By Mark Rossano

Domestic

The frac spread count resumed its downward trend with the national forecast coming in at 335 vs 340 last week. The trend remains on a lower path led by the Permian with the only sustained increase being the Mid-Con. Most regions have remained relatively flat with small gains over the last few weeks in the Utica, Mid-Con, and Eagle Ford while the Permian has declined each week. The OPEC+ decision (more on that below) will do little to stem the slide into year-end. Proppant loadings currently sit at 5 year lows, with little indication these will rise into year end. The WTI curve helps to highlight the OPEC+ comments on production have done little to adjust the back months, which also comes under pressure as any price increase is being used to hedge U.S. production. OPEC+ delivered a gift by allowing for better placed hedges, but the issues remain consistent with a slowing global economy and struggling crack spreads.

The below chart helps to drive home the very methodical move lower beginning in June of this year. Activity will keep following a similar trend, but will see some uplift in 2020 as budgets are renewed and hedges help protect some completions. The DUC count remains on a downward path as rigs continue to roll-off with little to stop the decline in the near term.

National Frac Spread Seasonally Adjusted

The proppant data shift in the Permian supports the decline in completion crews, and shows the extent of the slow-down. The fact that completion crews in the area continue to be released means the proppant loadings will shift lower into year-end. This will keep pressure on pricing and remain a headwind well into the middle of next year.

Permian Proppant Seasonally Adjusted

The WTI crude curve helps to highlight that supply increases and soft demand remain a problem across the next several years. The curve is far from predictive, but helps U.S. E&P companies hedge production- and after the OPEC meeting- they were able to lock in slightly better pricing.

These are the kind of activities that will keep U.S. production sticky at 13M barrels a day with exports rising driven by new infrastructure and limited U.S. demand. U.S. refiners can only handle a so much light sweet crude, which means a large portion of the oil is sent into the global market. The fact that Russia (and Nigeria) has now excluded condensate from the new OPEC+ “cuts” will allow more light-oil to enter the market and compete directly with U.S. exports. This is complicated further as chemical and refining assets facing terrible margins begin to roll-out economic run cuts.

WTI Crude Curve

As crude prices rise, it puts more pressure on refining and chemical margins unless they can pass along price increases to cover the increase in feedstock costs. Based on the declining demand in the global market, there will be little chance of an adjustment in the downstream market. Instead, margins will come under more pressure, which will put additional downside risk on oil demand as economic run cuts reduce the oil throughput. Gasoline margins have been negative for close to six month, which means that distillate has been carrying the crack but as economies struggle it has put pressure on the distillate crack. It has been balancing on razor thin margins, which have started to fall into negative territory.

Pressure is mounting on chemical plants as well for similar reasons, but new facilities continue to be brought online and many are now coming back from maintenance. So while the price spike on paper looks good, it will speed up the downstream nightmare while market share is lost and alternatives are adopted.

The most recent data on China helps to highlight the shift in their market, and the current accounts problem developing in their system as imports rise and exports decline limiting their access to U.S. dollars. Many of the margin issues across Asia all began as the two major Chinese refiners became operational as more product was pushed into the market.

The construction of world scale refining and chemical assets has flipped trading lanes as more refined products are exported. China used to be the buyer of last resort, but as the construction of advanced industrial assets are completed products are being pushed back into the open market. This is reducing margins and creating oversupply across many products in different parts of the world. China’s reasons to maintain production is two-fold:

- Become self-sufficient in products with a higher margin in the hydro-carbon chain

- Export products with elevated global pricing

- Employee large groups of highly trained individuals.

The last point is key, because in an oversupplied market many facilities will initiate “economic run cuts” which just means a facility will operate below their normal seasonal utilization rate. This helps to reduce the oversupply in the market and product margin. The view in China is “others” can cut, and they have already been operating at negative margins in order to force competitors to lower rates. The fact Chinese industries historically operate outside of normal economic theory will put increasing pressure on the refining and chemical space. “I think globally it’s increasingly a competitive environment for road fuels. China is already a net exporter of over 1mn b/d combined of gasoline, diesel, and jet. It’s the fastest-growing exporter of those fuels in the world. But over-supply is also percolating through into the seaborne market: Indian diesel exports are rising; everyone is trying to desperately seek out net short regions and they’re having to ship product further and further overseas. And we’re seeing a situation emerge now in China where these refineries are importing crude perhaps from Latin America and they’re exporting finished products to those same markets from which they took the crude. It’s a tricky arbitrage, one would imagine.”[1]

The OPEC Cut That Never Happened

So as this all plays out- it will be interesting to see if OPEC+ remains steady in their projections.

OPEC has “officially” highlighted what we have known all along… the slow down in demand. The bigger picture will be outlined in a coming write-up of Asia oversupply and declining demand. The “new” cuts are set off the baseline of Oct 31st, 2018. So lets clarify- what was OPEC and Russia doing on Oct 2018. In order to keep things consistent, I will use the self-reported numbers from OPEC nations. In 2018, OPEC was producing 33.1M barrels a day (and other sources like Energy Intelligence has it at 32.2M). The initial cut of 1.2M was supposed to reduce production within OPEC by 800k barrels with Russia cutting by 280k barrels. This means OPEC was set to reduce production to 32.3M barrels a day, and if we are kind and say no one cheated it brings us closer to 31.9M barrels even. So now we are ADDING 500k barrels a day in cuts, which takes OPEC (assuming they take all the cuts) down to 31.4M barrels a day. As of Nov 2019, OPEC is producing 29.7M barrels a day- so the “new” cut actually locks in something that is ABOVE current production levels. In order to offset it further, Saudi Arabia has pledged to keep the voluntary cuts of 400k barrels per day. This brings the total from 31.4M down to 31M, while OPEC is pumping at 29.7M barrels a day. The issue remains cheating because Saudi has said they will only maintain the additional 400k barrels a day as long as everyone stops cheating.

The biggest cheaters have been Iraq and Nigeria, which have pledged to adjust their production to meet the new targets. The below chart puts into context what the difference was between all the countries. Something I have highlighted in the past, the only reason the OPEC+ “cuts” had any semblance of a benefit was driven by sanctions on Venezuela and Iran. The “new cuts” haven’t even gone into effect yet and Russia/Nigeria are discussing why the numbers were “wrong,” and how adjustments to condensate will keep them in compliance while still pumping at higher levels. OPEC normally excludes the production of condensate, which is something Nigeria is looking to capitalize on by claiming Egina is not oil. Nigeria is producing about 2.2M barrels a day, with about 1.8M being considered oil. Condensate is typically an API level ranging from 45 to 70, which makes this next quote very interesting: “Country is testing Egina production in the market until end of the year; testing includes classification of Egina output as crude or condensate; “our partners are optimistic that Egina oil will fall into the condensate category”. NOTE: Egina has API gravity of 27.3 degrees, low sulfur content of 0.165%, according to Total.”

Egina started production last year, and produces about 200k barrels a day- which would be taken away from their “oil” quota and would put them in compliance with the cuts while not reducing anything. By Russia excluding condensate, the ESPO pipeline increase from 1.2M to 1.6M can be excluded from their calculation as it is being classified differently. With East Siberia ramping and gas fields increasing to fill the Power of Siberia, the amount of condensate from Russia is expected to grow by about 1M barrels a day.

OPEC Production 2019 vs 2018

Now lets shift to Russia, which was pumping 11.5M barrels a day in Oct 2018. They were supposed to reduce by 280k barrels down to 11.22M barrels a day. This total was only hit ONE TIME in 2019, and it was caused by production halts from a pipeline with the wrong specified crude shutting in 1.1M barrels a day. Even if Russia is required to take 100k barrels of the “New” 500K cut- it would just put them right back where they should be.

Russia Oil Production

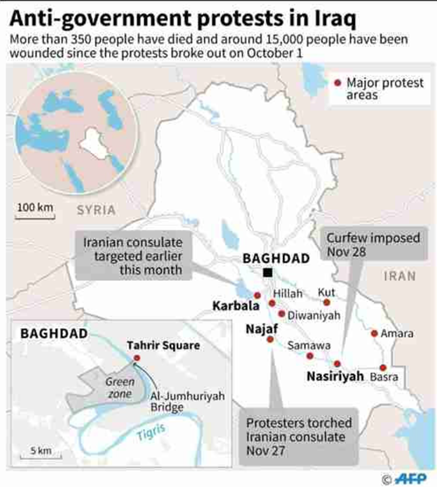

Iraq is an interesting situation as protests escalate across the country, and led to the resignation of the Prime Minister and a shake-up within the government. The issue remains unemployment, lack of social welfare programs, and an end to Iranian influence. The fact that the protestors in Iraq are protesting Shia’s (and not Sunni’s) against the involvement of Iran in the local government. The protests have resulted in hundreds of deaths, the burning down of Iran consulates, and unrest throughout Southern Iraq. The shortage of cash in the country has been helped by pumping over their allotment, which has brought additional cash into the government. Iran also uses the shared fields as a way to get oil in the market under the Iraqi flag and receive kickbacks. The Iraq Oil Minister, Jabbar Alluaibi stated that Kurdistan has reduced production to come into compliance with production targets. The issue remains the shortfall of cash in Iraq, and if they are willing to remain compliant in the hopes of displacing the lost volume with additional revenue per barrel. The new restrictions will also put pressure on Iran getting paid from oil removed from shared fields, and could very well be a backhand way of tightening the screws on Iranian financials.

The country has been facing mounting pressure along the same lines as Iraq in regards to political pressure driven by unemployment and anger over corruption. These problems remain localized, but the aggressive handling of protestors is only spurring more resentment and calls for addressing rampant corruption in both countries.

The new numbers are just laughable because it also requires “no more cheating” in order for it to work. The one thing we can all agree on- cheaters are going to cheat. Iraq and Nigeria have consistently been over their allotment from 150k to 250k barrels every single month. The same can be said about Russia, leaving Saudi Arabia stuck carrying the lion share of the cuts. Saudi Arabia has also been producing BELOW their allotment, and in the “new” cuts they still have the ability to produce 10M barrels a day. The bigger issue remains demand of refined products, and as I have been stressing- it is all down across the board. Lets look at just U.S. crack spreads in order to drive home the issues.

The new structure of allowing condensate to be excluded in the production cuts brings a new twist to the “cut” as it provides Russia the ability to produce an additional 400k barrels, Nigeria 300k from Abo and Akpo, as well as from Oman, Kazakhstan, and GCC nations. The freedom to pump and classify things as condensate will help countries skirt production cuts. Some other key developments from the recent news cycle:

- It is dependent on countries NO LONGER cheating and we know- “cheaters gonna cheat.” Saudi Arabia has leveled a threat that if people keep cheating they will pump at levels to crush competitors.

- Saudi Arabia has now priced their IPO at $8.53 at the top of the range: “The shares have been priced at 32 riyals ($8.53), with a formal announcement expected later on Thursday, according to the news agency. This means it is set to raise $25.6 billion and will likely beat Alibaba to be the world’s largest ever stock market flotation.”

- Brazil has formally declined to join OPEC allowing them to grow without any limitation to cuts.

- Russia is bringing on new gas fields, and is focused on exporting the new flow of condensate which will put pressure on prices and drive North American ethylene margins even lower.

The issues remain global as the “deal” leaves crude flowing unchanged with growth rising across Non-OPEC entities, and more condensate getting pushed into the market from OPEC+ nations. Russia has brought on new fields to supply gas as well as new oil fields in East Siberia. The growth can be seen in total as Russia has gained about 1.5M barrels a day of production (even with the cuts) while Saudi Arabia has lost anywhere from 250k-500k.

Here is an article for the refresher: https://www.spglobal.com/platts/en/market-insights/latest-news/oil/030618-russia-to-target-fading-urals-crude-oil-quality-in-2018

A Proxy for HollyFrontier’s Margin

A Proxy for Valero’s Margin on the Gulf Coast

A Proxy for Valero’s Margin on the West Coast

Refiner margins will remain under significant pressure as issues persist in the market of falling demand and slowing exports from the U.S. Crack spreads across the world remain depressed, and it is leaving more oil in the market that will remain based on this “new” deal of a cut. The issues are reverberating through the system and remain at the chemical level as well.

The rampant production of condensate (naphtha), which is now excluded from the OPEC cut calculation, means there will be growing availability of feedstock. Pressure is rising across the chemical supply chain as it hits across Asia- specifically in South Korea a core bellwether. The below chart highlights the pressure on HDPE, which is supposed to be a higher value product. As new facilities come online and chemical capacity that was down for maintenance ramps back up, pressure on prices/margin will rise. The issue also remains new facilities in China ramping up that is pumping out refined products and chemicals at a rapid pace.

China has been the buyer of last resort for the last 20 years, but as their construction of assets has shifted under Made in China 2025 and the Belt and Road Initiative- demand for products has dwindled. The pressure will remain across the board as the economy weakens, and their inability to stimulate the local market is exacerbated.

India is facing a similar problem with a slowing economy reducing domestic demand for refined and petchem products putting more on the water. The other issue (facing both countries) is an issue with current account balances as exports slow (the intake of USD) and imports rise (and outflow of USD). The limited access to foreign reserves keeps a lid on the type of stimulus and loans that can be generated to keep GDP supported. The above chart highlights just how bad the margins are regarding a high value petchem of high-density polyethylene. The stimulus China used in end of 2016 to the beginning of 2018 helped spur the market as a whole, but the chart above (and the others on refinery margins) demonstrates just how much worse things are vs 2016. This is driven by the new assets China has brought online, and they have indicated an unwillingness to cut runs as the state owned companies believe others should reduce operations in Asia and Europe. The problem is- South Korea has also responded with something similar, which will exacerbate an already difficult situation. The issues provided above will only get worse as the global economy continues to slow as demonstrated with recent economic indicators out of Germany, South Korea, Japan, and China- while the U.S. remains on a slowing trend but still the best looking house on a bad block.