U.S. and the World

The U.S. economy looks strong. On the positive side, job creation remains solid, with an average of 173,000 new jobs per month since September and a notable 227,000 jobs added in November. Consumer sentiment, as measured by the University of Michigan, rose to 74.0 from 71.8, driven by robust holiday spending.

Revolving credit surged at a 13.9% annual rate, the fastest in eight months, signaling heightened consumer reliance on debt. However, concerns persist as corporate debt-to-earnings ratios hover at record highs. Interest costs remain unyielding, and global debt ballooned by $12 trillion in three quarters. The U.S. debt-to-GDP ratio now stands at 326%, surpassing pre-pandemic levels, reflecting broader fiscal challenges.

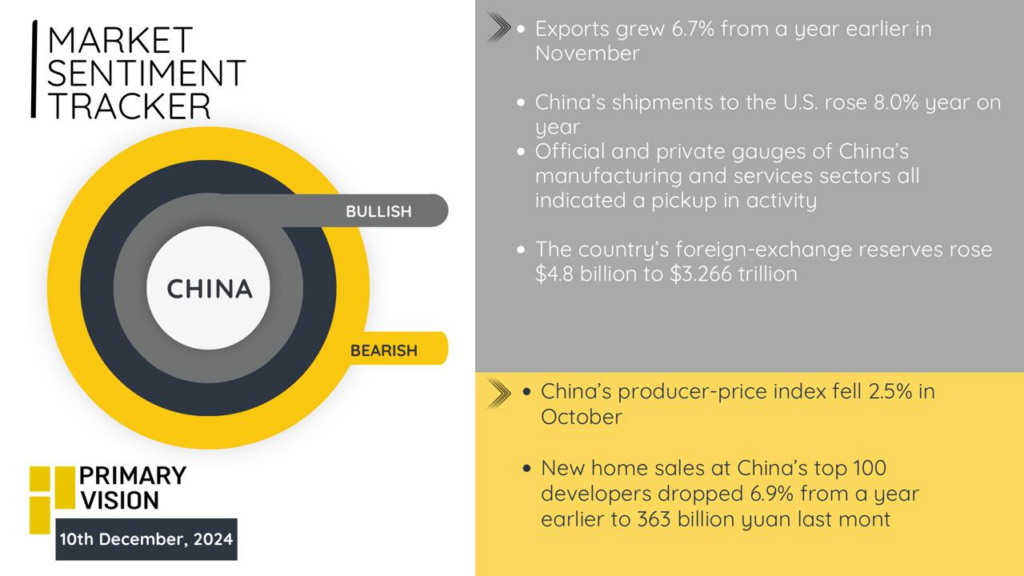

China

China’s exports surged by 6.7% year-on-year in November, with shipments to the U.S. rising 8%, signaling strong external demand. Manufacturing and services PMI data suggest steady activity. Foreign-exchange reserves expanded by $4.8 billion, reaching $3.266 trillion. Yet, the domestic picture is less rosy. Producer prices fell 2.5% in October, and home sales at top developers plummeted 6.9%, underscoring tepid domestic confidence. While external trade shows resilience, China’s internal economic dynamics signal fragility.

Eurozone

The Eurozone’s GDP growth inched up marginally in Q3, with Spain growing by 0.8% and France by 0.4%. However, exports declined 1.5%, reflecting weakening demand. Germany’s GDP eked out a 0.1% gain, missing expectations, while Italy’s manufacturing struggles weigh on sentiment. The Netherlands’ economy contracted by 0.8%, adding to regional disparities. Overall, the Eurozone is grappling with a fragile recovery, as declining exports and industrial sluggishness offset modest gains.