Frac’ing Update

In our short article, we discussed our initial thoughts about ProPetro Holding’s (PUMP) Q3 2024 performance a few days ago. This article will dive deeper into the industry and its current outlook. After Q3, PUMP had 14 hydraulic fracturing frac spreads and will keep it unchanged in Q4. It will also maintain seven Tier IV DGB dual-fuel. DGB fleets will accelerate diesel displacement. PUMP has continued to deploy the rollout of its FORCE electric frac fleets since August 2023.

e-Frac Strategy

Early in 2024, PUMP inked a three-year contract with ExxonMobil to provide hydraulic fracturing, wireline, and pump down services through two FORCE e-fracs. It can deploy a third FORCE fleet with wireline and pump down services. It is also expected to deploy a fourth fleet by Q4 and the fifth by early 2025. As it builds its FORCE E-frac portfolio, PUMP will reduce its Tier II diesel-only equipment investment. Investments in electric fracs not only diversify operational risks through increased contracts but also increase profitability, as recent records have shown. On top of that, PUMP deploys capital toward value-accretive acquisitions.

Recently, it pursued acquisitions such as Silvertip in the wireline market, Par Five in cementing, and AquaProp in last-mile sand solutions. These acquisitions have added to its top and bottom line. It has grown its market share in the Permian Basin with bifurcated service offerings, including next-generation frac assets, Silvertip wireline services, and AquaProp wet sand solutions. The company’s presence in the Permian has ensured a stable frac activity and increased free cash flow. Given the current pressure from oversupply in the frac market, it has maintained a disciplined pricing approach and optimally positioned itself for Q4 and beyond.

Challenges

The increasing consolidation in the E&P industry and adverse weather in the Permian through July and August adversely affected drilling and completion activity. During these challenges, PUMP’s Tier IV dual fuel and electric equipment remained highly utilized and high-performing as the industry saw a significant shift in customer preference away from Tier II diesel-only assets. The loss of relatively low-performing assets triggered impairment charges of ~$189 million related to its Tier II diesel-only hydraulic fracturing equipment in Q3.

Q3 Results And Financial Metrics

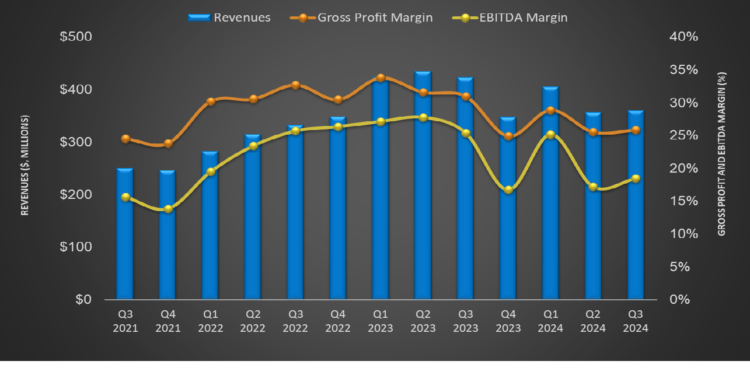

As we discussed in the Q3 earnings article, quarter-over-quarter, PUMP’s revenues from the Hydraulic Fracturing segment increased marginally by 1% in Q3 2024, while its adjusted EBITDA increased by 4%. Its revenues and adjusted EBITDA from the Wireline segment decreased by 3% and 15%, respectively.

PUMP’s cash flow from operations decreased significantly (by 30%) in 9M 2024 compared to 9M 2023. Its free cash flow, however, turned positive as capex fell even more sharply during this period. It reduced our FY204 capex guidance for the second time this year, from 175 million-$200 million to $150 million-$175 million. The ongoing transformation to more FORCE electric fleets can drive further declines in capex. By September 30, its liquidity was $127 million. In April 2024, it increased and extended share repurchases under the $200 million repurchase program.

Relative Valuation

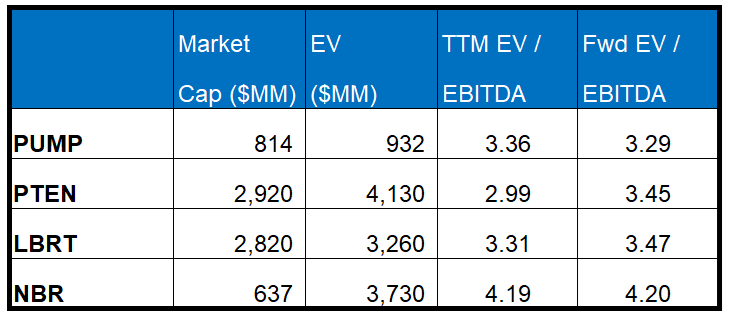

PUMP is currently trading at an EV/EBITDA multiple of 3.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 3.3x. The current multiple is below its five-year average EV/EBITDA of 4.6x.

PUMP’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is in contrast to its peers because its EBITDA is expected to increase compared to a fall in EBITDA for its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is marginally lower than its peers’ (PTEN, LBRT, and NBR) average. So, the stock is undervalued versus its peers.

Final Commentary

After Q3, PUMP largely maintained its stance as it kept its frac spread count and the Tier IV DGB dual-fuel frac fleet unchanged. In the ExxonMobil contract, it expects to deploy a total of five FORCE electric in the next few months. The transformation in the frac mix to more electric fleets will help lower capex. It plans to mitigate the industry challenges through next-generation frac assets, Silvertip wireline services, and AquaProp wet sand solutions.

However, the loss of demand for relatively low-performing assets triggered a significant impairment charge related to its Tier II equipment in Q3. With a deteriorated FCF in 9M 2023, its earlier decision to extend the share repurchases program can take a toll on the balance sheet. The stock is undervalued compared to its peers.

Premium/Monthly

————————————————————————————————————-