By Mark Rossano

U.S Completions

The North America crude market is going to continue to struggle as crude prices remain under pressure. Oil rigs are now heading below 2017 levels, which will be reached in the next week or two as oil prices start to impact E&P investment. Rig counts have fluctuated within a tight range, but will begin rolling over as DUC completion remains a core focus. Completions will outpace 2017 on a seasonal level, but the trend will be lower as pricing weighs on E&P balance sheets. Typically, completion crews trend lower into the close of Aug, but reactivate through Sept and maintain elevated rates until Thanksgiving where rates drop for the holiday season. The biggest question to be answered- how do E&P companies react and how can we see the information in the data?

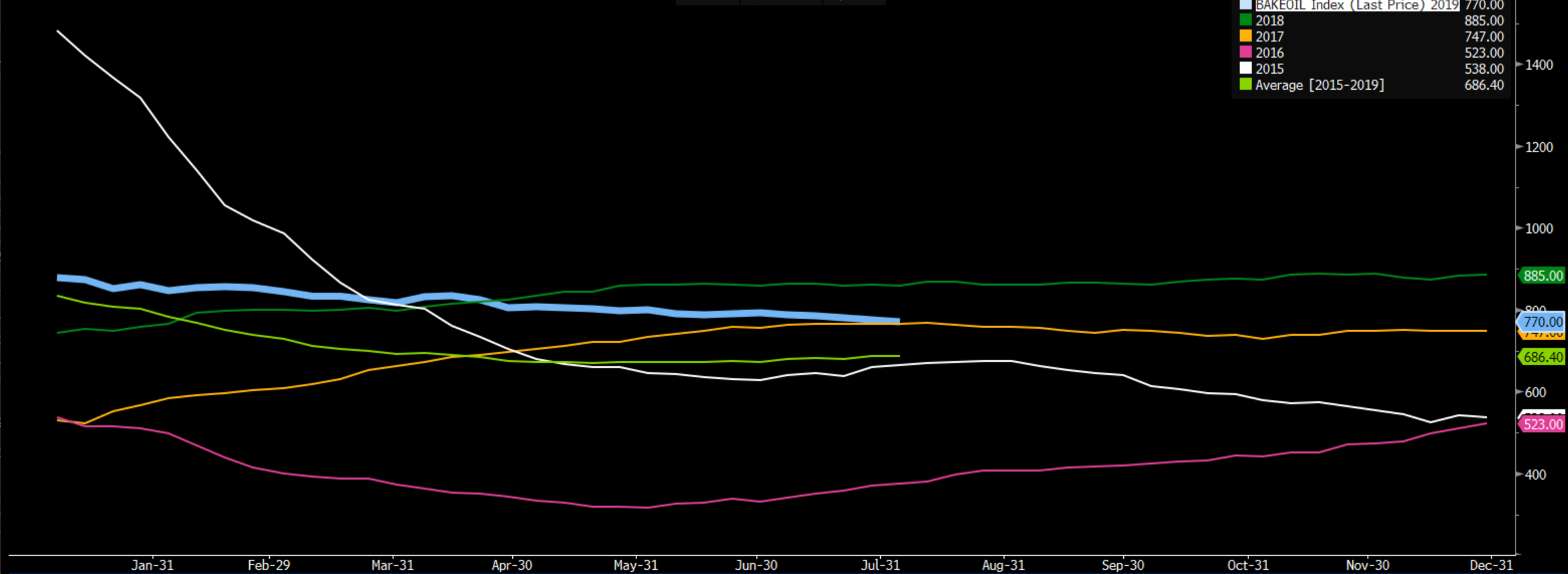

Baker Hughes Oil Rig Count

CAPEX will remain focused on completions and pressure pumping, but will underwhelm as cost remains prohibitive for SMID Cap E&Ps trying to preserving capital. The shift is in the data- more proppant, water, and stages but less wells being completed. Frac spreads are currently running at elevated utilization rates as pressure pumpers shelve spreads that have either reached the end of their useful life and/or require overhauls that currently don’t make economic sense. This may seem counterintuitive- why would an E&P keep spreads when looking to stay cut costs? The short answer is- there are pipes to fill out of the Permian, guidance to hit, contracts signed, and hedges in the near term. Over a longer time period, completion crew utilization rates will decline, and not see the same acceleration in Sept-Oct that has happened the last two years.

Primary Vision National Frac Spread Count

The data points to a rise in proppant levels and water, which is “pulling” production forward by increasing it through the first 3-12 months of the well, but sacrifice the length of time it will produce. The market saw something similar in 2015, but this time E&Ps are already recovering close to 15% more of hydrocarbons in place based on new well designs. Frac spreads will be kept busy with less wells, but instead higher levels of proppant, stages, and intensity (water). By just taking an example- Pioneers well ShackelFord- 101H to 103H consumed almost 51M pounds of sand and 65M gallons of water with something similar in 104H-106H. Another example is Driver 116H-118H consuming 66M gallons of water and 51M pounds of proppant- these are the type of numbers that will start to trend higher. Diamondback uses something similar- for example- Victory State 602H-603H was 40M pounds of proppant and 42.4M gallons of water. This is larger per well on the pad vs Pioneer- so there is flexibility to take some of these wells higher. Most wells are now drilled utilizing pads and slickwater, with the water based fracs benefitting from higher proppant loadings and intensity to drive near term production gains.

Seasonality will play a roll in the slowdown, but the bigger shift is (shockingly) the change in the price deck of the drilling portfolio. E&Ps across the U.S. are struggling, and those that will survive either control the full hydrocarbon supply chain (XOM, CVX) or are fully integrated from the well head to the dock (PXD and COP). There are others that have means to survive with firm transport and some integrated processing such as FANG and MTDR. The pressure will remain across independents that don’t have international holdings to help bridge the cash burn. These companies will be consolidated over time, which will lead to an adjustment to drilling over the long term. Full development is starting to be rolled out, and efficiencies will continue ranging from streamlined supply chain all the way down to e-fleets.

While the long-term trajectory is slowly unfolding, the current price deck and mix of oil, natural gas, and NGLs must be addressed. The rig count is already reflecting an adjustment in spending with more rigs getting released. The DUC count offers more than enough running room, but the biggest cost for a well is its completion. So how does an E&P maintain production guidance while minimizing cost- frac fewer wells, but the ones completed pump as much proppant and fluid down as the reservoir can handle. This will pull forward production from the specific wells helping to maintain production guidance while attempting to live within cashflow. The Permian will remain active even as realized prices come under pressure due to companies reducing cost. While price deck is important, it is key to consider total cost and if the E&P has any flexibility to reduce cost. For example, if crude prices fall $5 a barrel and the E&P reduces cost $5 a barrel- did anything really change? In 2015, there was a lot of price that came out of the service sector that doesn’t exist in the same way- so E&Ps that will survive (not so much thrive) will be the companies that are vertically integrated and can reduce costs in the supply chain.

Primary Vision National Frac Spread Count

International

The global market remains in a precarious state even as production has come off from the highs in Nov/Dec of 2018. Libya is coming back online with more product stranded in West Africa as Saudi Arabia cuts prices into Asia while announcing a reduction in exports. With the trade war heating up, China is sitting on a large chunk of Iranian crude that could easily be run through their system. Even as OPEC production has come off, oil storage has grown as well as global refined product storage. This is supported by builds across EIA/ ARA/ Singapore data that remain indicative of low product demand. The supply/demand picture remain problematic as OPEC remains at lows driven by Iran, Venezuela, and the OPEC+ deal while North Sea, Brazil, and North America expand. Angola has cut back some sales as deferrals rolled shipments back several months and Nigeria remains stuck with cargoes. This is all complicated as the market sits in August with the shoulder season just around the corner. Saudi discussed that customer requests were 700k b/d vs August- but the data doesn’t support the commentary nor will a cut in further exports be enough to get oil prices higher in any meaningful way. As Saudi exits their elevated oil burn seasonal period (summer) plus a reduction in exports, there should be a much larger drop in production numbers- if they don’t appear- it just points to more crude being placed in storage to either replace draws or to be unlocked in a strategic manner (oil remains an economic weapon).

OPEC Production

A bright spot some may point to is the recent China data: July crude imports 9.66 mln bpd, +14% on yr, but this also led to fuel exports up 20% on the year as there is a growing surplus. The oversupply is being generated by more facilities coming online (more supply) while local demand remains problematic and has led to negative margins in June. Diesel provided the uplift in July to bring slightly positive margins while gasoline margins continued to trend negative with no reprieve in gasoline margins any time soon based on global demand and storage trajectories for gasoline. The U.S. has seen gasoline demand fall to the 5-year average as storage levels are now well above the 5-year average- highlighting how the rise in exports haven’t been able to offset a bigger fundamental problem- demand.

ARA Gasoline

Pressure will remain across the energy supply chain with little to support refined product demand as economic data continues to highlight the global slowdown. This has already started to reverberate as builds have increased through the system even as oil supply has declined. Saudi Arabia has discussed potential ways to stem the tide of the price slide- but there is little opportunity unless KSA is willing to cut exports further. This would just leave more optionality for U.S., Russia, Iraq, and WAF crude to find a home, while Libya brings volume back online. Russia is going into turnaround a bit early so more crude will be available in the near term- keeping

pressure in the market. Price risk remains to the downside over the next few weeks as the market faces oversupply heading into shoulder season. In the U.S., as new pipelines come online crude will quickly fill and overwhelm coastal (export) infrastructure shifting the bottleneck to the coast, which will keep a lid on U.S. crude pricing as the international market struggles.