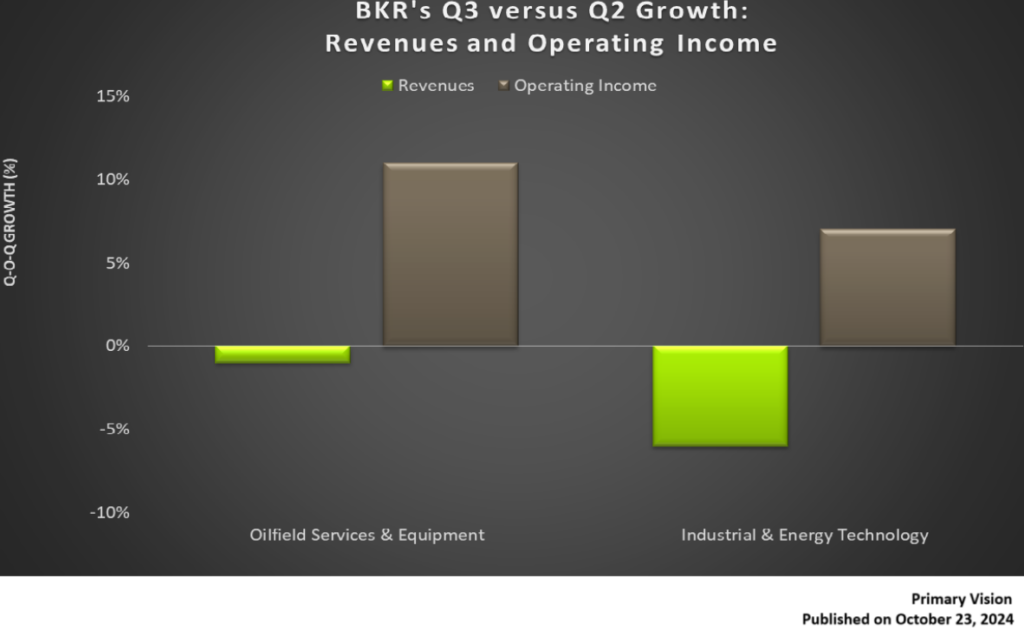

Baker Hughes (BKR) is a prime example of a shift in geographic focus. In response to a tepid North American outlook, BKR is leaning heavily into international markets, securing a multi-year contract for plug and abandonment services in Brazil and teaming up with Petrobras for seabed pumping systems. This isn’t just about diversification; it’s a calculated move to tap into markets with higher growth potential. They’re also strengthening their foothold in Algeria and Australia, with projects that capitalize on gas technology and long-term LNG operations. This diversification isn’t just strategic—it’s essential for companies facing reduced rig counts and a weaker domestic drilling environment. North America may not provide the growth it once did, so tapping into international opportunities becomes more than a choice; it’s a necessity for revenue stability.

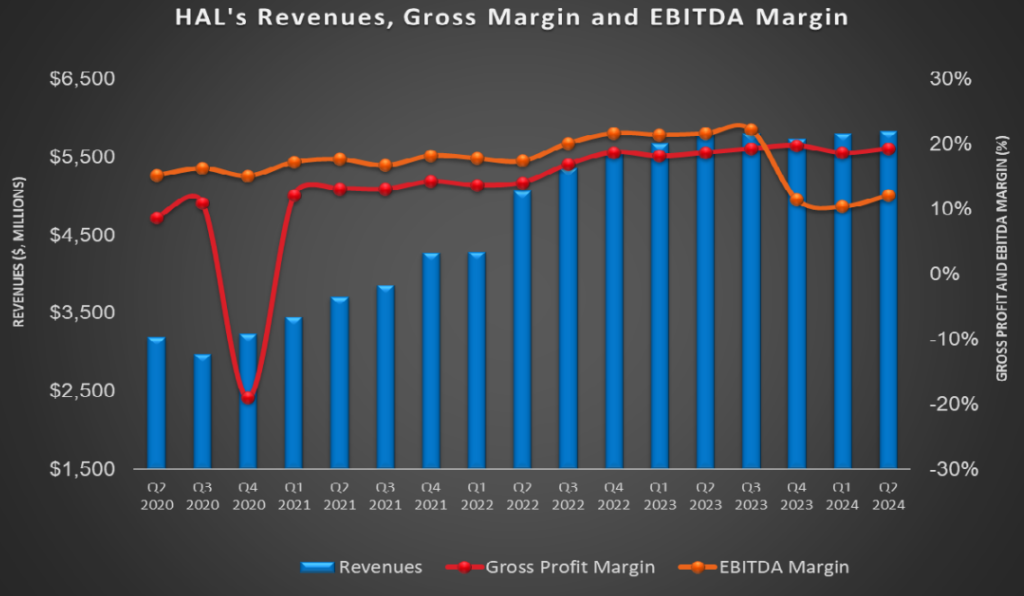

Looking at Halliburton (HAL), the company retired several frac spreads in Q2 as it anticipated reduced revenues from its North American operations for the latter half of 2024. In contrast, it’s ramping up in international markets, particularly with advanced technology plays like its GeoESP submersible pumps and its offshore multi-well construction project in Namibia. Halliburton’s pivot is a clear indication that while the U.S. market may be cooling off, there are still lucrative opportunities abroad—especially where higher-margin projects can make a meaningful impact on the bottom line. It’s no wonder then that HAL’s international revenue growth projections remain strong, even as it expects domestic revenues to settle a bit on the lower hand. The company’s savvy investments and partnerships, such as with Wintershall Dea and an AI firm in Abu Dhabi, highlight its adaptability and forward-thinking approach in a sector that’s getting squeezed on multiple fronts. We have also discussed this in detail in another FREE TO READ article here. HAL is wokring on an electric frac fleet and one of its projects with Chesapeake Energy includes Halliburton’s Zeus™ 5000 horsepower electric pumping unit and VoltaGrid’s power generation system is environemtnally friendly with a 32% reduction in emissions and applied over 25 megawatts of lower-carbon power generation.

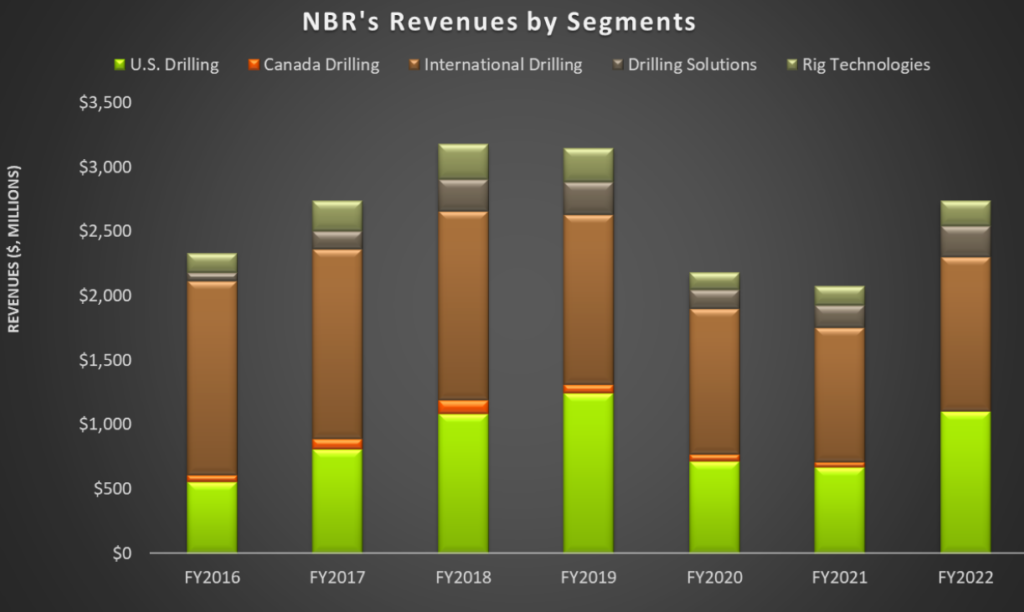

Nabors (NBR), another key player, is not just putting all of their eggs in one (domestic) basket. It’s aggressively deploying rigs overseas, particularly in Saudi Arabia and other parts of the MENA region. Saudi Aramco’s recent announcement of $25 billion in contracts for natural gas development underscores the strategic importance of this region for NBR. The company’s commitment to deploying SANAD joint venture rigs in Saudi Arabia and additional rigs in Kuwait, Algeria, and Argentina illustrates its proactive approach. By 2025, NBR plans to add around 30 new rigs, reinforcing its intent to capitalize on markets where demand remains robust. This is particularly critical given the downtrend in the U.S. rig count, making international ventures essential for growth. But it’s not all about international projects. Companies like ProPetro (PUMP) are focusing on fleet recapitalization, investing in next-gen natural gas-burning assets as they see higher demand domestically. Their increased frac spread utilization compared to late 2023 indicates a strategic shift to optimize existing assets while preparing for a more sustainable energy landscape. Similarly, KLX Energy Services (KLXE) is enhancing its downhole technology portfolio and diversifying its service offerings to stabilize cash flow. The success of these moves will depend largely on their ability to reduce costs and improve asset utilization in an environment where new drilling isn’t as aggressive as it once was.

The broader picture suggests that U.S. shale growth will be steady, but not exponential. Liberty Energy (LBRT) expects pressure pumping activity to slow in Q4 of 2024, only rebounding by 2025. The company is betting on the future, developing advanced pumping technology and expanding power solutions in places like the Beetaloo Basin in Australia. Liberty’s involvement in the DJ Basin for power applications also shows the increasing trend of U.S. firms diversifying into power-related sectors to mitigate volatility in oil markets. SLB (formerly Schlumberger) is another notable example. Its recent partnerships with NVIDIA and Amazon Web Services indicate that the future of the oilfield services sector is increasingly digital. The launch of SLB’s Lumi AI platform marks a significant step towards data-driven decision-making in an industry that has traditionally relied on physical assets and human expertise. By integrating AI and data analytics, SLB isn’t just innovating; it’s preparing for a future where efficiency and precision are paramount. The company’s decision to sell off interests in the Palliser Block further aligns with its focus on high-tech solutions rather than legacy oil assets.

Finally, PTEN has chosen not to pursue rigs that have become uncompetitive in an oversupplied market. So, it retired 42 rigs idle for more than three years and is retiring and decommissioning ~400,000 HHP of Tier-2 diesel frac equipment. It will reduce its pressure pumps by about 10% to 3 million HHP by 2024. After the NexTier merger, PTEN recorded $885 million in goodwill impairment charges. In Q3, the company identified 42 legacy non-Tier one rigs and equipment to be retired following the evaluation of its fleet of drilling rigs for marketability based on the condition of inactive rigs. Its management believes “these rigs have limited commercial opportunity and are unlikely to ever return to work with our significant capital investment.”

These developments demonstrate that the direction of U.S. shale is shifting towards a more efficient, less volume-driven model. The domestic focus is increasingly on technological enhancements, fleet optimization, and power applications rather than aggressive expansion. The future growth, then, lies in international markets and innovative technological solutions, which are set to stabilize and sustain U.S. shale firms in the years ahead. In essence, U.S. shale companies are recalibrating their strategies. The days of explosive domestic growth may be behind us, but the sector is evolving, leveraging international opportunities, and pioneering technology to remain resilient. The result is a more balanced, sustainable approach, which could redefine the trajectory of U.S. shale production in the decade ahead.

This relates very well to the overall supply picture in 2025 and how it can have a bearing on OPEC+’s decision to start unwinding their production cuts. It is all about connecting the dots.