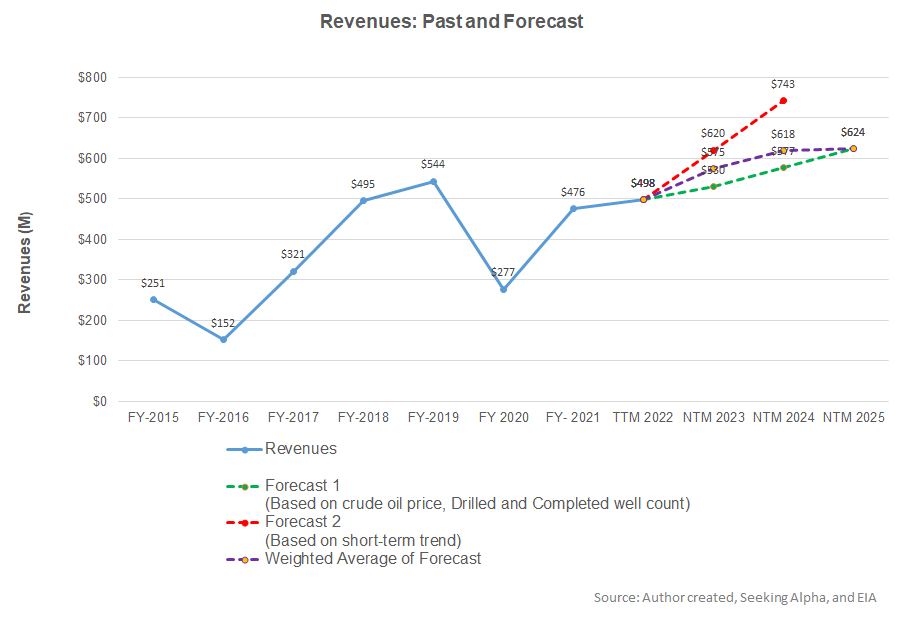

- Estimates suggest strong revenue growth in NTM 2023, but the rate can decelerate in NTM 2024 and NTM 2025

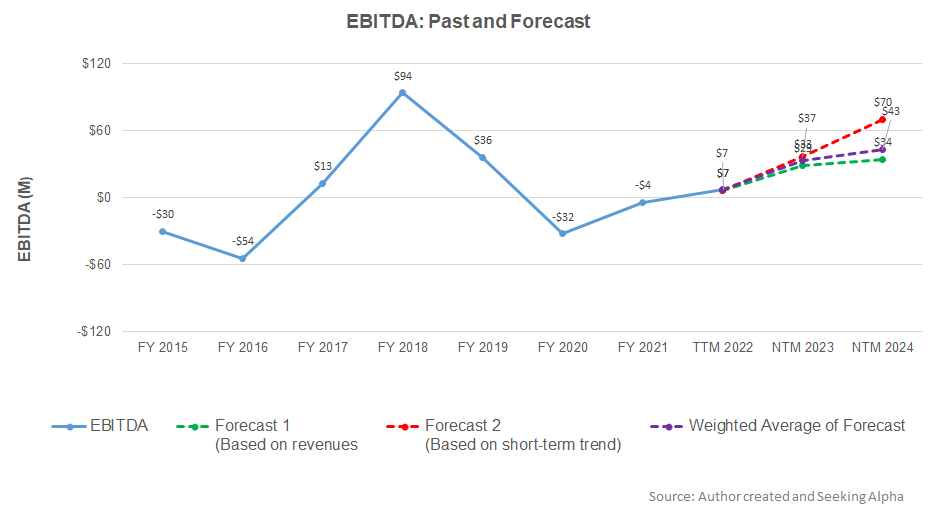

- EBITDA growth rate, too, can fall in NTM 2024 after a steady pace in NTM 2023

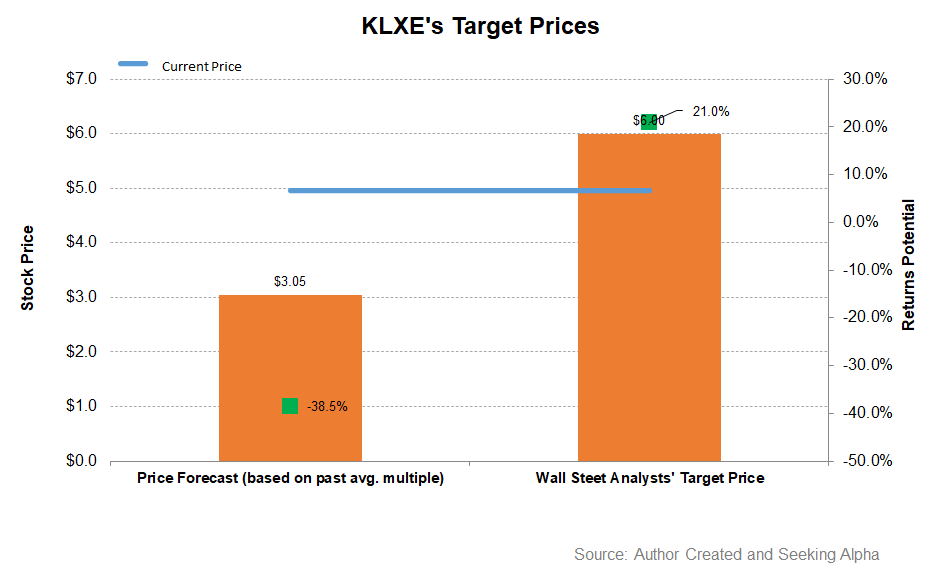

- The model suggests the stock has a downside at the current level

Part 1 of this article discussed the KLX Energy Services’ (KLXE) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation between the key industry indicators (crude oil price, and the US drilled well count and completed well count) and KLXE’s reported revenues for the past seven years and the previous four-quarters, I expect its revenues to increase steadily in the next 12 months (or NTM) in 2023. The growth rate can decelerate in NTM 2024 and NTM 2025.

Based on the same regression models and the forecast revenues, I expect the company’s EBITDA to increase in NTM 2023. The EBITDA growth rate can subdue in NTM 2024 and the following year.

Target Price

Returns potential using the past average EV/Revenue multiple (0.76x) is lower (38% downside) compared to the sell-side analysts’ expected returns (21% upside) from the stock.

What’s The Take On KLXE?

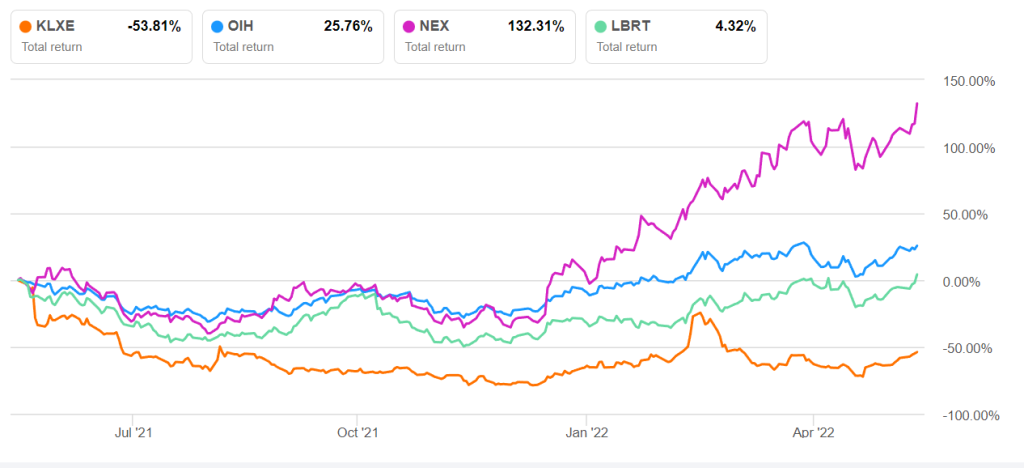

Since the energy market recovery started in late 2021, the oilfield services sector lagged the operators because of the fragmented nature of the industry, while excess equipment availability kept pricing low. On top of that, the supply chain disruption and the inflationary pressures on labor and material have curbed KLXE’s growth trajectory. In many of its primary asset classes, utilization remained at the low-30s in Q1. So, the stock significantly underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

Nonetheless, an improvement in pricing and the availability of utilization will enable KLX Energy Services to rapidly improve its top line and operating margin in Q2 and 2022. The company’s drilling, completion, production, and intervention activities are robust in various geographies. The company’s balance sheet is still out of shape. Its financial risks remain high due to negative shareholders’ equity. The rise in capex in FY2022 will keep free cash flows negative. We see further downside from the stock in the near-to-medium term.