By Mark Rossano

National Frac Spreads

In support of weak activity, proppant deliveries and loadings remain well off seasonal pace and are at 5 year lows across the U.S. This reduced activity highlights pressure on current U.S. production as we head into the end of the year, but also provides for pricing power with proppant providers and rail companies looking to sell volumes. The depressed pricing and willingness to move product will support completion activity as these levels with a small increase through year end. The cost savings will help spur some additional activity into Nov, but well off of seasonal norms and well below the typical increase in activity. It will also keep pressure across U.S production in the very near term. The bigger focus for E&Ps into year end is maintaining or reducing CAPEX, which has already started with some adjustments in production targets for 2019.

Permian Proppant Loadings

Proppant loadings still remain at 5-year lows into the Permian, but there will start to be an increase in proppant deliveries as activity stabilized while remaining well off typical pace. The Eagle Ford is fairing even worse with little in terms of adjusting activity into year-end, while the Permian will see some increase in activity into Thanksgiving.

U.S. refiners remain well off seasonal averages and have utilization rates that are below depressed levels caused by Hurricane Harvey. There will be a small increase over the next two weeks as East Coast refining margins have recovered a bit, and will incentivize additional utilization as more European product moves to Lat Am. The limitation on European product will keep margin strong in the near term for PADD 1 activity.

Typically, U.S. product fills Lat Am demand, but with heavy maintenance across the U.S. complex and oversupply in European markets- refined product is still making the cross-Atlantic trip- but to Lat Am instead. The weak U.S. activity will keep more refined product moving from storage, while limiting the demand for crude both domestically and the floating market.

Crude demand will remain under pressure driven by sky-high shipping rates, weakening global economies, and seasonality. Pressure remains across the crude complex with more expected from Angola, Nigeria, and other OPEC/non-OPEC nations even as current offerings for Nov haven’t cleared yet. We have said repeatedly that global oil demand was going to grow well below expectations, which is now being reflected in the data. The bigger problem remains demand being soft across the whole complex- oil and refined products, which will result in builds in all areas and take longer to clear even when demand picks up. Just given the nature of the headwinds- global cyclical headwinds, trade wars, and structural change based on policy and new production/refiners- not even geo-political uncertainty is enough to sustain a rise in crude pricing.

U.S. Refinery Utilization Rates

I still believe that global oil demand is even lower than what is posted below. I think total growth is much closer to 400k barrels a day vs the current one highlighted below. This means we will get builds across the complex unless OPEC+ cuts more, which is unlikely given their unwillingness to yield any more market share- which is demonstrated by Nigeria and Angola taking production higher (just to name a few). These builds also come at a time when Venezuela and Iran are sanctioned limiting their flows, and the Neutral Zone is expected to come back online in 1Q’2020 (which accounts for another 500k barrels a day).

International:

The overall market rallied on the back of a potential “mini-deal” with China that would lead to a broader benefit, on top of the ever-expanding balance sheets of central banks globally. Demand continues to struggle as signified by weakening refining crack spreads across the space. Margin softness is exacerbated by the cost of shipping crude and products due to the sanctions placed on Cosco by the U.S. The “Phase 1” trade deal essentially moves us back to 2 weeks ago, but does nothing to alleviate the core issues. It is also problematic that President Xi (instead of focusing on this) is out meeting with India’s Prime Minister Modi, which just means that China is sending its JV team to a Varsity game. The proposed deal has raised more questions than answers as Chinese officials say more has to be discussed before anything can be finalized- and this is in regards to a “mini-deal”. The deal would just delay new tariffs and open up an avenue to purchase agricultural products with some small (but poorly defined) financial and intellectual property adjustments. Both of those terms appearing in a potential deal was enough to send the market higher, but they remain buzzwords with little meaning in the proposed deal. The bigger issue is how far apart both sides are on such a simple deal- with an unwillingness to adjust incoming tariffs on U.S. agriculture products without the U.S acting in-kind.

The weakness continues to appear in key growth markets- such as India- highlighted by the weakness in diesel consumption as well as oil demand.

India’s Sept oil product consumption is the lowest in 25 months across key products:

“India September Oil Product Consumption Lowest in 25 Months- India’s oil consumption fell 0.3% y/y to 16.01m tons in September, the second monthly decline in fuel demand in the financial year that started April, according to data published by the oil ministry’s Petroleum Planning & Analysis Cell.”

- India’s gasoline consumption in September rose 6.2% y/y to 2.37m tons

- Diesel demand declined 3.3% y/y to 5.83m tons

- Naphtha usage down around 26% y/y to 844k tons

- LPG consumption +5.9% y/y to 2.18m tons

- Petcoke use +18% y/y to 1.74m tons

It is important to highlight that the demand/consumption numbers were weak even with lower prices compared year over year.

A key bellwether for oil demand has been Nigeria and Angola (West Africa in general) with Angola announcing 46 cargoes for December which is off multi-year lows and include 2 deferred cargoes from Nov. Nigeria still has more than half of their cargoes for November with an expected increase in December loadings as well (not including deferrals.) Crude movements have been impacted by refiners going into maintenance season and ships trying to minimize distances to limit total costs. U.S./China talks remain far apart on many key items, and I don’t see this adjusting in regards to the Cosco shipping sanctions. The sanctions are impacting U.S. exports- especially because large parts of our oil must travel the furthest distances. Typically, additional crude will be pulled from areas in the ME and Africa into Asia, and the U.S. would backfill into Lat Am and Europe- but slow demand across the system has brought shifting trade to a halt. Instead, countries are cutting refinery runs to operate out of storage and manage refined products from the floating market/storage.

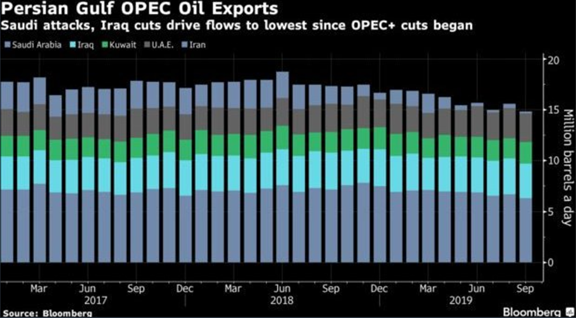

The geopolitical landscape is very fluid at the moment with issues ranging from BREXIT to Middle East upheaval to the U.S/ China trade war and the little talked about South Korea/Japan trade war. There is a global rise of protectionism and nationalism that is driven by weakening economies and over-levered countries that are struggling to stimulate growth. While the geo-political backdrop makes great sound bites, oil pricing is driven by supply/demand economics. The current Middle East battleground won’t be enough to drive price appreciation unless the supply side is significantly impacted. The new flow of oil from Nigeria, U.S., Russia, Brazil, and North Sea and deferred cargoes from areas such as Nigeria, Angola, and the U.S. have been more than enough to fill the short-term disruptions of Middle East conflicts. The current political upheaval in the Middle East (outside of KSA) remains regional and sporadic that won’t have lasting impact on supply at the moment. This is why demand is a big focal point, because even if the trade wars go away tomorrow— the bigger issue of economic slowdown outweighs any benefits. PPI, ISM, Export/Import, Shipping, and other data points highlight the bigger overarching issue that is plaguing the market. Demand is struggling with major economies contracting, and the law of diminishing returns limits the effectiveness of any form of quantitative easing. So unless a geo-political event can really disrupt supply measured in the millions for more than a few days— demand will continue to matter more to pricing metrics.

The Iran situation will continue to impact oil pricing as the current embargoes takes about 2M-2.5M barrels a day off the market. Iran is able to put about 500k-1M barrels into the market through Iraq pipes, Iran ownedships, ship-to-ship transfers, and “ghost shipping” through turning off transponders (which led to the Cosco- a Chinese Shipping Company- sanctions.) The shortage of heavy crude in the market (a staple of Iranian flow) will help maintain tightness between light-sweet spreads. The current sanctions aren’t going away anytime soon (or at least before U.S. elections) as President Trump wants to appear tough on trade following the removal of U.S. military forces from Syria (a mistake) and putting additional pressure on China following the Cosco sanctions. The only way negotiations could begin would be a willingness for Iran to forgo the deployment, development, and testing of ballistic missile systems. This is a non-starter for the Iranian government and military limiting the ability for any deal to be brokered. The growing divide between Iran and Saudi Arabia (greater between Shia and Sunni) will continue to expand, and will result in additional attacks on both a military and economic level.

As mentioned previously, Middle East discourse is rising driven by the last 4 or so years of depressed oil prices resulting in stressed economies, reduced social subsidies, and declining foreign reserves. The region has always had tension driven by tribal and religious divide going back thousands of years, but the relationships have always ebbed and flowed over the years. The lasting wars and declining cooperation- such as Syria and Yemen or Arab Spring in general, collapse of OPEC in Nov 2014, and the GCC (Gulf Cooperation Council) under duress driven by the divide between Qatar and other Gulf nations— is highlighting how problems have continued to build over the last several years. Everyone will point to the Saudi Arabia attack as a singular event, but the discord was sown years prior and are rapidly declining now with the added stress of struggling economies with depleted currency reserves. The discord in the Middle East has been smoldering for years- limited to regional conflict, but is now reaching a point that will bring the issues to the center stage.

Primary Vision has expanded its line of services to organizations looking for transparency or to better understand their exposure to global oil markets.

Our broad line of data products and analyst services can help your business today make better decisions tomorrow.

Interested in learning more?

Contact our team at: info@pvmic.com