Frac Spreads Falling

By Mark Rossano

The national frac spread (fsc) continues to decline as work remains slow across the U.S. with noticeable shifts in the Permian, Eagle Ford, and Williston. Realized prices will remain under pressure driven by seasonality (refinery maintenance season), oversupply of refined products, and glut of light/sweet crude in the market. This is all impacting E&P balance sheets driving them to reduce rig counts as well as frac spreads in an attempt to live within cash flow. The below is a breakdown of the slowing activity versus previous years with changes from 8/30 to 9/27 resulting in growing reductions: Permian- 14 / Eagle Ford- 7. These were key locations that should have seen stable activity as pipelines came online in the Permian, and the Eagle Ford filters into the LLS (Louisiana Light Sweet) market, which should have been strong with the Saudi Arabia attack. Instead, the Permian pipelines were filled with capacity competing for space on other lines, oil behind pipe, and current operational spreads. The U.S. exports did rise, and will be reflected in next week’s EIA report, but the total number still remains underwhelming given the expected impact of the global supply chain disruption. Typically, E&Ps will increase activity by bringing on more completion crews from now until Thanksgiving, instead- we expect a stabilization where national spreads hover around 375 versus the normal rise.

The chart below highlights how this is the longest slow period without an uptick in frac spreads since Primary Vision began collecting data. Based on the current available data, there could be a decline to about 375 before there is a bounce in activity. Either way- the data highlights the limited activity across the U.S, which will stabilize at these levels over the next two weeks. The pressure on crude, natural gas, and natural gas liquid pricing will keep activity muted across the U.S. Weak natural gas prices has already sent the Utica and Haynesville to historic lows, while the Marcellus sees the most stable activity driven by low breakeven costs. Robust NGL pricing helped support activity throughout 2018, but current pricing pressure has limited activity in several basins including the Mid-Con and Utica. There is a lot of pent-up demand for natural gas liquids in the global market, but the U.S. lacks the effective infrastructure to get it to market in a cost effective manner. This is quickly being addressed, but it will take time to bring the new coastal facilities online. LPG demand has risen globally, and the recent disruption caused by the Saudi Arabia attack has sent countries throughout the world, scrambling to replace the lost cargoes. The U.S. is in position to be the swing producer of NGLs, but that is still 24+ months away, so the rise in global NGL pricing won’t translate to rising frac spreads in the near term. As the energy financial markets struggle, there will be limitations on the available capital for struggling companies to issue equity or debt. The degrading balance sheets of many service and E&P companies will keep activity low, and as hedges roll off activity will continue to decline in an attempt to preserve cash.

Soft demand for U.S. oil will continue as domestic and international refinery utilization rates decline during typical maintenance season. The U.S. decline in utilization rates is currently below the 5-year average- per the chart below. This is on the back of slowing U.S. product demand along seasonal norms, pressure in the export market for refined products, and expected product builds. The limitations in the European markets and muted Latin American demand has kept a lid on U.S. exports, which has pushed domestic refiners to slow down activity further than normal. European refiners are also in turn around, and this is typically a time when the arb opens up for distillate from the U.S. to Europe. Instead, the European markets are being fed by a glut of distillate originating from West Africa and Asia.

International

The international market is signaling additional headwinds for U.S. crude and products that will persist throughout the remainder of the year. There was a big disruption in the market when the third largest oil producer in the world was attacked, and any premium left in the oil market from the supply shakeup has evaporated. This is driven by demand that continues to fall as indicated by economic markers globally, and an oversupply of light/sweet crude in the market that quickly backfilled the disruption. The persistent pressure on crude demand is also at the crux of Saudi Aramaco’s drive to sign on long term crude deals to solidify their placement of KSA oil in countries, such as India and China. The oversupply of light/sweet crude in the market will continue to pressure U.S. exports in a world experiencing a slow-down in total demand.

Several recent events have shifted crude movements around the world.

-

The Saudi attack has impacted their ability to upgrade/ process crude at the facility. This means that customers will either accept a “lower quality” crude (higher sulfur than initially agreed) or go out and find new shipments on the spot market. The cost to replace would be expensive so it is easier to just accept the lower grade, and blend on their side, while adjusting shipments going forward until Abqaiq can process oil to typical specifications. This will take months given the specific nature of machinery that was impacted.

-

KSA has been able to get close to normal operation and is making up any shortfall from storage. Saudi Aramco has enough spare capacity away from the facility that they can pump above exports in order to backfill storage, while meeting near term export demand. It will just take time to get the operations going and the crude to areas that have experienced draw downs. The company has announced they have currently achieved these levels and is already filling drawdowns.

-

The decline in crude quality has pulled more shipments from West Africa, the U.S., and other regions, which will persist through November as Saudi Aramco’s ability to upgrade crude remains impacted. While this move cleared some deferred Nigerian and Angolan crude into the market, purchases have slowed into November with Nigeria increasing export to a 4 year high of 2.14M barrels a day while Angola is still sitting on 40% of their initial cargoes for Nov.

-

This points to a continued slowdown in total demand globally as builds in products continue and crude demand slows.

-

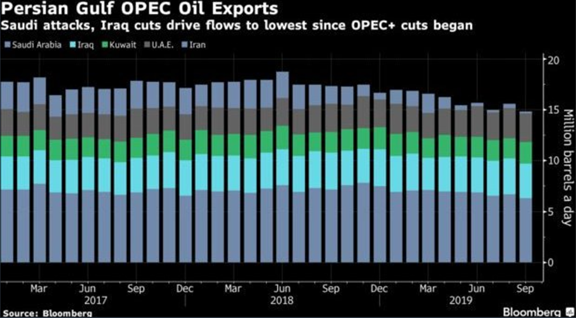

The decline of 736,000 barrels a day in September for Persian Gulf OPEC oil exports wasn’t enough to support pricing as product draws underwhelmed, and WAF spare cargoes filled the void and responded with increases in November loadings.

-

The weak global oil price has led many OPEC+ nations to adjust their y/y demand growth estimates.

-

-

The new U.S. Sanctions on Chinese Shipper Cosco: Cosco Shipping Tanker Co and Cosco Shipping Tanker Seaman & Ship Management Co have been added to the Office of Foreign Assets Control’s (OFAC) designated nationals and blocked persons list. This has blacklisted about 100 tankers in the oil trading business, which has sent countries and companies scrambling to charter other vessels to maintain operations. This pushed dayrates to 11 month highs.

-

Gasoil/Diesel in floating storage in West Africa has shifted the movement of cargoes as more flow into Europe. Even though European refiners are in turnaround- storage levels remain elevated. This has impacted the shipment of distillate from the U.S. into Europe pushing U.S. exports to seasonally adjusted lows that are below the 5-year average. This will persist and continue to pressure U.S. exports from the Gulf as Lat Am demand remains below normal.

-

Economic data globally continues to highlight a slow-down in economic activity, which will remain an overarching theme as we evaluate refined product demand. Refined products have quickly been building above seasonally adjusted averages in Singapore, Europe, and Fujairah.

-

Leading and current economy indicators point to a contraction that is being reflected across the refined product market, and is resulting in a total slow down of oil demand across the complex. The Saudi attack provided a near term bump, but it quickly faded as pressure resumes across the landscape.

-

The pressure in oil highlights some key facts following the Saudi attack:

-

Demand for crude remains under pressure

-

There is more than enough crude in the market to supplement, but it took time to deliver as it was originating from further distances

-

KSA has been able to effectively fill the void created by the disruption faster than the market expected as we explained in our previous analysis.

-